As with other Central banks across the world, inflation rate plays a major role in the decision of what the official interest rates of African apex banks will be.

In Africa, where most countries are struggling with, globally and locally influenced inflation, apex banks use the Monetary Policy Rate (MPR) to ward off or control inflation.

In Q1 of 2025, this has come in the form of slight increases, reductions, or retention of the benchmark interest rates.

These rates will influence the final interest rates offered by commercial banks to individuals and businesses in those countries, and also economic activities and the real sector within the period when the rates are effective.

African countries and their interest rates

Nigeria

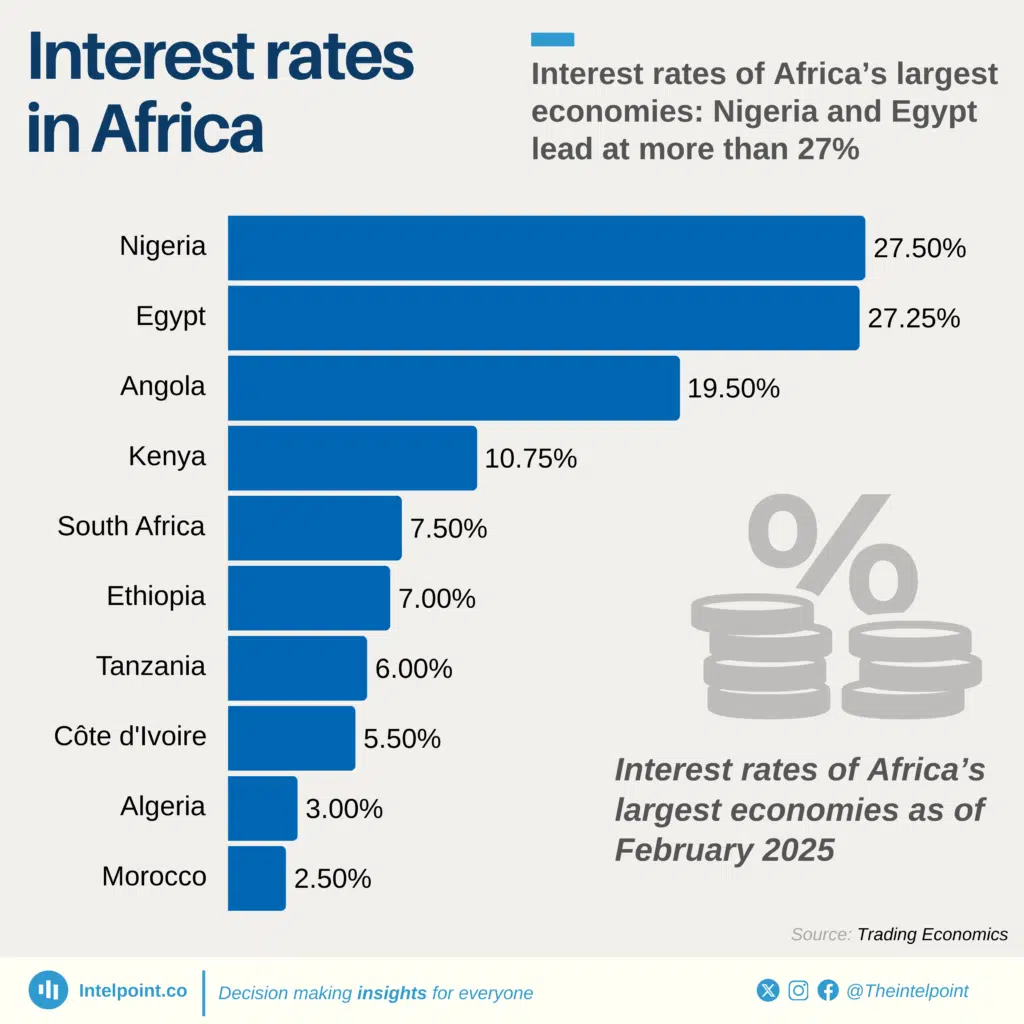

Nigeria has the highest recorded rate of 27.50% as of November 2024. In response to biting inflation, the country’s apex bank increased interest rates by 875bps in 2024. This meant that the least interest rate businesses could borrow money from banks went up to 27.5%, from 18.75%.

