Perspective: Monday, 22 September 2025 — using last week to plan the new week

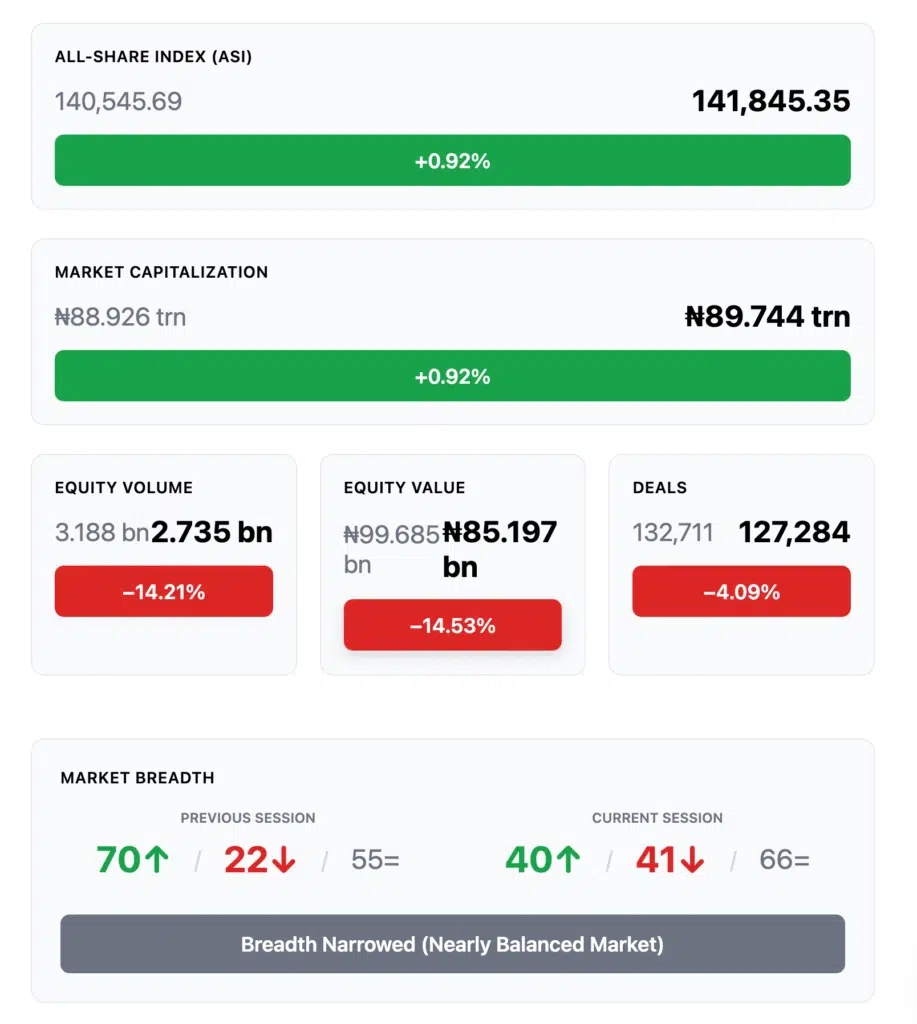

Sometimes the market whispers; last week it spoke plainly. The NGX closed higher, with the All-Share Index (ASI) adding 0.92% to finish at 141,845.35, and a market capitalization of ₦89.744 trillion. Gains were not fireworks—they were deliberate steps forward in a market sorting leaders from passengers.

Under the surface, activity cooled from the prior week, with 2.735 billion shares changing hands across 127,284 deals, compared to 3.188 billion shares and 132,711 deals previously. In naira terms, value traded declined to ₦85.197 billion from ₦99.685 billion. That’s a lighter breadth and value—yet, with the index up, the message is one of selective accumulation, not exuberance.

Leadership rotated. Financials again dominated flow—nearly 70% of all shares traded by volume—while Consumer Goods and Oil & Gas led the index scoreboard. Insurance and Banking, by contrast, took a breather. Translation: investors paid up for staples and energy while trimming financial beta.

