The Nigerian Federal Inland Revenue Service (FIRS) is rolling out an e-invoicing system for big companies to improve tax collection.

Notably, this has been positioned as a pilot phase, meaning there will be adjustments before a full rollout.

While this development could help prevent tax evasion, businesses in different industries have concerns. The main question is whether Nigeria’s infrastructure can handle this digital change.

Companies are also worried about how the system will work, whether their current setup will be compatible, and if it will lead to extra costs.

Beyond these issues, it’s important to understand why the government is making this change and if it will work in Nigeria’s economy.

Nigeria isn’t alone in this

E-invoicing is not a new concept. Many countries have adopted it as part of broader tax digitisation efforts to improve revenue collection, curb fraud, and enhance transparency.

Globally, Brazil, India, and South Africa have implemented e-invoicing systems with varying degrees of success.

Brazil introduced mandatory e-invoicing in 2008, reducing tax evasion and increasing VAT compliance. India also adopted a phased approach in 2020, starting with large businesses before extending it to smaller firms. South Africa integrated e-invoicing with its digital tax system, linking it to national identification databases for better monitoring.

Nigeria’s e-invoicing policy was first introduced by the Central Bank of Nigeria (CBN) in 2022 for importers and exporters, requiring them to submit electronic invoices authenticated by Authorised Dealer Banks (ADBs). However, businesses criticised the system for causing delays in customs clearance.

The FIRS has since expanded e-invoicing requirements beyond trade transactions, making them compulsory for large taxpayers across all sectors.

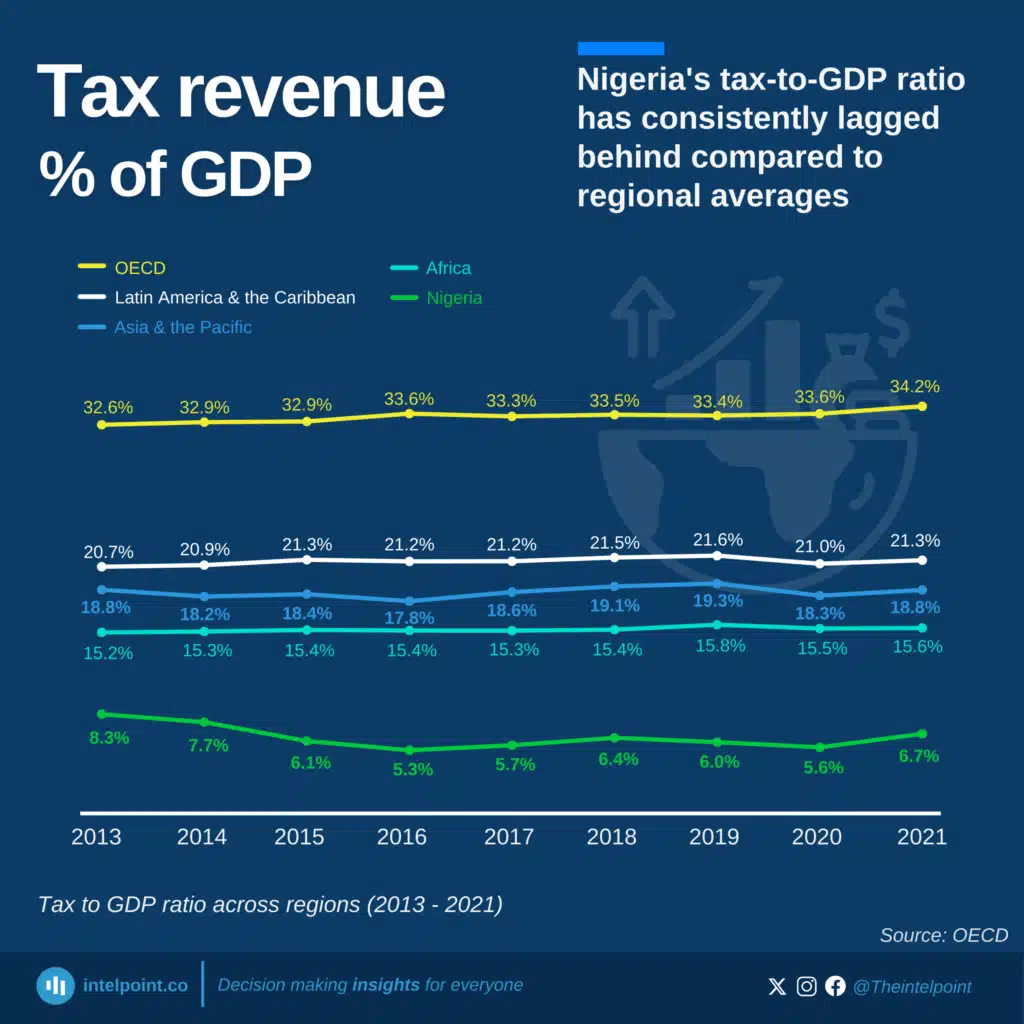

The government argues that Nigeria’s low tax-to-GDP ratio, reported at 9.4% in 2023, necessitates stricter measures, and e-invoicing is expected to help address revenue leakages.

