As Nigeria approaches 2026, a pre-election year, the banking sector is bracing for a complex mix of pressures and prospects that could reshape performance after two years of reform-driven windfalls.

At the Fitch on Nigeria 2025 forum in Lagos on Tuesday, industry experts identified seven major trends and risks—from inflationary shocks to rising cybersecurity threats—that investors and market participants should monitor closely.

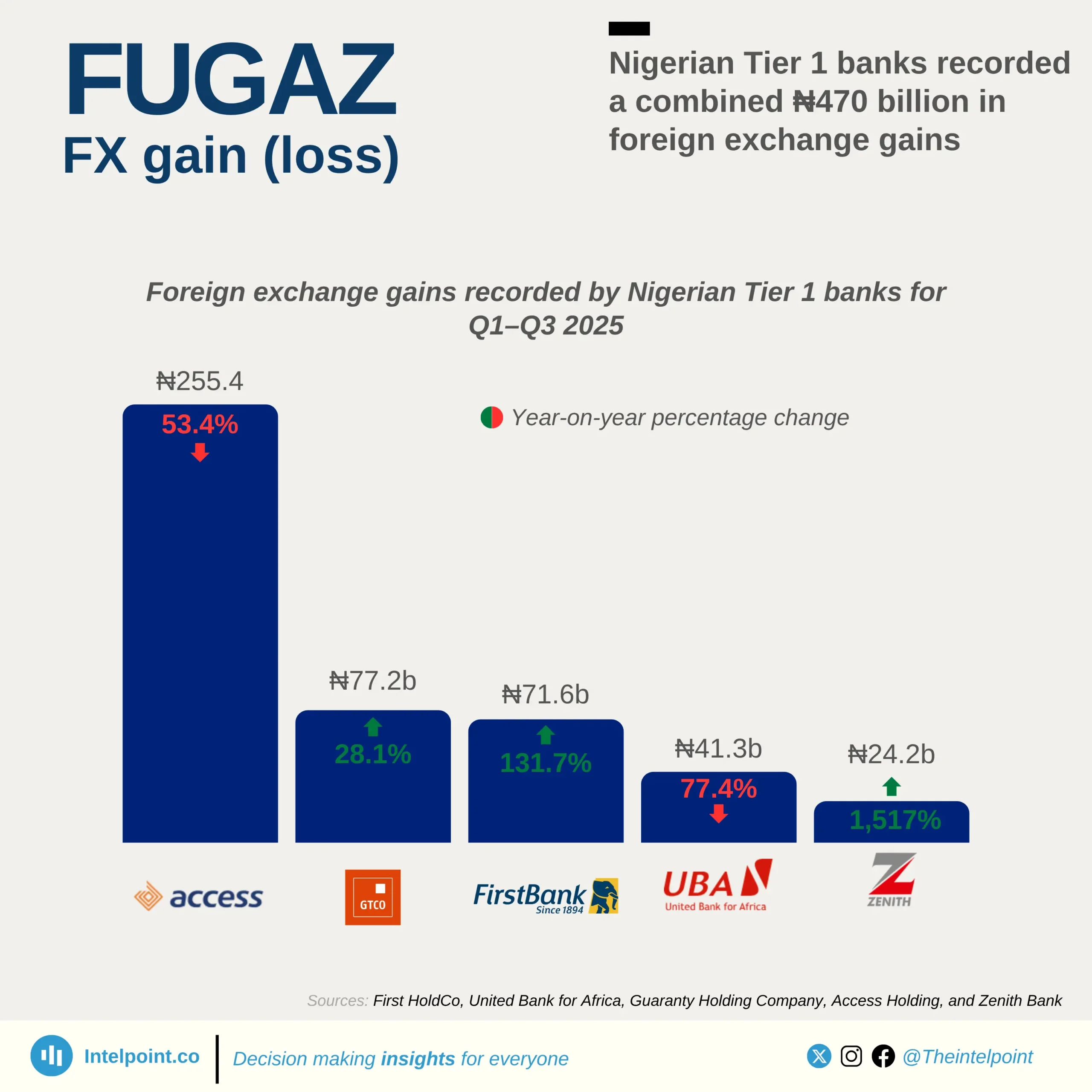

This year marked an unusual turn for the sector as many big banks reported a rare drop in profits. After two years of bumper gains fuelled largely by naira devaluations and aggressive monetary tightening, earnings have begun to normalise as the currency stabilises and interest rates soften.

When President Bola Tinubu implemented sweeping reforms, especially the sharp devaluations in mid-2023 and January 2024, banks with large foreign exchange positions benefited enormously.

Data from the Central Bank of Nigeria (CBN) shows that the average official exchange rate rose to ₦1,450/$ in 2024 from ₦645.10/$ in 2023. In the first eight months of 2025, the naira traded within the ₦1,500–₦1,600/$ range before firming to ₦1,480.3/$ on September 26. On November 19, it closed at ₦1,455.5/$ at the official window.

