The United States’ imports from Africa surged in the first half of 2025, according to official data from the US Census Bureau and Bureau of Economic Analysis. The increase defied expectations that President Donald Trump’s revived “America First” tariff regime would choke trade flows.

Finance in Africa analysis of the data shows that American imports from Africa rose by 24% year-on-year to $23.4 billion in the six months to June, compared with $18.9 billion in the same period of last year. The rebound marks a sharp turnaround from the 5% contraction recorded in H1 2024, easing some strain on the US trade balance.

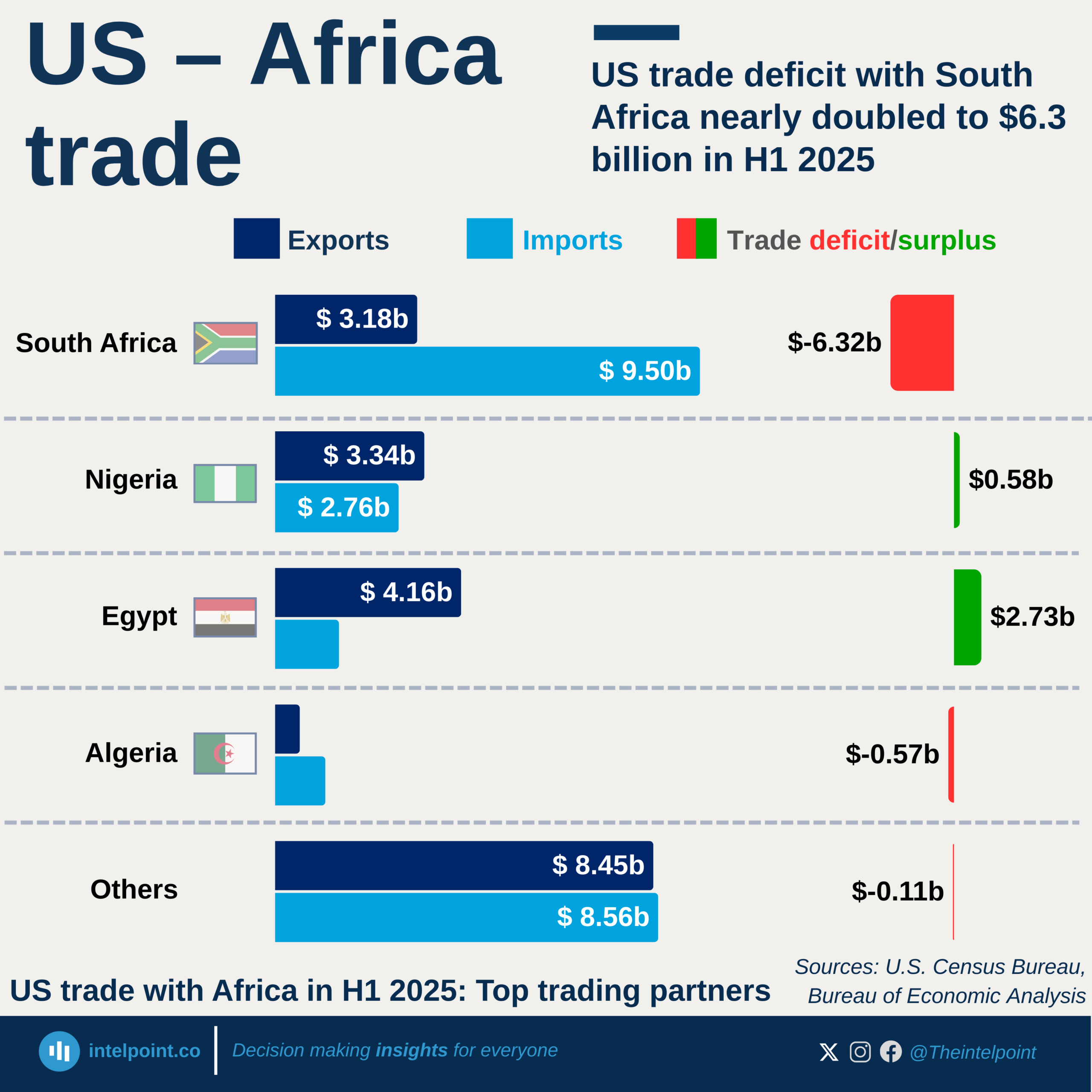

Exports to Africa also grew, rising to $19.7 billion from $15.2 billion. But because imports outpaced exports, the US still recorded a $3.69 billion goods deficit with the continent — slightly wider than the $3.62 billion deficit a year earlier.

