British investment firm, Baillie Gifford, has sold the last of its 18 million shares in Jumia, ending a 6-year bet on the “Amazon of Africa. With this update, the eCommerce firm sees another global growth fund exit its cap table.

Baillie Gifford’s new Schedule 13G/A shows its stake in Jumia at 0.0%—down from 7.4% last November, 9.2% in January 2024, and 11% at the IPO in 2019. The filing confirms that all 18.1 million ADRs (≈9 % of the float) have been sold.

Why it matters

This exit sees one of the last legacy anchors of Jumia, following the exit of Rocket Internet, MTN Group, among others.

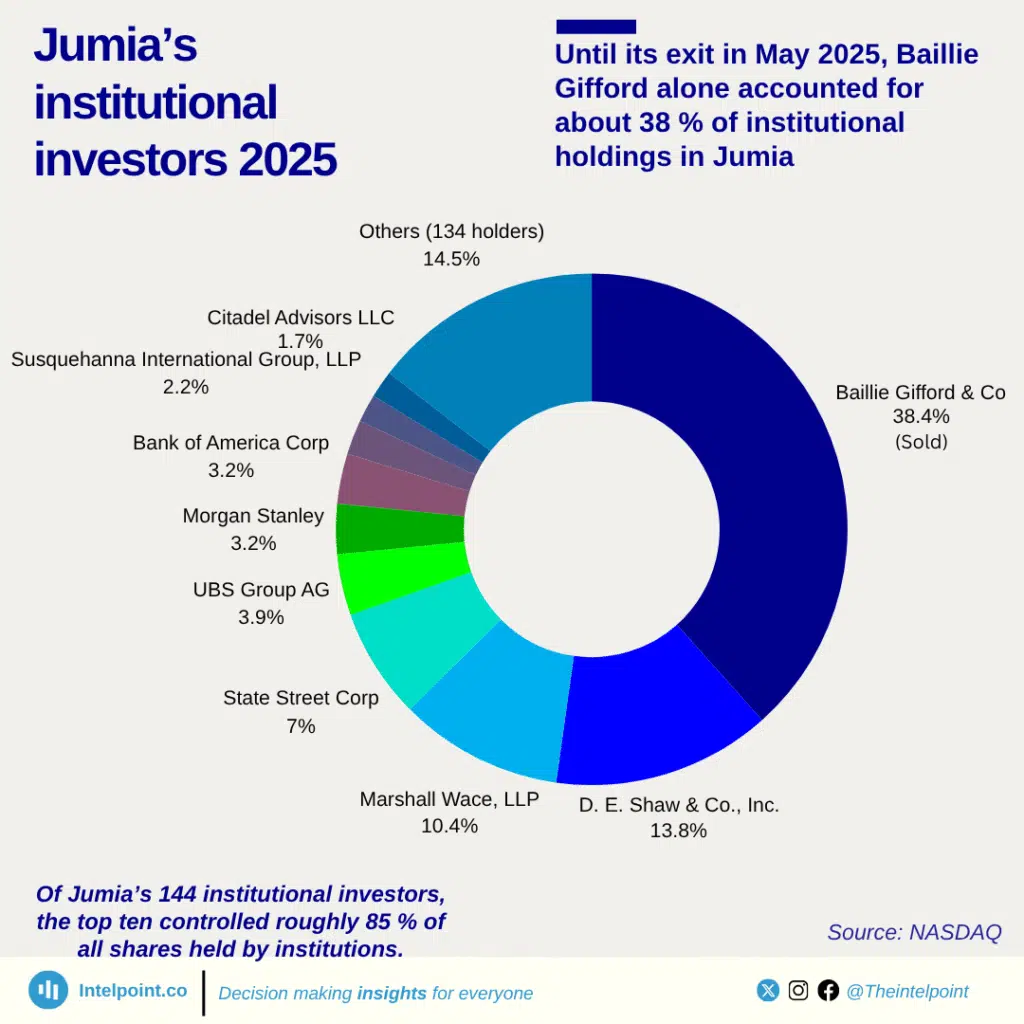

With over 8.5 million shares (American Depositary Shares), Bailie Gifford was Jumia’s largest institutional investor. More than double the holdings held by D.E. Shaw, the second-largest institutional investor.

The British investment firm acquired 17.99 million Jumia shares in 2019, a month after the company’s initial public offering (IPO), for 11.45% of the company. The latest exit ends a six-year bet on the Amazon of Africa.

This move marks another round of institutional retreat for Jumia. Goldman Sachs, JPMorgan, Morgan Stanley and Citi still appear on the roster, yet each has reduced their positions below the 5 % disclosure line since 2021.

Some global crossover funds like BlackRock and Old Mutual have reduced Africa exposure; however, dedicated Africa managers such as DPI continue to deploy fresh capital.