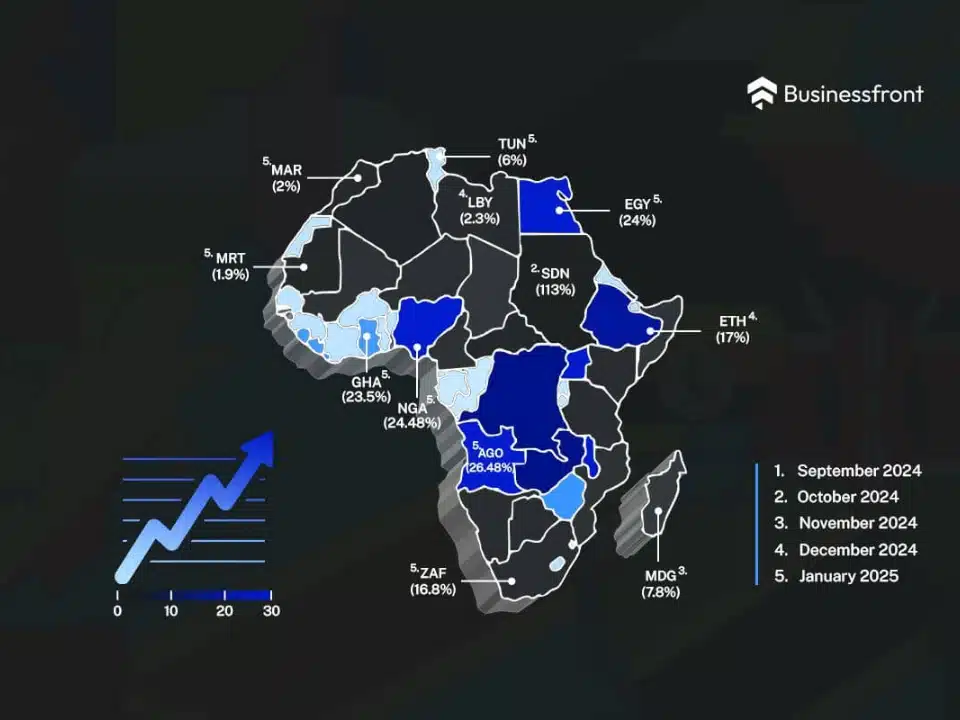

The inflation rate was at 34.80% in December 2024. The National Bureau of Statistics (NBS) however calculated the rebased inflation rate at 24.48% as of February 2025

This rate was retained in the latest MPC meeting held on Friday, 21st February 2025. The apex bank’s governor, Mr Yemi Cardoso, cited the need to maintain the status quo so as not to disrupt the progress made in reducing the inflation rate in the country.

Egypt

Egypt ranks next highest with the prevailing rate of 27.25%. This rate has been retained in the last seven months, with inflation being the main reason for its high value.

Egypt’s consumer price inflation (CPI) rate was calculated as 24% in January 2025, a marginal decline from the 24.1% CPI in December 2024. In November 2024, inflation was calculated at 25.5%.

Inflation remains well above the 5% target with a 2% buffer on both sides. Just as in the case of Nigeria, reducing the MPR will result in a hike in inflation and will overturn the apex bank’s efforts at reducing inflation.

South Africa

South Africa, the continent’s leading economy, lowered its official interest rates to 7.50% to reflect the country’s falling inflation rate.

The country’s inflation rate in December 2024 was at 3.0%, well within the 3-6% inflation target. Headline inflation in 2024 also averaged 4.4%.

Despite these remarkable figures, South Africa’s economy currently faces high external pressures, stemming from the country’s strained relations with the United States concerning the ongoing Israeli-Palestinian war and the US’s most recent threats to stop aid to South Africa following the passage of the Land Expropriation Act.

Zambia

Zambia’s inflation rate rose to 16.7% in December 2024 and remained unchanged in January 2025. In November 2024, the rate was calculated at 16.5%, an increase from 15.7% in October 2024.

The steady increase in inflation rate is caused by the severe El-Nino drought, which has occasioned an increase in food inflation. The price of food increased by 19.2% in January 2025, higher than the 18.6% increase recorded in December 2024.

However, non-food price inflation reduced to 13.2% in January 2025 from 14.2% in December 2024.

The rising inflation informed the Bank of Zambia’s decision to raise its MPR rates by 50bps to 14.5% in February 2025.

Ghana

West Africa’s Ghana retained its MPR at 27% for the second time in a row in January. This is despite its increased inflation rate to 23.8% in December 2024, largely driven by rising food costs.

The Bank of Ghana refused to increase its rate, citing inflation, which is expected to decrease once the newly elected government publishes and starts the implementation of its economic policies.

Rwanda

In February 2025, the Bank of Rwanda retained its rate of 6.5% for the second time in a row, citing the steady inflation rate in the country.

Although inflation in January 2025 rose by 5.2% from 4.1% in December 2024, the National Bank of Rwanda is hesitant to increase its MPR as the inflation rate is still well within the 2-8% range.

Namibia

Unlike the other countries which have either increased or retained their interest rates, Namibia tells a different story.

The Bank of Namibia slashed its interest rate by 25bps to 6.75% in February 2025. This follows the country’s steadily reducing inflation rate and increasing economic growth.

Namibia’s inflation rate was down to 3.2% in January 2025 as against 5.4% recorded in January 2024.

Apart from Namibia’s favourable economic state, the fact that it pegged its currency to that of South Africa’s Rand has also helped to stabilise its economy and foreign exchange rates.

Kenya

As a result of improving economic conditions, Kenya also lowered its MPR from 11.25% to 10.75% in February 2025.

The Central Bank of Kenya noted that inflation in January 2025 increased to 3.3%, from 3.0% recorded in December 2024. Core inflation reduced to 2.0% in January 2025, from 2.2% in December 2024.

However, non-core inflation added an extra 1.9%, increasing to 7.1% in January 2025, from 5.2% in December 2024. This was due to the increase in the price of food stemming from seasonal changes.

AfDB’s macroeconomic outlook for 2025 and interest rates across Africa

For the African Development Bank (AfDB), the average GDP of the continent in 2024 was estimated to be 3.2%, a slight .2% increase from the projected 3.0%. However, the figure is still largely below the 7% GDP needed to remove millions from poverty across the continent.

Per the report, 30 out of 54 African countries saw an increase in their GDP including South Africa, Nigeria, Angola, Equatorial Guinea, Niger and Uganda.

The report also noted that the average estimated inflation rate for the continent in 2024 was 18.6%, far above the medium target for most African countries for the year in review.

It also noted that the aggressive increase in MPR across the continent resulted in the reduction of countries with double inflation from 19 in 2023 to 15 in 2024.

Why the interest rates matter

Countries across Africa are grappling with different socioeconomic situations that may potentially weaken their real sector, drive inflation to higher rates and ground their economies.

From currency devaluation to war and the impact of foreign economic policies, African apex banks need to be on their toes to ensure the stability of their economies despite internal and external factors that may affect their economies.

The interest rates are a viable tool to tackle and manage economic pressures before those pressures negatively affect the economic and purchasing powers of their citizens, finally grounding the economy.