In the first instalment of this series, we ranked African banks by absolute profit—revealing that while South African and Egyptian banks booked the highest earnings in 2024, Nigerian banks lagged despite a record-breaking year.

In the second part, we turned to Return on Equity (RoE), a more refined metric that showed Nigerian banks outperforming on shareholder returns, thanks to leaner capital structures and operational efficiency.

Now, we widen the lens further.

Return on Capital (RoC) offers a deeper view into a bank’s financial discipline. Unlike RoE, which focuses solely on returns from shareholders’ equity, RoC evaluates how well a bank uses all available capital—equity and debt—to generate profit. It answers a more fundamental question: Is this bank good at turning money into value, regardless of where that money came from?

This distinction is especially important in a region like Africa, where access to capital is often constrained, and external shocks—from currency devaluation to regulatory tightening—make efficiency more critical than ever.

A bank that can consistently generate high RoC is likely better positioned to scale sustainably, navigate volatility, and deliver long-term value to both investors and customers.

Return on Capital (RoC) –

RoC is calculated by dividing Net Operating Profit After Tax (NOPAT) by the total capital employed in the business:

RoC = NOPAT / Total Capital

A high RoC indicates that a company is deploying its capital effectively into profitable ventures, making it a key performance indicator for long-term value creation.

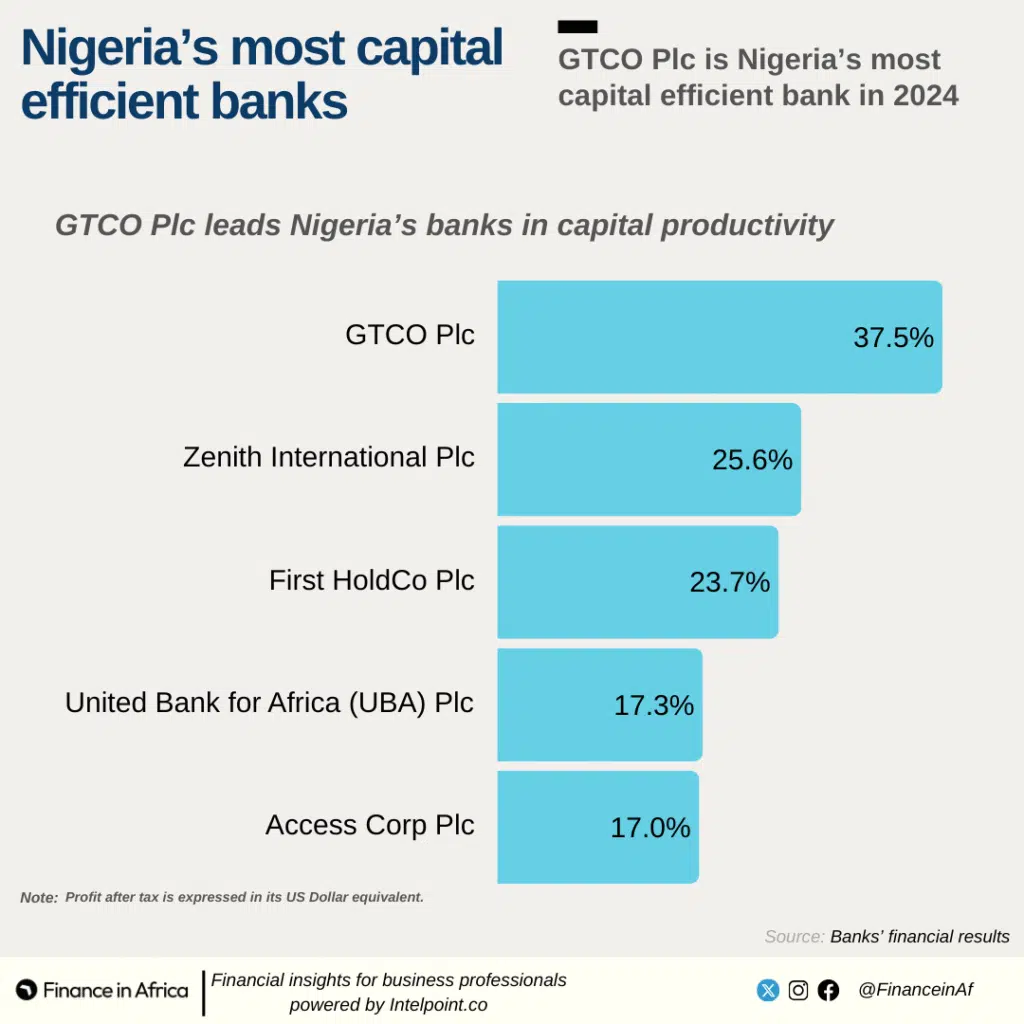

Nigeria

Nigerian banks outperformed their African peers on the RoC front in 2024, with three Nigerian banks featuring among the top five performers on the continent. All five members of the FUGAZ group appeared in the top ten, signalling strong capital efficiency across the sector.

