Nigeria and South-Africa are expected to witness an additional GDP growth of $15 billion through Real-Time Payments by 2028. This prediction was made by the ACI Worldwide in its Real-Time Payments: Economic Impact and Financial Inclusion report.

The report, produced in collaboration with The Centre for Economics and Business Research, focuses on 40 countries and draws connections between real-time payments and financial inclusion.

South Africa embraced real-time payments early, having launched its interbank instant payments system Real-Time Clearing (RTC) in 2006 while Nigeria started RTP in July 2011 when the Nigeria Inter-Bank Settlement System (NIBSS) launched NIBSS Instant Payments (NIP).

The ACI report found that in 2023, Real-Time payments contributed $164 billion to the GDP of the 40 countries studied—equivalent to the labor output of 12 million workers. Some of the countries studied include Nigeria, South Africa, Thailand, Pakistan, Philippines, India, China, Saudi Arabia, the UAE, Brazil, Mexico and the U.S.

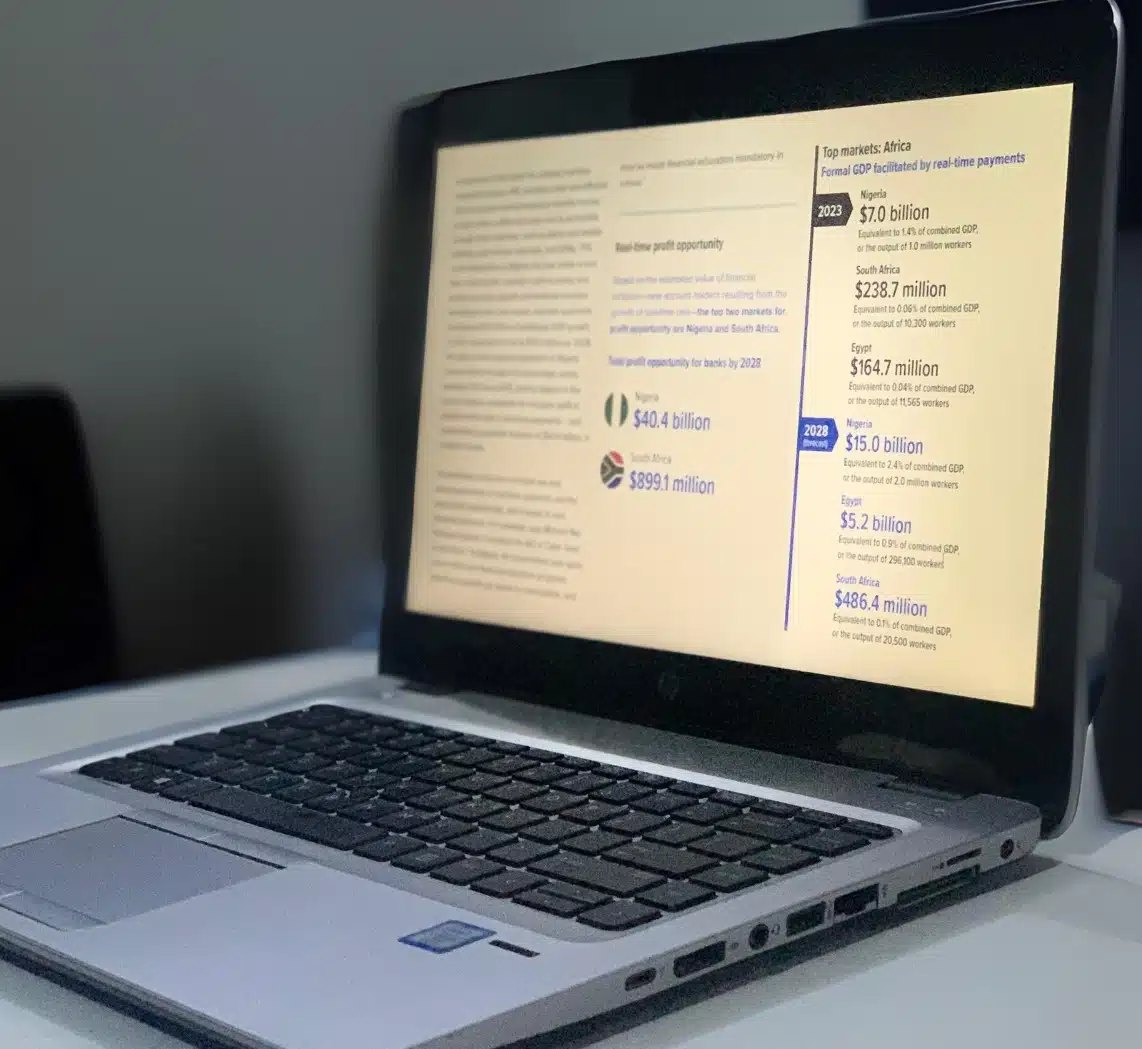

Focusing on Nigeria, the report noted that, “As Africa’s largest real-time payments market, Nigeria is reaping the biggest economic benefits, with real-time payments contributing $7 billion of additional GDP growth in 2023.”

As of 2023, Nigeria’s GDP stood at $362.8 billion. By 2028, the contribution of RTP to the country’s GDP is expected to grow to $15 billion, double its current contribution size.

“The share of the banked population in Nigeria is expected to increase by 6.5% between 2021 and 2028, placing Nigeria in the top five nations worldwide for inclusion uplift and representing a potential increase of $40 billion in profits for banks.” the report noted.

In Nigeria, some of the leading figures and spearheads of RTP are the Nigerian Inter Bank Settlement System (NIBSS) and payment switch providers such as Interswitch, eTranzact and TeamApt. Bill payment apps such as Paga also play a significant roles in the advancement of RTP in the Nigerian financial sector.

As a testament to the potentials for RTP in the country’s financial sector, this year, Interswitch, Nigeria’s leading switch payment provider, signed a renewed partnership deal with ACI Worldwide to integrate ACI’s real-time payment solutions into Interswitch’s technology.

The essence of this integration is to ensure safe and efficient digital payments, including instant transactions and a drastic reduction in cash reliance, thereby improving payment experiences in Nigeria and other parts of Africa where Interswitch operates.

Turning to South Africa, the report holds, “The potential for banks extends beyond regions with large unbanked populations. By 2028, South Africa—already at 84% banking penetration—could add 425,000 previously excluded individuals to the financial system.”

Highlighting the significance of how much economic growth opportunities RTP holds in South Africa, the report continued, “This modest 0.8% growth (that is, the additional 425,000 individuals) represents a remarkable $899 million profit opportunity for banks.

As Africa’s second-largest economy, South Africa is also a rising leader in real-time payments, with their contribution to GDP expected to more than double to $486 million by 2028, highlighting the transformative power of financial inclusion and innovation.”

Globally, real-time payments are expected to contribute $285.8-billion in additional GDP growth, which is a 74.2% increase over five years, and create more than 167-million new bank account holders by 2028.

Capturing the importance of RTP, the report highlights that real-time payments not only fuel economic growth but also provide citizens with fast and affordable access to financial services.

“Real-time payments are a catalyst for economic empowerment by enabling citizens and businesses to access affordable, seamless financial services that drive growth and opportunity,” says ACI Worldwide Middle East, Africa and South Asia Sales senior VP Santhosh Rao.