Nigeria’s biggest bank by asset base has established a reputation for inorganic growth through aggressive mergers and acquisitions. The bank has been unrelenting in its growth strategy over the past few years, which has lifted it from a 65th-placed bank in Nigeria to arguably the largest lender.

In its five-year growth strategy from 2022 to 2027, the bank identified 16 new markets it has earmarked for entry through strategic M&A activities and organic growth. These countries include; the United States, France, India, Morocco, Niger, Egypt, Burkina Faso, Senegal, Togo, Benin Republic, Rwanda, Tanzania, Angola, Congo, Namibia and Cote d’Ivoire.

In the past three years, the bank has made successful acquisitions in Sierra Leone, Angola, Mauritius, Tanzania, Kenya, Uganda, Gambia, and Zambia. Recent acquisitions have been Standard Chartered subsidiaries in Sierra Leone and Angola, which were announced in November of last year. In that same month, the bank disclosed it had reached an agreement to acquire Afriasia Bank of Mauritius- the country’s fourth-largest bank by total assets.

Its latest catch is Standard Chartered’s Gambian subsidiary, which was a sequel to a 2023 agreement between the two banks for Access to acquire the latter’s subsidiaries in Angola, Cameroon, The Gambia, and Sierra Leone, and its Consumer, Private & Business Banking business in Tanzania

The strategic acquisition underscores the bank’s commitment to be the financial gateway to Africa and cement its place as the number one bank in Africa. Although a new trend is emerging in Access Bank’s strategy- it is moving into countries without any existing Nigerian bank, with hopes of charting a new course.

Typical expansion patterns of Nigerian banks

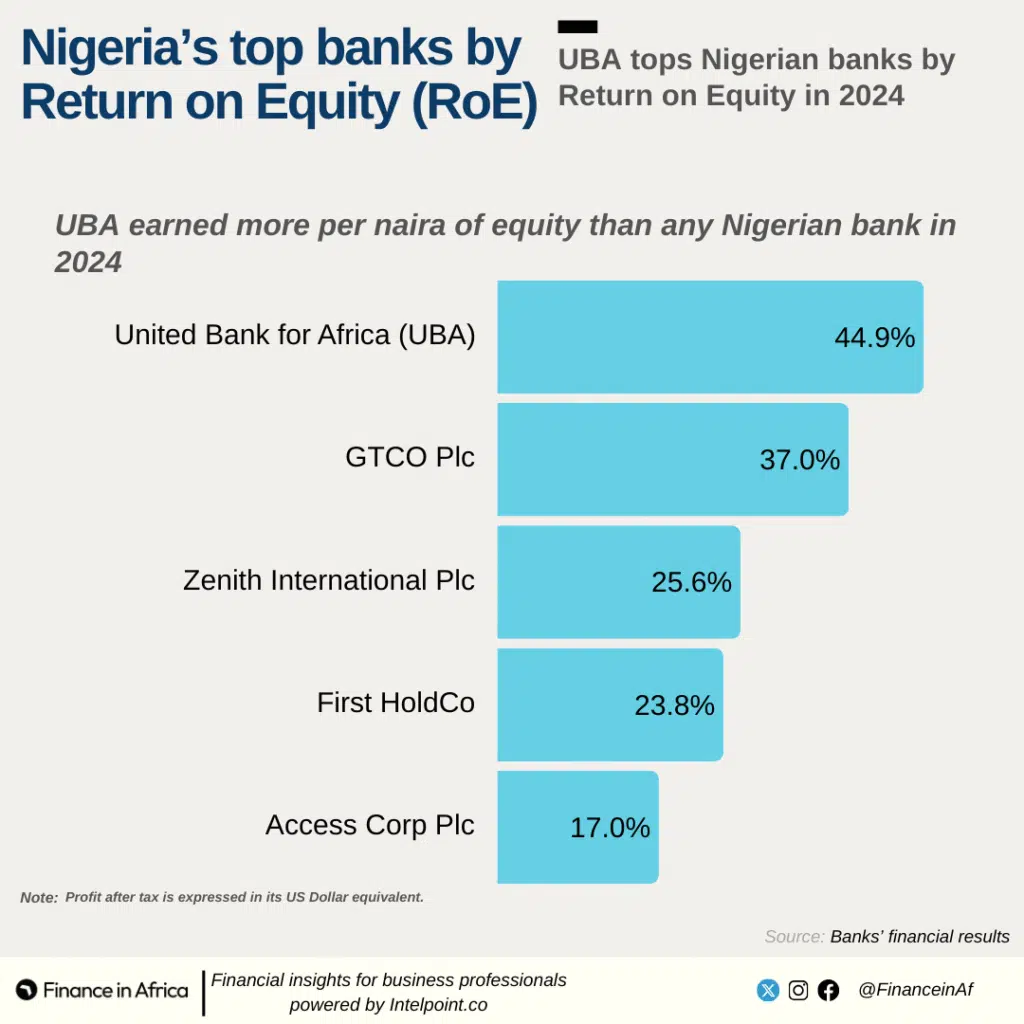

Nigerian banks are big players in the African banking industry, with subsidiaries in over 21 African countries. In 2024, Nigeria’s top five banks by market capital saw pre-tax profit from international subsidiaries reach $1.1 billion while gross revenue totalled $11.3 billion. This denotes the increasing significance of their foreign operations, which are mainly based in Africa.