Breadth cooled: 40 gainers vs 41 losers and 66 unchanged, a significant moderation from the prior week’s 70 advancers. This was a “stock-picker’s tape”—gains where conviction was highest, hesitation elsewhere.

See our stock market report series here.

Key Market Metrics Dashboard

Read: Price ↑, turnover ↓ → selective conviction; breadth tightened.

Market Analysis Narrative (What the numbers mean)

Here’s what really caught our attention: the index advanced by 0.92% despite a nearly 14% decline in both shares and the naira traded. That’s the hallmark of quiet accumulation — buyers are picky, paying up for specific names while the broader market digests prior gains.

Activity concentration remained high in Financial Services (≈approximately 69.8% of shares; ≈approximately 44.4% of naira value), with ICT and Services a distant second. Three counters — Abbey Mortgage Bank, Fidelity Bank, UBA — captured roughly 32% of total weekly volume, underscoring a liquidity crowding effect around familiar banks.

Performance rotated: Consumer Goods (+5.48%) and Oil & Gas (+2.79%) led, while Banking (−2.57%) and Insurance (−4.67%) lagged as investors trimmed rate‑sensitive beta. The Main Board (+2.03%) outpaced the Premium Board (−1.14%), hinting at preference for domestically focused, mid‑to‑large caps over mega‑caps.

Breadth cooled to 40/41, and the day‑by‑day pattern matters: Wednesday printed the turnover high; Friday closed with only 11 advancers vs 43 decliners, a caution flag for early‑week follow‑through tests.