The CBN’s tightening cycle, which raised the Monetary Policy Rate (MPR) by 875 basis points to 27.5% between July 2023 and May 2025, boosted yields and interest income for banks.

But the environment shifted this year as the central bank held rates steady before delivering its first cut since September 2020—reducing the MPR to 27% at its September meeting.

That policy pivot coincided with a sharp earnings slowdown for Tier-1 lenders. GTCO, Zenith, First HoldCo, and Access Holdings posted combined after-tax profits of ₦2.49 trillion ($1.64 billion) in the first nine months of 2025, down from ₦3.07 trillion ($1.94 billion) in the same period of last year. Although UBA saw a growth of 2.3%, it is lower when compared with the 17% gain in 2024.

Smaller lenders such as Wema, Stanbic IBTC, and Sterling Holdings, however, reported a combined 159.9% surge in profit to ₦541.6 billion. FCMB, which had not released Q3 numbers as of November 19, recorded a 23.6% rise in H1 profit to ₦73.4 billion ($47.3 million), while Fidelity saw its H1 earnings fall to ₦132.3 billion ($85.3 million) from ₦159.8 billion ($106.3 million) last year.

Before the nine-month slowdown, signs of cooling were already evident as nine listed lenders saw Q1 after-tax profit rise only 0.74%, compared with a 274.3%jump in Q1 last year.

Pre-election pressures and inflation risks

Pre-election years typically come with heavy government spending, raising public finance concerns that cascade into the banking sector. Despite inflation dropping for the seventh consecutive month to a nearly four-year low of 16.1% in October, it remains in double digits—one of the highest in Africa—and continues to pose a major threat to operating costs and asset quality.

There are also fears that heightened government spending could reignite inflationary pressures in 2026.

“Next year is a pre-election year, typically characterised by heightened government expenditure. Key areas of concern include revenue generation,” said Chukwukadubia Okoye, Chief Financial Controller at UBA.

“For the banking sector, inflation will be a major issue, affecting the cost of doing business and operations. Exposure to the public sector and transition risks from a political or investor standpoint will also need close monitoring.”

Operational risk, capital adequacy pressure

Operational risk continues to weigh on capital adequacy even as banks strengthen internal controls. “One key risk is operational risk. There is still significant room for improvement, and it affects capital adequacy ratios,” said Femi Jalyeola, Group Chief Conduct and Compliance Officer at Access Bank.

Cybersecurity threats intensify

Cyber threats remain one of the most severe vulnerabilities. Cybersecurity risk is critical. Even mature markets like the UK struggle with cybersecurity, underscoring the magnitude of the problem,” Femi added.

Nigerian banks are increasing investments in digital security and data protection as attacks grow more sophisticated.

Regulatory uncertainty ahead of policy resets

With the MPC cautiously easing, banks may monitor potential shifts in the cash reserve ratio, loan-to-deposit ratios, and FX loan provisioning. “Regulatory risk will be a key development to watch,” said Tim Slater, Director of African Banking Ratings at Fitch Ratings.

Recapitalisation and strategic capital deployment

With less than five months before the March 31, 2026, recapitalisation deadline, banks are scrambling to meet new minimum capital thresholds—₦500 billion for international banks, ₦200 billion for national banks, and ₦50 billion for regional banks.

According to the CBN, 14 have already met the requirement. A recent Agusto & Co. report noted that the industry raised ₦1.7 trillion ($1.15 billion) in 2024 and another ₦800 billion ($522.9 million) between January and July 2025, with an additional ₦900 billion ($588.2 million) expected before year-end.

“Capital-raising activities have dominated the industry,” the report said, projecting stronger revenues in 2025 as fresh capital is deployed into a still-high-yield environment.

Banks are also accelerating regional expansion and technology investments. “On capital deployment, I see banks focusing on regional and market expansion,” said UBA’s Femi. “There is also significant investment in technology, particularly in areas of security and data.”

Lending strategy and SME support

Despite a perception that banks are not lending, credit activity continues—though more conservatively. “Banks are lending in a way that preserves capital, supporting SMEs and the real sector,” Femi added.

Technology, innovation reshape operations

Digital innovation—from real-time settlement to tokenised issuance—will play a transformative role. Nigerian banks spent ₦268.7 billion ($171.5 million) on technology in 2024, up 74.5% from the prior year.

Dapo Olagunju, Managing Director and Head of West Africa at JPMorgan, said global investors are impressed by the resilience of Nigeria’s financial system despite operating with a cash reserve ratio as high as 50%. “Capital adequacy remains strong, profitability is robust, and risk management continues to evolve,” he said.

As 2026 approaches, Nigerian banks face a year defined by heightened political risk, regulatory shifts, and operational vulnerabilities. Yet, opportunities in capital deployment, regional expansion, technology, and digital banking remain strong.

Institutions that prioritise risk management, transparency and innovation will be best positioned to navigate uncertainty and sustain long-term growth.

Note: Exchange rates referenced are based on official averages — ₦1,521.5/$ for Q3 2025; ₦1,584.5/$ for Q3 2024; and ₦1,551.9/$ for H1 2025.