Lagos, Rivers, and Oyo States have emerged as Nigeria’s top three VAT contributors, each playing a crucial role in the nation’s economic growth. In 2024, Nigeria’s total VAT revenue surged to ₦6.72 trillion, up 84.62% from ₦3.64 trillion in 2023. These three states alone contributed ₦3.855 trillion, accounting for over 57% of the national VAT pool.

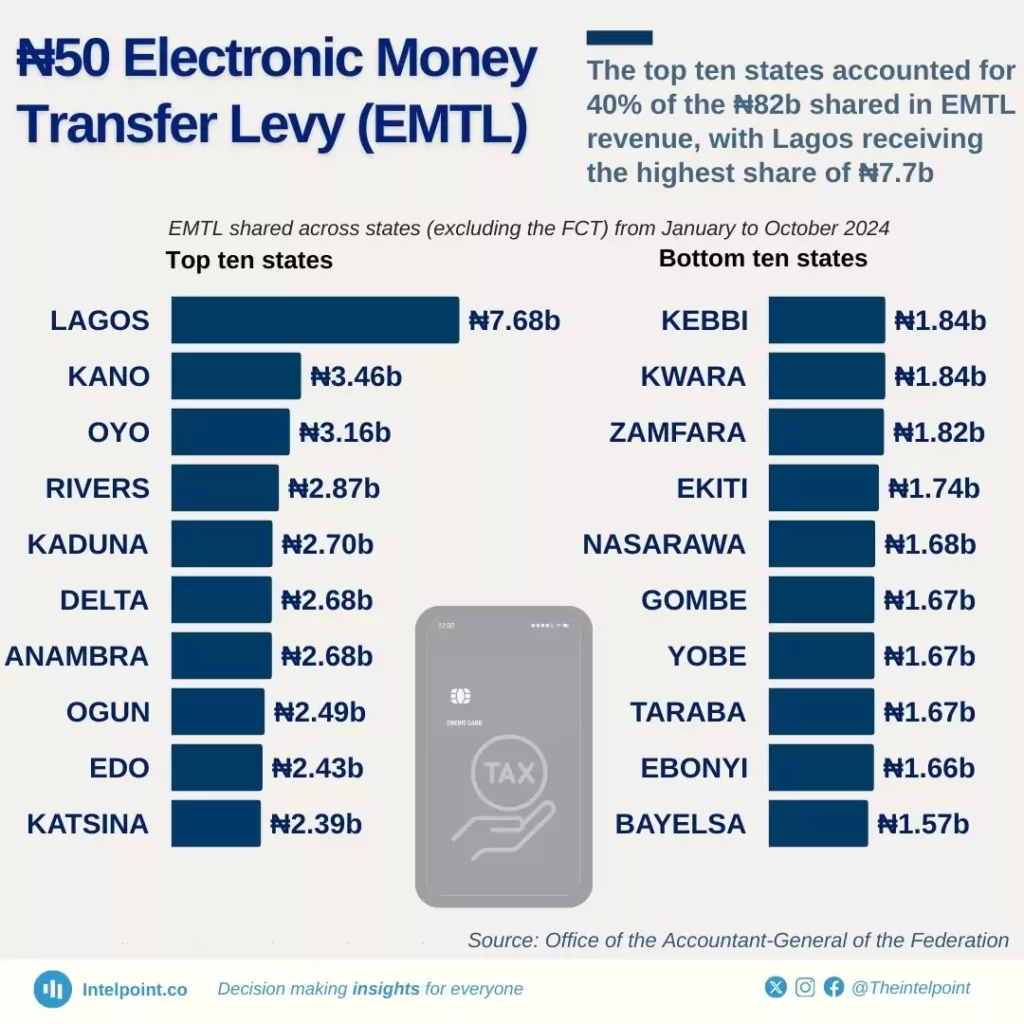

Beyond VAT, these states were also top contributors to other revenue sources. Lagos contributed ₦7.68 billion, Oyo ₦3.16 billion, and Rivers ₦2.87 billion to the Electronic Money Transfer (EMT) levy.

