President Trump’s first term rattled the global political-economic order in ways leaders across the world never anticipated.

From trade wars and tariffs with China, to his short-lived bromance with North Korean leader Kim Jung Un, withdrawal from the Iran nuclear agreement, the Paris Climate Accord, Trans-Pacific Partnership, travel bans, as well as local political and economic shakeups.

The Middle-East, Asia, Europe and even the Americas felt the whirlwind impact of POTUS 45 now 47.

During Trump’s first term, Africa stood almost isolated from the troubles of his foreign policy decisions relating to trade, politics and economy except in rhetoric and immigration. In fact, Africa was the only continent Pres. Trump did not visit during his first term in office.

However, everything has changed now in his second term- there are no allies, no adversaries and no innocent passerby in Donald Trump’s playbook. Trump’s policy upheavals did not spare Ukraine, which has been defending its sovereignty for the past three years.

President Trump’s second coming reveals that he will not spare Africa this time. In the first 100 days of the Trump Presidency, several policy moves have already had a direct impact on the continent- the withdrawal from the World Health Organisation (WHO) the 90-day pause on USAID activities.

More recently, the diplomatic spat with South Africa, which led the U.S. to declare SA’s Ambassador a persona non grata shows that Africa should be well prepared to deal with Trump.

The current POTUS will influence one policy: the Africa Growth and Opportunity Act (AGOA), a legislation that guarantees duty-free export of goods from Sub-Saharan African countries to the U.S. market.

In May 2000, President Clinton signed AGOA into law for 15 years, then extended it in 2015 for another 10 years, meaning it is set to expire this September. The objective of the initiative is to help businesses in Africa access the U.S market unhindered, which will translate to boosting businesses and local African economies.

Furthermore, President Clinton viewed the policy as a vehicle to drive economic growth and promote democracy across the SSA region. He also pointed out that it would benefit the U.S. economy by opening markets with “hundreds of millions of potential consumers” to American businesses while helping African nations expand and diversify their economies.

Volume and value of trade under AGOA

There are currently 32 Sub-Saharan African countries eligible for the program, while 17 are ineligible. Some of the reasons for the ineligibility of some countries include the absence of rule of law, military dictatorship as in the case of Burkina Faso in 2022, deeply regulated economy, authoritarianism and others.

The program has significantly expanded the volume of trade between the U.S. and the SSA region. Between 2001 and 2022, African beneficiaries of AGOA exported $103 billion worth of non-oil goods to the United States.

In 2023, total trade volume between the U.S and SSA countries under AGOA reached $47 billion, with the U.S recording a deficit of $11 billion.

In 2023, the top U.S. exports to sub-Saharan Africa included aircraft ($1.8 billion), petroleum products ($1.3 billion), motor vehicles ($1.2 billion), natural gas and components ($1.2 billion), and motor vehicle parts ($861 million). The leading destination markets were South Africa ($7.2 billion), Nigeria ($2.6 billion), Ethiopia ($1.2 billion), Ghana ($850 million), and Angola ($595 million).

