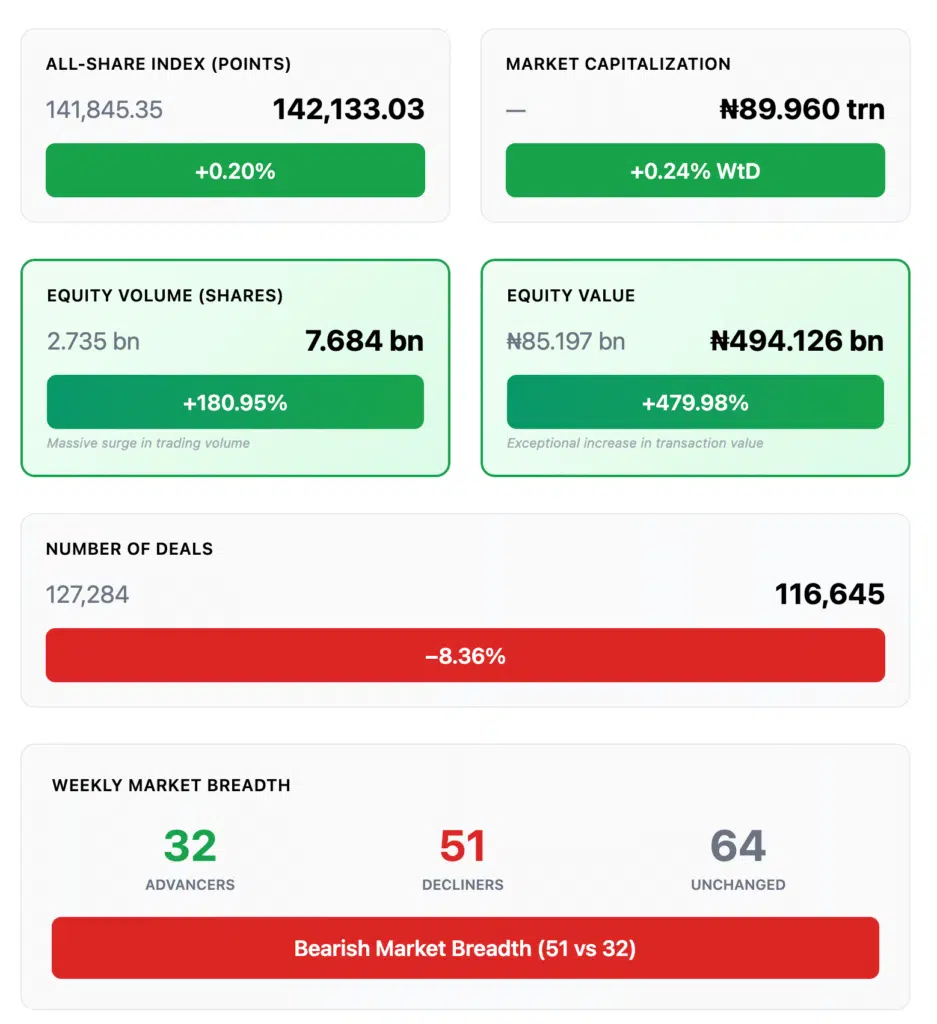

If you only glanced at the headline, you’d think it was a sleepy week. The All‑Share Index (ASI) added a modest +0.20% to 142,133.03. Yet under the surface, the market fired off one of the heaviest liquidity waves of the quarter. Equity turnover exploded to 7.684 billion shares worth ₦494.126 billion across 116,645 deals, dwarfing the prior week’s 2.735 billion shares and ₦85.197 billion. That’s a +181% jump in volume and a ~+480% surge in value, even as total deals declined week‑on‑week. Translation: fewer tickets, far larger tickets. Institutions, not dabblers.

The activity map was brutally concentrated. Three names—Unity Bank, Aradel Holdings, and Consolidated Hallmark—accounted for ~68% of the volume and 82% of the value. Meanwhile, Oil & Gas printed ₦391.364 billion of the week’s ₦494.126 billion—about 4 naira out of every 5—even though the sector’s price index finished –1.62% WtD. That is classic high-value churn: big money is rotated and re-priced risk in size.