- GTCO Plc recorded the highest RoC among Nigerian banks at 37.5%, meaning investors effectively received ₦37.5 in profit for every ₦100 of capital invested.

- Access Corp Plc, however, recorded the lowest RoC among Nigeria’s top banks. This was largely due to its extensive asset base—Access is Nigeria’s largest bank by assets and was on an acquisition spree across Africa during the year, which likely diluted its capital efficiency.

This outperformance in RoC suggests that, beyond profit figures, Nigerian banks—particularly GTCO, Zenith, and UBA—are demonstrating superior internal capital allocation strategies compared to many of their continental peers.

- GTCO Plc – 37.5%

- Zenith International Plc – 25.6%

- First HoldCo Plc – 23.7%

- United Bank for Africa (UBA) Plc – 17.3%

- Access Corp Plc – 17.0%

Egypt-

Despite recording significantly high RoE and also profits in 2024, the only bank from Egypt represented in the article fell woefully behind its peers in the year under review. The other bank, Banque Misr has not published its 2024 full year result.

Commercial International Bank- 8.4%

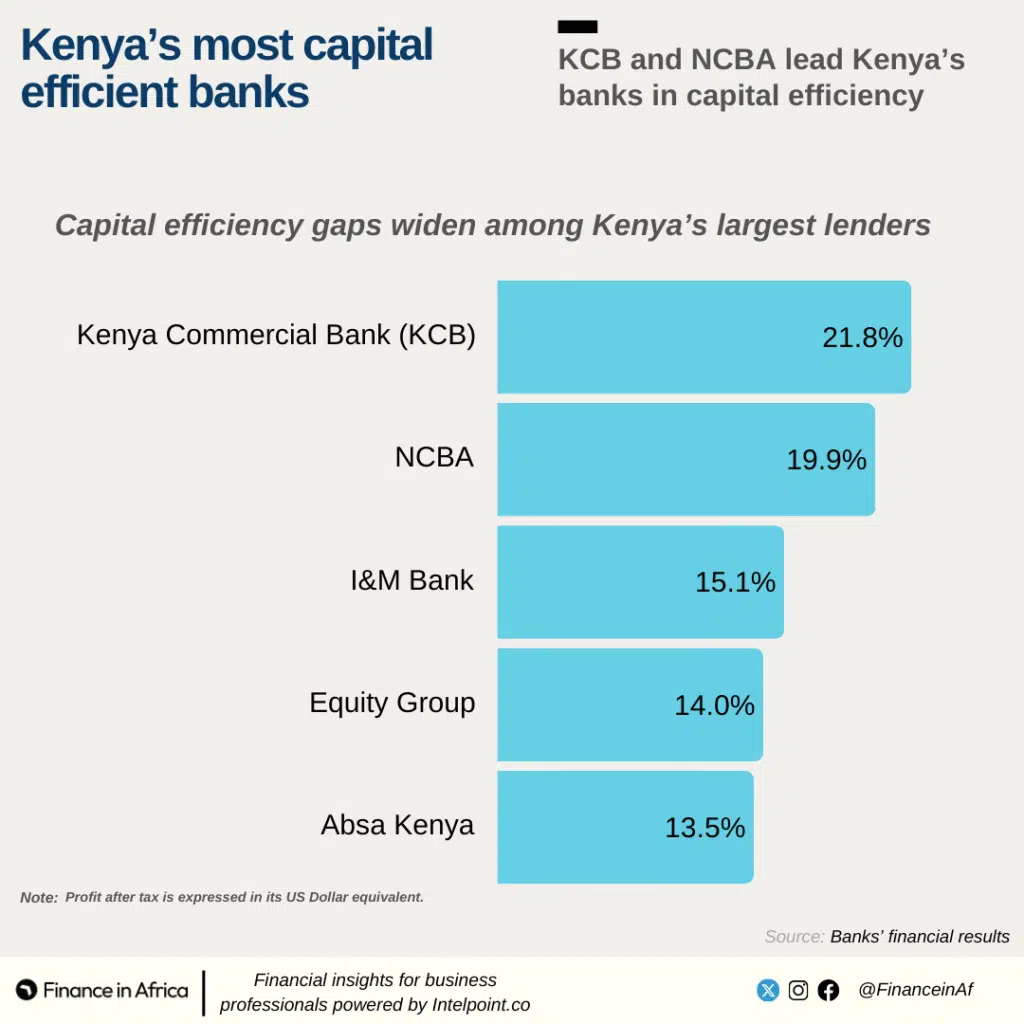

Kenya

In the period under review, Kenya banks in this review recorded an average RoC of 16.86% – just above South Africa’s at 16.57%. KCB recorded the highest at 21.8% while Equity Group at 14 was the lowest.