However, international subsidiaries of Nigerian banks are concentrated mainly in West Africa, with few operations in East and Central African countries. For example, 13 of the 16 West African countries have at least one subsidiary of a Nigerian bank. On the other hand, only five of the 13 countries in East Africa have at least a subsidiary of a Nigerian bank. The situation is even worse in North Africa, where there is a near absence of Nigerian banks in the region despite its relatively advanced economy.

Access Bank’s deviation from the Nigerian norm

This is where Access Bank’s recent acquisition opens up a new chapter in the adventure of Nigerian banks. With the acquisition of Standard Chartered’s Angola subsidiary, Access Bank became the first Nigerian bank to announce its presence in the country. The acquisition of Standard Chartered’s Angolan subsidiary serves to deepen Access Bank’s operations in the country as it had earlier announced the acquisition of Finibanco Angola S.A.

But it is not only in Angola, the bank is pioneering a new chapter in Nigeria’s banking industry. The bank’s agreement to acquire Afriasia bank in Mauritius will mark the first foray of a Nigerian bank into the country. In Mauritius, its new subsidiary will have to compete with the country’s industry leaders such as MCB Group, SBM Holdings, Absa Mauritius and Investec Bank.

In Southern Africa, Access Bank pioneered the entry of Nigerian banks in the continent’s most advanced economy when it acquired a majority stake in Grobank of South Africa for $60million and rebranded it as Access Bank South Africa in 2021.

The firm restructured the bank from an agriculture-based lender to a full-service bank with retail and commercial operations. To broaden its base in the rainbow nation, the Nigerian lender is expected to complete the acquisition of 100% equity in another South African lender, Bidvest Bank soon.

South Africa is home to the largest and most sophisticated banking industry in Africa with the total assets of its four major banks (First Rand, NedBank, Absa and Standard Bank) up to $500 billion as of 2024. The sector in the country is dominated by six banks, which own 90% of the industry’s market share and has made it difficult for new entrants to command significant market share.

Also, in Southern Africa, Access Bank last year announced it has obtained a license from regulatory authorities in Namibia to begin banking operations in the country last year. This is the third country, the Nigerian lender will be venturing into where its contemporaries at home are absent.

In Namibia, Access Bank will have to compete with other subsidiaries of South African banks (Standard Bank and NedBank), together with other banks in the country such as Bank Windhoek, First National Bank, and Letshego Bank in the country. These four banks hold a combined asset of around $166 billion, with their assets constituting just over 70% of the country’s GDP.

It remains to be seen how Access Bank hopes to compete in this highly dominated banking sector in Namibia. The bank does not have a history of dominating markets, as it acquired existing banks with the acquisition of Grobank in South Africa.

In North Africa, Access Bank is looking into opening subsidiaries in one of the region’s industrial powerhouses- Morocco, which, as usual, does not have any Nigerian bank presence. The bank noted that it has already secured approval from Nigeria’s Securities and Exchange Commission (SEC) and the country’s apex bank to start the process.

Beyond Morocco, the bank has identified Egypt as another North African country it hopes to register its presence to achieve its goal of having 100 million customers on its books.

Outside Africa, Access Bank is the only Nigerian operating in Malta through its United Kingdom’s subsidiary, and the bank plans to open new frontiers in India, Nigeria’s second-largest trading partners

What this means for investors

In FY 2024, Access Corp Plc delivered a dividend of ₦2.05kobo to its shareholders- an increase from the previous year’s payment of ₦1.80k. Its aggressive expansion drive is expected to boost the contribution of foreign subsidiaries to its profit, which was around 45% in 2024.

However, many of the recent acquisitions are not in large economies and fast-growing economies in Africa, except South Africa, whose growth rate in recent times has been judged to drag the continent. Sierra Leone, Namibia, Angola, and Mauritius do not have any exceptional growth or development, leaving investors to guess the rationale behind entry into those countries. Perhaps, these are the reasons why its contemporaries in Nigeria are not charting those waters.

Beyond its acquisitions in small-sized economies, its entrance into a major economy on the continent was not through a bank to reckon with. Grobank in South Africa is a small fish in the country’s ocean-sized banking industry, as well as Bidvest Bank, which commands no significant stake in the country’s banking sector.

Furthermore, entry into those markets increases the banks’ operational expenses without any guarantee of recouping their cost in the near term, as some of the acquired banks are struggling. For example, the National Bank of Kenya had a loss of $22.5 million (Ksh 3billion) in the third quarter of 2023 prior to the announcement of the acquisition and held a retained loss of $59.3 million (Ksh7.9 billion). In the first quarter of 2025, the bank’s net profit declined by as much as 48%.

On the other hand, Access Bank could leverage the success of its Fintech arm Hydrogen payment and deploy the same in those markets where the paytech space has not been saturated, as it is in economies like Nigeria, Kenya, and South Africa, with increased competition from multiple players.

While acquisitions would guarantee a good foundation as it explores new markets and opportunities, to become a major player in those countries, the bank would have to do the hard work of growing organically.