Are companies right to be concerned?

Many industries are questioning how e-invoicing will work in practice.

Manufacturers, for instance, are unsure how returned goods will be handled and how tax records will be adjusted when sales are reversed.

There are also concerns about whether rectifying filings will be a complicated process.

In the oil and gas sector, many fuel stations conduct thousands of small cash transactions daily. It’s unclear whether they must issue e-invoices for each sale in real time or invest in new technology to comply.

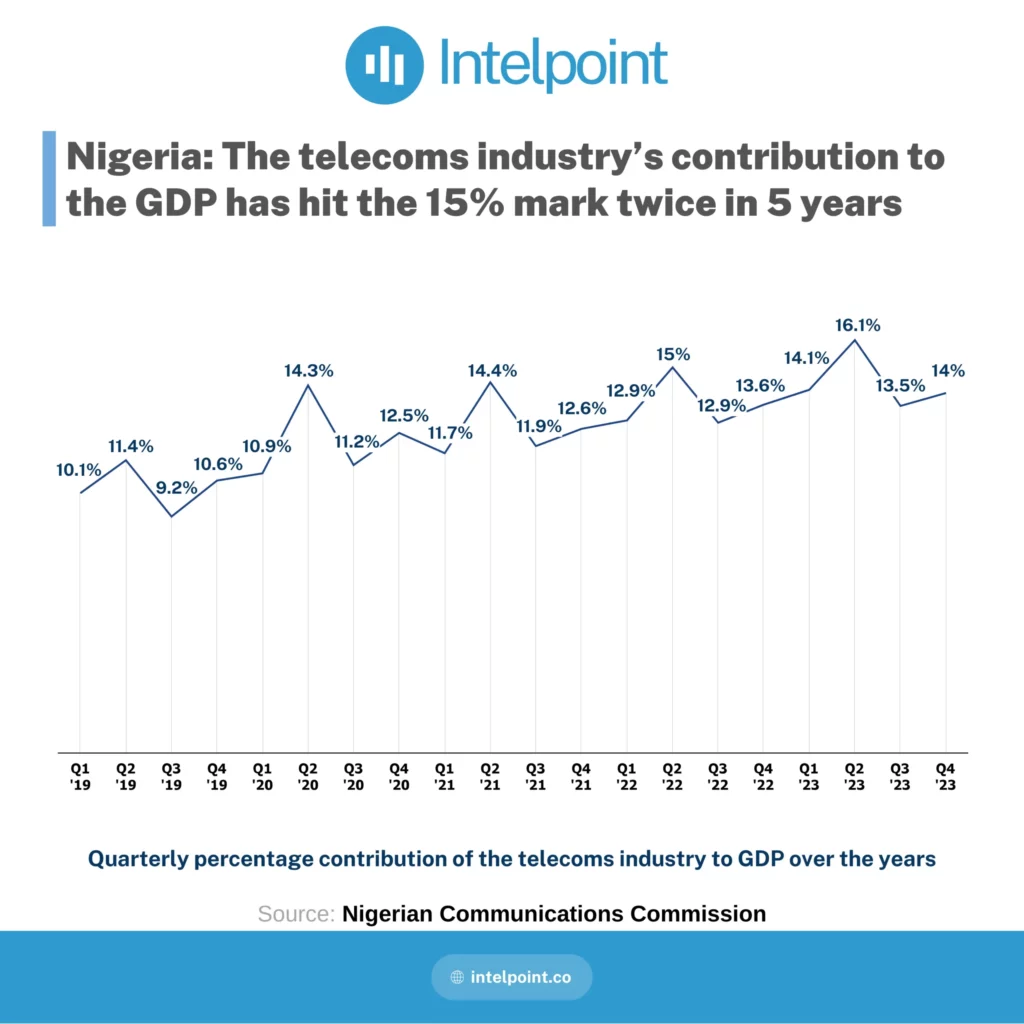

The telecom sector faces similar challenges. In 2023, Nigerians spent about ₦2.6 trillion ($6.2 billion) on airtime and data in nine months, with companies like MTN Nigeria and Airtel Africa processing millions of prepaid transactions daily.

If every sale requires an e-invoice, telcos may need exemptions or bulk invoicing solutions to avoid technical and financial strain.

Multinational corporations are also concerned. A 2022 KPMG survey found that 68% of these companies in Nigeria had tax audits, with 17% reporting slow processes.

