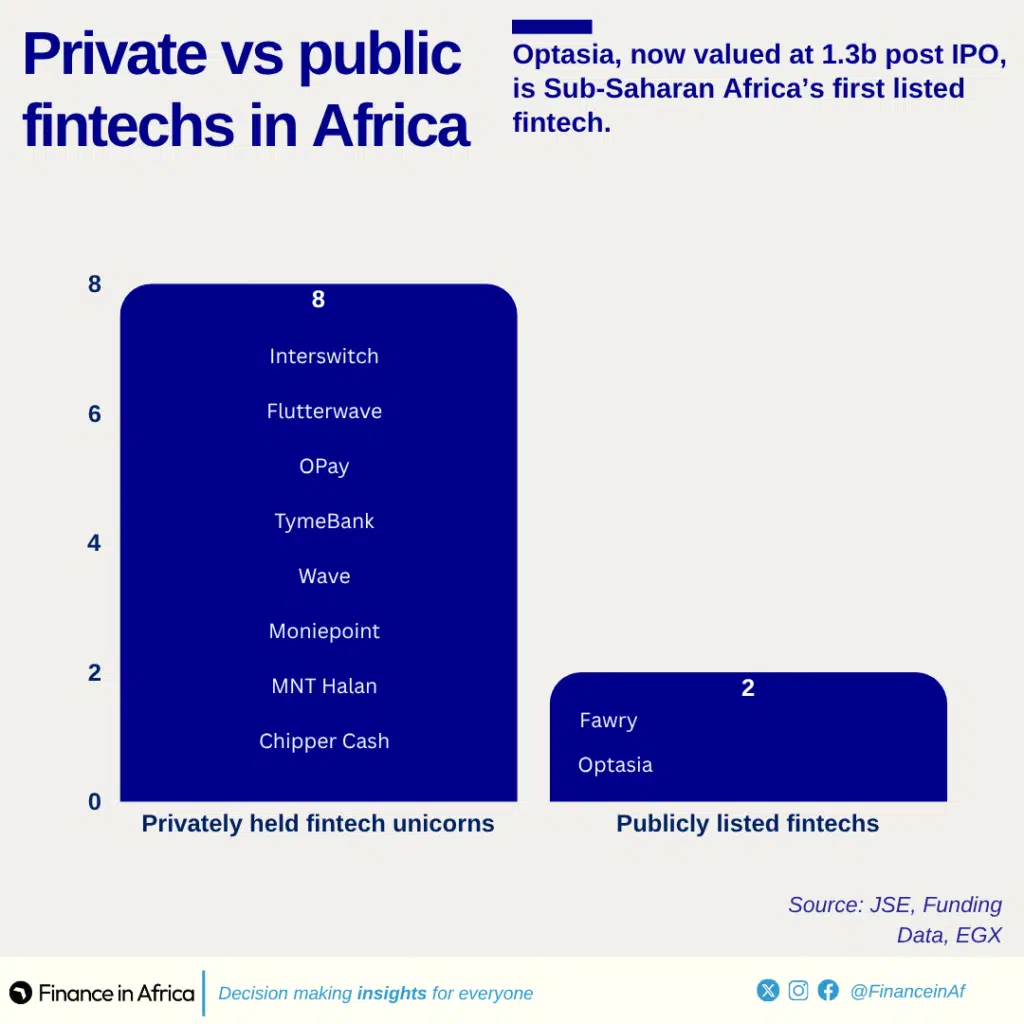

Editor’s note: An earlier version of this article described Optasia as Africa’s first fintech IPO. The title properly belongs to Egypt’s Fawry, which listed on the Egyptian Exchange in August 2019. However, given Egypt’s financial ecosystem is often grouped with the Middle East and North Africa (MENA), the initial reference reflected the context of Sub-Saharan Africa’s first fintech listing.

African fintech Optasia has reached a milestone that few of its peers have attempted: listing locally. The artificial-intelligence-driven credit-scoring and lending platform debuted on the Johannesburg Stock Exchange (JSE) in late October 2025 and, within its first week of trading, achieved a market capitalisation of ZAR 23.9 billion ($1.28 billion).

The company’s stock opened at ZAR 1,950 and traded in a narrow band around ZAR 1,987 in early November, suggesting a stable aftermarket rather than a speculative pop. That composure indicates institutional rather than retail participation and suggests investors see Optasia not as a momentum trade but as a test case for African fintech price discovery on local exchanges.

A rare local fintech listing

For the past decade, African fintech capital formation has been dominated by venture funding and offshore valuations, from Silicon Valley and London to Dubai. Optasia’s decision to go public in Johannesburg, instead of pursuing a London or Nasdaq dual-listing, breaks that orthodoxy.

