Talk to anyone in banking or payments, and they’ll tell you that what works against fraudsters today might not work tomorrow.

In Africa, digital payments—mobile money, agency banking, and instant transfers—have brought millions into the financial system. But with growth comes risk. For these innovations to thrive sustainably, we must outpace fraudsters before they outmaneuver us.

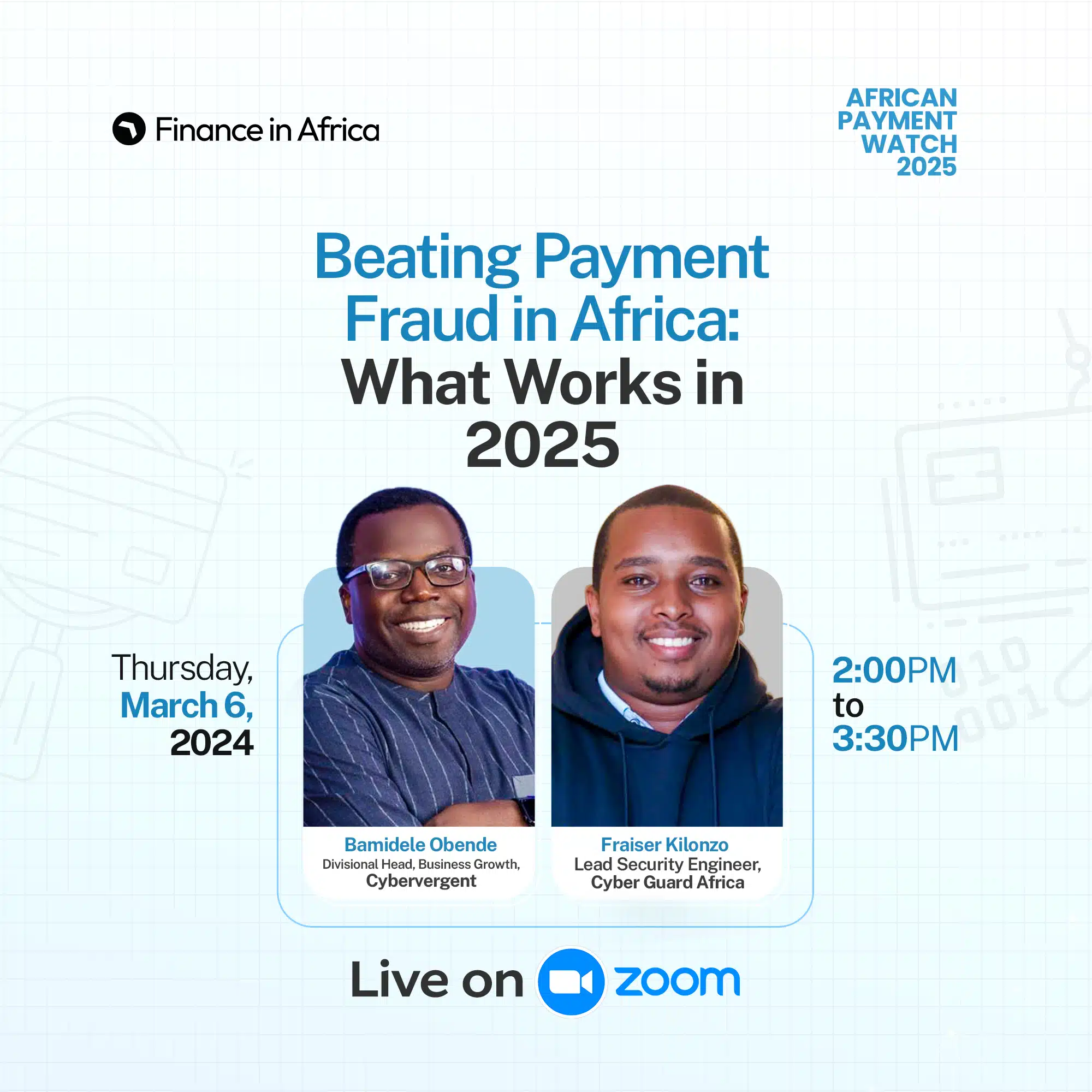

That’s why we’re hosting a must-attend webinar to uncover what actually works against payment fraud in 2025.

Why This Matters

Financial fraud remains a pressing concern across Africa, with each region battling unique threats:

- West Africa – Fraud on the Rise

In Q3 2024, fraud cases surged by 65% to 19,007, with attempted fraud amounts doubling to ₦115.9 billion ($10 billion in losses). - East Africa – The Identity Crisis

This region saw the highest rates of document fraud in 2024, with a 27% rejection rate for identity verification attempts due to poor-quality ID documents. - Southern Africa – Outdated Systems, Growing Risks

Fraud rates jumped from 9% to 21%, largely due to legacy ID systems, such as the retiring Green Book ID, creating loopholes for criminals.

Even beyond regional differences, fraudsters are getting more sophisticated—exploiting race conditions, brute force attacks, and collaborating better than financial institutions do.

Who Should Attend?

If you work in fraud prevention, risk management, IT security, or compliance in Africa’s financial sector, this session is for you.

🔹 Date: Thursday, March 6, 2025

🔹 Time: 2:00 PM WAT

🔹 Platform: Zoom

Meet the Experts

- Bamidele Obende – Divisional Head of Business Growth, Cybervergent

- Fraiser Kilonzo – Lead Security Engineer, Cyber Guard Africa

With deep regional expertise in tackling fraud across Africa, they’ll break down what works in 2025—from non-obvious fraud detection to practical security strategies you can apply immediately.

Register Now.

Wait, what’s that? You don’t know what Finance in Africa is? Okay, we can’t complain, but we have a decade of history behind us. You can find out more about Finance in Africa here.