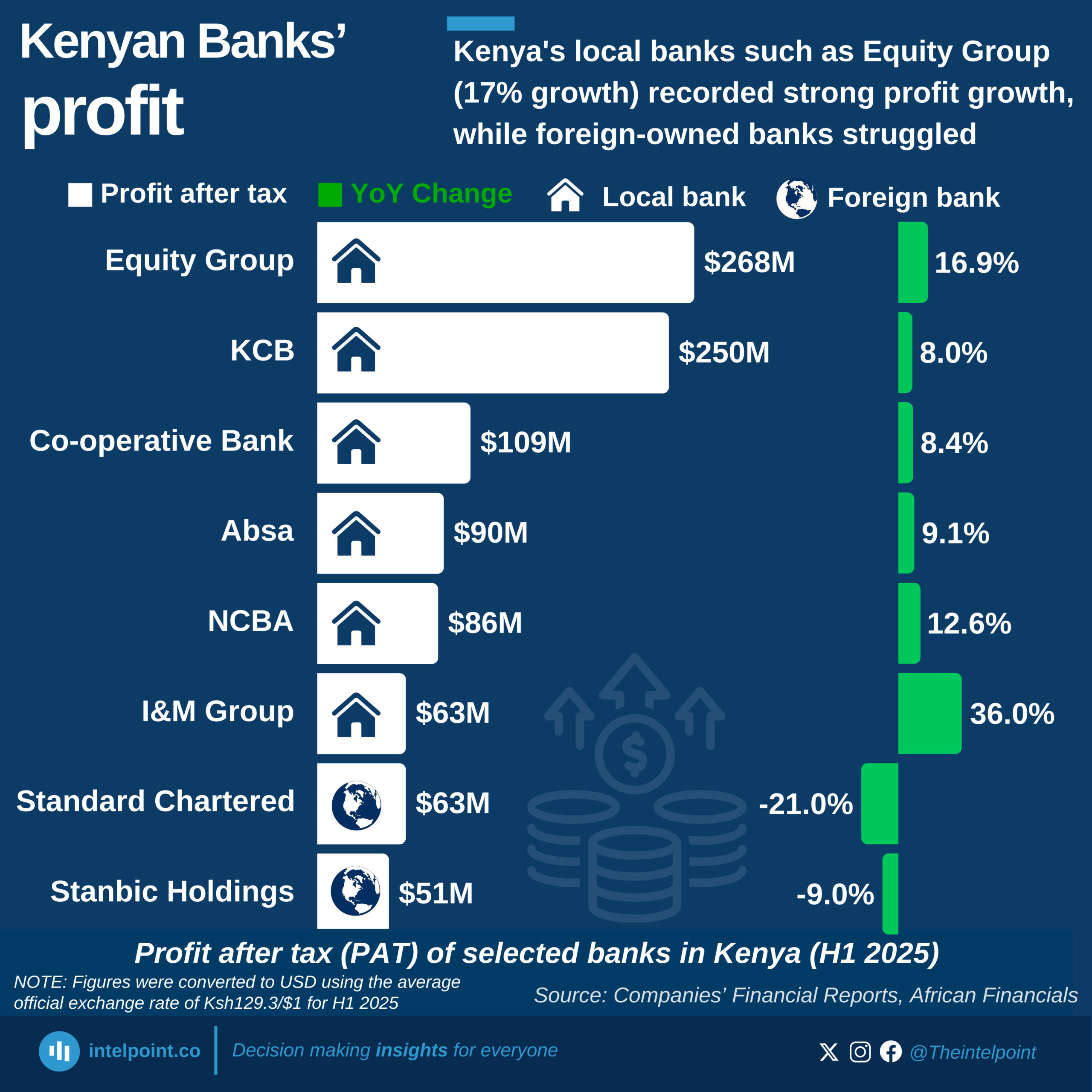

Kenya’s banking sector delivered mixed results in the first half of 2025, with local lenders recording strong profit growth while foreign-owned banks struggled.

Among the eight major banks anaylsed, I&M Group Plc posted the highest jump in after-tax profit at 36%, followed by Equity Group Holdings at 17% and NCBA Group Plc at 12.6%.

