Nigerian banks pumped ₦1.92 trillion ($1.2 billion) into the stock market, accounting for 23.4% of total capital raised in 2024.

The Nigerian Exchange Group (NGX) disclosed this on December 9, 2024, highlighting the ₦8.12 trillion ($5.1 billion) raised by listed companies between January and November.

This surge was largely driven by the Central Bank of Nigeria’s (CBN) 2024 recapitalisation policy, which mandated banks to meet higher minimum capital requirements.

Recall that on March 28th, 2024, the CBN, Dr Olayemi Michael Cardoso, announced through the bank’s circular, the CBN Banks Recapitalization policy, 2024. By the circular, national banks were mandated to increase their minimum share capital from N25 billion to N200 billion.

International banks had their share capital increased from N50 billion naira to N500 billion. Regional banks also saw their share capital increase from N10 billion to N50 billion.

By increasing their share capital, the CBN believed that banks will be able to absorb more losses and provide more credit to support the growth of the Nigerian economy which the President, Bola Ahmed Tinubu had targeted to be a $1 trillion economy by 2030. The recapitalization exercise was also key to the banks retaining their license for operations.

How the recapitalisation exercise worked

Through the CBN’s circular, banks had three ways to meet the recapitalization demand (1) injecting fresh equity capital through private placement, rights issue and/or offer for subscription. (2) Mergers and Acquisition and/or (3) Upgrade or downgrade of license authorization.

- By Private placement, public companies could issue securities to selected persons, not more than 50 subscribers.

- Rights issue entailed that existing subscribers of a company would be given the right to purchase newly issued shares in accordance with their existing shareholding with the banks.

- By offer for subscription, the general public will be invited to subscribe for newly unalloted shares in the bank at a fixed price.

- Mergers and Acquisition meant that banks could merger with one another or acquire one another in order to raise the required minimum share capital.

- Lastly, banks also had the option of upgrading or downgrading as the case may be, their current license so that they become recategorized under a new kind of licence.

How banks responded to the recapitalisation directive

As a result of the CBN’s directive, most banks, including GTCO, Access Bank Plc, Zenith Bank Plc, Fidelity Bank Plc, and Sterling Financial Holdings Co, used rights issues and subscription offers to sell shares to new and existing customers.

In contrast, Jaiz Bank Plc received approval from the Exchange in February 2024 to raise ₦10.05 billion through private placement.

On 6 August 2024, the CBN approved the merger of Providus Bank Plc and Unity Bank Plc. Additionally, the newly formed Providus Bank Plc secured a ₦700 billion loan approval from the CBN to meet its recapitalisation requirements.

Happy news following recapitalisation exercise

As part of the recapitalisation exercise, banks contributed significantly to Nigeria’s Stock Exchange market. Between January and November 2024, the Exchange Group reported a total capital boost of ₦8.12 trillion from share transactions.

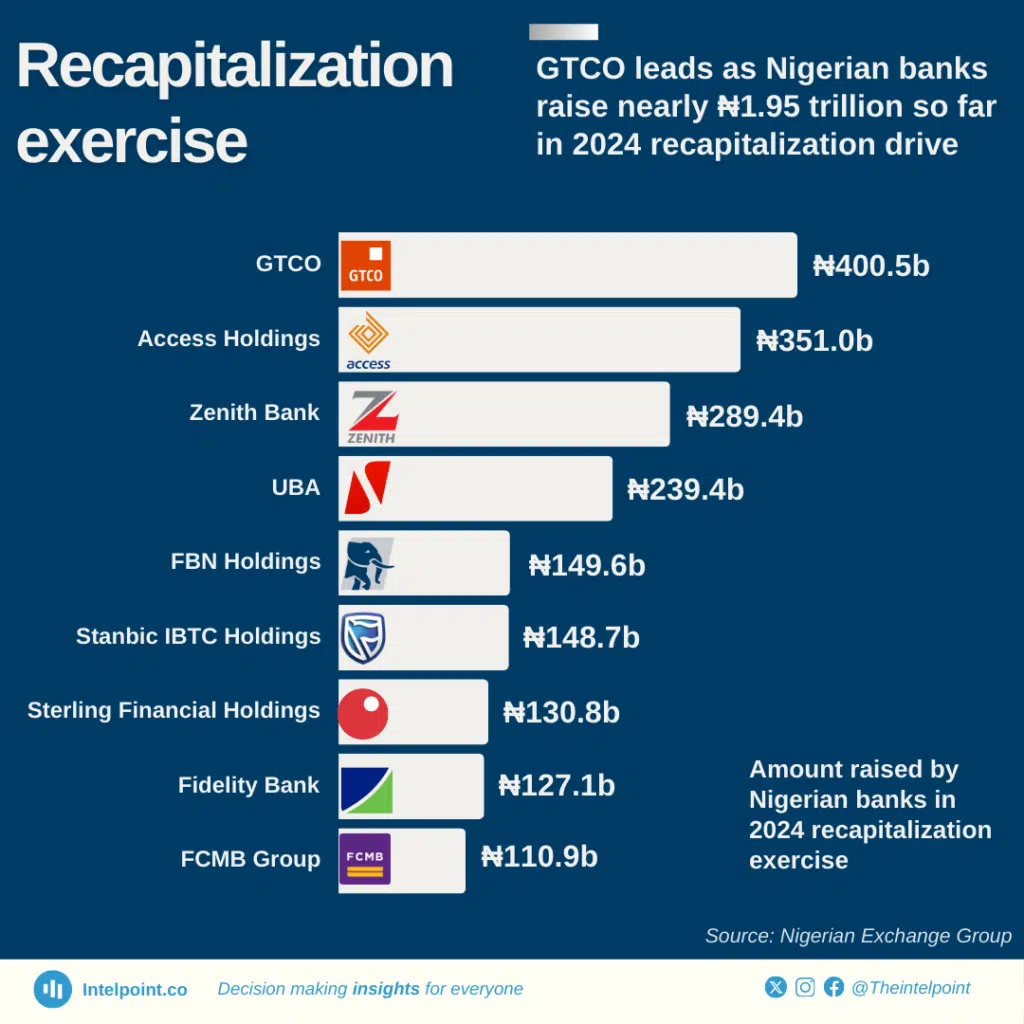

Nine banks accounted for ₦1.92 trillion—roughly 23.4% of the total raised. These banks include GTCO, Zenith Bank Plc, Access Holdings Plc, FCMB Group Plc, Fidelity Bank Plc, United Bank for Africa Plc (UBA), FBN Holdings Plc, Sterling Financial Holdings Company Plc, and Stanbic IBTC Holdings Plc.

GTCO raised ₦400.5 billion by offering 9 billion ordinary shares at ₦44.50 per share. Access Holdings raised ₦351.01 billion through a rights issue of 17.77 billion shares at ₦19.75 per share, offered on the basis of one new share for every two held as of June 7, 2024.

Zenith Bank Plc contributed ₦289.38 billion via a public offer and rights issue, while Fidelity Bank Plc raised ₦127.10 billion through similar methods. FCMB Group injected ₦110.94 billion, and Sterling Financial Holdings raised ₦130.79 billion through private placements and rights issues.

UBA, Stanbic IBTC Holdings, and FBN Holdings are also raising capital, with approvals for ₦239.4 billion, ₦148.71 billion, and ₦149.56 billion, respectively.

The recapitalisation exercise is set to conclude on 1 April 2024, following a 24-month implementation period.