Top stories

News

Top stories

The apex bank’s latest decision reflects cautious optimism about the country’s economic trajectory as food supply picks up easing inflationary pressures.

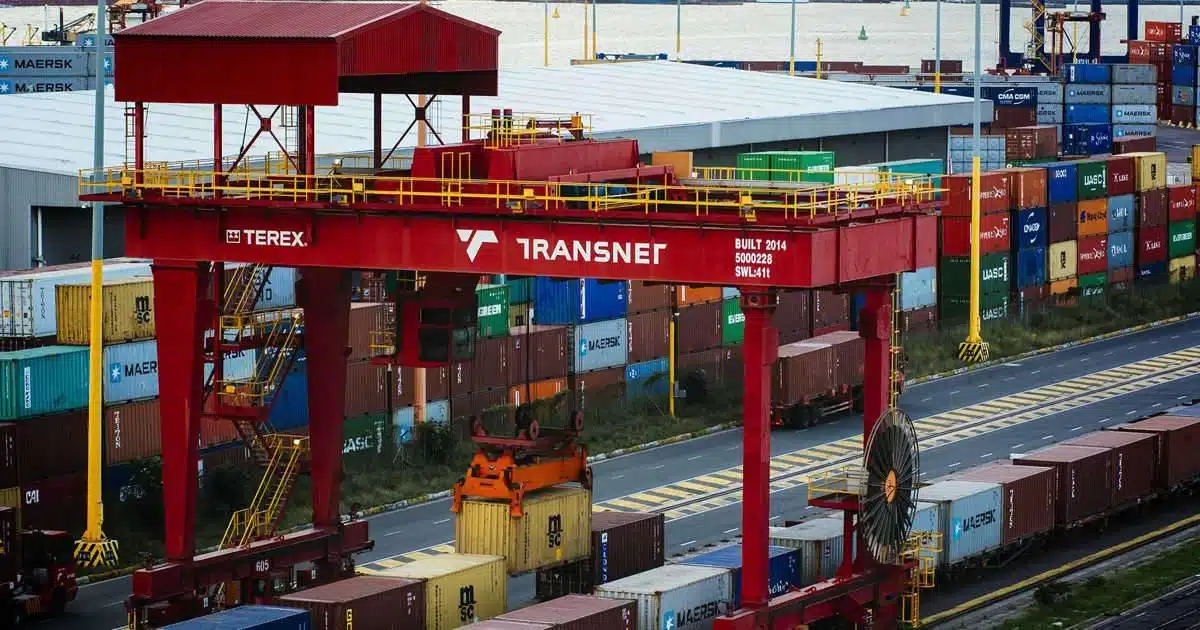

The government’s $2.8 billion guarantee to Transnet targets debt relief and urgent infrastructure repair

Investec Ltd. has announced a $139.2 million share repurchase set to begin in May 2025 on the Johannesburg Stock Exchange.

Dangote’s new polypropylene plant, backed by a global export deal with Vinmar, signals Nigeria’s shift toward value-added exports.

Ethiopia and the Netherlands are investing $50 million to improve agricultural exports through dry port and cold storage facilities.

In addition to simplifying forex pricing structures for bank customers, the new rules offer greater flexibility for international travellers and businesses through higher cash limits and relaxed import payment rules.

A Nigerian court has barred a privacy lawyers’ group from joining a lawsuit over control of the BVN, a national biometric ID system linked to bank accounts, raising concerns about data governance and civil society exclusion.

Following the AGOA ban, Uganda leaned on targeted market surveys, better trade representation, and local reforms to break into new markets across Asia and Europe.

New data from the finance ministry shows that Kenya’s total debt stock rose to a record $88 billion in the 12 months leading to March 2025 driven by increased domestic borrowing.

The CBN’s decision was influenced by a modest easing in inflation and improved macroeconomic indicators, including a narrower exchange rate gap and a better balance of payments position.

While the surge in technology investments highlights the digital sector’s growing role in Nigeria’s economy, investor confidence in the broader landscape remains weak, as reflected in the continued decline in overall FDI.

The bank, while denying insolvency claims, clarified that its actual exposure ranges between $9 million and $19 million—a sum it would share with G. Cappa, another party to the suit.

The new deal marks a significant step-up from previous commitments, with IsDB indicating plans to double Algeria’s financing volumes which currently stand at around $2.9 billion.

FIRS and RMAFC have formed a joint committee to enhance tax revenue monitoring, marking a strategic move toward fiscal transparency and reducing Nigeria’s reliance on volatile oil income

The energy project is expected to supply electricity to over 1 million Malawian households and create thousands of jobs, both directly and through downstream industries.

Ethiopia’s central bank has announced it will phase out a controversial rule that requires commercial banks to buy government bonds.

The Mozambican government expects to collect 500 million meticais ( about $7.5 million) in taxes from casinos and gambling activities in 2025.

The upgrade marks a significant shift in the lender’s expansion strategy beyond its traditional markets in Eastern Europe, Central Asia, and parts of the Middle East.

Despite the apparent drop in headline inflation, Nigerians continue to face high costs of essentials amid ongoing economic challenges.

A Kenyan lawmaker, Caroli Omondi, has suggested a new law called the Central Bank of Kenya (Amendment) Bill 2025. This law would make it against the rules for shops and businesses with real locations to refuse cash for payments under $775. If they don’t follow this rule, they could be fined or sued.