Winners & Losers Analysis

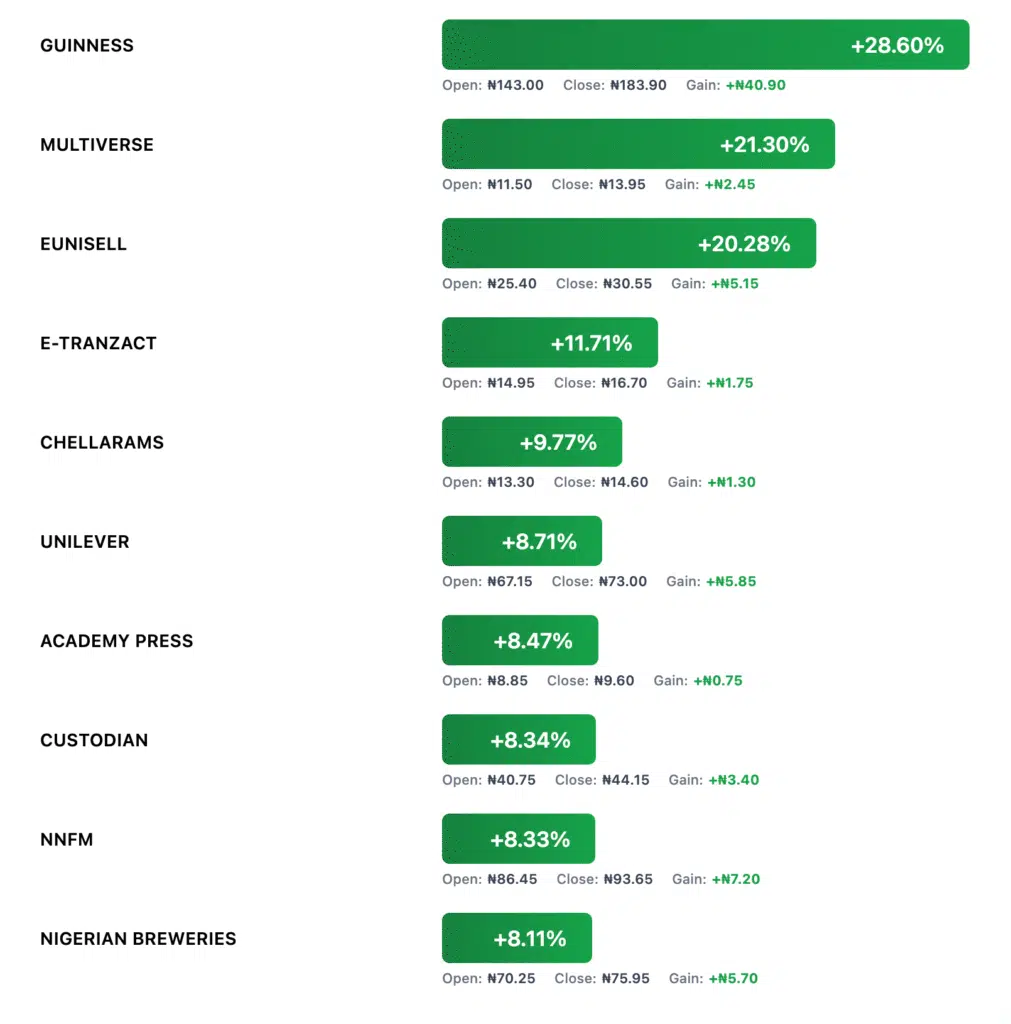

Top 10 Gainers (Week‑on‑Week)

Take: Consumer staples and selected mid‑caps dominated. If you held Guinness, you banked a 28.6% return in five sessions — momentum plus defensiveness.

