For Nigeria’s over 10 million contributors, the periodically released results from Pension Fund Administrators (PFAs) mean a lot.

Inflationary pressure, tighter financial conditions, and interest rate adjustments did little to deter fund managers from producing solid returns for contributors.

According to data compiled by Nairalytics, a Nigerian-only Data Repository platform, all 18 Pension Fund Administrators reported gains in July 2025, the latest available report as of the time of writing.

However, a few PFAs stood out, posting remarkable performances that place them firmly at the top of the table.

TL;DR: Rundown on the best PFAs in Nigeria 2025

- FCMB Pensions Limited: Top performer with 5.68% average return, led by 7.29% in RSA Fund II.

- Pensions Alliance Limited: Strong consistency across funds, standout 8.89% in RSA Fund I.

- Trustfund Pensions Plc: Highest single-category return with 9.37% in RSA Fund I.

- Crusader Sterling Pensions: Best in RSA Fund III, proving strength in conservative portfolios.

- Tangerine Apt Pensions: Solid 9.10% in RSA Fund I, growing reputation in competitive space.

- AccessARM: Balanced gains, 8.01% in RSA I and 5.78% in RSA II.

- Leadway Pensure: Stable, with 6.80% and 6.45% returns in Funds I and II.

- Fidelity Pension Managers Limited: 4.56% average return.

Retirement Savings Account (RSA) Funds are investment pools for contributors based on age and risk appetite, with Fund I being an “aggressive” fund for younger contributors (age 49 and below), allowing higher investment in variable income instruments like equities.

Fund II is a “balanced” fund for the same age group, featuring a lower exposure to variable investments and serving as the default option for most active contributors.

How performance is measured

Performance in the pension industry is typically measured by the percentage change in the Net Asset Value (NAV) of the fund over a specified period.

This reflects how well investments such as sukuk, equities, or fixed-income instruments grew or preserved their value.

Analysts also compare returns against benchmarks such as government bond yields or inflation rates to assess real growth in contributors’ retirement savings.

Leading PFAs by recent monthly returns (July 2025)

Here’s a closer look at the top performers:

1. FCMB Pensions Limited (average monthly return of 5.68%)

FCMB Pensions Limited emerged as the best-performing PFA in July 2025, delivering an average monthly return of 5.68%.

The firm’s standout results came from its RSA Fund II, which posted an impressive 7.29%. RSA Fund II is the largest and most widely subscribed category, making this performance particularly significant for the majority of contributors.

FCMB also delivered a steady 4.23% return in RSA II, demonstrating its balanced approach across fund types.

2. Pensions Alliance Limited (average monthly return of 5.62%)

Hot on FCMB’s heels was Pensions Alliance Limited, with an average return of 5.62%.

What distinguished Pensions Alliance was its ability to deliver across all fund categories, with RSA Fund I and Fund II performing especially well.

The firm recorded 8.89% in Fund I and 7.28% in Fund II (two of the highest returns across the entire industry for July).

The breadth of performance across funds highlights Pensions Alliance’s strength in portfolio diversification and its ability to generate value for both aggressive and moderate investors.

3. Trustfund Pensions Plc (average monthly return of 5.48%)

Trustfund Pensions Plc rounded out the top three with an average return of 5.48%.

Its RSA Fund I, designed for younger and more risk-tolerant contributors, returned a remarkable 9.37% (the single highest figure posted by any PFA in any category for the period under review).

While other funds under its management delivered steady, positive gains, the record-setting RSA Fund I return is a testament to its willingness to take calculated risks that paid off.

4. Crusader Sterling Pensions (average monthly return of 5.32%)

Crusader Sterling Pensions Limited secured an average monthly return of 5.32%. Its RSA Fund II returned 6.89%, while Fund III led its category with a 5.32% gain.

Crusader Sterling’s ability to dominate RSA Fund III is particularly noteworthy, as this fund is typically more conservative and caters to contributors nearing retirement.

Delivering the highest returns in this space reflects sound fixed-income management.

5. Tangerine Apt Pensions (average monthly return of 5.07%)

With an average return of 5.07%, Tangerine Apt Pensions delivered a strong performance for July.

The fund manager’s RSA Fund I posted an impressive 9.10%, while RSA Fund II recorded 6.23%.

These results show that Tangerine Apt is increasingly competitive in the Halal and ethical investing space, appealing to younger contributors and professionals who demand both returns and alignment with their financial values.

6. AccessARM (average monthly return of 4.99%)

AccessARM returned an average of 4.99% in July, making it another strong contender. The firm’s RSA Fund I returned 8.01%, while RSA Fund II recorded a 5.78% return.

These numbers place AccessARM firmly in the top half of the industry, demonstrating that the fund manager can successfully manage riskier portfolios while still delivering meaningful gains for contributors.

7. Leadway Pensure (average monthly return of 4.68%)

Leadway Pensure PFA Limited posted an average return of 4.68%. Its RSA Fund I delivered 6.80%, while RSA Fund II followed closely at 6.45%.

The pension fund administrator is a conservative and well-established entity.

This performance is particularly notable for its emphasis on striking a balance between stability and growth, which may explain why it benefits contributors focused on steady wealth accumulation.