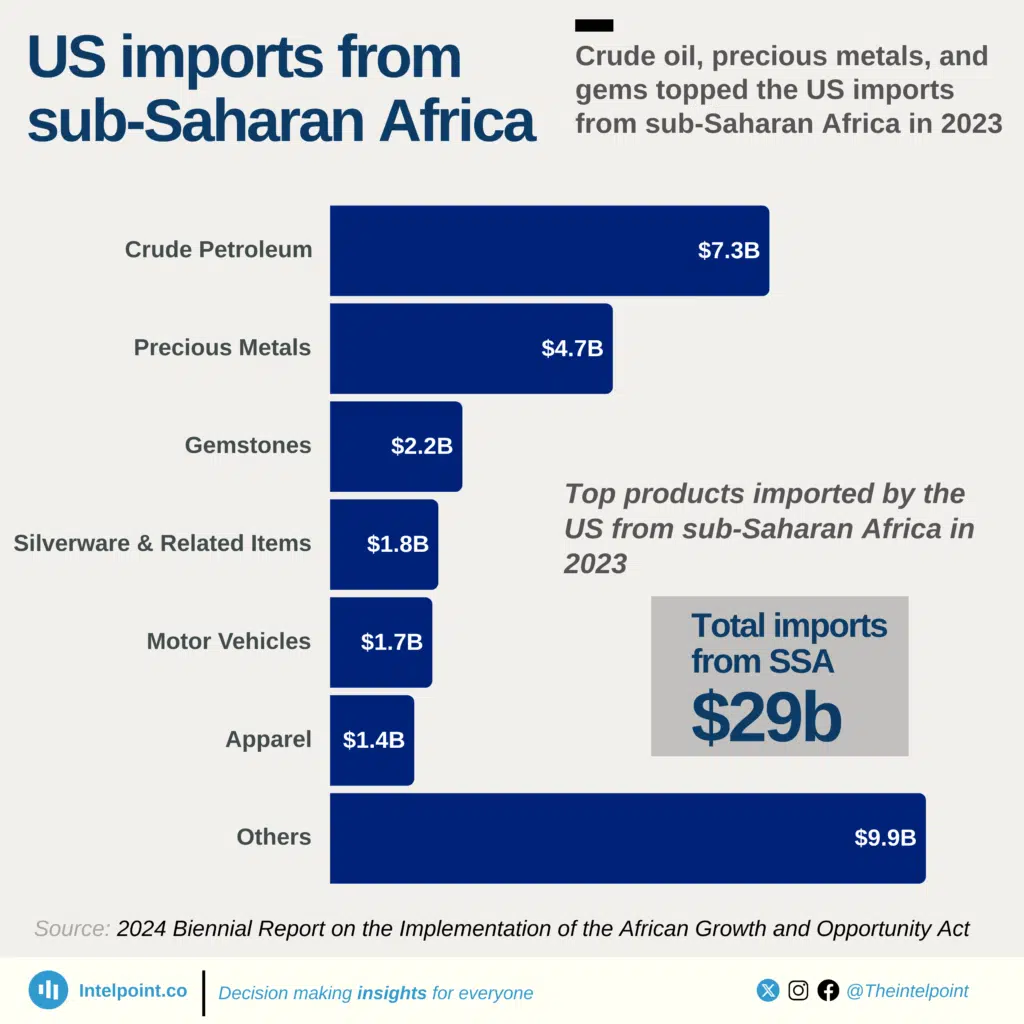

On the import side, the U.S. sourced crude petroleum ($7.3 billion), precious metals ($4.7 billion), gemstones ($2.2 billion), silverware and related articles ($1.8 billion), motor vehicles ($1.7 billion), and apparel ($1.4 billion) from sub-Saharan Africa. The top suppliers to the U.S. were South Africa ($14.0 billion), Nigeria ($5.7 billion), Ghana ($1.7 billion), Angola ($1.2 billion), and Côte d’Ivoire ($948 million).

Challenges and criticisms of AGOA

However, critics have noted that oil and gas have dominated exports under the AGOA program since its initiation. According to the United States Trade Representative (USTR), oil and gas products made up 45% of U.S imports under the AGOA program. This is not to downplay non-oil exports from AGOA eligible countries which have almost quadrupled since 2001.

The non-oil sectors propelling this increase during this period include; apparel, auto parts, macadamia nuts, jewelry, fresh oranges, and footwear. South Africa is the largest AGOA beneficiary.

Beyond the preponderance of oil exports from SSA countries under the AGOA scheme, in the past decade, the rise of China-Africa trade has proven a significant competitor to the AGOA initiative and would prove to be an important factor in the negotiations to extend the program. In 2009, China surpassed the United States as the single largest trade partner with Africa and has maintained that position ever since.