Breadth told a cautionary tale. 32 gainers vs. 51 losers (64 unchanged)—a narrow leadership carried the day. Yet the daily pattern matters for what comes next: a liquidity super‑spike on Thursday (Sept 25)—5.48 billion shares, ₦419.69 billion—flipped the week. Then, on Friday (Sept. 26), momentum was kept alive (advancers 36 vs. decliners 23). That late‑week thrust often bleeds into month‑end and quarter‑end flows—exactly the setup we have for Sept 29–30.

Here’s the punchline for portfolio decisions: a quiet index with thunderous value, negative breadth, and sectoral rotation signals a market repositioning into month-end. The next two sessions can deliver outsized moves as funds square books for Q3 close and sketch the first strokes of October’s playbook.

Read our stock market report series here.

Key Market Metrics Dashboard

Sector activity (by volume & value):

- Financials: 6.399 billion shares; ₦71.807 billion (≈83.27% of volume; 14.53% of value)

- Oil & Gas: 730.517 million shares; ₦391.364 billion (≈9.5% of volume; ≈79.2% of value)

- Services: 128.647 million shares; ₦0.963 billion

Top 3 equities by activity (volume & value concentration):

Unity Bank • Aradel Holdings • Consolidated Hallmark (≈67.79% of volume; ≈81.95% of value).

Market Analysis Narrative — What Actually Happened

Here’s what really caught our attention: value surged while breadth sagged. That combo signals portfolio rotation, not blind risk‑on. The Oil & Gas complex dominated cash value but still fell –1.62% on its sector index—evidence of heavy two‑way trade and re‑pricing rather than fresh bullish conviction. Financials accounted for 83% of shares traded, consistent with institutional liquidity patterns; yet the Banking Index rose a controlled +1.19%—accumulation without a blow-off.

The daily tape matters for month-end: Monday through Wednesday saw mixed breadth, and then Thursday’s gigantic print likely reflects block flows/portfolio squaring tied to quarter-end. Friday saw sustained positive breadth, indicating that buyers maintained a bid under the market. From September 29–30, that pattern often extends as funds finalize Q3 marks and window-dress exposures.

Indices corroborate the rotation:

- Winners WtD: Industrial Goods +1.33%, Consumer Goods +1.15%, Banking +1.19%, MERI Value +2.77%, AFR Bank Value +3.10%.

- Laggards WtD: Oil & Gas –1.62%, Insurance –0.91%, CG –0.08%, Pension –0.15%.

Net: the market paid for value and defensiveness, funded partly by profit‑taking in Oil & Gas and selected growth/insurance names. With ASI +1.31% MtD and +18.47% QtD, managers have performance to protect—a classic backdrop for month‑end support into the close.

