In the first part of this series, we ranked African banks by absolute profit, revealing South African and Egyptian lenders at the top, at least in raw earnings.

We followed with Return on Equity (RoE), which flipped the leaderboard and crowned Nigerian and Egyptian banks as the most rewarding to shareholders.

Then came Return on Capital (RoC), where GTCO Plc emerged as the continent’s most capital-efficient bank.

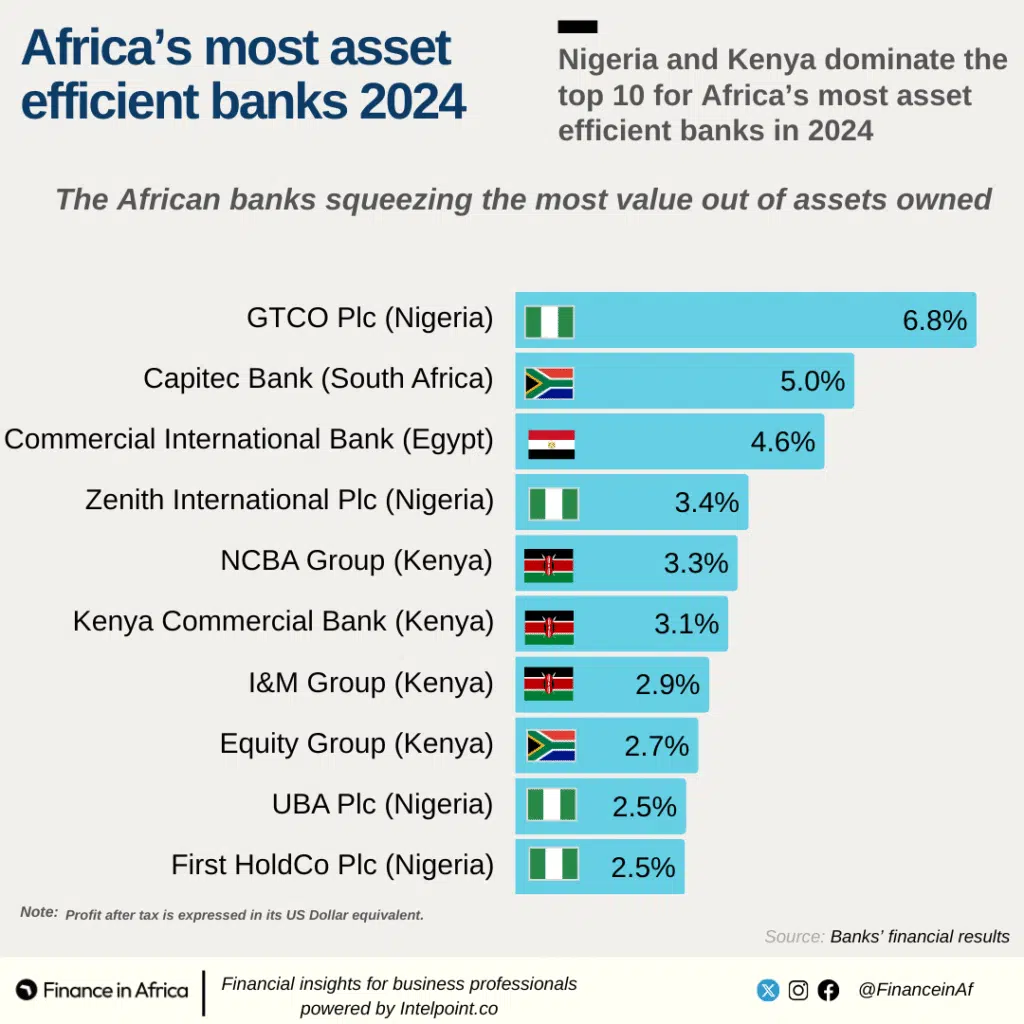

Now, in the final part of our scorecard, we turn to Return on Asset (RoA)—a measure that strips away leverage and scale to show which banks squeeze the most value from everything they own.

It’s the cleanest cut of operational efficiency, and in a continent where capital is scarce and reform is painful, RoA might be the truest performance metric of all.

From our analysis, GTCO, Capitec, and Egypt’s CIB lead the continent. Kenyan banks make a strong collective showing, while most South African banks, despite their size, struggle to cross even the 2% mark. It’s a reminder that in African banking, more assets don’t always mean more value.

