Kano, Nigeria, is embracing the saying “better late than never” as it finally unveils its New Year resolution which is an ambitious revenue target of over ₦100 billion for 2025. The state hopes to boost its economy through better tax collection and digital reforms. However, companies and investors are keeping a close eye on how these changes will affect them.

Why Kano fell short in 2024

Despite being a major economic hub in northern Nigeria, Kano struggled to meet its revenue goals in 2024. The state aimed to generate ₦536.56 billion but had only managed ₦323.64 billion by the third quarter, just 60.3% of its target.

Inflation and foreign exchange instability hurt businesses, leading to lower tax collections. Tax evasion and non-compliance were also major issues, prompting the government to tighten enforcement in 2025.

A large part of Nigeria’s economy is informal, making tax collection difficult. While the government restructured the Kano State Internal Revenue Service (KIRS) and appointed new leadership, these efforts didn’t yield the expected results.

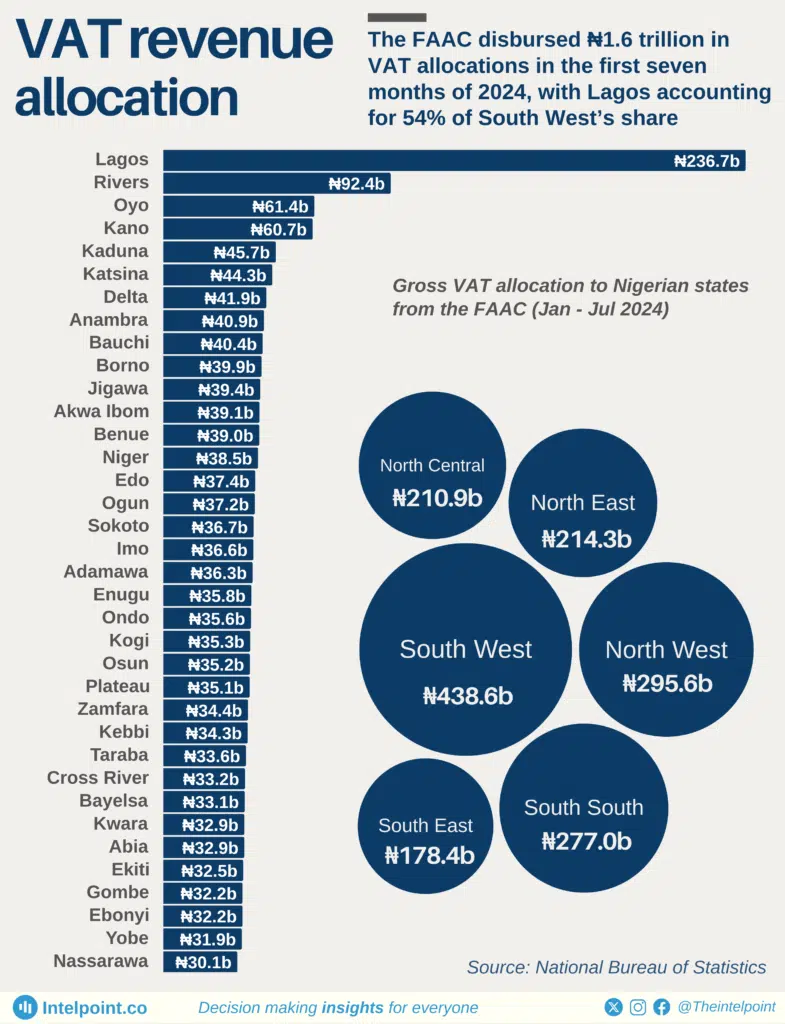

Kano contributed ₦77.76 billion in Value Added Tax (VAT) but received ₦117.19 billion from the VAT pool, showing its heavy reliance on federal allocations rather than internally generated revenue.

The state has also struggled to attract foreign direct investment (FDI), with security concerns and economic uncertainties discouraging investors. Despite efforts by KanInvest, the state’s investment promotion agency, businesses remain wary of Kano’s business climate.

More audits and stricter tax compliance

With tighter tax enforcement ahead, companies in Kano should expect more audits and digital tax monitoring. While the government insists tax rates won’t increase, compliance will be strictly enforced.

Companies may face greater scrutiny of their financial records, leading to tax disputes. This could create financial strain, legal battles, or even force businesses to shut down if they can’t meet their tax obligations.

In 2018, MTN was accused of owing $2 billion in taxes, a claim which it denied. The demand was withdrawn in 2020, but the company later faced another dispute, with a tribunal ordering it to pay $72.5 million for tax defaults from 2007 to 2017.

Globally, Volkswagen faced a $1.4 billion tax bill in India in 2025 after a prolonged dispute, showing how aggressive tax enforcement can impact businesses.

If Kano’s approach is too rigid, companies may relocate to states with friendlier tax policies, affecting economic growth and investment.

Can digital reforms improve tax collection?

Kano is betting on digital reforms to improve tax collection. The KRIS Introduced digital platforms like KIRMAS in 2024 and eeZitax in early 2025, allowing businesses to register, generate invoices, and pay taxes online. The goal is to simplify tax payments, reduce leakages, and improve transparency.

However, several challenges could slow adoption. Many areas lack reliable internet access, and with a literacy rate of only 48.9% (although some other reports record 38.06%), a large portion of taxpayers may struggle to use these platforms.

Outdated tax laws don’t fully support digital transactions, and concerns over data security and privacy could discourage businesses from embracing the new systems.

For these reforms to work, the government may have to address infrastructure gaps, improve internet access, and update tax laws. There’s nothing wrong with ambition and high targets, but without proper execution, even the best plans can fail.