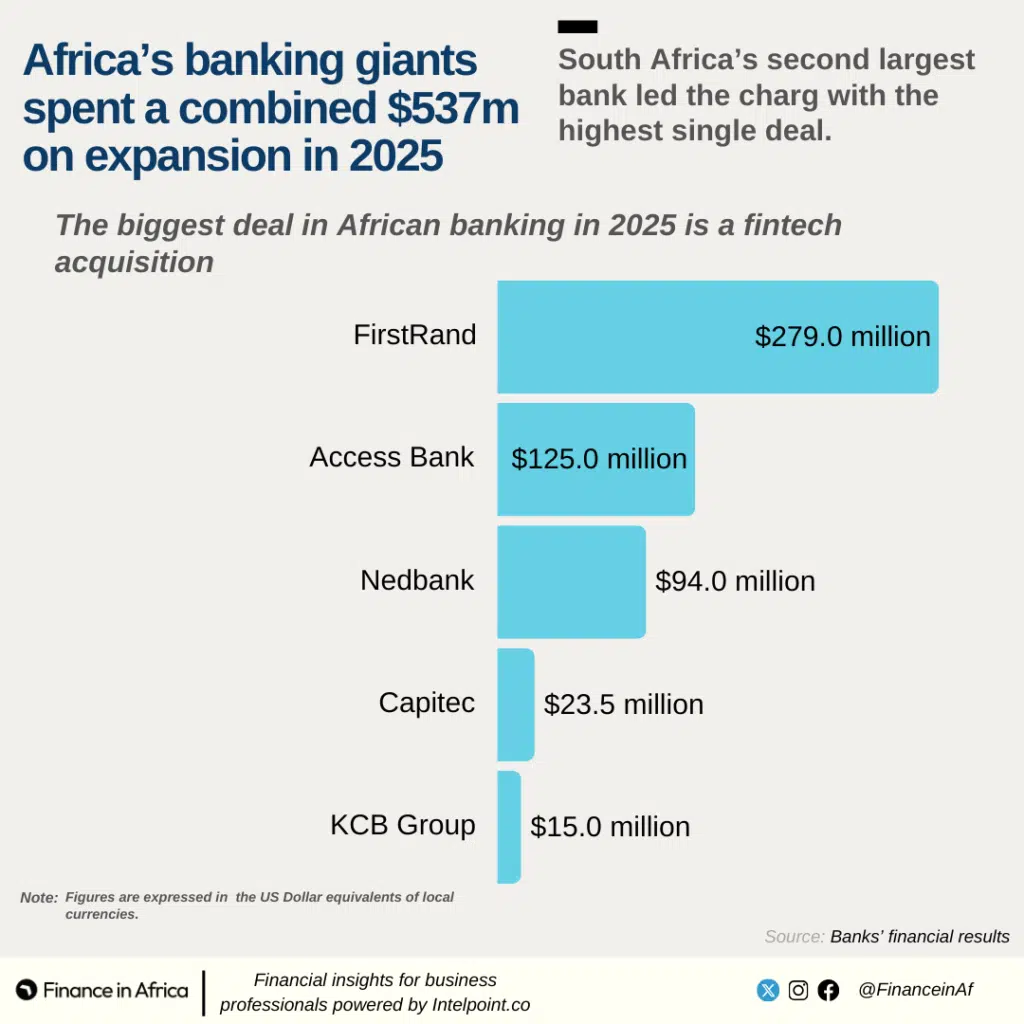

Africa’s largest banks spent more than $537 million on expansion deals in 2025, pressing ahead with acquisitions even as tougher regulation, challenging macroeconomic conditions and uneven earnings weighed on the sector.

Details from official bank statements and media reports show that five major lenders deployed at least $536.7 million to seven strategic transactions during the year, ranging from full bank buyouts to minority stakes and fintech investments, as they sought to deepen offerings and solidify their positions in the region.

South African banks accounted for the bulk of deal value, with FirstRand, Nedbank and Capitec together spending about $396.5 million.

Elsewhere, expansion was limited. Nigeria’s activity was driven largely by Access Bank – its biggest lender by assets, which led on geographic reach with four cross-border acquisitions, three valued at more than $125 million, while Kenya saw a single major mover, with KCB agreeing to acquire a 75% stake in Riverbank Solutions for a reported $15 million.