What is Return on Asset (RoA)

This is a metric used in determining how much a business makes from its total asset. It is calculated by dividing net income by the total asset as expressed as a percentage. Investors and analysts use RoA to understand how a company manages its assets efficiently.

From our analysis of banks in major African economies, Nigerian and Kenyan banks had a better RoA compared to other African counterparts.

RoA of Banks in Major African Economies

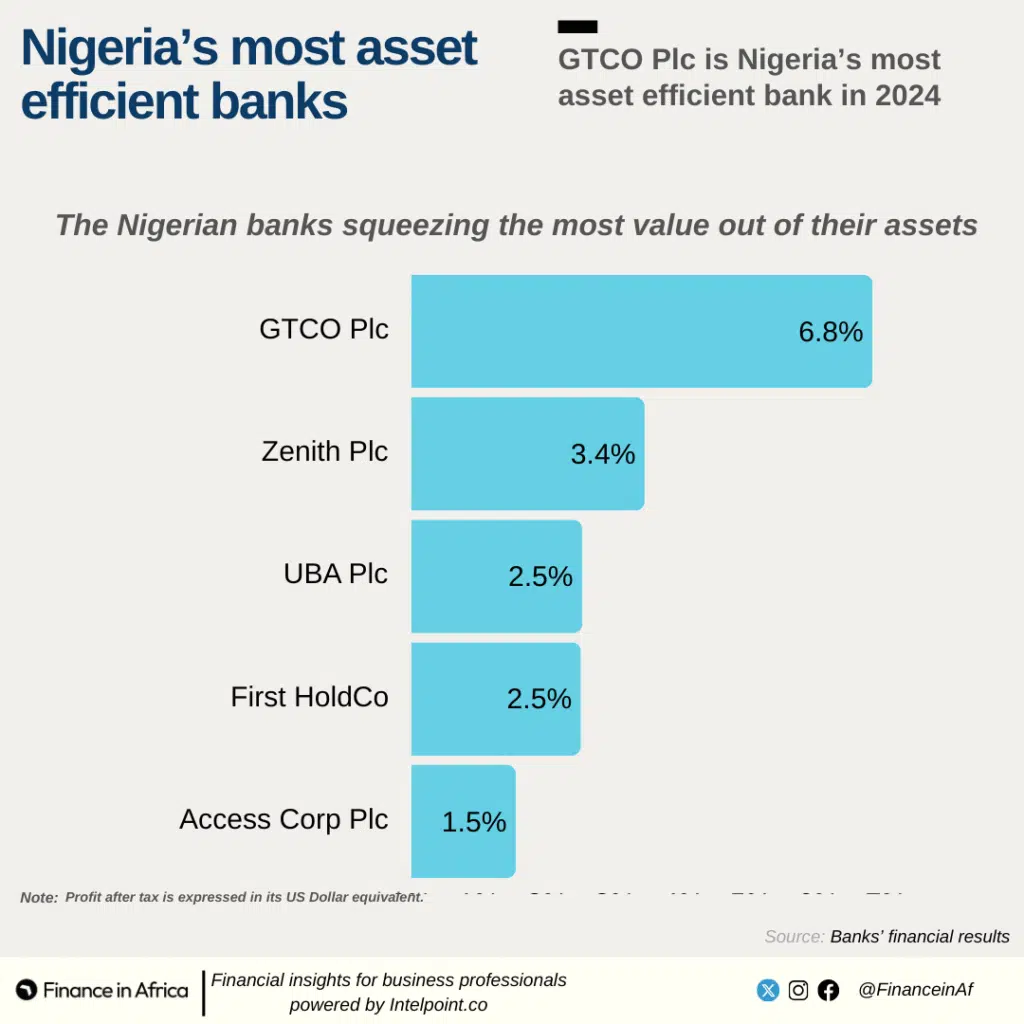

Nigeria

GTCO Plc had the highest RoA among Nigeria’s ‘FUGAZ’ banks and in Africa at almost 7%. Zenith Intl Plc trailed GTCO in Nigeria with an RoA at 3.44% while Access Corp Plc had the least RoA at 1.5%

