The South Africa’s parliament has approved a budget that includes a VAT increase from 15% to 15.5%, effective 1 May 2025.

However, the Democratic Alliance (DA) has opposed the hike and filed a court case challenging the budget’s legality.

This legal challenge could delay or alter the implementation of the VAT increase.

While the government aims to raise revenue for public services, businesses may need to prepare for higher costs, changing consumer behavior, and potential regulatory challenges.

Behind the numbers

At first glance, a 1% increase in VAT might seem insignificant.

However, especially in business, even small changes in tax rates can add up to millions of rands in additional costs.

Since VAT is calculated as a percentage of the transaction value, the higher the value, the more you pay.

When these transactions happen frequently, the financial impact becomes even more noticeable.

Let’s look at this example:

A company receives an operations invoice worth $792,000.

- At the current 15% VAT, the tax amounts to $118,800, bringing the total to $910,800.

- Under the new 15.5% VAT, the tax increases to $123,000, pushing the total to $913,800.

That’s an additional $3,960 on a single transaction just from a 0.5% change.

If the business handles dozens of similar invoices each month, these costs could quickly accumulate into millions more in VAT payments over the course of the year.

The impact increases even more with larger transactions:

- At $52,800, the VAT rises from $7,920 to $8,070, an increase of $250.

- At $528,000, VAT increases from $79,200 to $81,000, a difference of $2,460.

- At $5.28 million, VAT rises from $792,000 to $814,000, an additional $25,800.

Why is VAT increasing?

The South African government justifies the VAT hike as a necessary measure to sustain essential services, particularly healthcare and defence.

In 2025, the government is adding about $1.57 billion to healthcare spending.

Overall health costs are also expected to rise from $15.1 billion in 2024/25 to $17.9 billion by 2027/28. Officials say this will help care for people with HIV and pay medical workers.

The defence budget is also getting $272 million, with the government citing security issues in eastern Congo.

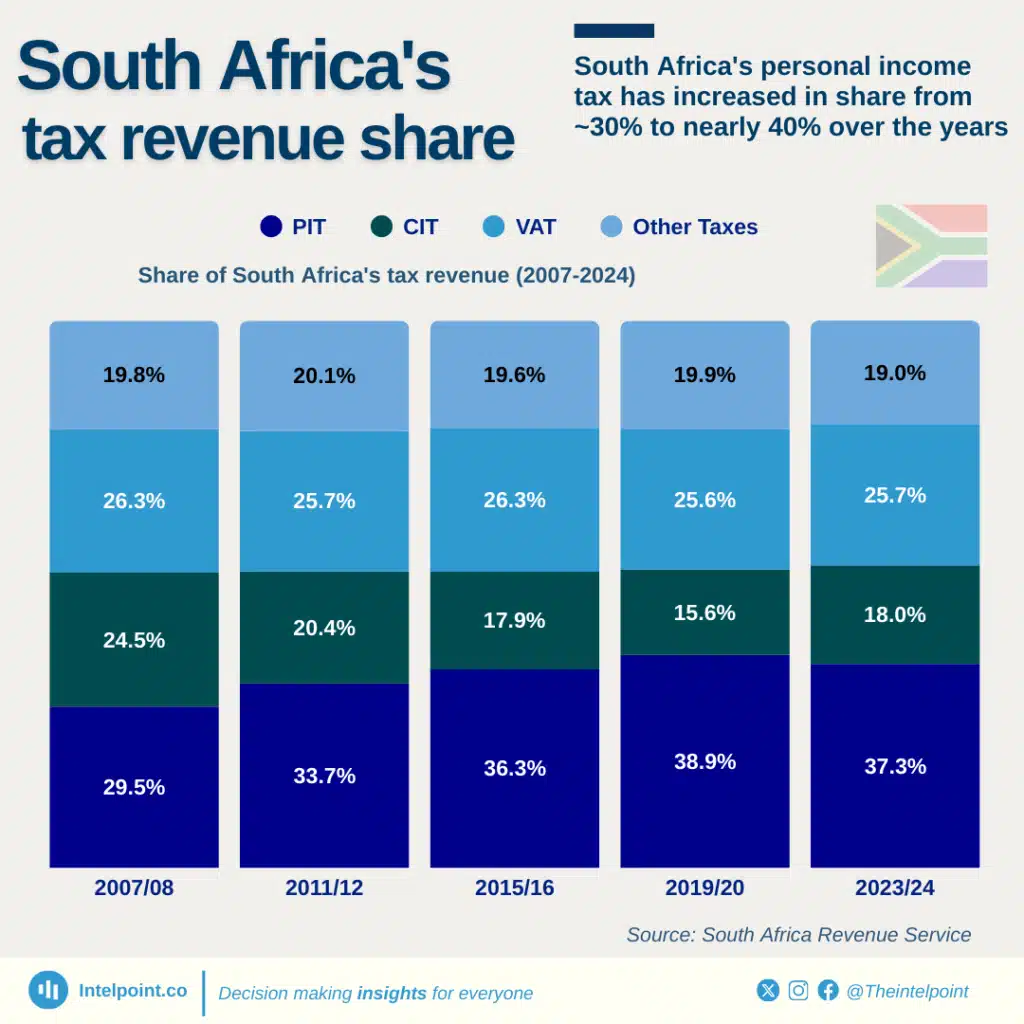

VAT has always been a big source of income for the government. In 2017/18, the South African Revenue Service (SARS) collected $16.2 billion from VAT, making up about 70% of domestic taxes on goods and services.

