In recent days, Nigerian banks have been publishing their full-year results for 2024, sparking considerable public interest. Shareholders are smiling as tier-1 banks post record-breaking profits—running into the trillions of naira—and declare eye-popping dividends to investors.

This is in addition to significant share price appreciation over the past year, serving as the icing on the cake for investors. For instance, the NGX Banking Index rose from 894.20 points at the beginning of 2024 to close at 1,105.6 points by the final trading day of the year.

However, this piece isn’t about share price performance on the NGX. Rather, it offers insight into the African country housing the continent’s most profitable bank—especially in light of the record-breaking year Nigerian banks have just had.

The stellar profits posted by Nigerian banks in 2024 build on an impressive 2023, a year in which foreign exchange revaluation played a major role.

According to available analysis, Nigerian banks recorded approximately ₦3.3 trillion in FX gains. This prompted the federal government to introduce the controversial windfall levy—targeting 70% of banks’ FX gains for both 2023 and 2024.

By contrast, the 2024 profit surge was driven less by FX gains and more by high-interest income, stemming from the Central Bank of Nigeria’s (CBN) hawkish monetary policy.

Other contributors included investment income from high-yielding securities/assets and increased electronic transaction fees, thanks to the continued rise in digital banking adoption.

Nigeria

Let’s take a look at Nigerian banks and their record-level profits in 2024:

Zenith Bank Plc

In its audited full-year result for 2024, Zenith Bank posted a profit after tax of ₦1.03 trillion (approximately $670.57 million), making it Nigeria’s most profitable bank in 2024—pending Access Bank’s final numbers.

Gross earnings surged to ₦3.971 trillion, reflecting an 86.28% year-on-year (YoY) increase. Interest income rose by 137.74% YoY to ₦2.721 trillion, while interest expenses grew by 142.96% YoY to ₦992.47 billion. Consequently, net interest income reached ₦1.729 trillion—up 134.85% YoY.

Fee and commission income also jumped, rising 89.25% YoY to ₦206.87 billion.

GTCO Plc

Profit after tax rose by 88% to ₦1.017 trillion ($662.10 million). The bank reported a record pre-tax profit of ₦1.266 trillion, more than double the ₦609.3 billion posted in the previous year. Gross earnings climbed to ₦2.148 trillion from ₦1.186 trillion YoY.

The bank declared a final dividend of ₦7.03 per share, payable on April 24, 2025. This brings its total 2024 dividend to ₦8.03 per share—a 151% YoY increase in shareholder payouts.

United Bank for Africa (UBA) Plc

In its audited 2024 financials, UBA posted an after-tax profit of ₦766 billion ($499.02 million), the highest in its history. It declared a total dividend of ₦170 billion for the year, comprising an interim dividend of ₦2 per share and a final dividend of ₦3 per share.

Interest income rose by 120.40% YoY to ₦2.3 trillion, while interest expenses increased by 128.18% YoY to ₦839.2 billion. Net interest income reached ₦1.5 trillion, up 116.35% YoY.

First HoldCo Plc

In its unaudited 2024 financial statement, First HoldCo reported a profit after tax of ₦738.85 billion ($481.02 million), from a pre-tax profit of ₦862.39 billion.

Interest income surged 158.40% YoY to ₦2.42 trillion, while interest expenses jumped 254.24% YoY to ₦1.029 trillion. This resulted in net interest income of ₦1.392 trillion—up 154.76% YoY. Net fee and commission income grew by 27.86% to ₦239.18 billion.

Access Corp Plc

Access Corp has yet to release its audited full-year 2024 results. However, from its unaudited nine-month report, the bank posted a pre-tax profit of ₦558.1 billion ($363.34 million), representing an 89.59% increase YoY.

These are the figures from Nigeria’s five biggest banks—commonly referred to as the “FUGAZ.” Notably, none of them reported a profit after tax in excess of $800 million.

In contrast, banks in similarly sized African economies such as Egypt, South Africa, and even Kenya, Morocco, and Algeria, posted profits surpassing $1 billion.

South Africa

In South Africa, the five largest banks recorded an average PAT of $910 million in 2024:

- Standard Bank Group: R19.69 billion ($1.069 billion)

- FirstRand Ltd: $831.5 million

- Absa Bank: R22 billion ($1.201 billion) – the most profitable bank in South Africa

- Nedbank: $876.4 million

- Capitec Bank: $575.39 million

Egypt

In Egypt, home to some of the continent’s biggest banks, the average PAT stood at $761 million—higher than Nigeria’s most profitable bank:

- Banque Misr: $1.19 billion

- Commercial International Bank (CIB): $1.091 billion

- QNB Al Ahli: $522.4 million

- Banque du Caire: $244 million

Kenya

In Kenya, Nigerian banks outperformed their counterparts in 2024, but key players still posted solid numbers:

- Kenya Commercial Bank (KCB): $479.81 million

- Equity Bank: $378.88 million

- Absa Bank Kenya: $374.76 million

- NCBA Bank: $170.03 million

- I&M Bank: $95.83 million

Other parts of Africa

Outside the big three markets, Algeria’s Banque Nationale d’Algérie posted a profit of $441.8 million, while EcoBank Transnational, headquartered in Togo, reported $333 million.