- GTCO Plc- 6.8%

- Zenith Plc- 3.44%

- UBA Plc- 2.52%

- First HoldCo- 2.50%

- Access Corp Plc- 1.54%

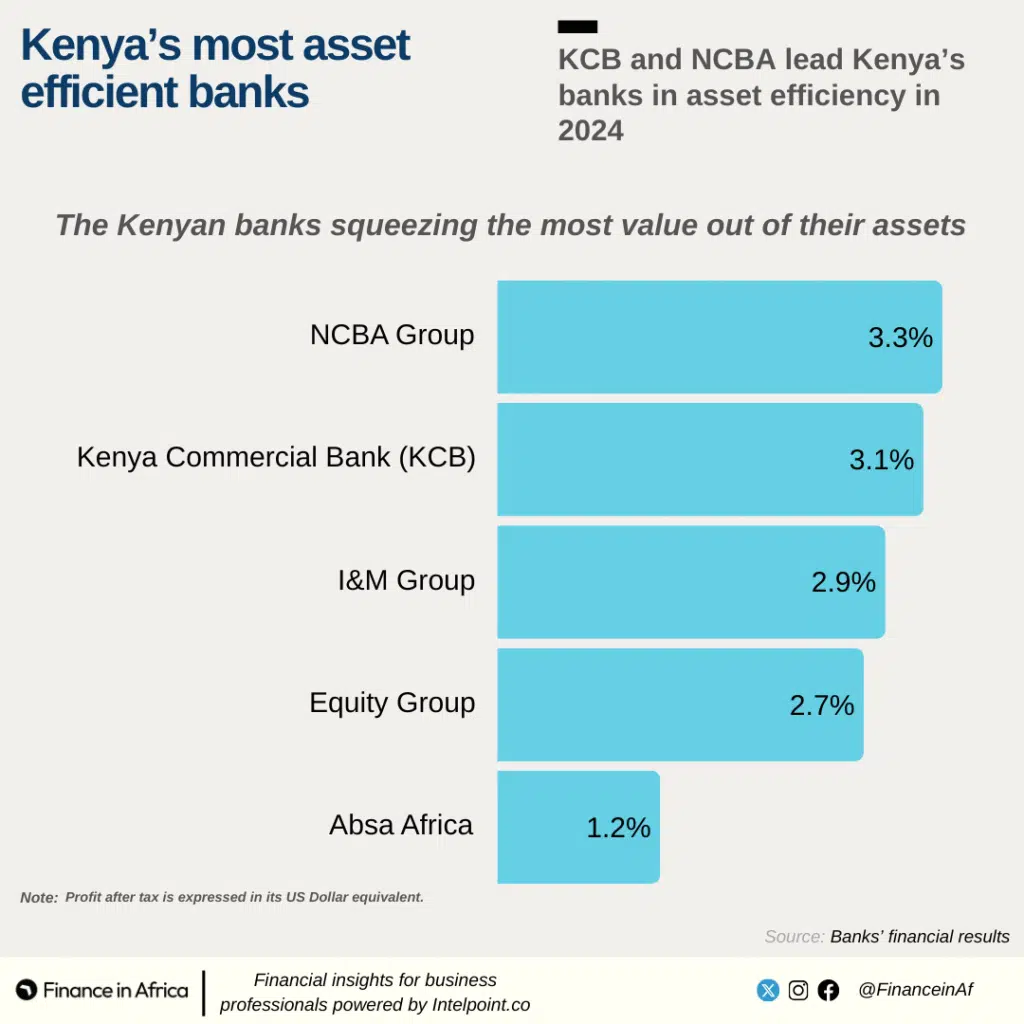

Kenya

Kenyan lenders showed respectable asset productivity in 2024, with NCBA Group (3.28%) and KCB (3.14%) leading the pack. While I&M and Equity followed closely, Absa Africa’s 1.2% RoA lagged behind the group—pulling down the country’s average.

Overall, Kenya’s banks appear to manage their assets more efficiently than peers in South Africa, though still behind top performers like GTCO and Capitec.