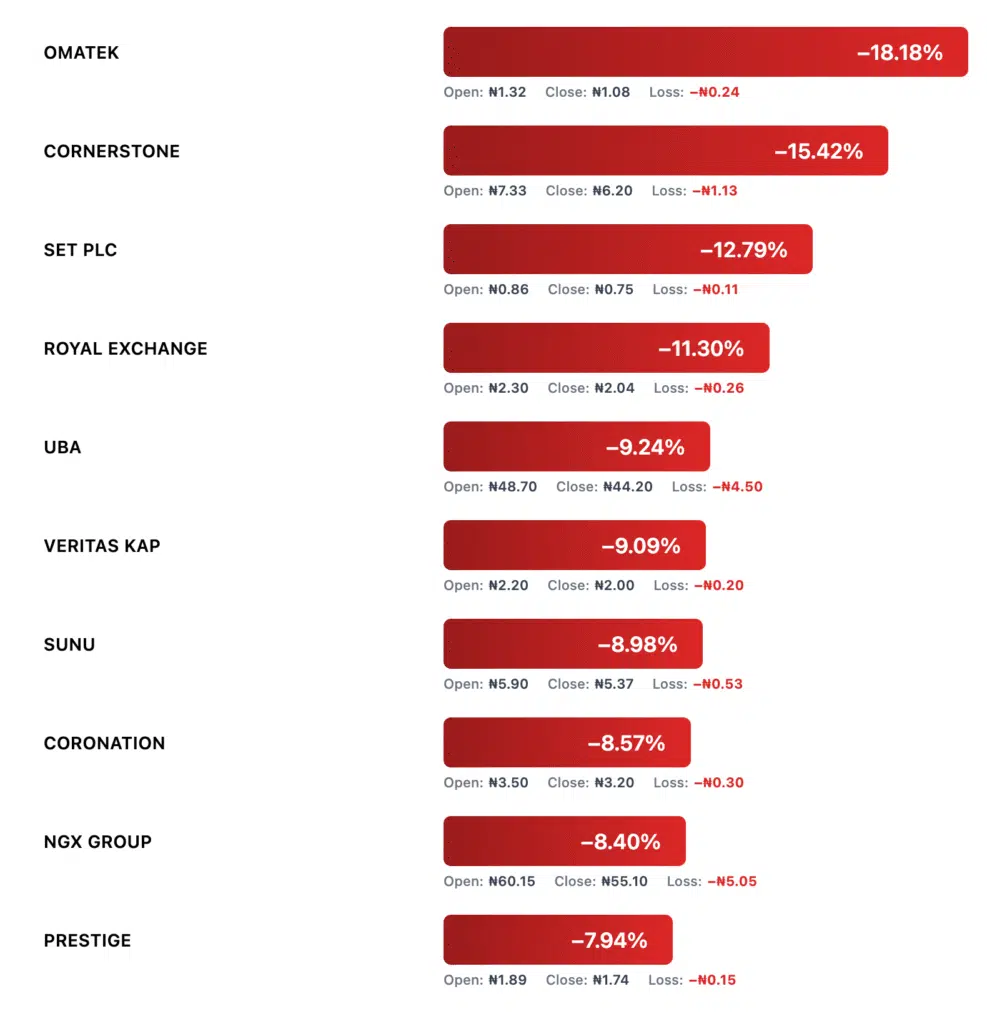

Top 10 Decliners (Week‑on‑Week)

Take: Financials dotted the decliners — classic profit‑taking after strong runs. Contrarians: shortlist quality names with catalysts before bottom‑fishing.

Sector Performance Deep Dive

- By Activity (Volume / Value):

- Financial Services: 1.909bn shares (~69.79%); ₦37.834bn (~44.41%).

- ICT: 184.87m shares (~6.76%); ₦6.189bn.

- Services: 176.51m shares (~6.46%); ₦0.813bn.

- Top 3 volume counters: Abbey Mortgage, Fidelity, UBA = 875.82m shares (~32.02% of weekly volume; ₦16.417bn value).

- By Performance (Indices, WoW):

- Leaders: Consumer Goods +5.48%, Oil & Gas +2.79%, Lotus II +1.84%.

- Laggards: Banking −2.57%, Insurance −4.67%, Premium −1.14%, CG −1.04%.

- Boards: Main Board +2.03% vs Premium −1.14%.

Read: Smart money favored defensives and energy; rate‑sensitive names digested.

Volume & Value Analysis (Liquidity & Psychology)

- Turnover Compression: Shares −14.21%; value −14.53% w/w while ASI rose +0.92% → buyers paying up in select names; sellers less aggressive.

- Concentration: Top‑3 volume names captured ~32% of all shares; liquidity clustered in familiar bank tickers.

- ETPs: 107,552 units (≈−42.2% w/w) worth ₦15.02m (≈−27.1%).

- Bonds: 44,730 units (≈+84.6%) worth ₦46.73m (≈+110.1%); flow concentrated in sovereign/sukuk lines.

Read: Equity risk appetite narrowed; fixed‑income prints suggest parallel demand for quality/hedge exposure.

Daily Market Progression (15–19 Sep)

| Day | Deals | Volume (shares) | Value (₦) | Adv | Dec | Unch | Tape Note |

| Mon (15‑Sep) | 31,566 | 555,117,365 | 24,082,068,758 | 32 | 32 | 64 | Balanced breadth |

| Tue (16‑Sep) | 25,383 | 414,980,467 | 12,944,934,911 | 23 | 27 | 78 | Quiet drift |

| Wed (17‑Sep) | 23,272 | 1,004,611,165 | 24,654,007,935 | 28 | 32 | 68 | Peak turnover |

| Thu (18‑Sep) | 22,770 | 325,099,769 | 8,412,858,094 | 30 | 20 | 77 | Breadth rebound |

| Fri (19‑Sep) | 24,293 | 435,184,076 | 15,102,795,272 | 11 | 43 | 70 | Weak breadth into close |

Corporate Actions & Market Events

- Futures Listings (15 Sep 2025):

- NGX30H6 — Price ₦5,435.00; Expiry 20 Mar 2026.

- NGXPENSIONH6 — Price ₦7,108.25; Expiry 20 Mar 2026.

Implication: Expanded toolkit for hedging/tactical beta.

- Ex‑Dividend:

- Learn Africa (Ex‑div ₦0.35) — ex date 15 Sep.

- Northern Nig. Flour Mills (Ex‑div ₦0.25) — ex date 18 Sep.

