African countries have long maintained economic and cultural ties with London, dating back to pre-colonial and colonial eras. Today, 19 African members of the British Commonwealth form part of a trade and investment network that continues to link the continent to the United Kingdom’s capital.

One sign of this connection is the growing number of African companies listed on the London Stock Exchange (LSE). The latest entrant is Nigeria’s Guaranty Trust Holding Company (GTCO) Plc, which became the first West African financial services firm to list on the LSE.

Since the first African listing in the 1930s, 117 companies from the continent have joined the British bourse, which dates back to 1801. GTCO’s London debut added £1.4 billion in market value and raised £105 million to fund expansion and meet Nigerian regulatory requirements.

The move has also boosted investor confidence at home, briefly pushing its share price above ₦100 in July before settling between ₦90 and ₦99, maintaining a market capitalisation of ₦3.6 trillion ($2.41 billion) as of August 8, the biggest by any Nigerian bank.

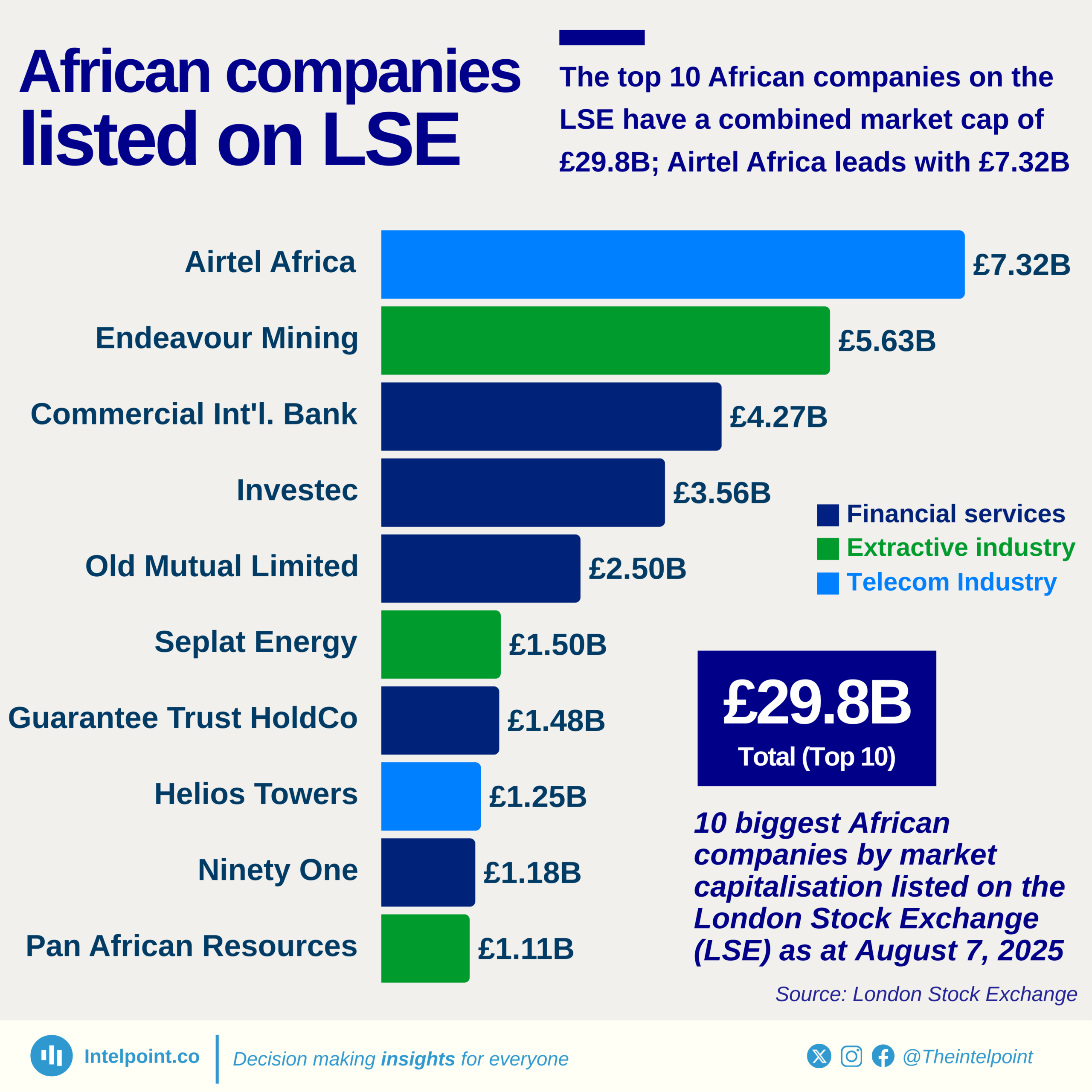

As of August 1, 2025, the ten biggest African companies on the LSE had a combined market value of £29.8 billion, dominated by South African firms (four entries), followed by Nigeria (two), and one each from Egypt and Kenya, with the remaining headquartered in London but operating heavily in Africa.