To emphasize the impact of competing trade relations against the U.S in Africa, the two countries most dependent on AGOA-facilitated trade- Nigeria and South Africa, exported goods to the U.S. under the act amounting to only about 1% of their GDP last year.

Exports from Africa to the United States under the Act have nosedived from 81% of total exports in 2008 to just 33% in 2023, denoting the impact of closer trade relations with the European Union and China.

One favourable aspect of the China-Africa trade relationship is the absence of strings from the more powerful partner, unlike the United States. This tacitly compels countries to adhere to its political or social ideals as seen as in the case that resulted in the expulsion of Ethiopia from the Act.

Extension efforts and influence of Pres. Trump

In April 2024, U.S. Senators Jim Risch (R-ID) and Chris Coons (D-DE) introduced the AGOA Renewal and Improvement Act of 2024 which hopes to extend the implementation of the Act for another 16years. However, the effort hit a brick wall in December when Congress halted its passage, meaning the Trump administration will now be responsible for extending the program.

The Trump administration should consider that extending the Act is expected to provide the United States with access to critical energy minerals. The U.S in the past decade has lagged behind its closest rival China in the race to access critical minerals for energy transition.

AGOA is going to face increased scrutiny during its extension from the Trump administration, unlike under previous Presidents. Trump has preached an “American first” agenda, especially on trade, during the campaigns and has walked the talk in his second tenure so far.

But will AGOA be one of the casualties of Trump’s trade wars? International Trade Pricing consultant, Ore Atobatele, told FinanceinAfrica that Africa might not be a target of Trump’s trade wars since the U.S has a trade surplus with the continent and the volume of trade between both parties is less than 2% of U.S trade.

However, she notes that for Trump, trade is a tool to achieve strategic political and diplomatic goals and since AGOA seems like a one-way deal with Africa as the sole beneficiary, Trump would want more.

“However, Trump has shown that he’s willing to use trade policy as a tool to push for political or strategic goals. For example, during his presidency, he removed countries like Ethiopia and Cameroon from the Africa Growth and Opportunity Act (AGOA) program over issues related to human rights and governance.

“If Trump sees Africa as a battleground in the growing U.S.-China rivalry, he could get more aggressive with trade tools, possibly including tariffs or stricter trade rules.”

“African leaders should be prepared for less predictability in trade relations. There may be more pressure to sign bilateral trade agreements that favor U.S. interests. AGOA might not be renewed unless African governments, the African Union, and U.S. lawmakers push hard to keep it alive. Countries that rely heavily on AGOA.“

South Africa’s diplomatic row with the U.S will complicate discussions going forward as it is one of the biggest beneficiaries of the program. As the clock ticks and the pressure kicks in, African leaders will need to deploy every weapon in their arsenal to ensure the program stays alive. The continent has not fully recovered from the economic impact of the COVID-19 pandemic and would need every favourable trade deal.

Impact of Trump’s Presidency on AGOA’s Future

Trump’s MAGA base would likely not favour an extension but seek a deal that gives something to the U.S unlike the current one-way deal. A conservative coalition group last year described efforts towards extending the program under the continuing resolution Act, a slap on the then incoming administration’s “America first agenda”.

According to the Coalition for Prosperous America (CPA), “Congress has no business resurrecting decade-long unilateral tariff cuts in the final hours of this session. Reviving these outrageous tariff waiver programmes is the opposite of putting America first.”

However, it is instructive to note that Pres. Trump has not made any statement regards to extension or repelling of AGOA or any trade deal with African countries.

Businesses will shut down and lose jobs if September arrives and AGOA is not extended. When the United States withdrew Ethiopia’s participation under the agreement in 2018, global fashion giant PVH Corp announced its exit from the country. This foreshadows a reality that many African countries will face if the Act is not extended.

The Ethiopian government earlier stated that her exclusion from the trade partnership cost as many as 400,000 jobs. This could be reality for many African countries if Trump allows the program to run its course without any extension as the continent grapples with a sluggish post-pandemic recovery.