Equity also reclaimed its title as the most profitable bank in East and Central Africa with net earnings of KSh 35 billion ($268 million). Other domestic lenders—Absa Bank Kenya Plc (9.1%), Co-operative Bank of Kenya Limited (8.3%), and Kenya Commercial Bank (KCB) Limited (8%)—also delivered solid earnings.

In contrast, foreign lenders came under pressure. Stanbic Holdings Plc reported a 9% decline in profit, while Standard Chartered Bank Kenya Limited saw a 21% drop, the steepest among its peer group.

The divergence came even as the sector as a whole strengthened. According to the Central Bank of Kenya’s (CBK) latest Credit Survey Report, aggregate profit before tax rose to KSh 74.6 billion ($577 million) in the quarter ended June 2025, up KSh 1.1 billion ($9 million) from March. Sector-wide assets, gross loans, deposits, and liquidity also expanded.

The CBK said the industry remains well-capitalised, with “sufficient capital and liquidity buffers to withstand shocks,” though risks from elevated interest rates and rising credit stress persist.

Bank performance highlights

- I&M reported a 36% rise in after-tax profit to KSh 8.1 billion ($63 million), supported by higher operating income and disciplined cost control. Total assets rose 4% to KSh 588.9 billion ($4.55 billion).

- Equity grew its net profit 16.9% to KSh 34.6 billion ($268 million), with nearly half of the earnings derived from its regional subsidiaries. Assets expanded to KSh 1.79 trillion ($13.9 billion).

- NCBA lifted profit 12.6% to KSh 11.1 billion ($86 million), underpinned by double-digit income growth. However, assets and deposits contracted, even as digital lending surged 35%.

- Absa posted 9% profit growth, helped by strong non-interest income and cost control, despite weaker net interest income.

- Co-operative Bank delivered an 8.4% rise in net profit to KSh 14.1 billion ($109 million), driven by robust lending activity.

- KCB posted 8% profit growth to KSh 32.3 billion ($250 million), supported by loan expansion, even as non-interest income slipped. The bank declared a record mid-year dividend despite a slight contraction in assets following the sale of National Bank of Kenya.

- Stanbic Holdings saw profit fall 9% to KSh 6.5 billion ($51 million), weighed down by weaker non-interest income and rising expenses.

- Standard Chartered Bank Kenya recorded the steepest drop, with profit plunging 21% to KSh 8.1 billion ($63 million) on lower trading and interest income.

Banking sector assets hit $59.3 billion amid loan growth

Kenya’s banking sector remained resilient in the second quarter of 2025, with total assets rising by 2.3% to KSh 7.9 trillion ($60.7 billion) in June from KSh 7.7 trillion ($59.3 billion) in March, according to the CBK credit report.

Gross loans increased 0.6% to KSh 4.1 trillion ($32.1 billion), supported by higher lending to manufacturing, energy, and construction. Analysts say the growth in private sector credit underpins robust second-quarter performance and could set the stage for stronger results in the second half of the year.

“All banks recorded better results in Q2 compared to Q1, except StanChart,” said Robert Ochieng, CEO of Abojani Investment, during a recent X (formerly Twitter) Space discussion on H1 earnings reports for the banks. “The uptick in private sector lending shows Q2 was strong, and if momentum continues, Q3 and Q4 should be even stronger.”

Deposits rose 2% to KSh 5.7 trillion ($45.2 billion), bolstering liquidity, which improved to 58.6%—well above the regulatory minimum of 20%. Capital buffers also held firm, with the capital adequacy ratio edging up to 20.4% from 20.1% in March.

Purity Chege, a Research Analyst, attributed the broad-based expansion to revenue diversification and rising digital adoption. “Banks are no longer just about deposits and loans—customers now access full-spectrum financial services under one roof,” she said.

However, asset quality remained a pressure point. The sector’s gross non-performing loan (NPL) ratio rose slightly to 17.6% from 17.4%, reflecting a 1.6% increase in bad loans against a 0.6% rise in total loans. Return on equity also slipped marginally to 23% from 23.1%, as profits grew by KSh 1.1 billion ($8.5 million) while shareholders’ funds expanded by KSh 12.7 billion ($98.2 million).

Note: The financial figures were converted to US dollars using the average official exchange rate of Ksh129.3/$1 for H1 2025