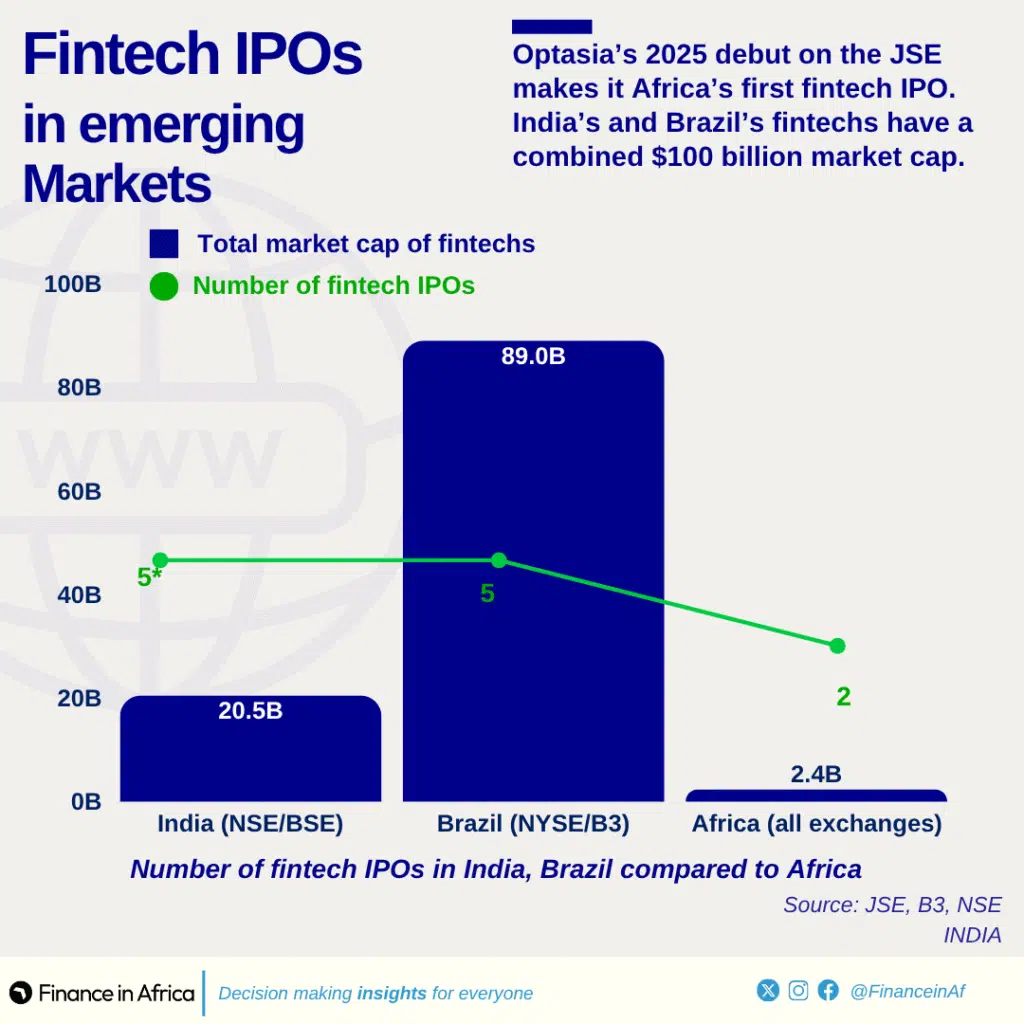

Fawry listed on the Egyptian Exchange in 2019, becoming one of Africa’s earliest digital-payments IPOs and briefly surpassing a US $1 billion market cap.

While Egypt is often grouped with the Middle East and North Africa in global datasets, Fawry’s listing set the continental precedent. Optasia’s 2025 Johannesburg debut, then, is best viewed as sub-Saharan Africa’s first fintech IPO — a regional milestone in local capital formation.

The firm’s listing introduces a new benchmark: can a technology-driven financial-inclusion company achieve liquidity, transparency, and long-term capital in African markets without dollar-denominated dependency?

Optasia’s story is rooted in infrastructure rather than hype. Founded in 2012 as Channel VAS and rebranded in 2022, the company uses AI to assess creditworthiness for unbanked and underbanked consumers, working with mobile-network operators and banks across 40 markets.

Its model is embedded finance at scale: analysing telco data, extending airtime and nano-loans, and partnering with institutions such as Ecobank, MTN Group, and Orange Money to deliver instant credit.

Systemic significance

Optasia’s debut goes beyond its ZAR 23.9 billion ($1.3 billion) valuation. It’s a capital-markets stress test of whether African public exchanges can absorb high-growth, technology-driven issuers. The JSE has seen limited fintech representation despite being Africa’s most liquid bourse.

