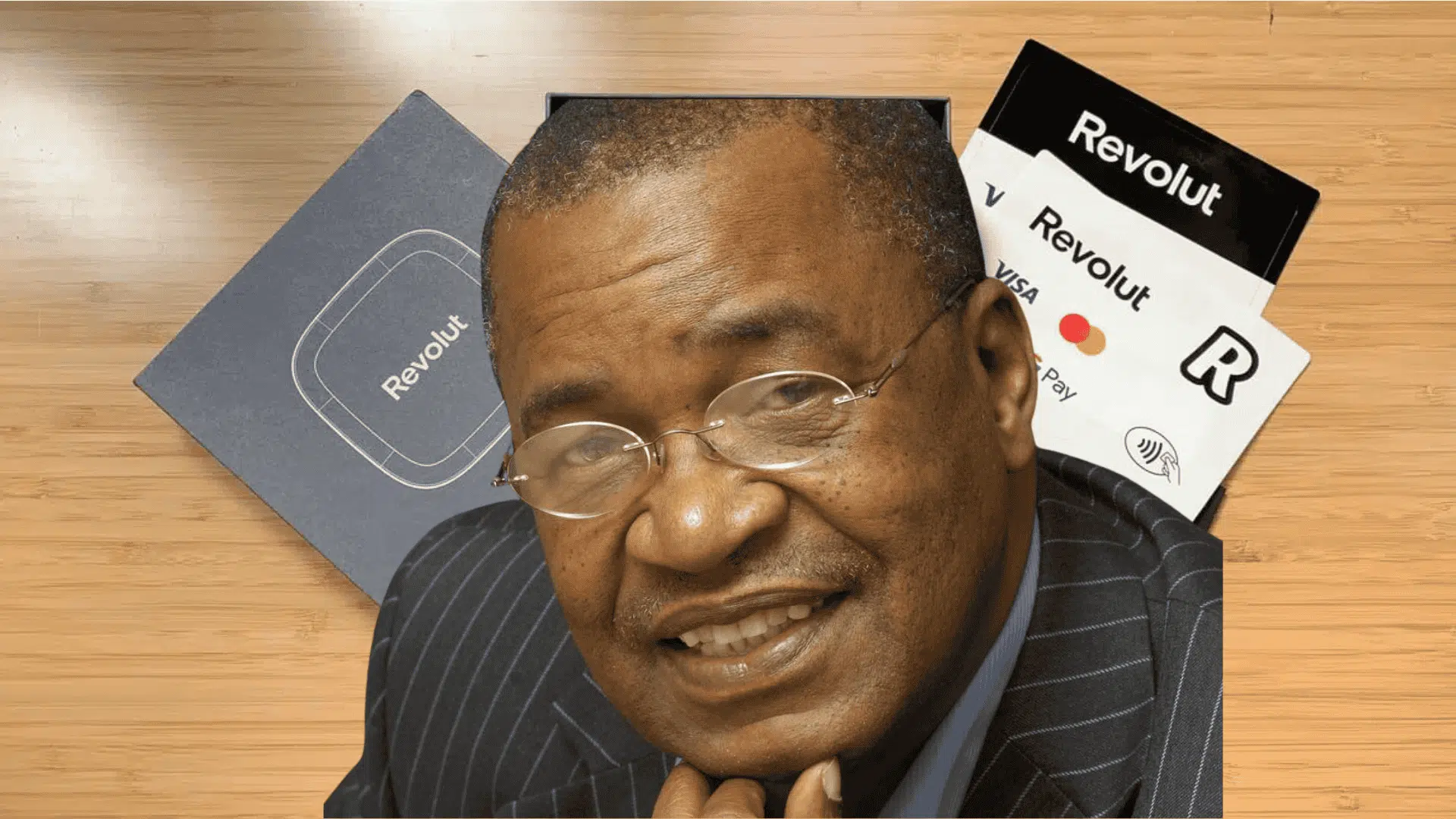

Global fintech firm Revolut has taken a decisive step in its African expansion by appointing South African banking veteran Dr Gaby Magomola as chairman of its South Africa subsidiary and formally applying for a full banking licence under the country’s Banks Act.

Magomola brings more than four decades of executive experience across Citibank, Barclays, First National Bank, African Bank and the Development Bank of Southern Africa — the kind of governance profile regulators expect from a new entrant seeking to take deposits and offer credit in one of Africa’s most tightly regulated markets.

Revolut’s Section 12 application signals intent to build a fully licensed banking platform rather than a lightweight payments operation. South Africa’s regulatory bar is significantly higher than most emerging markets, requiring capital adequacy, local governance, and detailed fit-and-proper scrutiny.

For Revolut, pairing a formal licence application with a seasoned local chairman is a strategic attempt to navigate a market where digital banks, incumbent institutions and super-apps are already competing fiercely for retail deposits and transaction volume.

Revolut’s Africa strategy: the Morocco foundation

Magomola’s appointment follows a sequence of senior hires that shows Revolut is building Africa through local credibility rather than remote oversight. Earlier this year, Revolut named Yacine Faqir, a former Mastercard executive, as CEO for Morocco, responsible for market entry, licensing dialogue and localisation of its product suite.

Faqir’s appointment came just months after Revolut hired Amine Berrada, a former Uber director, as Head of Operations for Morocco, signalling a phased build-up: operational leadership first, followed by regulatory-facing leadership.

This Morocco-South Africa twin-track creates a deliberate geographic architecture. Morocco anchors Revolut in North Africa with a lighter-touch regulatory on-ramp, while South Africa represents the harder, systemic prize — a test of whether Revolut can become a licensed bank in Africa’s most sophisticated financial system.

Taking on well-documented challenges

Finance in Africa has previously reported that Revolut faces a materially tougher environment in South Africa than in most growth markets. Our analysis highlighted regulatory fragmentation, exchange-control constraints, deposit-taking requirements, and competition from TymeBank, Discovery Bank, and Capitec’s digital rails.

Revolut’s decision to appoint Magomola directly addresses those friction points: regulatory familiarity, governance legitimacy, and institutional experience in managing prudential obligations.

By contrast, the company’s Morocco strategy reflects a different kind of regulatory path — starting with a payments operator footprint, building a local team, then pursuing a banking licence within two years.

Revolut’s Africa build-out therefore mirrors its broader global playbook: enter via payments, localise leadership, stabilise regulatory relationships, and then expand into banking where allowed.

Implications for South Africa and the region

Revolut’s South African entry now moves from intention to execution. If the banking licence is approved, the company will introduce a new competitive dynamic into retail banking, challenging incumbents on low-cost accounts, FX pricing, and digital onboarding.

For regulators, Revolut’s pursuit of a full licence creates a precedent for how global fintechs can embed within Africa’s prudential frameworks rather than operating at the edges.

For the wider region, the move also signals a shift in how global fintechs approach Africa: local governance, transparent regulatory engagement, and a licence-first strategy, rather than purely digital agility.

With Morocco and South Africa now forming the pillars of its continental footprint, Revolut is positioning itself not as a cross-border fintech but as an African banking player in the making.