Y Combinator-backed fintech Bujeti has launched a tax management product that embeds compliance directly into its finance management platform, a move timed to Nigeria’s 2025 Tax Act, which tightened filing requirements and raised penalties for businesses that miss deadlines or remit late.

The Lagos-based startup, which has raised $2.5 million and serves over 5,000 finance professionals across Nigeria and Kenya, built the product in four months with input from tax experts at Forvis Mazars and independent consultants.

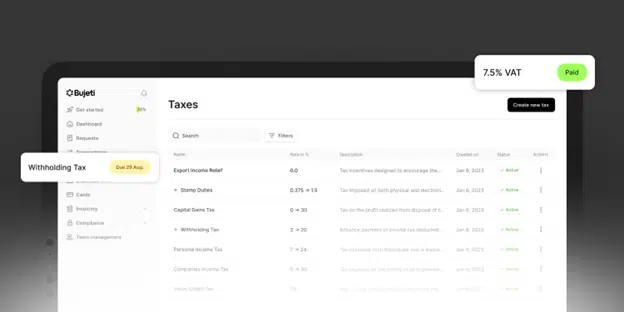

The tool automatically calculates locally applicable taxes, including withholding tax (WHT) and value-added tax (VAT) when businesses create invoices or pay vendors, and separates tax liabilities into a “Tax Vault” so funds can’t be accidentally spent before remittance is due.

“Most SMEs don’t fail because they don’t want to comply,” said Titilayo Akinjogunla, Bujeti’s Head of Product Marketing. “They fail because compliance depends on memory, manual tracking, or external advisers who are expensive and inconsistent.”

Nigeria’s tax reforms present a paradox for small and medium-sized enterprises, which contribute 46% of the country’s GDP.

Companies with annual revenue below ₦100 million ($31,000) now qualify for zero corporate income tax—but they must still file returns to maintain that status.

Higher WHT rates apply to vendors without valid tax identification numbers, forcing businesses to verify counterparties before making payments. Penalties for late or incomplete filings have increased, and the window for correcting errors has narrowed.

The problem Bujeti is solving: businesses often mix tax funds with operating capital, then spend them before filing deadlines arrive. When remittance is due, the money is gone, forcing businesses into non-compliance. Bujeti’s Tax Vault automatically ring-fences collected VAT and withheld taxes, eliminating the liquidity scramble.

“Once money leaves your account as tax, getting it back is super tough,” CEO Cossi Achille Arouko commented. “So the real value is stopping mistakes before payment happens.”

Bujeti positions itself as a financial control center rather than a digital bank. The platform issues corporate cards with customizable spending limits, enforces multi-level approval workflows, automates bulk vendor payments, and now calculates taxes at the transaction layer. The system integrates with Google Sheets, QuickBooks, ZohoBooks, and Slack, and supports transactions in naira, US dollars, and shillings.

Notably, Bujeti’s all inclusive suite of products largely outranks other financial management platforms in Africa in scope, capabilities, and reach. The company knows this well, and fittingly describes itself as the Finance Control Centre for African businesses

The company also recently launched mobile apps for iOS and Android, extending payment approvals, fund requests, receipt capture, and transaction tracking to smartphones. The mobile layer makes governance continuous—finance leaders can approve expenses and track spending in real time, regardless of location.

Bujeti’s client roster includes payments infrastructure company Mono, creator economy platform Selar, and car rental startup Autogirl.

The company was part of Y Combinator’s Winter 2022 batch and has since formalized partnerships with Nigeria’s Small and Medium Enterprises Development Agency (SMEDAN) and the Presidential Committee on Economic and Financial Inclusion as part of the “SheIsIncluded” initiative targeting 10 million Nigerians.

The institutional partnerships matter for distribution. SMEDAN’s network reaches thousands of SMEs, and the Federal Government initiative provides credibility as Bujeti scales beyond early adopters.

Caleb Nnamani, Bujeti’s chief storyteller, described the tax launch as a “compounding moment” for the company. Nigeria’s B2B fintech sector is growing at 13-15% annually, and African fintech revenues are projected to reach $30 billion by 2025. The regulatory environment is also shifting—across Ghana, Kenya, Egypt, and francophone markets, governments are pushing for greater transaction visibility and predictable revenue collection.

Bujeti’s Africa-wide expansion roadmap includes cross-border tax features to handle permanent establishment rules and VAT registration thresholds. The company believes platforms that embed compliance into workflows—rather than treating it as an add-on—will gain structural advantages as enforcement tightens across African markets.

Whether Bujeti can convert regulatory pressure into widespread adoption remains to be seen. Skeptics note that Nigeria’s enforcement has historically been inconsistent, which could reduce urgency around compliance software. Businesses exempt from corporate income tax may also continue relying on spreadsheets and external accountants.

But Samy Chiba, Bujeti’s Operations Chief and Cofounder, argues the value extends beyond avoiding penalties. The platform prevents overpayment—critical in a system where tax refunds are rare and difficult to obtain. And because Bujeti maintains immutable transaction records, it also functions as a trust layer during audits, fundraising, or regulatory reviews.

The tax management product is available now to existing Bujeti users. Businesses not yet on the platform can request a demo at bujeti.com/contact.