- Rights Issue Extension:

- Chams Holdings (CHAMS) — Trading in rights extended by 10 working days; new close: Friday, 26 Sep 2025.

- Terms: 1 for 2 at ₦1.70.

- ETPs & Bonds (Weekly):

- ETPs: 107,552 units | ₦15.023m | 261 deals.

- Bonds: 44,730 units | ₦46.727m | 41 deals.

- Heaviest bond lines: FGSUK2033S6 (17,000 units; ₦17.792m), FGSUK2031S4 (11,597 units; ₦11.596m).

What This Means for Your Investment Strategy (Actionable Playbook)

Conservative (Capital Preservation & Income):

- Keep a core tilt to Consumer Goods after +5.48% sector strength; staples continue to absorb naira vol and demand resilience.

- Within financials, trim high‑beta bank exposure after the −2.57% sector print; redeploy into quality insurers only on catalysts.

- Maintain a barbell with fixed‑income, noting the +110% jump in bond market value traded; focus on sovereign/sukuk lines.

Growth‑Oriented (Selective Upside):

- Oil & Gas (+2.79%) and defensive consumer leaders are where momentum and fundamentals rhyme; use Wednesday‑style turnover spikes as confirmation.

- Ride winners with risk controls — e.g., GUINNESS (+28.6%), MULTIVERSE (+21.3%) — but trail stops given Friday’s breadth wobble.

Value Hunters (Contrarian Set‑ups):

- Screen decliners’ list for quality with temporary drawdowns (e.g., UBA −9.24%, NGX GROUP −8.40%) and layer in only on improving breadth.

- The Chams Rights window (closed on 26 Sep) may create technical issues; reassess post-event normalization for entries.

- Deploy NGX30H6 / NGXPENSIONH6 futures to hedge portfolio beta while accumulating underpriced cash equities.

Portfolio Principles for This Week:

- Respect the quiet‑up tape; demand liquidity + breadth before adding risk.

- Overweight defensives & energy until breadth re‑expands.

- Hedge beta on rallies; buy dips only in names with rising participation (volume) and stabilizing breadth.

Disclaimer: This is not investment advice; please do your due diligence.

Forward‑Looking Levels & Catalysts (22–26 Sep)

- ASI Reference: 141,845 (weekly close). A retest toward 140,546 would check buyer resolve; sustained holds above keep the up‑trend intact.

- Breadth Trigger: Watch for early‑week snapback from Friday’s 11/43 adv/dec; continued narrow breadth = stay selective.

- Flow Cue: If Financials’ share of volume (~69.8%) moderates while Consumer names keep leading returns, the defensive‑tilt persists.

- Key Calendar: Chams rights trading ends Fri, 26 Sep; futures liquidity development (NGX30H6, NGXPENSIONH6) to watch for institutional adoption.

Appendices (Quick Stats)

- Equity Turnover (w/w): 3.188bn → 2.735bn (shares); ₦99.685bn → ₦85.197bn (value).

- Sector Activity Split (vol): Financials 69.79%, ICT 6.76%, Services 6.46%.

- Top Volume Trio: Abbey Mortgage, Fidelity, UBA → ~32.02% of total volume.

- ETPs: 107,552 units (₦15.023m) | 261 deals.

- Bonds: 44,730 units (₦46.727m) | 41 deals | Most active: FGSUK2033S6, FGSUK2031S4.

TL;DR (Executive Summary)

- ASI +0.92% to 141,845.35; turnover −14% w/w → selective accumulation.

- Leaders: Consumer Goods +5.48%, Oil & Gas +2.79%. Laggards: Banking −2.57%, Insurance −4.67%.

- Financials ≈70% of weekly volume; top‑3 counters ≈32% of all shares.

- Bonds value traded +110%, ETPs −27% by value — quiet equity risk with parallel quality bid.

Please note that this analysis reflects market observations and institutional patterns, rather than personalized investment advice. Always conduct your due diligence and consider your risk tolerance before making investment decisions.