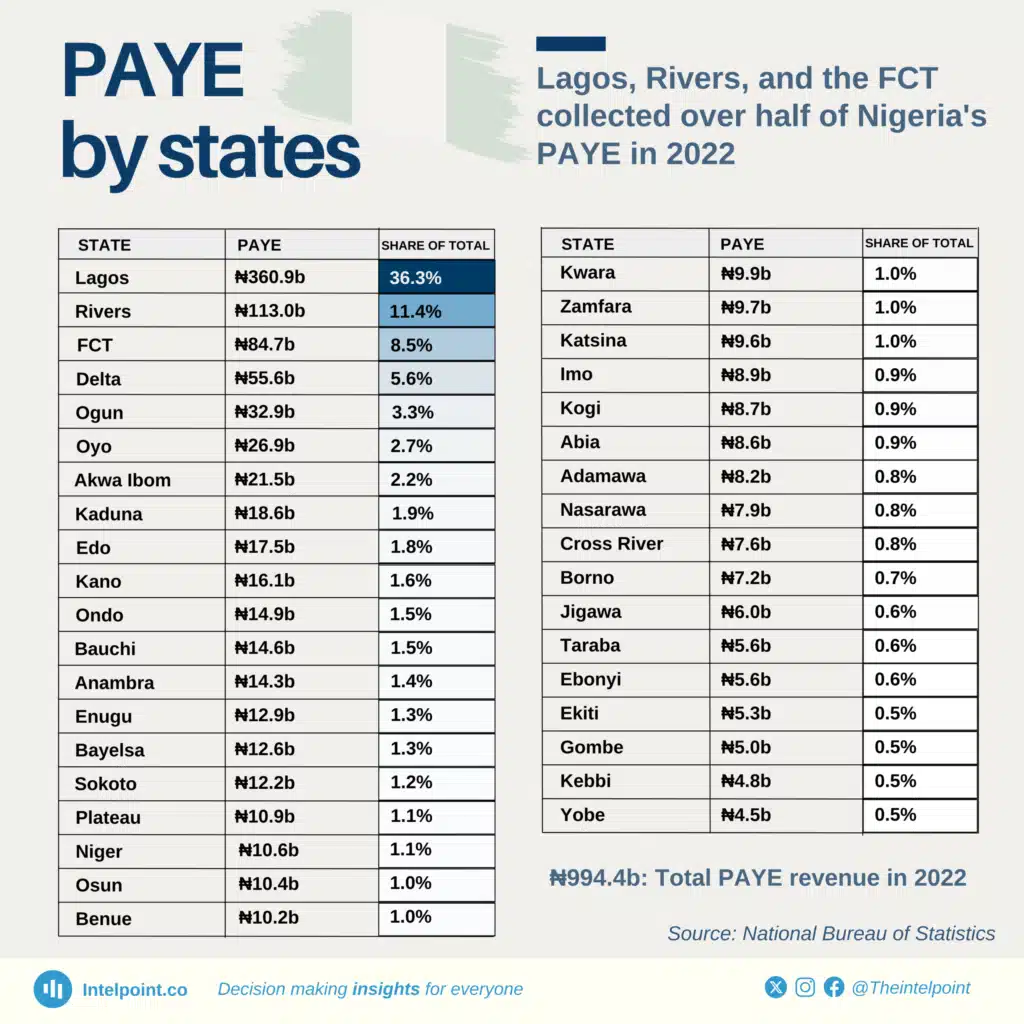

Additionally, Lagos and Rivers collected over half of Nigeria’s Pay-As-You-Earn (PAYE) tax revenue in 2022, with Lagos leading at ₦360.9 billion, Rivers at ₦113.0 billion, and Oyo at ₦26.9 billion.

