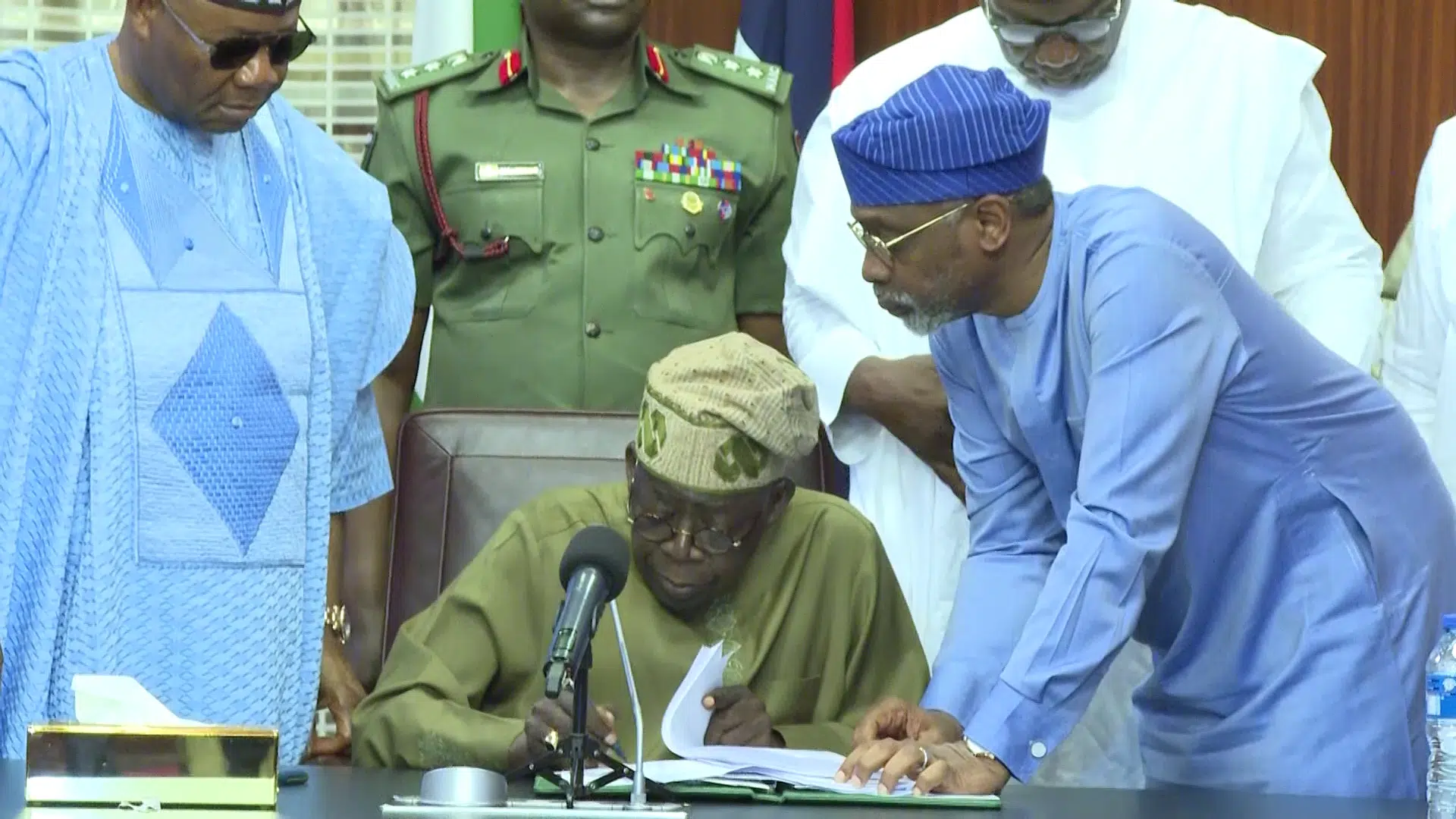

President Bola Tinubu has signed into law four tax reform bills that are set to transform Nigeria’s fiscal and revenue framework.

The four bills, the Nigeria Tax Bill, the Nigeria Tax Administration Bill, the Nigeria Revenue Service (Establishment) Bill, and the Joint Revenue Board (Establishment) Bill, were passed on Thursday after extensive consultations with various interest groups and stakeholders.

The laws are expected to transform tax administration in the country, leading to increased revenue generation, improved business environment, and a boost in domestic and foreign investments.

One of the four bills is the Nigeria Tax Bill (Ease of Doing Business), which aims to consolidate Nigeria’s fragmented tax laws into a harmonised statute.

By reducing the multiplicity of taxes and eliminating duplication, the bill will enhance the ease of doing business, reduce taxpayer compliance burdens, and create a more predictable fiscal environment.

The second bill, the Nigeria Tax Administration Bill, will establish a uniform legal and operational framework for tax administration across federal, state, and local governments.

The Nigeria Revenue Service (Establishment) Bill, the third bill, repeals the current Federal Inland Revenue Service Act and creates a more autonomous and performance-driven national revenue agency— the Nigeria Revenue Service (NRS). It defines the NRS’s expanded mandate, including non-tax revenue collection, and lays out transparency, accountability, and efficiency mechanisms.

The fourth bill is the Joint Revenue Board (Establishment) Bill. It provides for a formal governance structure to facilitate cooperation between revenue authorities at all levels of government. It introduces essential oversight mechanisms, including establishing a Tax Appeal Tribunal and an Office of the Tax Ombudsman.

Since taking office in May 2023, Tinubu’s administration has introduced a series of fiscal reforms, including finance and tax bills, that have stirred significant public debate and controversy.

Businesses and citizens argue that the Tinubu administration’s approach leans heavily on tax increases during a period of high inflation, fuel subsidy removal, and naira devaluation.