Financial services lead the pack with companies, followed by extractive industries (three) and telecoms (two).

Below are the ten biggest African companies by market capitalisation on the London Stock Exchange (LSE) as of August 1, 2025. Current share prices are as of August 7, 2025.

Note that some LSE-listed shares are priced in GBX or GBP (pence sterling), while others are priced in USD. Historical share prices are sourced from Yahoo Finance, a media company that provides real-time stock quotes, market data, news, analysis, and portfolio tracking tools.

Here are the top ten companies trading in London

Pan African Resources

Pan African Resources, a South Africa-based gold mining company, has a market capitalisation of £1.11 billion, with shares trading at 61.7p on the exchange. It debuted on the LSE’s Alternative Investment Market (AIM) in 2004, when its share price ranged between 1.2p and 2.5p.

For the year ending June 2024, the company posted an after-tax profit of £61.4 million — a 30% increase from the previous year — driven by higher production at several of its mines.

Ninety One

Listed on the LSE in March 2020, Ninety One has a market capitalisation of £1.18 billion. Its shares closed at 191.7p on August 7, 2025, after debuting at 190p.

Since listing, pretax profit has grown modestly from £198.5 million to £204.3 million for the year ending March 2025. However, assets under management have expanded, rising from £103.4 billion in 2020 to £130.8 billion by March 2025.

Helios Towers

Helios Towers listed on October 15, 2019, at 117p per share. As of August 7, 2025, the share price stood at 120.4p, giving the company a market value of £1.25 billion — the eighth most valuable African firm on the LSE.

Financially, the company has more than doubled its adjusted Earnings Before Interest, Taxes, Depreciation and Amortisation (EBITDA) from £233.8 million in 2019 to £455.6 million in 2024. Tower sites have also doubled, from 6,974 to over 14,000, reflecting the effective deployment of the $360 million raised at its Initial Public Listing.

Seplat Energy

Nigeria’s Seplat Energy has a market cap of £1.50 billion, with shares trading at 255.5p, up from its April 14, 2014 debut price of 210p. In 2014, the company posted a gross profit of £608.8 million, compared to £518.4 million in 2024.

Seplat has expanded aggressively through acquisitions, including a $1 billion deal for ExxonMobil’s onshore assets. On the Nigerian Exchange Limited (NGX), its share price has soared from ₦576 at listing to ₦5,450, with a market cap of ₦3.1 trillion.

GTCO

The most recent entrant to the LSE, GTCO, debuted with a market cap of £1.48 billion, trading at $0.07 per share. Having been listed a month ago, the bank has yet to release its second-quarter results.

Old Mutual Limited

Listed on June 26, 2018, Old Mutual has a market value of £2.50 billion. Shares closed at 50.8p on August 7, well below the debut price of 135.3p.

While Adjusted Headline Earnings (AHE) were £763.8 million in 2019, they climbed to £6.7 billion in 2024, reflecting a strong operational recovery.

Investec

South Africa’s Investec has a market cap of £3.56 billion, with shares at 544.4p. It joined the LSE on July 22, 2002, at 118.8p.

Operating profit has risen nearly threefold — from £388.7 million in 2006 to £920 million in the year ending March 2025.

Commercial International Bank (CIB)

Egypt’s CIB, the sole North African representative in the top ten, was listed on May 14, 2004, at $2.94 per share. Shares closed at $1.99 on August 7, 2025, with a market value of £4.27 billion.

Net profit after tax jumped from £82.4 million in 2007 to £935.8 million in 2024.

Endeavour Mining

Operating across several West African countries, Endeavour Mining is the second-largest African company on the LSE, valued at £5.63 billion. Shares closed at 2,253p on August 7, 2025, slightly below the 2,484p debut price in January 30, 2018.

EBITDA has grown from £145.4 million in 2021 to £835.5 million in 2024, driven by higher production and acquisitions.

Airtel Africa

Airtel Africa, a subsidiary of India’s Bharti Group, listed on January 28, 2019, at 77p per share. The stock has since tripled to 210p, giving the company a market cap of £7.32 billion and FTSE 100 membership.

Operating in 14 African countries, Airtel Africa is also listed on the NGX, where it is valued at ₦8.68 trillion, with shares at ₦2,310.5.

What this means

The performance of these companies underscores Africa’s growing footprint in London’s capital markets, offering firms access to global investors, enhanced governance standards, and capital for expansion. With mega-projects like the $20 billion Dangote Refinery considering dual listings, the LSE remains a magnet for ambitious African corporates.

However, gaps persist — notably the absence of major players from fast-growing economies such as Kenya, Morocco, and Côte d’Ivoire, and limited representation from high-growth sectors like technology, e-commerce, and entertainment.

Tech companies like Flutterwave could replicate Jumia’s success on the New York Stock Exchange, proving that African innovators can compete on the global stage.