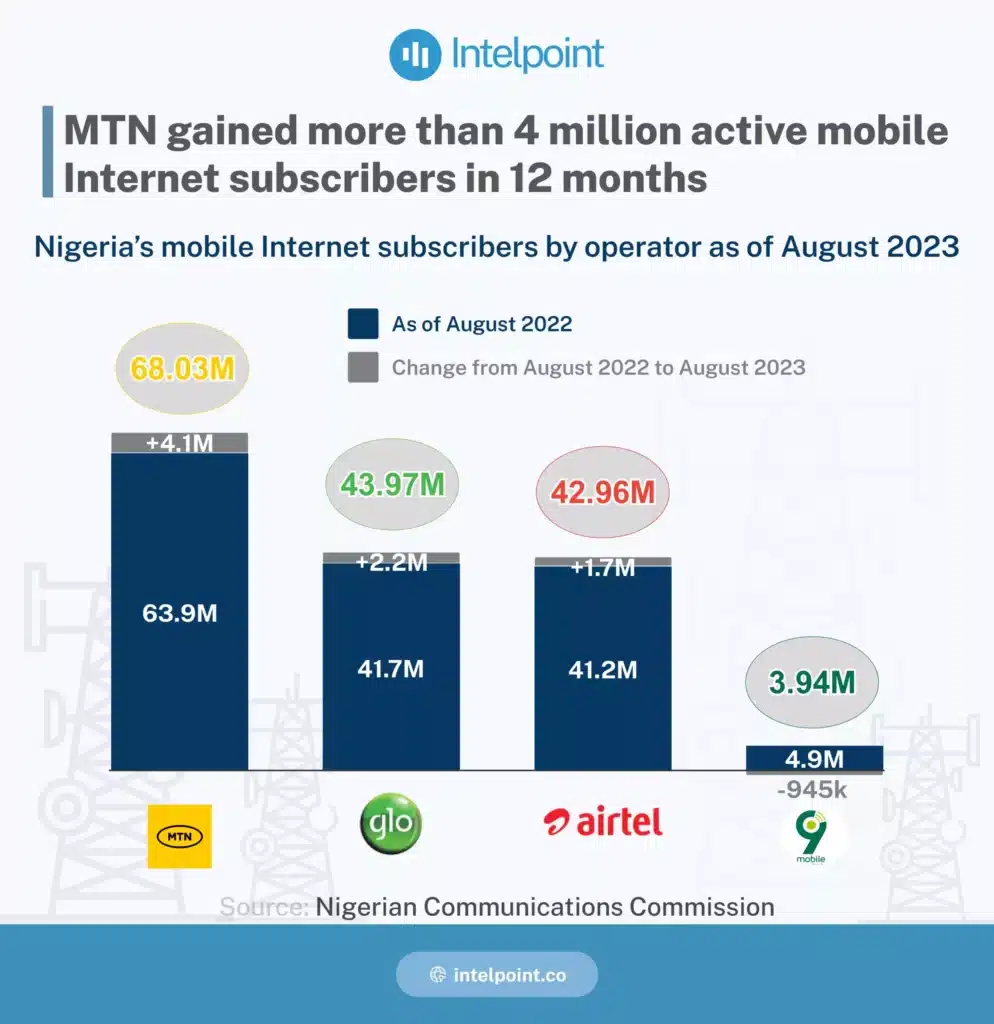

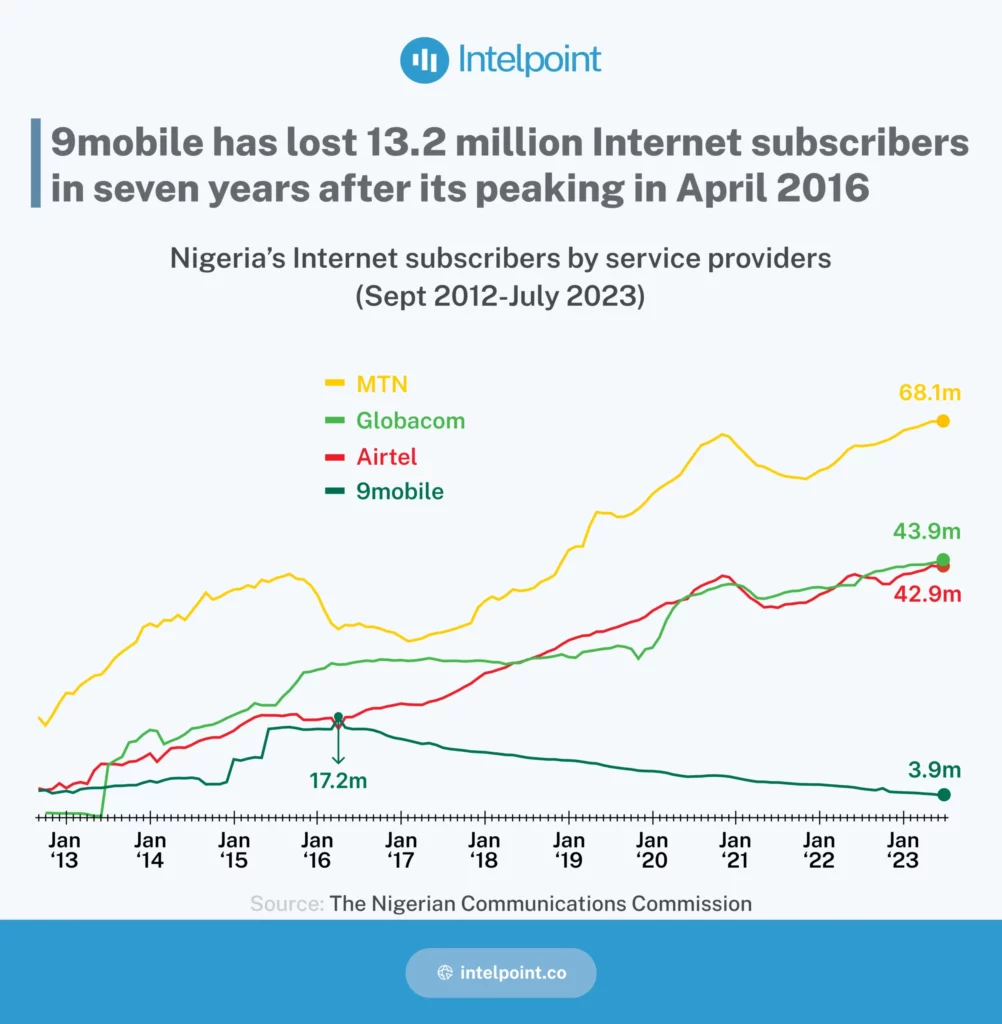

9mobile, Nigeria’s fourth-largest telecom company, has seen its market share fall to 1.9% by December 2024. Once a major player with 23.4 million subscribers in 2015, the company now has only 3.2 million subscribers as its base fell by 68.82% in 2024.

This marks a major decline in its performance. Despite efforts from 9mobile, its subscriber base has remained stagnant for two months.

Meanwhile, other telecom companies like MTN, Airtel, and Globacom are growing. MTN now leads the market with 84.6 million subscribers, while Airtel has reached 56.6 million subscribers, and Globacom has grown to 20.1 million. 9mobile is the only major telecom company not increasing its customer numbers.

The decline in 9mobile’s market share is poised to significantly affect Nigeria’s tax revenue. Telecom companies contribute heavily to the nation’s tax base, particularly through Value Added Tax (VAT) and corporate tax payments.

In 2023, the sector paid around ₦2.4 trillion in taxes, underlining its significant economic impact. The ICT sector, which includes telecoms, accounted for about 12.61% of Nigeria’s GDP in Q4 2021. Since 9mobile is one of the contributors to this milestone, a decrease in subscribers will therefore mean a reduction in the company’s ability to generate revenue, and consequently, pay taxes.

Recent analysis indicates that with an average revenue per user (ARPU) of ₦1,616 and a subscriber base of 3.2 million, 9mobile’s annual revenue is approximately ₦5.87 billion (around $3.5 million)

If 9mobile’s subscriber base has dropped by 68.82% and the APRU remains constant, it means that 9mobile’s annual revenue was approximately ₦18.83 billion before it now fell to ₦5.87 billion.

Additionally, in July 2024, Light House Telecom bought a 95% stake in 9mobile for around $750 million. New leaders were brought in to help improve the company, but there has been no sign of fresh investments or improvements since the takeover. Some insiders are concerned that the new owners haven’t made any major changes yet, with no new funding or maintenance to modernize the company’s operations.

This leaves 9mobile at a disadvantage against its competitors, who are expanding and contributing more to Nigeria’s tax pool.

Without proper investments in upgrading its network and services puts it at a disadvantage against its competitors. If 9mobile’s financial struggles continue, it may find it harder to meet its tax obligations. This could lead to long-term revenue losses for Nigeria, especially as MTN, Airtel, and Globacom continue to grow, contributing higher tax revenue.

To recover, 9mobile may need to secure investment to upgrade its network and services. The company also faces the challenge of attracting new customers and improving its competitive position. Without addressing these issues, 9mobile’s financial health and its tax contributions to the government may remain under pressure.