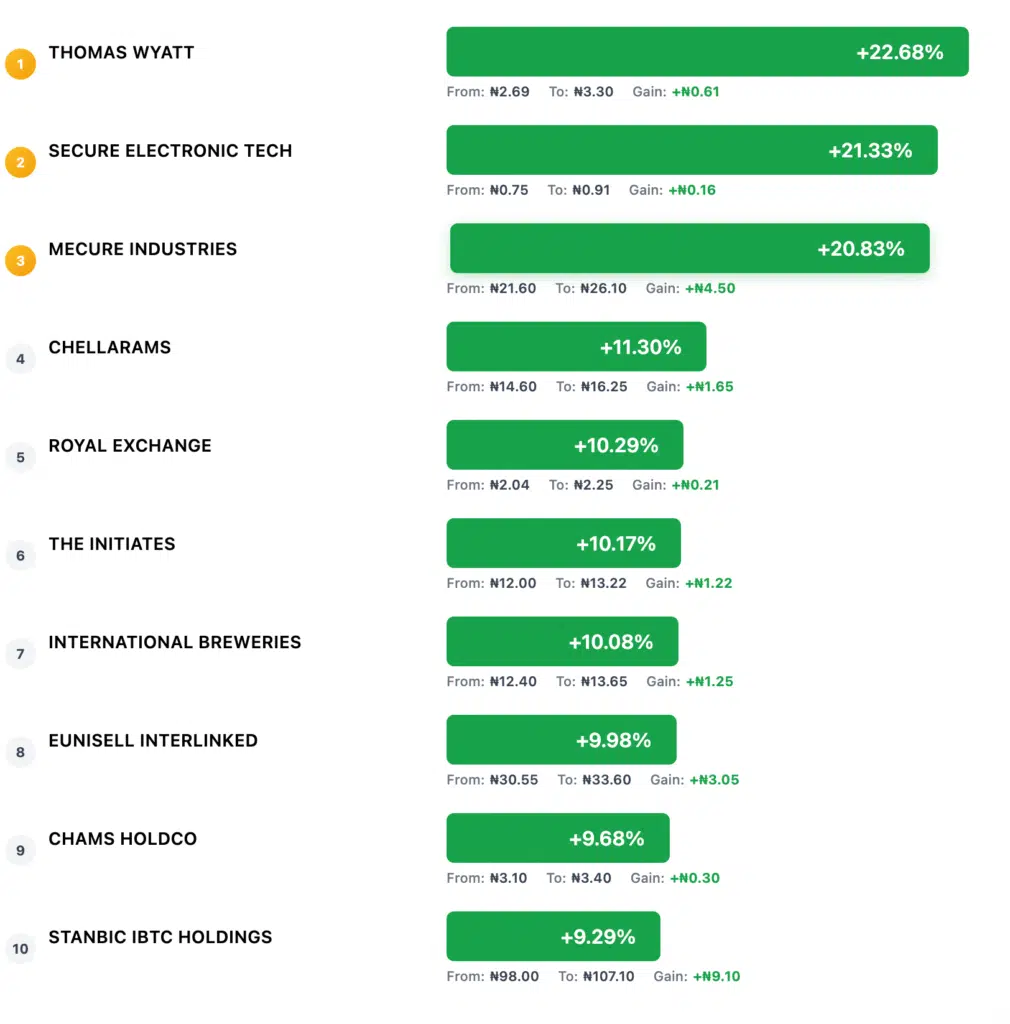

Winners & Losers — Price Performance (Open → Close, ₦, Abs, %)