- I&M Group- 2.86%

- NCBA Group- 3.28%

- Kenya Commercial Bank (KCB)- 3.14%

- Absa Africa- 1.2%

- Equity Group- 2.7%

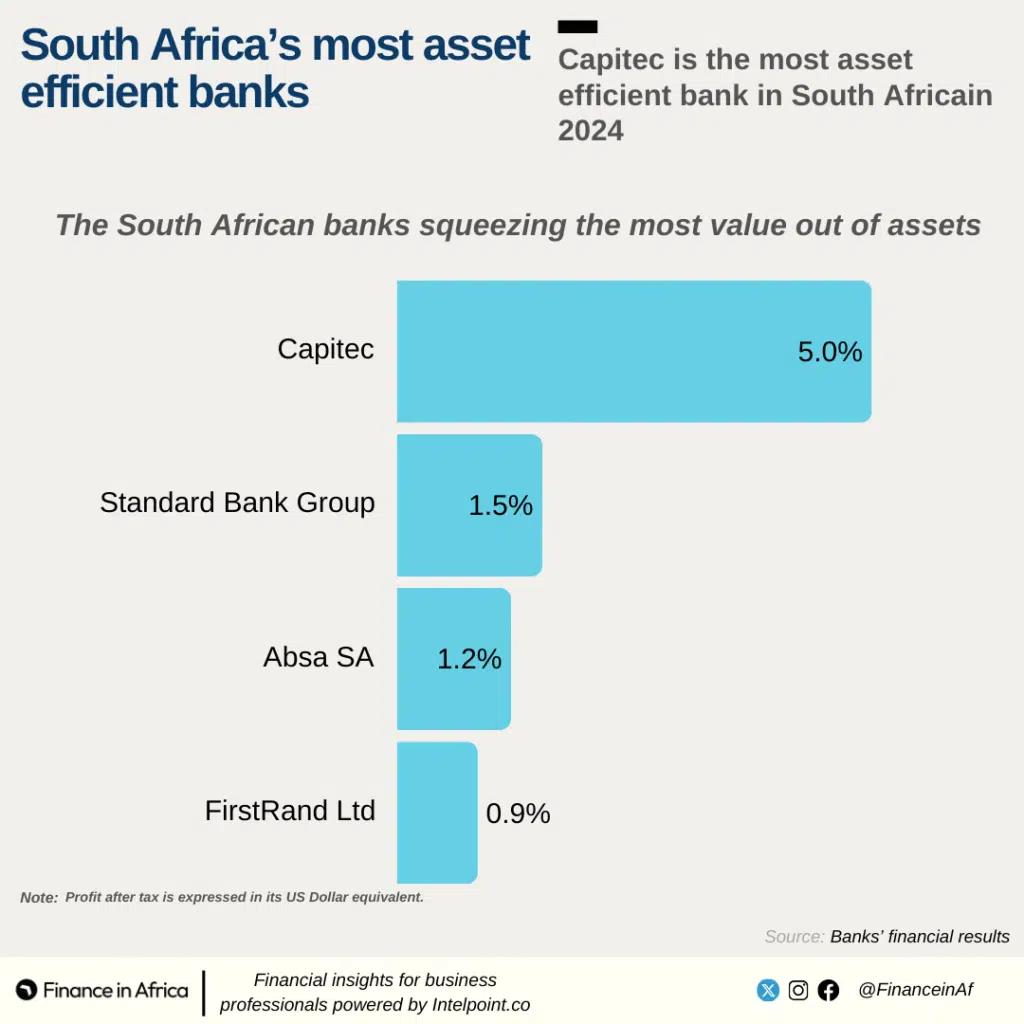

South Africa

Asides Capitec, none of the banks in South Africa posted RoA above 2% which does not augur well for the country. It represents poor utilisation of its assets by the banks’ directors.

Standard Bank Group Ltd- 1.53%

Absa SA- 1.2%

First Rand Ltd-0.85%

Capitec- 5.0%

Egypt

Commercial International Bank (CIB)- 4.56%

Top ten African banks based on Return on Asset (RoA)

10. First HoldCo Plc- 2.50%

9. UBA Plc- 2.52%

8. Equity Group- 2.7%

7. I&M Group- 2.86%

6. KCB- 3.14%

5. NCBA Group- 3.28%

4. Zenith International Plc- 3.44%

3. Commercial International Bank (CIB)- 4.56%

2. Capitec- 5.0%

1. GTCO Plc- 6.8%

Macroeconomic realities in featured African economies remain with challenges from inflation, hard reforms and influence from global geopolitical and economic shocks. In Nigeria, the banking sector is undergoing a recapitalisation whilst the government is steering the country away from highly regulated to market-driven through tough reforms in the energy and foreign exchange sectors.

Reforms in Nigeria are similar to what President Sisi is executing in Egypt and it seems to be bearing fruits for now with the level of investment that has poured into the country and the stability in its currency.

President Ruto’s plan to increase taxes in Kenya as part of the International Monetary Fund (IMF) conditions to disburse further loans was met with the fiercest protests and public outrage the country has witnessed in recent times leading to new debt negotiations.