Since 94% already have systems for financial reporting, mismatched e-invoicing rules could force them to create Nigeria-specific systems, increasing costs.

Banks and financial institutions process thousands of daily transactions, including loans, interest, service fees, and currency exchanges. If e-invoices are required for each charge, system upgrades could be costly.

While a 2019 PwC study noted that regulations have driven banks to digitise, Nigerian banks already face currency instability and heavy compliance costs.

In 2021, they paid ₦259.75 billion in levies, and the Central Bank of Nigeria has since raised capital reserve requirements. Additional compliance expenses could worsen financial strain.

Data security is another concern. Banks handle sensitive financial information, and linking their systems to FIRS’ platform could pose security risks.

Would tax authorities have real-time access to all transactions? How would this impact banking secrecy laws? Without clear guidelines, banks may struggle to balance compliance with customer data protection.

FIRS officials, however, have assured businesses that these concerns are being considered.

Mike Adoga, head of the tax automation department at FIRS, stated, “The system allows for real-time or near real-time inputs, and we are still getting feedback and learning.”

Despite these assurances, companies remain cautious, knowing that technical issues or rigid requirements could disrupt operations.

Government support could ease the transition

We spoke to a seasoned tax expert, Tomi Akinwale, about navigating the costs of transitioning to e-invoicing.

He explained that businesses must invest in IT upgrades, staff training, and system integration, all of which can be significant. To ease this burden, he suggests government incentives like tax credits.

“Tax credits can directly alleviate the financial strain of initial implementation while encouraging compliance,” he stated.

Beyond financial relief, technical assistance is equally critical. “There should be regionally accessible training programmes and on-site implementation support tailored to the specific needs of businesses,” Akinwale suggested.

He also highlighted the need for practical guidance on integrating e-invoicing with existing accounting software and regulatory frameworks.

While FIRS has been engaging with stakeholders, Akinwale argued that sustained government support is crucial for businesses to successfully transition to e-invoicing without excessive financial strain.

Is E-Invoicing feasible in Nigeria?

Countries like India and Brazil overcame similar challenges, proving that e-invoicing can work. A major success factor was government support. India provided tax credits to ease the cost of transition, while Brazil rolled out its system in phases, allowing businesses time to adjust.

Nigeria, on the other hand, has yet to offer any financial or technical assistance, even though a 2024 PwC report found that compliance costs for electronic tax systems tend to rise in the early years. Without support, many companies may struggle to keep up.

Infrastructure is another major issue. E-invoicing relies on stable electricity and reliable internet, but Nigeria still struggles with both. The Nigerian Communications Commission (NCC) reports that internet penetration is just 45.61%, meaning nearly half the country lacks reliable access.

In 2024, Standard bank reported that Nigeria loses $26 billion annually due to power shortages, with businesses spending an extra $22 billion on off-grid fuel. If Nigeria doesn’t address these pitfalls, companies may find compliance nearly impossible.

Although, one potential solution could be allowing offline invoicing or periodic reporting instead of requiring real-time submissions.

Another reason e-invoicing worked in other countries was gradual implementation. Brazil and India started with large corporations, tested the system, and fixed issues before expanding to smaller businesses.

They also ensured that common accounting software was compatible with their e-invoicing platforms so companies wouldn’t have to spend extra on new systems.

While Nigeria seems to be following India’s phased approach, enforcement remains a concern. Will non-compliant businesses face penalties? Does FIRS have the capacity to monitor transactions in real time? Without clear answers, companies may adopt a wait-and-see approach rather than fully embracing the system.

Nigeria needs a balanced approach to E-Invoicing

Tomi Akinwale also believes that while e-invoicing can improve tax administration, its success depends on Nigeria addressing key infrastructure and economic challenges.

“The effective implementation of FIRS’ mandatory e-invoicing system for large taxpayers is intrinsically linked to Nigeria’s ability to address persistent infrastructure challenges, particularly power shortages and unreliable internet,” Akinwale explained.

As it concerns the issue of poor electricity, he suggested that Nigeria must diversify its energy strategy to improve reliability.

“Learning from regional successes, such as Ghana, is crucial. The 2023 Electricity Act, which empowers states and companies to generate power, is a step in the right direction,” he said.

Beyond traditional power sources, he emphasises the need for government-backed subsidies on alternative energy solutions like solar, wind, and hydroelectric power.

For internet reliability, Akinwale warns that rising telecom costs could undermine e-invoicing adoption. “The recent increase in internet access costs poses a considerable challenge. Businesses already struggling with economic downturns and inflation may find compliance with e-invoicing even more difficult,” he noted.

Akinwale also stressed that a balanced approach is necessary, where infrastructure development is prioritised while ensuring affordability for businesses.