The South African government has extended a $2.8 billion guarantee to Transnet, the struggling state-owned logistics company, according to the Ministry of Transport on May 22, 2025.

This guarantee consists of $2.3 billion to cover the company’s funding needs for 2025/2026 and 2026/2027, and $0.5 billion to help service its existing debt and finance capital investments.

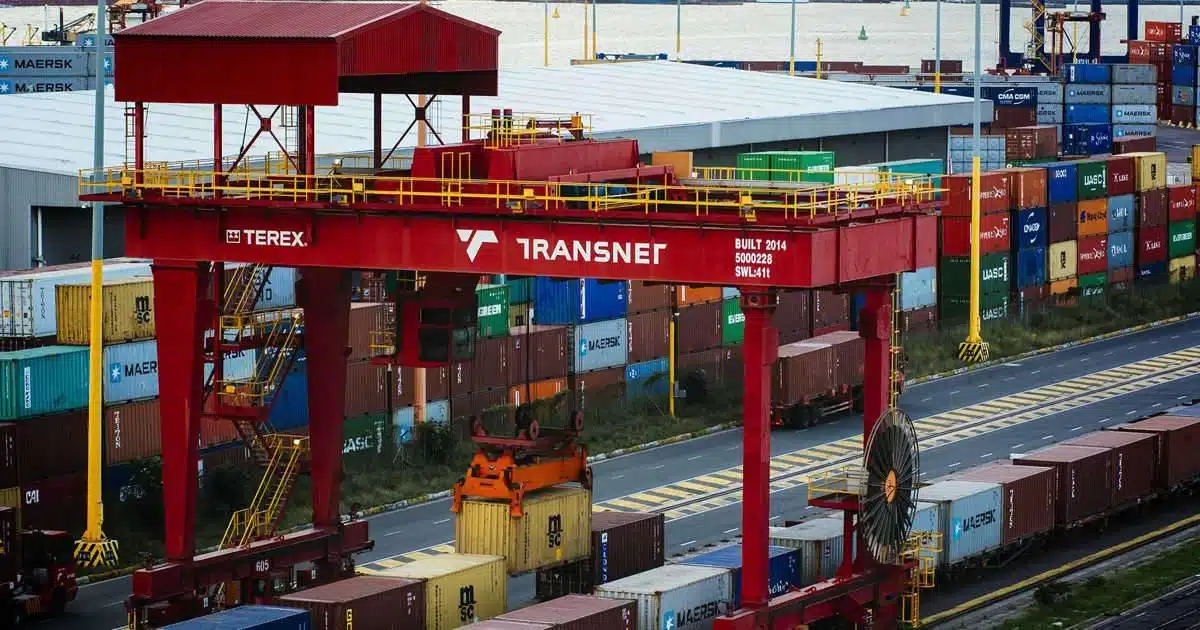

This move follows years of decline in Transnet’s ability to provide essential rail and port services due to equipment shortages, maintenance failures, and widespread theft and vandalism.

Why this matters

Transnet plays a critical role in South Africa’s economy. It operates rail freight, major ports, and pipelines that are essential for moving minerals, fuel, and goods across the country.

The company’s performance directly affects mining, agriculture, manufacturing, and exports. When Transnet fails, it has ripple effects in South Africa’s economy.

During a Transnet strike in October 2022, the Minerals Council of South Africa reported that miners were losing approximately $44 million in export revenue per day due to disruptions in Transnet’s freight rail and port services.

As of February 2025, South Africa was reportedly losing $55 million daily in missed trade opportunities due to transport and logistics challenges, including those associated with Transnet.

Investors—both local and international—have long raised alarms over the rising cost of doing business in South Africa, largely due to Transnet’s inefficiencies. This latest guarantee is not just about rescuing a company—it’s about safeguarding economic stability.

What’s going on at Transnet?

Transnet is in debt—$7.5 billion as of March 2024. It’s been struggling to meet debt obligations, and operational performance has continued to decline. The company cannot attract meaningful private sector partnerships or investments without a credible recovery path.

The guarantee aims to help Transnet stabilise, reform, and regain credibility. It will fund debt servicing, restore rail and port infrastructure, and support the rollout of long-term reforms under Operation Vulindlela, a government-led initiative to fix key economic sectors.

This isn’t Transnet’s first bailout. In December 2023, the National Treasury extended a $2.6 billion guarantee, but progress since then has been slow. Analysts say Transnet still hasn’t met several key reform targets.

It continues to suffer from poor leadership, internal corruption, and the legacy of state capture. Transnet was named in the Zondo Commission, and billions were siphoned through irregular procurement during the previous decade.

In addition, Transnet faces criminal threats—cable theft and vandalism have become rampant. These crimes are not isolated; they are part of an organised network that thrives in South Africa’s weak enforcement environment. These factors, combined with underinvestment and economic pressures, pushed the company to the brink.

Bailout or reform—or both?

This guarantee is both a bailout and a reform tool. It prevents immediate collapse, but it also comes with conditions: Transnet must implement reforms, attract private capital, and clean up governance.

In the short term, the guarantee prevents a financial default and keeps critical freight systems running. But in the long term, the risk is real—if Transnet fails to reform, the government becomes liable for billions of dollars in debt. That means taxpayers carry the risk.

What’s next: policy, politics, and public response

Transport Minister Barbara Creecy emphasised that this support is tied to “clear reform milestones” and better transparency. Ratings agency Moody’s warned that Transnet is on a tightrope: “Without urgent operational improvements, this guarantee will only delay—not avoid—a financial crisis.”

Business Unity South Africa (BUSA) welcomed the funding but urged the government to act fast and involve the private sector. According to BUSA, “Throwing money at a broken system won’t work. We need governance reform, strong partnerships, and an end to theft and sabotage.”

Civil society group OUTA (Organisation Undoing Tax Abuse) echoed similar concerns. They stressed the need for independent oversight to prevent further misuse of public funds. OUTA said, “Public guarantees must not become bottomless pits. We’ve seen this story before.”

The bigger picture

Transnet is a symbol of South Africa’s economic crossroads. The crisis reflects deeper problems in state-owned enterprises: corruption, inefficiency, and mismanagement.

If Transnet reforms succeed, it could become a case study in how to rebuild public infrastructure and restore investor confidence. If it fails, it risks dragging the economy down and placing additional burdens on already-stretched public finances.

For South Africa, this moment is about more than saving a logistics firm. It’s about restoring trust in the state, protecting the economy, and setting a new path for public sector reform.

Exchange rate used: $1 = R18.30 (as of May 22, 2025).