Top stories

Insights

Top stories

The scale of the exposure emerged just days after Nigeria’s apex bank ordered lenders with unresolved forbearance loans to suspend dividend payouts, delay executive bonuses, and freeze new investments in offshore subsidiaries.

Nigeria-born fintech LemFi has acquired UK-based credit card issuer Pillar, marking a strategic pivot from cross-border remittances into the underserved migrant credit market.

The escalating conflict between Israel and Iran is sending tremors through global energy markets, with Nigeria caught in the crosscurrents, poised to reap short-term benefits from surging oil prices while facing heightened inflation and monetary tightening at home. Crude oil prices jumped from $65 to $75 per barrel in the week following Iran’s missile strikes…

Glaring discrepancies in official fiscal data are fuelling fresh doubts about the true scale of Nigeria’s financial woes.

According to the latest NGX report, Nigeria’s top-ten brokers in May, transacted $280.05 million in value, and 13.61 billion shares, representing 62.29%, and 50.23% respective share of all broker’s input on the NGX.

Despite concerns that open banking could be detrimental to Nigeria’s commercial banks, Adedeji Olowe, CEO of Lendsqr, argues that they could be the biggest winners when it goes live.

The CBN’s recapitalisation benchmark introduced in 2024 aimed at reforming Nigeria’s informal sector runs on a deadline today, only 5% of BDC operators has hit the bar

In addition to the renewed warrant, the special prosecutor has begun the process of issuing an Interpol red alert for the former minister’s arrest and extradition to Ghana.

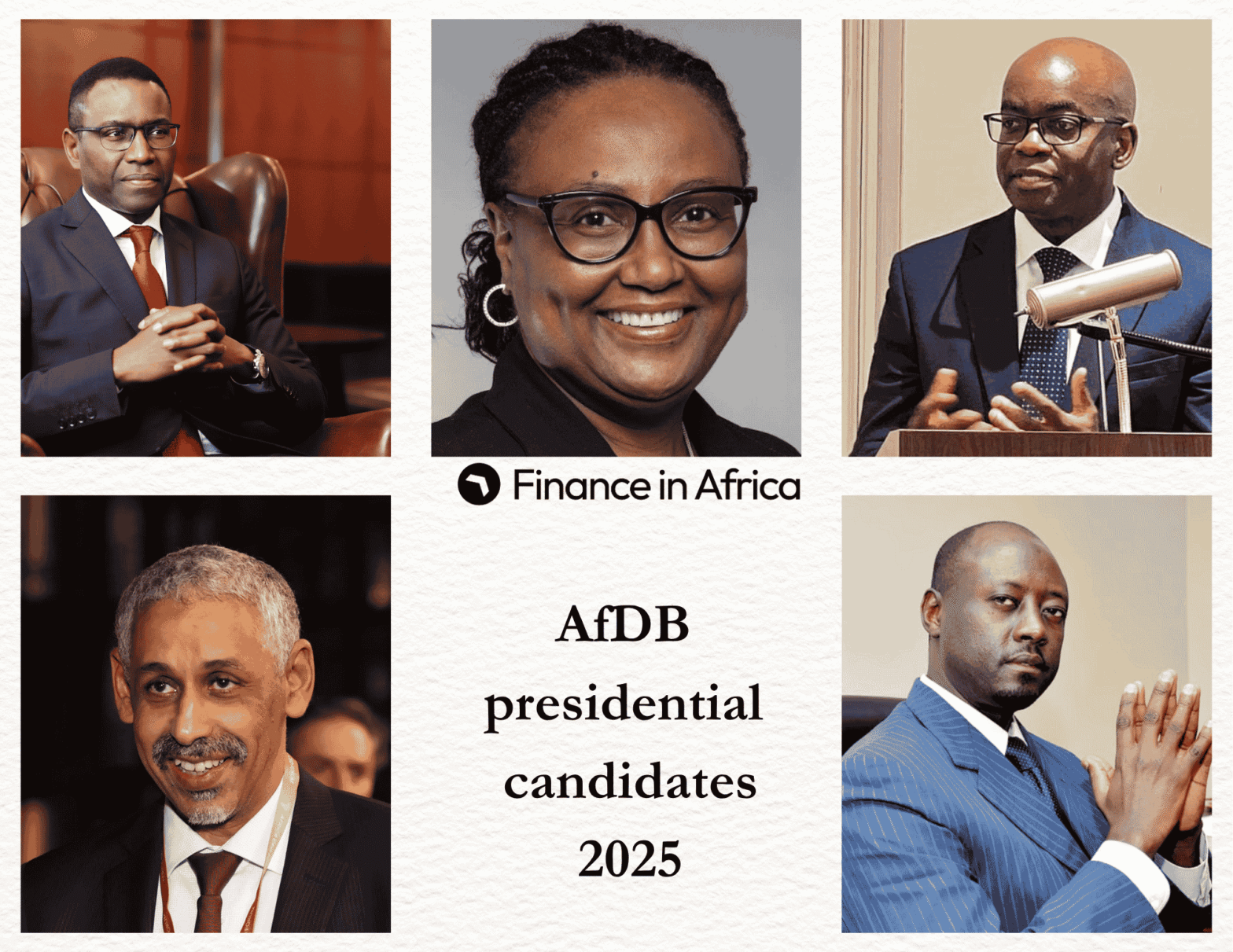

Dr. Adesina’s AfDB tenure saw $273B+ mobilised for energy, food, and industry, but progress on trade and livelihoods lagged amid conflict, climate shocks and global crises.