The headline figure, however, captures only transactions with published or estimated values. Several additional deals announced during the year by the reviewed banks and their rivals had no price attached, pointing to a broader but less transparent regional dealmaking push.

The acquisitions came against a backdrop of mixed financial results in the first half of 2025, with Access Bank and Nedbank reporting declines in profit after tax despite higher gross income.

Meanwhile, KCB and Capitec posted strong bottom-line earnings of 8% and 23%, respectively. FirstRand, which reports its full-year performance in June, also delivered improved results, supported by growth across its business franchises and tighter financial discipline.

Additionally, banks faced a more constrained operating environment marked by inflation risks, foreign-exchange volatility, and global trade and geopolitical tensions.

Tougher rules

The slower pace of bank expansion across Nigeria and Kenya in 2025 coincided with sweeping recapitalisation programmes aimed at strengthening financial stability.

In March 2024, the Central Bank of Nigeria (CBN) raised minimum capital requirements for commercial, merchant and non-interest banks as part of a broader push to boost the sector’s resilience.

Under the new framework, commercial banks with international licences must hold a minimum share capital of ₦500 billion, up from ₦50 billion, with compliance required by March 31, 2026.

Banks are permitted to meet the threshold through fresh equity raises — including public offers, rights issues and private placements — as well as mergers, acquisitions or licence downgrades. Unlike the 2005 recapitalisation exercise, however, lenders are barred from using retained earnings to boost buffers.

The announcement triggered a wave of fundraising, but early compliance was limited. Access Bank emerged as the only lender to meet the revised requirement in 2024 after raising ₦351 billion via a public offer, giving it greater strategic flexibility than most peers.

For the rest of the industry, the narrowing compliance window intensified capital mobilisation in 2025. Banks raised about ₦800 billion ($523 million) in the first seven months of the year, according to Agusto & Co.

By November, the CBN said 16 banks had met the new paid-up capital levels, while 27 were in different stages of mobilisation.

Kenya adopted a similar approach last December when it introduced the Business Laws (Amendment) Act, 2024, as authorities stepped up efforts to create stronger banks.

The new rule requires lenders to raise core capital to KSh10 billion by 2029 from KSh1 billion, with phased increases starting at KSh3 billion in 2025. Data from the Central Bank of Kenya (CBK) shows 27 of Kenya’s 39 banks had met the 2025 threshold, with most holdouts concentrated among smaller tier-three lenders.

Earlier in June, at least seven Nigerian banks were ordered by the CBN to suspend “foreign investments in subsidiaries or offshore ventures” until they exit their credit and single obligor forbearance exposure, highlighting increased regulatory oversight in the sector.

Analysts expect the recapitalisation push across the region to result in fewer but better-capitalised banks, with consolidation among weaker players strengthening liquidity and resilience over time.

Strategic acquisitions

FirstRand South Africa – $279 million

Riding on a strong financial performance for the year ended June, South Africa’s second largest lender, FirstRand Bank, moved to consolidate its pan-African footprint through a series of targeted acquisitions aimed at scale, digital capability and higher-value retail clients.

The standout deal was announced in October when the bank acquired a 20% stake in UAE-based digital finance platform Optasia for a reported R4.7 billion ($279 million). The transaction alone makes FirstRand the biggest spender among the reviewed banks.

In the same month, FirstRand agreed—through FNB Zambia—to acquire Standard Chartered Zambia’s Wealth and Retail Banking portfolio, subject to shareholder and regulatory approvals. Earlier, in June, the bank secured regulatory clearance to take over the clients, assets, liabilities and staff of HSBC’s South African unit, completing a deal first announced in September last year.

Financial terms for the latter transactions, however, were not disclosed, suggesting that the bank’s total expansion spending was likely higher .

The acquisitions followed a resilient year, with normalised earnings rising 10% to R41.8 billion and return on equity reaching 20.2%.

Access Bank – Nigeria – $125 million

Access Holdings Plc completed four cross-border acquisitions in 2025, three of which were valued at a combined $125 million, reinforcing the group’s aggressive regional expansion strategy.