8. Fidelity Pension Managers Limited (average monthly return of 4.56%)

Fidelity Pension Managers Limited closed the top-performing list with an average return of 4.56%.

While it did not top any single category, Fidelity’s results rest calmly on consistent growth across all RSA fund types.

Why do these PFAs lead?

This year has been an interesting one in the pension industry. The PFAs at the top of the table share some patterns: diversification and strong governance.

FCMB and Pensions Alliance benefited from a shrewd allocation into equities when the market gained momentum, particularly in RSA Fund I and II.

Meanwhile, Trustfund’s bold play in growth assets gave it the month’s highest single-fund return. Crusader Sterling and Leadway, meanwhile, proved adept at navigating conservative mandates, showing that fixed income still delivers when carefully managed.

While there are, of course, other notable pension fund administrators with solid track records, it’s safe to say that these top ones have leaned on experienced fund managers who know when to chase yield and when to play it safe.

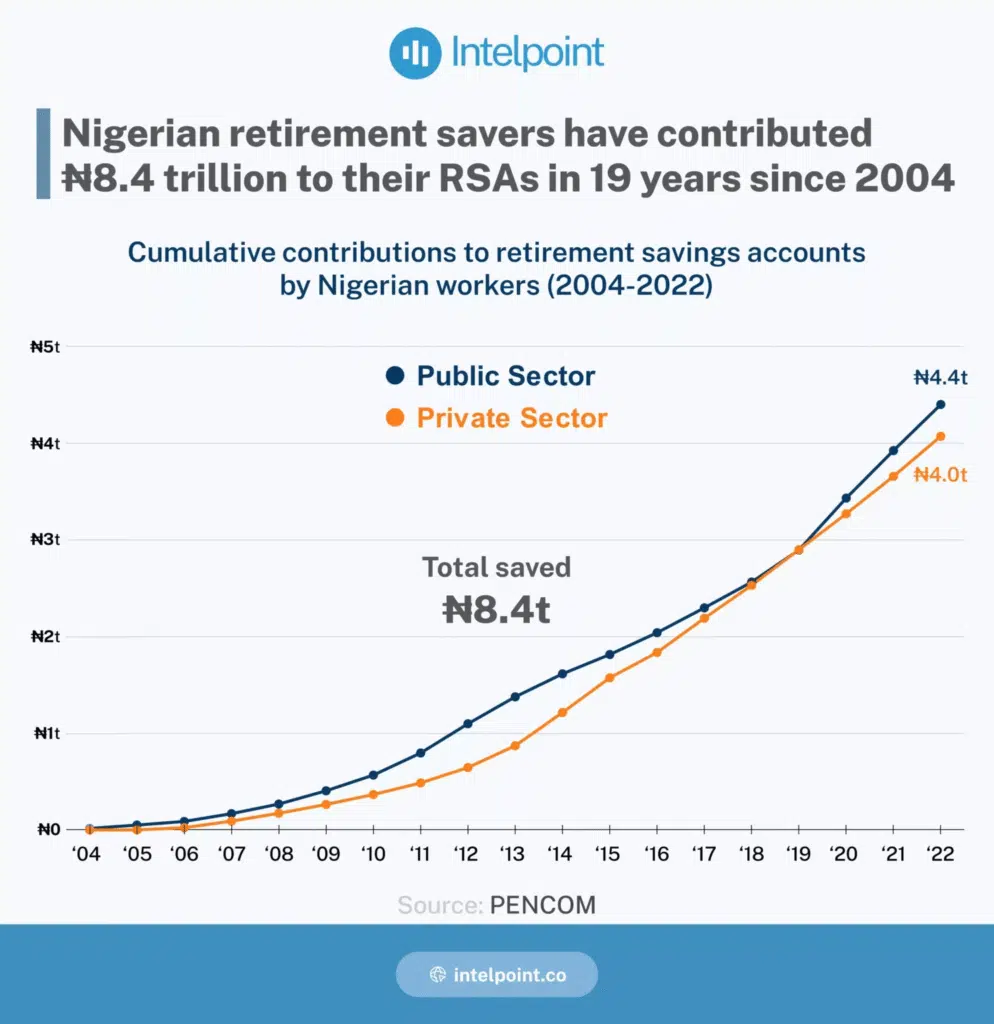

Meanwhile, since 2004, Nigerian employees have saved a cumulative ₦8.4 trillion for their retirement.

According to data from the National Pension Commission, monitored by IntelPoint, over the period from 2004 to 2022, employees in the public sector have saved ₦4.4 trillion, while those in the private sector have put aside ₦4 trillion.

How to choose the best PFA for your retirement goals

Selecting a PFA is less about chasing one good month and more about matching long-term goals with a fund’s philosophy.

If you’re young and willing to take more risk for higher growth, a PFA with strong RSA Fund I and II records may be better suited.

For those nearing retirement, stability matters more. PFAs with consistent fixed-income performance may align better.

Beyond returns, consider a PFA’s customer service, transparency in reporting, and history of paying out claims promptly.

Retirement is a long game. The right PFA is the one whose style and discipline align with both your tolerance for risk and your future income needs.