Tinubu’s two-year economic scorecard reveals gains in growth and investment — but inflation, debt, and hardship still plague businesses and citizens

The Amazon of Africa, has just lost its largest backer—after a Q1 revenue drop of 26% and only $110m left in the tank.

The African Development Bank (AfDB) will pick its next president on May 29, 2025, at its annual meeting in Abidjan, Ivory Coast. The timing is critical. With a recent $555 million funding cut proposed by the United States, the bank faces pressure to steer Africa’s growth through tough global financial waters. The current president, Dr.…

In the fourth quarter of 2024, liquidity in Nigeria’s banking sector fell below $100 billion for the first time in years. At the same, emergency borrowing by banks rose sharply, fuelling fears of a liquidity squeeze. Despite the signs of distress, Nigerian lenders remain broadly resilient —this piece explores why.

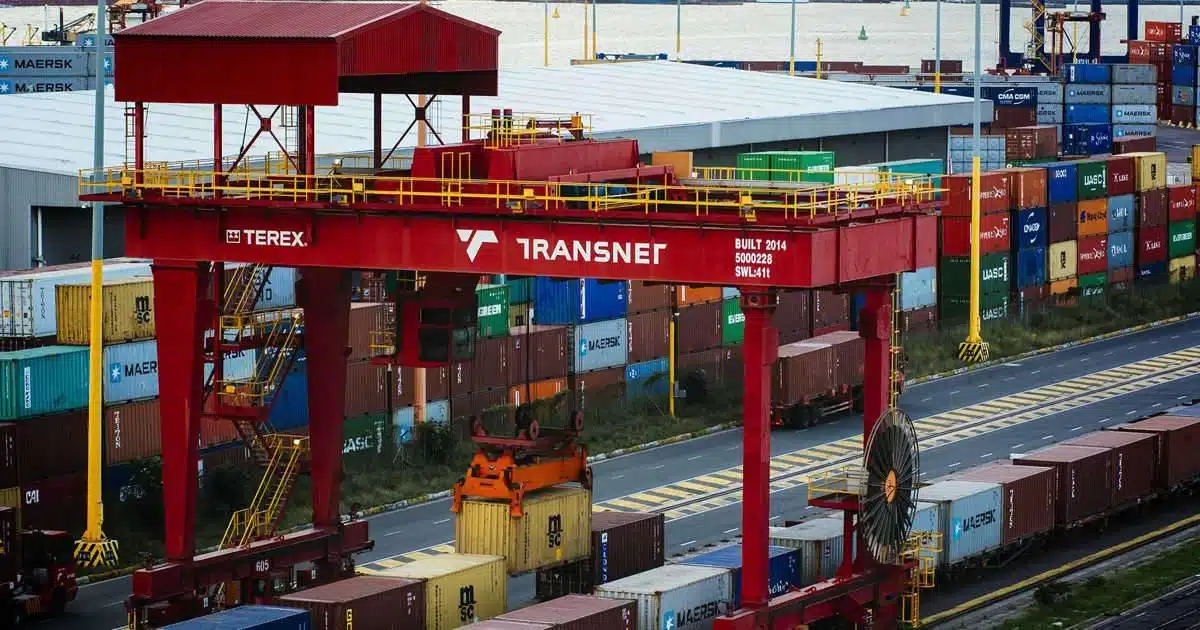

The government’s $2.8 billion guarantee to Transnet targets debt relief and urgent infrastructure repair

Africa’s fastest-growing sectors in 2025 include fintech, IT, healthcare, and education—driven by population growth, tech adoption, and urgent infrastructure needs across the continent.

Nigeria’s financial ecosystem looks like a crowded maze of banks, fintechs, microfinance institutions, and agencies—but beneath the noise is one quiet force keeping everything running: NIBSS. If your product moves money, verifies identities, or talks to a bank, chances are it’s already riding on NIBSS rails. This guide breaks down what NIBSS does, how it…

A proposed 5% U.S. tax on remittances sent abroad spell trouble for African economies, which rely heavily on money sent home by their diaspora.

Q1 2025 marks a turnaround for Nigeria’s corporate giants, with many returning to profit as FX losses ease and business strategies adapt to a tougher economy.

GTCO, Capitec, and CIB lead the pack on Return on Asset, showing that in African banking, the real winners aren’t always the biggest—but the ones that do more with less.

In Africa, GTCO, Capitec, and Zenith are turning capital into profit with ruthless efficiency.