- Kenya Commercial Bank (KCB) – 21.8%

- NCBA – 19.9%

- I&M Bank – 15.1%

- Equity Group – 14.0%

- Absa Kenya – 13.5%

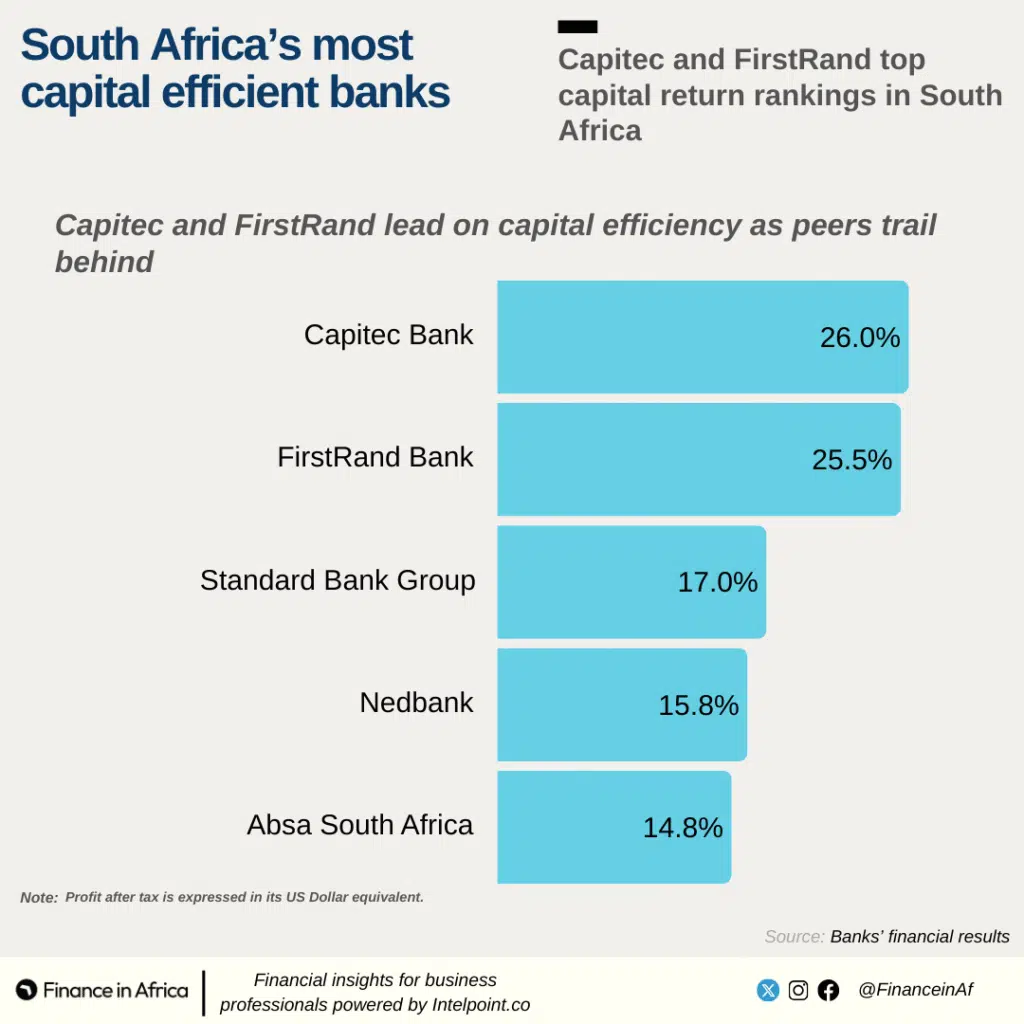

South Africa

Capitec Bank had the highest return on capital in the year under review at 24.2% while the others recorded figures below 20%. It reveals that despite high Profit-After-Tax (PAT), South African banks performed below their peers in other major African economies in terms of RoC.