The total tax revenue collected in the 2018/19 fiscal year amounted to $68.1 billion, reflecting a year-on-year growth of $3.7 billion (5.9%), with VAT contributing 25.2% of this amount.

The government expects another boost this time, but it’s unclear how businesses and consumers will be affected.

Other countries have also raised VAT to deal with financial problems. Kenya increased VAT from 14% to 16% in 2021 after a financial crisis.

However, whether South Africa’s VAT increase will help fix its budget issues without making life harder for people is still uncertain.

Has this happened before?

The last VAT increase in South Africa occurred in 2018 when the rate was raised from 14% to 15%.

That increase was met with strong opposition from labour unions, consumer groups, and businesses concerned about declining demand.

A similar pattern has emerged in 2025, with opposition parties, including the Democratic Alliance (DA), rejecting the VAT hike unless it is temporary.

Lawmakers have approved the fiscal framework, including the VAT increase.

However, the ongoing political disputes within the ruling coalition could still delay or challenge its implementation.

How will the VAT increase impact businesses?

Companies in retail, manufacturing, and fast-moving consumer goods (FMCG) are likely to feel the greatest impact from the VAT increase.

Typically, VAT hikes lead to higher prices, which can reduce consumer spending, leaving businesses with the decision of whether to absorb the additional tax or pass it on to customers.

Absorbing the increase may shrink profit margins, pushing companies to find ways to cut costs through supplier renegotiations, automation, or even job reductions.

On the other hand, passing the cost to consumers could result in lower sales, particularly in competitive sectors where pricing plays a key role in consumer choice.

The 2018 VAT hike showed that increased indirect taxes often lead to price rises, dampening demand and slowing economic activity.

As the VAT rate change takes effect, companies will need to update their accounting systems, pricing structures, and invoicing processes.

From May 1, 2025, and April 1, 2026, businesses will need to ensure the correct tax rate is applied to transactions, with long-term contracts and tax invoicing reflecting the updated rates.

Enterprise Resource Planning (ERP) and accounting systems may require adjustments to ensure automated compliance.

This could be more seamless for large corporations equipped with digital tax compliance tools, but may prove more challenging for smaller businesses with limited resources.

Adding to the uncertainty, Finance Minister Enoch Godongwana’s suggestion that the second VAT increase in 2026 might be reconsidered adds another layer of unpredictability to the business environment.

Investors typically favour stable tax policies, and unexpected changes can deter long-term investments.

For multinational companies, tax unpredictability could lead to reassessments of expansion plans in South Africa, especially if concerns about profitability increase.

Businesses dependent on foreign investment may also struggle to secure funding if the country’s economic conditions remain unstable.

Who will bear the weight of this increase?

Tax educator and founder of Irhafu, André Bothma, has strongly criticised South Africa’s proposed VAT increase, calling it a “direct assault on consumers and the lower/middle class of South Africa.”

According to him, businesses can reclaim VAT but it’s the ordinary South Africans that will bear the true financial burden.

“Businesses are not expected to be significantly affected, as they can claim VAT refunds on purchases,” Bothma explained.

However, he acknowledged that companies paying large amounts of VAT will face higher costs, even though the refund mechanism softens the blow.

For consumers, however, there is no such relief. “The real burden of the VAT increase will fall on consumers, as they cannot claim refunds,” he stressed. “Everyday goods and services will become more expensive, further straining household budgets”.

Beyond immediate costs, Bothma raised concerns about the broader economic impact.

“The VAT hike adds to South Africa’s already challenging economic climate,” he noted, adding that investors may see it as part of a larger pattern of economic instability.

While some may worry about the tax increase itself, he believed many will be “more concerned about the overall business environment rather than just the VAT increase.”

He also pointed to South Africa’s strained international relations, particularly with the US, as an additional factor that could weaken investor confidence.

“When you add political uncertainty and global tensions to the mix, it makes South Africa a more difficult environment for investors to commit long-term,” Bothma warned.

His assessment suggested that while the VAT hike is meant to generate revenue, it may have unintended consequences for both businesses and the economy at large.

What can companies do to adapt?

Companies will need to take a proactive approach to mitigate the impact of the VAT increase.

Reassessing pricing strategies will be important in determining how much of the VAT hike can be absorbed without significantly affecting profit margins.

Cost efficiency measures, such as automation, supply chain optimisation, or restructuring, could help ease operational strain.

Companies will also need to prepare for compliance costs by investing in tax automation software and ensuring their accounting teams are adequately equipped for the transition.

Given the ongoing policy uncertainty, staying informed and closely monitoring government announcements will be crucial to avoid any surprises from last-minute changes.

Exchange rate: 1 USD = R18.9