Top 10 Gainers

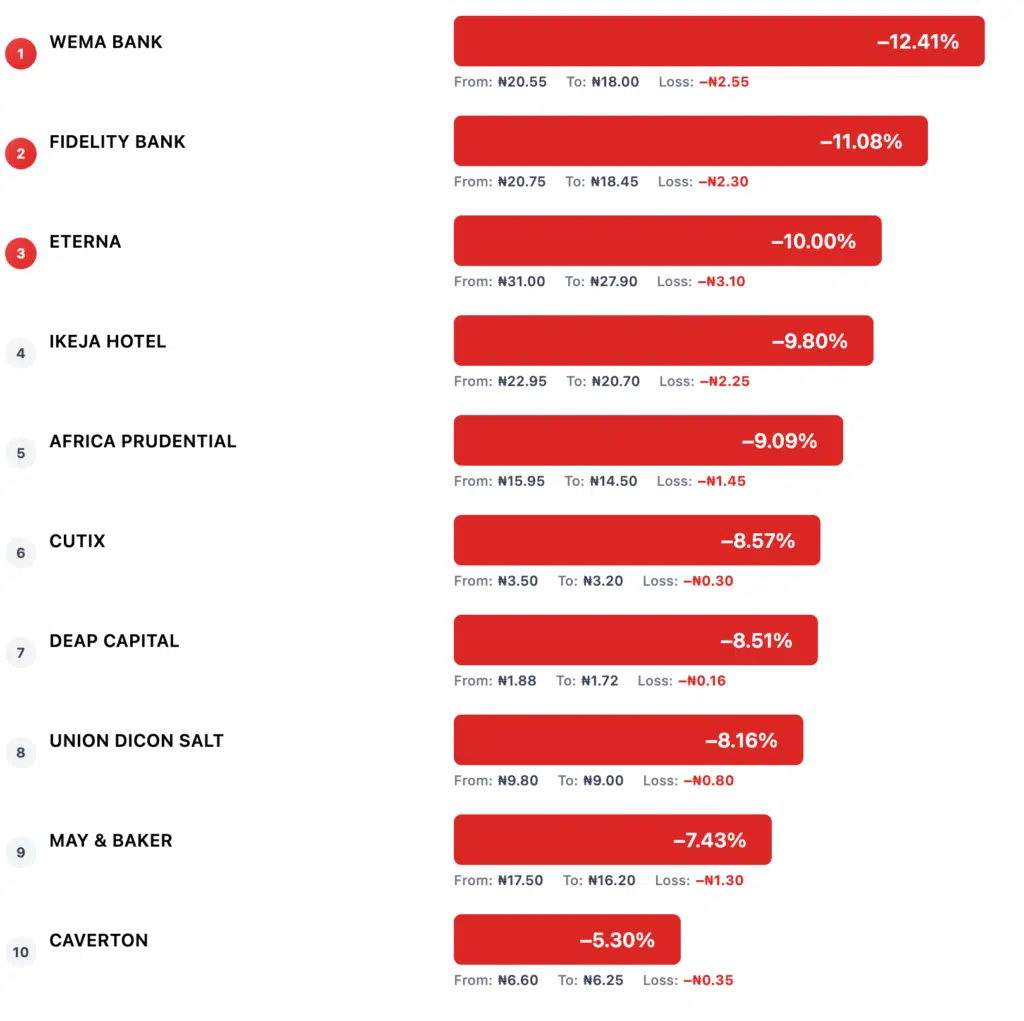

Top 10 Losers

Read: Winners were a mix of industrial/chemicals, consumer, and small‑mid caps; decliners clustered in banks and Oil & Gas peripherals, consistent with the rotation story.

Sector Performance Deep Dive

- Liquidity gravity: Oil & Gas commanded ≈79% of cash value, yet finished –1.62% WtD—strong evidence of position reshuffling.

- Share churn: Financials took 83% of volume, but value share was just ~15%—large blocks in lower‑priced bank/finance names drove prints without spiking sector prices.

- Style tilt: MERI Value +2.77% and AFR Bank Value +3.10% outpaced broad beta, while Consumer Goods +1.15% and Industrial Goods +1.33% added defensive ballast.

- Laggards: Insurance –0.91% and Oil & Gas –1.62% showed profit‑taking rather than breakdowns; both ran hard YtD and are now cash sources for funds.

Volume & Value Hot List

- Most active complex (Value): Oil & Gas (~₦391.4 bn).

- Most active complex (Volume): Financials (6.399 bn shares).

- Top activity names: Unity Bank, Aradel Holdings, Consolidated Hallmark (≈68% vol, 82% val).

- ETF tape: 154,584 units, ₦23.31 m across 222 deals (NEWGOLD also traded, alongside LOTUSHAL15, STANBICETF30, VETGRIF30, VSPBONDETF, etc.).

- Bonds: 75,196 units, ₦73.98 m in 27 deals; flows concentrated in FGSUK2033S6, FGSUK2027S3, FGSUK2031S4, and FGSUK2032S5.

Daily Market Progression (Sept 22–26)

| Date | Deals | Volume (shrs) | Value (₦) | Adv | Dec | Unch |

| Mon 22‑Sep | 28,598 | 488,514,774 | 13,714,196,011 | 22 | 28 | 75 |

| Tue 23‑Sep | 23,639 | 759,058,546 | 25,723,122,412 | 16 | 35 | 77 |

| Wed 24‑Sep | 21,678 | 442,546,611 | 16,963,379,712 | 23 | 29 | 75 |

| Thu 25‑Sep | 20,391 | 5,475,048,764 | 419,688,104,050 | 34 | 22 | 73 |

| Fri 26‑Sep | 22,339 | 518,641,035 | 18,037,629,376 | 36 | 23 | 70 |

Inflection: Thursday’s outsized block‑like flows are typical of quarter‑end book moves. Friday maintained a positive advance/decline line, a constructive handoff into Sept 29–30.

Corporate Actions & Notables

- FCMB Group Plc: 3,166,284,712 additional ordinary shares listed on Sept 23, arising from conversion of a mandatory convertible loan (₦23.114 bn at ₦7.30 per share). Issued shares increased to 42,771,706,274. Liquidity events like this can temporarily pressure price while broadening float.

What This Means for Your Investment Strategy (Read Carefully)

Context for Sept 29–30 (month‑ & quarter‑end) and October’s open: Last week’s tape says institutions are repositioning. The two sessions ahead often finalize marks, hedges, and window dressing. Expect follow‑through liquidity, especially in names already central to last week’s flows. Here’s how to translate that into portfolio decisions:

A) If you’re conservative (capital preservation first)

- Stay core‑beta, add on dips: With ASI +1.31% MtD and breadth negative, avoid chasing extended pockets. Scale into broad, liquid exposures aligned with Industrial Goods and Consumer Goods strength (both +1%–1.3% WtD), staggering entries across Sept 29–30 to exploit any markdown volatility.