The same can be said for every other exchange on the continent. Optasia’s listing offers regulators and investors a working model for tech valuation transparency within the continent’s prudential framework.

It also marks a structural evolution: venture capital exits via local IPO rather than cross-border acquisition. With its former Vodacom executive shareholder now reportedly setting up a $200 million AI fund post-exit, a new loop of reinvestment could be forming — where African founders and ex-operators recycle liquidity into new ventures rather than relying on external LPs.

Optasia’s listing also lands in the middle of an unresolved contradiction in Africa’s fintech story. As Finance in Africa reported in its analysis, “African Fintechs: Revenue Without Scale,” the continent leads the world in mobile-money usage with more than 1.1 billion registered accounts and $1.1 trillion in annual transaction value, yet captures less than 1 per cent of global fintech revenues.

Most African fintechs have built vast user bases on peer-to-peer payments and cash-in/cash-out functionality, but have struggled to monetise those networks beyond basic transfers.

Optasia, by contrast, has done precisely what most have not: built a scalable, revenue-generating model. Its AI-driven credit-scoring engine converts mobile-usage data into loanable insights, unlocking lending income where others depend on transaction fees.

A measured market reaction

Since its listing, trading volumes have remained moderate (3.18 million shares on November 5), and the price has stayed within five percent of its opening level. That’s a contrast to tech listings elsewhere in the world that often suffer early volatility.

The JSE, still heavily weighted toward mining and financial stocks, has sought new-economy listings to signal its relevance to Africa’s digital transformation. Optasia’s debut gives the exchange something it has lacked: a scalable fintech equity story with continental exposure and defensible revenues.

Regional context and competitive signal

Across Africa, major fintechs — Flutterwave, Chipper Cash, Interswitch, Moniepoint — remain privately held, with opaque valuations and lingering governance concerns. Optasia’s public float creates comparative pressure: private peers now have a valuation yardstick anchored in an audited, exchange-listed entity.

It also arrives at a time when cross-border fintech regulation and payments infrastructure are maturing. With initiatives like the Pan-African Payment and Settlement System (PAPSS) and emerging fintech-passport agreements (such as Ghana–Rwanda), investors are starting to price systemic risk differently. Publicly traded fintechs can act as bellwethers for investor sentiment toward Africa’s regulatory interoperability.

| Company | Primary Listing Exchange | IPO Year | Current Market Cap (Approx. Nov 2025) | Primary Business Focus |

| Optasia (South Africa) | JSE (Local) | 2025 | $1.30 billion | AI-driven Digital Credit and Financial Inclusion (B2B2X platform for micro-lending, airtime advance, and credit decisioning in emerging markets). |

| PB Fintech (PolicyBazaar) (India) | NSE/BSE (Local) | 2021 | $10.05 billion | Digital Insurance & Lending Marketplace (Policybazaar for insurance; Paisabazaar for credit). |

| Paytm (One97) – India | NSE/BSE (Local) | 2021 | $9.34 billion | Digital Payments & Financial Services (Mobile payments, digital wallet, merchant acquiring, wealth management). |

| Zaggle Prepaid Ocean – India | NSE/BSE (Local) | 2023 | $0.45 billion | Fintech-SaaS and Expense Management (Prepaid cards, employee benefits, expense automation). |

| Nubank (Nu Holdings) – Brazil | NYSE (International) | 2021 | $77.63 billion | Digital Banking (Largest neobank in Latin America offering credit cards, accounts, and lending). |

| XP Inc. – Brazil | NASDAQ (International) | 2019 | $13.75 billion | Investment Platform & Brokerage (Democratizing access to financial investments, wealth management). |

| StoneCo – Brazil | NASDAQ (International) | 2018 | $5.44 billion | Merchant Acquiring & Payments (POS solutions, e-commerce gateways, digital banking for merchants). |

| PagSeguro – Brazil | NYSE (International) | 2018 | $4.07 billion | Payments and Digital Banking (Solutions for micro-merchants, digital accounts, and payment processing). |

Optasia’s JSE listing recalls the early-stage domestic IPOs of Paytm (India) and Nubank (Brazil), both of which tested whether fintechs could mature inside emerging-market exchanges. Like those examples, Optasia’s success will depend on execution and liquidity depth — not launch-day fanfare.

What to expect

For Optasia, sustaining investor confidence will hinge on translating AI credit analytics into consistent profitability. For Africa’s financial ecosystem, the company’s ZAR 23.9 billion ($1.38 billion) debut represents more than a single success story: it’s a referendum on whether the continent’s capital markets can finally finance their own digital future.