The largest transaction was the acquisition of National Bank of Kenya from KCB Group for $109.6 million, disclosed in the bank’s H1 2025 report. Access Bank also completed the purchase of Standard Chartered’s Consumer, Private and Business Banking operations in Tanzania for ₦13.9 billion, alongside its Gambia subsidiary for ₦9.4 billion ($6.2 million), under a broader deal framework initiated in 2022.

In July, the bank concluded a fourth deal, acquiring a 76% stake in Mauritius-based AfrAsiaBank Limited through its UK subsidiary. The transaction, first announced in November 2024, received regulatory approvals, though its value was not reported.

The expansion came amid weaker earnings, with H1 profit after tax falling 23.2% to ₦281.3 billion, even as total assets rose to ₦42.4 trillion and deposits reached ₦22.9 trillion.

Nedbank – $94 million

Nedbank’s only publicly announced expansion move in 2025 came in August, when the South African lender agreed to acquire fintech firm iKhokha in an all-cash deal valued at about R1.65 billion ($93–$94 million), stepping up its push into the small and medium-sized enterprise (SME) market.

Announced on August 13, the transaction will see Nedbank acquire 100% of iKhokha, which provides card machines, digital payments and working-capital solutions to SMEs in the country. Founded in 2012, iKhokha will operate as a wholly owned subsidiary, retaining its brand and management team, subject to regulatory approvals.

“The acquisition is a pivotal moment in our strategy to empower the SME market,” said Ciko Thomas, Nedbank’s group managing executive for personal and private banking.

The deal follows a mixed earnings backdrop. Nedbank reported a 6% rise in headline earnings to R8.4 billion for the six months to June 2025, even as profit after tax slipped 6% to R8.1 billion on higher operating costs.

Capitec – $23.5 million

Capitec, South Africa’s largest lender by market cap, moved to strengthen its payments and e-commerce capabilities with the acquisition of local fintech Walletdoc Holdings in December.

Supported by strong H1 earnings, the bank entered into a binding agreement to acquire 100% of Johannesburg-based Walletdoc, subject to regulatory approvals, in a deal valued at up to R400 million ($23.5 million).

The purchase consideration includes an upfront cash payment of R300 million, with a further R100 million structured as a deferred earn-out payable in cash over three years and linked to the Capitec share price and agreed performance milestones.

The transaction followed a strong set of interim results. For the six months ended August 31, 2025, Capitec’s headline earnings, a key measure of profitability in South Africa, rose to R8 billion, up from R6.4 billion in the previous year, reflecting sustained growth across its banking, insurance and fintech operations despite a tougher operating terrain.

KCB – $15 million

In its first strategic investment of the year, KCB announced a 75% acquisition of Riverbank Solutions, a payments startup, for an estimated value of $15.4 million (KES2 billion), pending regulatory approval.

The deal is expected to enhance KCB’s capacity to deliver integrated digital services to banks, e-commerce platforms, and government agencies.

Following the announcement, the East African banking giant posted solid H1 results, with profits rising 8%/ to KSh 32.3 billion ($250 million) and a robust KSh 2.0 trillion balance sheet, reflecting its financial resilience following the strategic divestiture of NBK.

Later in October, the bank expanded its fintech portfolio further by acquiring a minority stake in Pesapal Limited, a leading regional payments firm.

If cleared by the CBK, the investment will support SMEs with digital tools and create a full-stack financial ecosystem by combining KCB’s network with Pesapal’s POS and payment gateway infrastructure. The transaction falls among deals with concealed payment terms.

More deals with hidden prices

Other leading African banks that pursued expansion deals with undisclosed costs during the year. Investors entered into an exclusive agreement to acquire Brown Shipley’s International Southern African business, while Absa signed a similar agreement to acquire Standard Chartered Bank Uganda’s Wealth and Retail Banking portfolio.

Furthermore, Ethiopia’s banking sector became a key focus in 2025. As of September, KCB, Equity Group, BCIMR, and Standard Bank Group have all indicated plans to enter this frontier market as authorities open the country to foreign investment.

Broader push

These announcements underscore a broader expansion drive in Africa as major lenders race to diversify their revenue streams to cushion the impact of volatile domestic markets.

While the $537 million spent on disclosed deals shows significant confidence, the true scale of investment is likely much higher given the numerous transactions with concealed valuations.

As banks accelerate recapitalisation efforts, the industry appears headed toward a period of consolidation, where fewer, more resilient titans will dominate the regional landscape.