- Prefer quality liquidity: In Financials, the volume magnet implies easy entry/exit; allocate to higher-quality bank names rather than thin, small-cap stocks.

- Hold some yield: Keep a sleeve in FG sovereigns/quality ETFs (NEWGOLD/LOTUSHAL15 traded; bond flows were healthy). Month‑end can jar equities; yield smooths the ride.

B) If you’re growth‑oriented (seeking upside with risk controls)

- Ride the value‑tilt, but time entries: Style leadership flipped toward Value (MERI Value +2.77%) while Oil & Gas backed off. Look for post‑month‑end follow‑through in Industrial/Consumer and AFR Bank Value proxies. Use intraday weakness on Sept 29–30 to add.

- Exploit crowded‑trade shakeouts: The Oil & Gas complex saw 79% of cash value while closing lower. That’s where volatility = opportunity. Lean into high‑liquidity names only, and scale with stops—month‑end can produce sharp mean reversion.

- Momentum hand‑off: Thursday/Friday breadth improved. If Monday (29th) opens firm, consider short-cycle swing holds into Tuesday (30th), then reassess for the tone of October.

C) If you’re a value hunter (patient, price‑sensitive)

- Follow the money, not the noise: Unity Bank, Aradel, Consolidated Hallmark concentrated ~82% of value. Dig into names where float is expanding (e.g., FCMB listing) and valuation screens improved on last week’s pullbacks.

- Watch banks selectively: The Banking Index, up 1.19% with massive volume across Financials, suggests accumulation without euphoria. Target quality balance sheets, not just price laggards.

- Harvest from laggards with catalysts: Insurance (–0.91%) and Oil & Gas (–1.62%) can serve as cash sources now and as entries later—but they demand a clear catalyst (such as results, guidance, or index inclusion) before scaling.

Risk controls and execution

- Scale around month‑end prints: Liquidity is your friend, but marking effects can whipsaw prices. Use staggered orders from September 29 to 30.

- Respect breadth: The index rose on narrow leadership. If breadth worsens on Monday/Tuesday, reduce risk; if it broadens, you have green light to lean in modestly for October.

- Position sizing: Concentration risk was the story; do not mirror it blindly. Maintain disciplined single-name exposure and prefer baskets/ETPs for thematic investments.

Disclaimer: This is not investment advice; please do your own due diligence and consider your risk tolerance, horizon, and constraints.

Forward Look — The Last Two Days of September & October’s Opening Notes

- Month‑/Quarter‑End Mechanics: Expect continued high value prints as funds finish Q3 books. Thursday’s ₦419.7 billion day is your tell; similar—but likely smaller—waves can hit on Sept. 29–30.

- Levels & tone to watch: ASI ~142k held; MtD +1.31% provides cushion. A firm advance/decline on Monday would argue for constructive October seasonality; a relapse into narrow leadership warns to keep powder dry.

- Sectors:

- Industrial & Consumer: candidates for early‑October leadership if breadth expands.

- Banking: follow‑through likely, but stair‑step rather than surge.

- Oil & Gas: high‑value churn suggests tradable swings; treat as tactical, not core, until leadership re‑emerges.

- Industrial & Consumer: candidates for early‑October leadership if breadth expands.

- Corporate actions: FCMB float expansion is fresh; monitor how the tape absorbs supply into month‑end—price stabilization would be bullish for October.

Appendix — Indices Snapshot (WtD moves)

- ASI: +0.20% (142,133.03)

- Main Board: +0.03%

- NGX 30: +0.24%

- Premium: +0.48%

- Banking: +1.19%

- Consumer Goods: +1.15%

- Industrial Goods: +1.33%

- AFR Bank Value: +3.10%

- AFR Div Yield: +1.01%

- MERI Value: +2.77%

- Insurance: –0.91%

- Oil & Gas: –1.62%

- Lotus II: –0.52%

- Growth: +16.30%

Data source: NGX Weekly Report for the week ended Sept 26, 2025. All calculations and interpretations are derived strictly from the provided document.