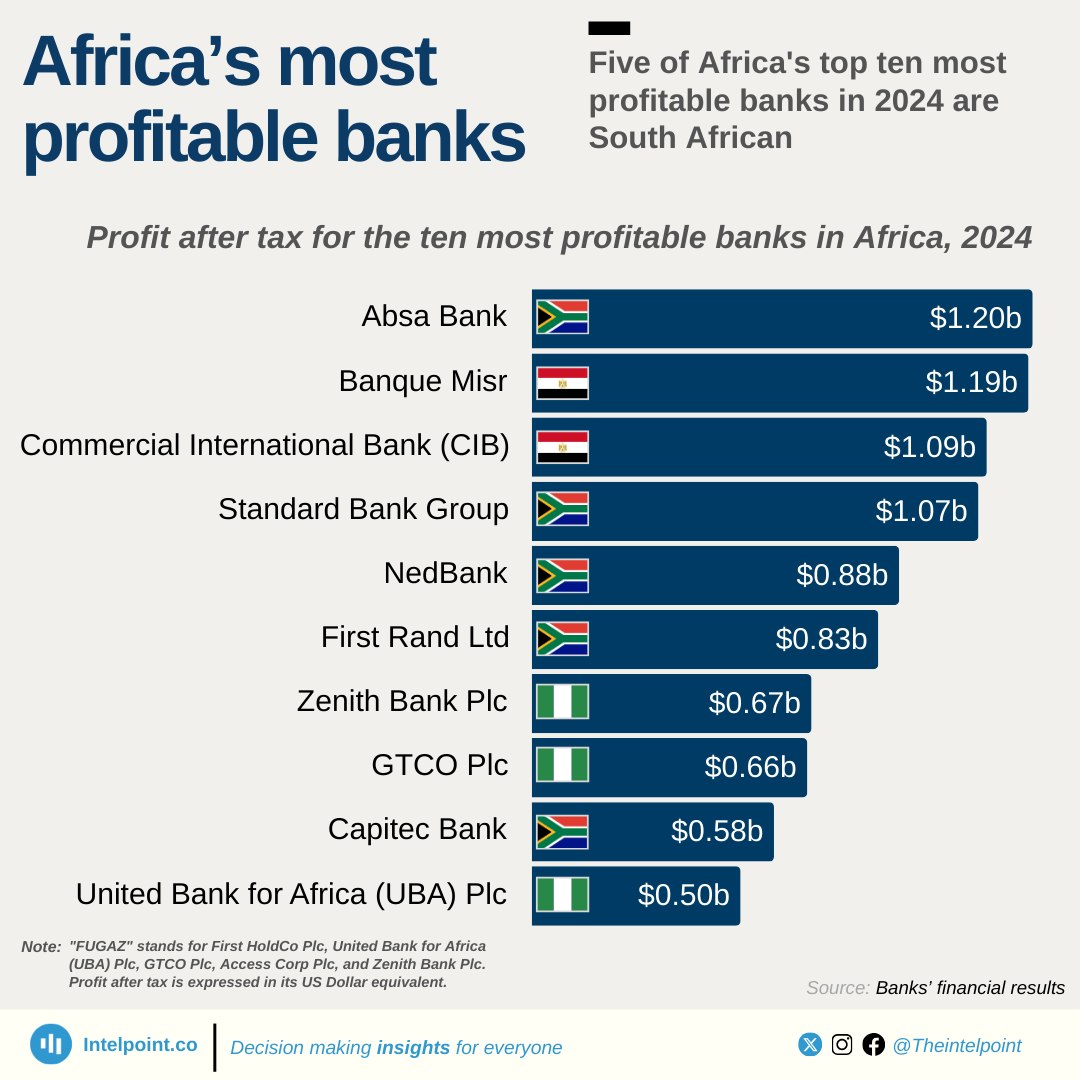

Top 10 most profitable banks in Africa (2024)

- Absa Bank (South Africa) – $1.201 billion

- Banque Misr (Egypt) – $1.19 billion

- Commercial International Bank (Egypt) – $1.091 billion

- Standard Bank Group (South Africa) – $1.069 billion

- Nedbank (South Africa) – $876.4 million

- FirstRand Ltd (South Africa) – $831.5 million

- Zenith Bank Plc (Nigeria) – $670.57 million

- GTCO Plc (Nigeria) – $662.10 million

- Capitec Bank (South Africa) – $575.39 million

- UBA Plc (Nigeria) – $499.02 million

Naira depreciation: A double-edged sword for Nigerian banks

Nigerian banks were among the biggest beneficiaries of the CBN’s unification of multiple FX windows, which triggered a major devaluation of the naira. This resulted in trillions of naira in foreign exchange revaluation gains—at a time when businesses in other sectors were grappling with heavy losses.

However, while FX gains buoyed overall profit through 2023 and into 2024, they also eroded the dollar-denominated value of these profits. This left Nigerian banks trailing their African peers when measured in USD terms, as clearly illustrated in the rankings above.