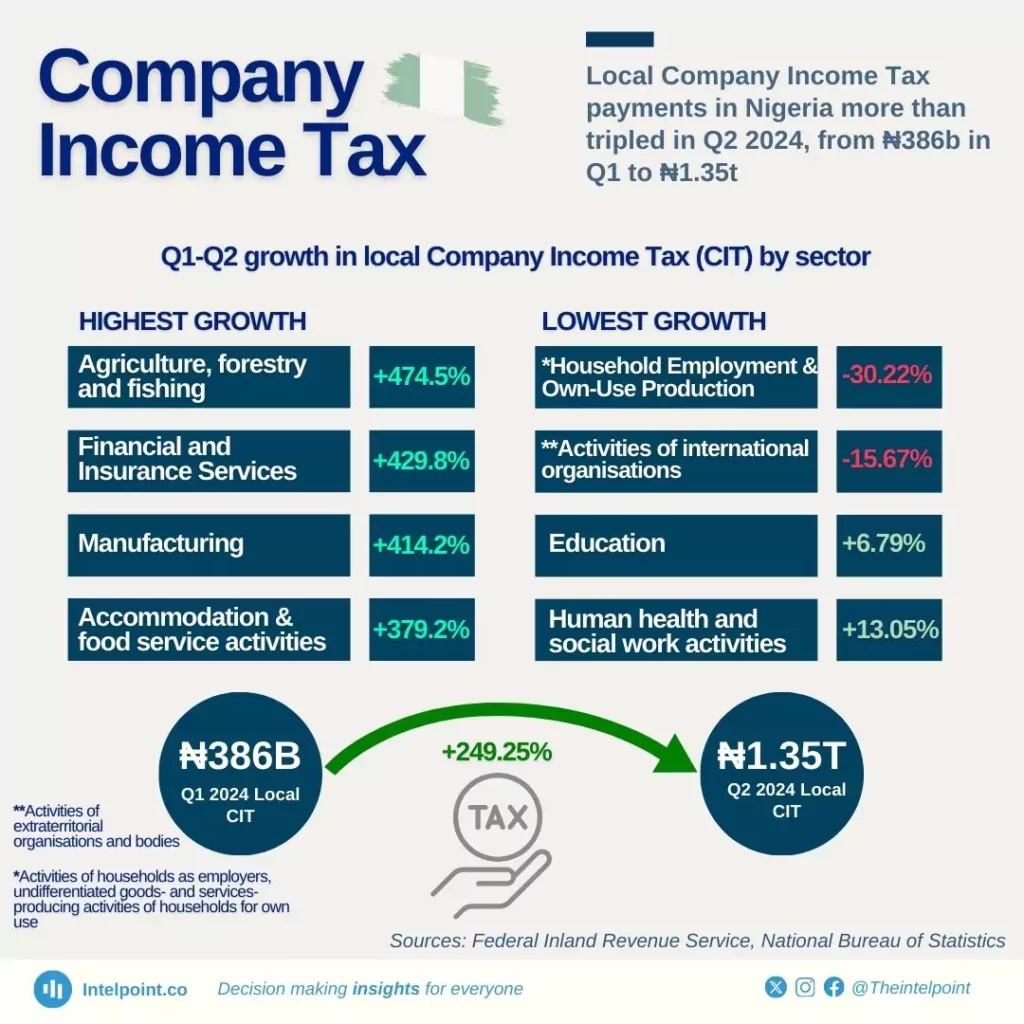

In recent months, Nigeria has seen a drop in the amount of tax businesses are paying. The most recent report from the National Bureau of Statistics (NBS) shows that company income tax (CIT) collections fell by 28% from one quarter to the next in 2024. This is a big drop, but when compared to the same time last year, the total tax collection increased slightly by 1%.

So, what’s causing the decline? The main reason is the tough business environment in Nigeria. Many businesses are struggling due to high inflation (prices going up), the weakening value of the Naira (Nigeria’s currency), and higher interest rates (the cost of borrowing money). These problems make it harder for businesses to make money, and when they don’t make enough, they can’t pay as much tax.

Some sectors are more affected than others. For example, businesses in finance, communication, and transportation have seen big drops in the taxes they are paying. However, industries like manufacturing and mining are still doing better and continue to pay a large share of the total CIT.

Foreign businesses are also paying less tax. Their CIT collections dropped by 24% in the third quarter of 2024 compared to the previous Month quarter. This is because the global economy is also facing challenges, which affects businesses that operate in Nigeria and elsewhere.

Despite the drops, the Nigerian government is still hopeful about the future. In the first nine months of 2024, they collected N5.2 trillion in CIT, which is more than what they expected. However, the government is targeting N5.7 trillion in 2025. To reach that goal, they need to improve the country’s business environment and make tax collection more efficient.

The decline in CIT collections shows that Nigeria’s economy is facing tough times, but there are still opportunities for improvement. The government needs to make it easier for businesses to succeed and pay their fair share of taxes to help the country’s economy grow.