These states have employed distinct strategies in 2024 to boost their economies, with a focus on infrastructure, business-friendly policies that directly fuel growth and attract investments.

Lagos state: Nigeria’s economic powerhouse

In 2024, Lagos strengthened its position as Nigeria’s top VAT contributor, generating ₦2.75 trillion. The state’s growth was driven by infrastructure projects and sector-specific strategies.

One of them is the continuation in its development of critical infrastructure, notably its ports, such as Apapa and Tin Can Island, which handled a significant share of Nigeria’s imports and exports. In the first quarter of 2023, these ports accounted for approximately 89.9% of Nigeria’s total trade, amounting to N10.83 trillion out of N12.05 trillion.

The tourism sector also played a significant role, with Lagos’ tourism contribution to GDP reaching about ₦4.1 trillion, driven by cultural festivals and investments in hospitality infrastructure.

In addition to infrastructure, Lagos also introduced tax incentives and simplified business registration processes. These efforts attracted billions altogether, both from local entrepreneurs and international investors.

In 2024 alone, Lagos attracted over ₦50 billion in investments through Foreign Direct Investment (FDI) and Domestic Direct Investment (DDI). It also led in foreign investments, securing $5.95 billion in foreign inflows between Q2 2023 and Q2 2024. As businesses grew, so did the state’s tax revenue, creating a cycle of growth that propelled Lagos’ economy forward.

Rivers state: Oil & gas stronghold

Rivers State, contributing ₦832 billion to Nigeria’s VAT pool in 2024, is powered by its strong oil and gas industry, which continues to be a major driver of economic activity.

As of 2023 reports, Rivers has maintained its position as a leading oil producer, with the state accounting for approximately 18.07% of Nigeria’s total oil production. Revenue from petroleum exports was reinvested into sectors like refining, petrochemicals, and shipping, fueling industrial growth.

The state also established a ₦4 billion enterprise fund in partnership with the Bank of Industry to boost Micro, Small, and Medium Enterprises (MSMEs), encouraging local entrepreneurship and creating job opportunities.

Additionally, Port Harcourt handled a large portion of the country’s crude oil exports, which helped Nigeria achieve ₦5.81 trillion in trade surplus in the third quarter of 2024. The port also deals with other goods like manufactured products, machinery, and consumer items, making it an important trade center.

In 2024, Nigeria’s total trade value reached ₦35.16 trillion, with a big rise in exports, mostly due to oil. Rivers State has also invested in improving its ports and infrastructure, like the Onne Oil and Gas Free Zone.

With better roads and rail systems, Port Harcourt continues to play a vital role in Nigeria’s trade, driving economic growth and increasing VAT contributions.

Oyo state: A model of steady investment

Ranking third in VAT contributions is Oyo state with ₦272.41 billion in 2024. This is a significant achievement for a state which lacks the oil resources of Rivers or the commercial dominance of Lagos. A major factor behind this success is the government’s steady injection of money into the economy, particularly through salary payments.

Since 2019, the Oyo State government has consistently paid ₦6.4 billion in salaries every month, ensuring a steady flow of money into the hands of workers. Also, with the new ₦80,000 minimum wage introduced in 2025, this amount has increased to ₦12 billion per month, totaling ₦143 billion annually.

The increase in salaries also led to an increase in spending culture. Many people dined at restaurants, booked event centers, and stayed in hotels, creating a huge demand for hospitality businesses. As a result, the number of hospitality businesses in Oyo skyrocketed from 1,424 in 2019 to 5,342 in 2024, an incredible 221% increase.

The real estate sector has also felt this impact. With higher earnings, more people could now afford to rent better apartments or buy homes. This led to a boom for property developers, real estate firms, and property management companies, all benefiting from the increased demand.

Beyond rising incomes, Oyo has also made it easier for businesses to operate. The government has simplified the process of acquiring land, sped up permit approvals, and invested in road networks, making business expansion smoother. These improvements have drawn more investors, fueling even more growth.