- Capitec – 24.2%

- Standard Bank Group – 17.1%

- Absa Bank SA – 13.5%

- FirstRand Plc – 11.5%

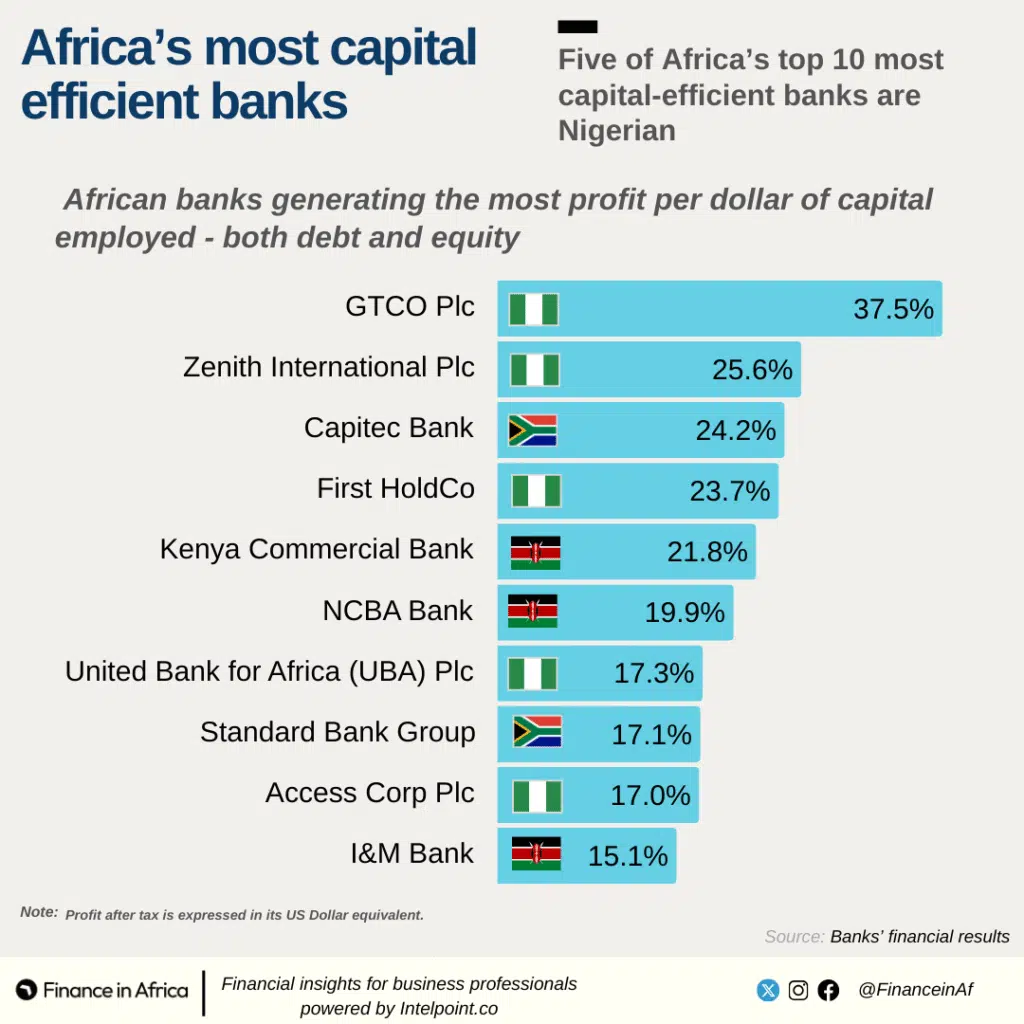

Top Ten African banks by Return on Capital (RoC)

10. I&M Bank – 15.1%

9. Access Corp Plc – 17%

8. Standard Bank Group – 17.1%

7. United Bank for Africa (UBA) Plc – 17.3%

6. NCBA Bank – 19.9%

5. Kenya Commercial Bank – 21.8%

4. First HoldCo – 23.7%

3. Capitec Bank – 24.2%

2. Zenith International Plc – 25.6%

1. GTCO Plc – 37.5%

Return on Capital makes one thing clear: profits don’t always tell the full story. What matters more is how effectively a bank uses what it has—whether equity or debt—to generate value.

GTCO’s commanding lead suggests that capital discipline, is increasingly defining bank performance in Africa. Meanwhile, South Africa’s conservative capital structure and Egypt’s underwhelming RoC figures serve as reminders that high profits don’t always equal high efficiency.

In the next and final part of our series, we shift from capital to total assets—uncovering which banks are squeezing the most out of every naira, shilling, or rand they control.