The surge highlights the resilient US appetite for African goods, though gains remain uneven: Nigeria and Egypt have emerged as the biggest winners, while South Africa and Algeria continue to struggle under protectionist duties.

Trade holds firm under tariff pressure

The monthly data point to the resilience of US demand for African goods despite tariff headwinds. In June, imports rose to $3.67 billion, up from $3.32 billion in May, while exports slipped to $3.37 billion from $3.48 billion. That swing flipped the monthly balance from a $157 million surplus in May to a $302 million deficit in June.

Earlier this month, Trump lowered maximum tariffs on African exports to 30%, down from 50% in April 2, offering partial relief to countries most affected by his protectionist stance. The new regime — effective August 7, 2025 — also sets a minimum 10% tariff for countries outside the “reciprocal tariffs” list, which has been expanded to cover 68 countries plus the European Union.

Trump defended the measures under Executive Order 14257, arguing they are necessary to reduce the US trade deficit and safeguard national economic interests.

The data suggest tariffs have not suppressed US demand but have instead reshaped trade balances, with surpluses widening with some partners and deficits deepening with others.

Nigeria – From deficit to surplus

The US swung to a $576 million surplus with Nigeria in H1, reversing a $779 million deficit a year earlier. Exports to Nigeria surged by 41% to $3.34 billion, while imports fell 12% to $2.76 billion.

In June, exports reached $919 million against imports of $639 million, producing a $280 million surplus. Much of this reflected robust US sales of refined petroleum products, machinery, and equipment, alongside weaker Nigerian oil shipments.

Nigeria now faces a 15% tariff under Trump’s new reciprocal system, slightly higher than the 14% rate imposed under April’s “Liberation Day” order. Jumoke Oduwole, the country’s Industry, Trade and Investment Minister, warned the new tariff threatens competitiveness in non-oil exports, though she stressed Nigeria remains committed to the US market while “actively pursuing alternative opportunities.”

Egypt – Surplus more than doubles

Egypt also strengthened America’s trade position. US exports to Egypt jumped 63% to $4.16 billion, while imports grew 15% to $1.43 billion, widening the US surplus to $2.73 billion, from $1.31 billion in H1 2024.

June’s monthly surplus narrowed to $398 million from $556 million in May, reflecting faster import growth. Egypt faces only a baseline 10% tariff under Trump’s revised list, leaving its competitive position largely intact compared with peers.

South Africa – Deficit nearly doubles

South Africa has borne the brunt of Washington’s new trade rules. The US deficit with the country nearly doubled to $6.32 billion in H1, from $3.38 billion a year earlier. Imports soared by 52% to $9.50 billion, while exports rose only 11% to $3.18 billion.

In June, exports slumped to $469 million from $693 million in May, while imports held at $829 million, leaving a $360 million monthly deficit.

As of August 7, South African goods face a 30% reciprocal tariff, with automotive exports subject to an additional 25% duty. Industry groups and the central bank warn the measures could threaten hundreds of thousands of jobs in an economy already battling one of the world’s worst unemployment crises.

President Cyril Ramaphosa has pledged to intensify trade missions into new markets across Africa and beyond in response.

Algeria – Narrowing deficit

Algeria also faces the maximum 30% tariff, but the impact has been limited as most exports are oil, typically exempt from US duties. America’s deficit with Algeria narrowed to $571 million from $844 million a year earlier, helped by a 15% rise in US exports to $552 million and a decline in imports to $1.12 billion.

Other African economies – From surplus to deficit

Collectively, other African economies slipped into deficit with the U.S. in H1, moving from a $77 million surplus to a $108 million shortfall. Exports rose by 21% to $8.45 billion, but imports grew faster, climbing 23% to $8.56 billion.

Several vulnerable exporters gained relief when tariffs were eased in August. Lesotho, hit hard under April’s 50% levy, now faces 15%, offering respite to its struggling textile industry.

Similar reductions were applied to Madagascar, Mauritius, Botswana, Angola, and Côte d’Ivoire. Tunisia’s rate was trimmed slightly to 25%. While these cuts ease pressure, Africa remains exposed to Washington’s escalating protectionist strategy.

US trade in H2

Beneath the headline numbers, however, the trade story is highly uneven: Nigeria and Egypt are proving resilient, even swinging balances in Washington’s favor, while South Africa faces deepening deficits and severe economic risks.

As the second half of 2025 unfolds, key questions remain: Will these patterns persist? Can African governments blunt the impact through new trade alliances? And will deeper integration under the African Continental Free Trade Area help buffer the continent from U.S. protectionism?