When patient capital wears thin

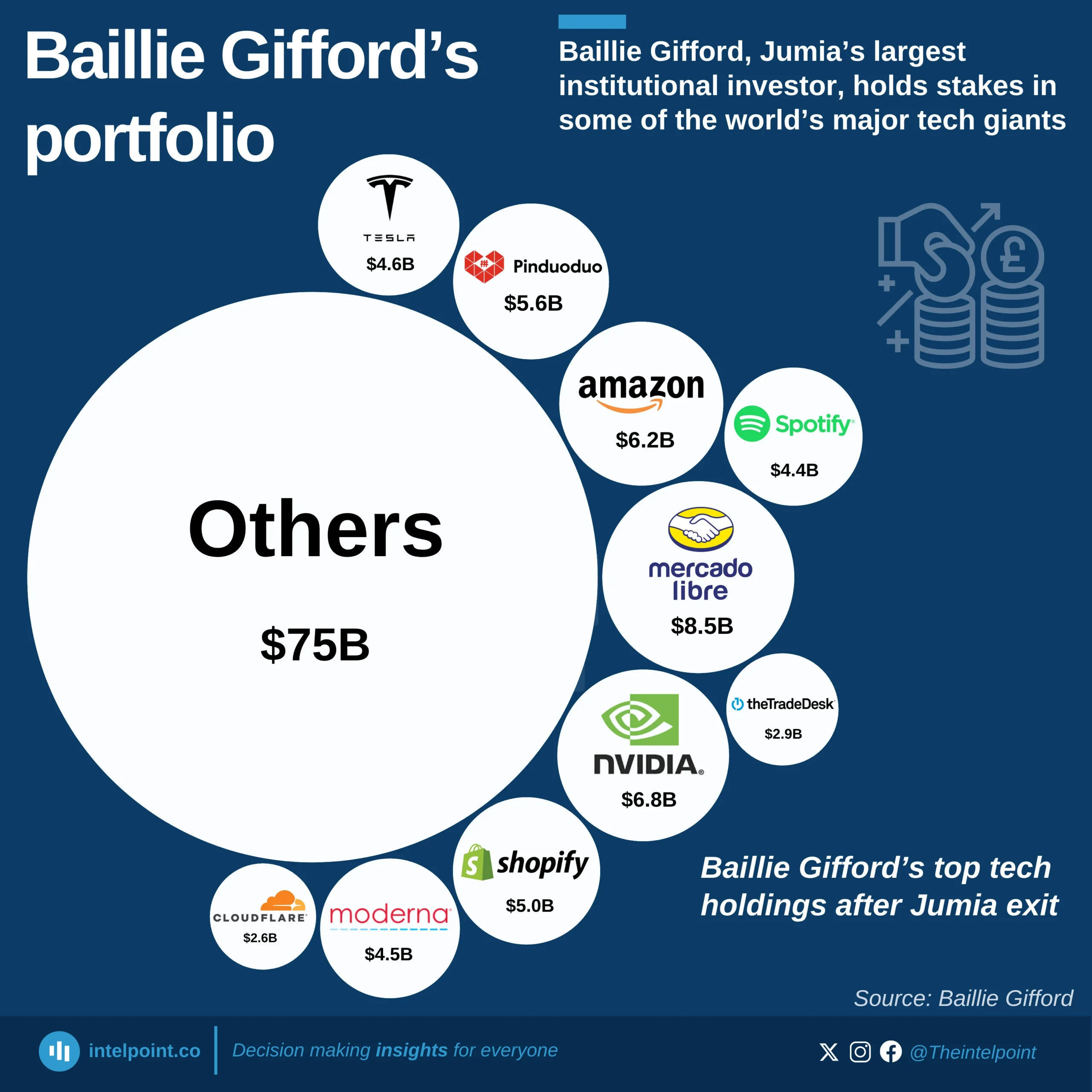

Bailie Gifford, an investor in the likes of Tesla, Shopify and MercadoLibre, held positions in these companies for over a decade. It typically makes long-term bet on companies it deems to have sustainable high growth potential.

With over a century of investing, the firm manages assets for top professional investors, with assets under management of over $225 billion as of 2024. In the six years it held Jumia shares, it largely followed this strategy and made additional investments in the company at key moments where others seemed to be backing out.

The firm came close to Jumia’s IPO and sat tight through its “fraud-mail” controversy and early losses. In that period, Jumia lost over $2.6 billion in market cap.

From 2020 onward, the investment firm made a SEC 13G/A filing (a disclosure form by investors who intend to hold more than 5% of a company without seeking control), indicating that the position was actively managed rather than a “set and forget”.

A small top-up in 2021 was reversed in 2022, holding the line at 10%.

Despite a brutal 2022, Bailie Gifford added ~1.9m shares just as Jumia changed CEOs and began a cost-cutting drive. The said cost-cutting drive went on to have mixed results.

In 2024, Baillie Gifford reduced its ownership to 9.2% and a further 7.4%.

With its latest filing from May 5, 2025, the firm appears to have liquidated its entire position.

Did Bailey Gifford sell at a loss or profit?

Baillie Gifford’s Jumia share sale was almost certainly a loss—and a very large one.

It’s public filings let us bracket its entry and exit prices:

| Date | JMIA ADRs held | Closing price that quarter | Market value |

| 30 Jun 2019 – first 13F after the IPO | 9.0 m | $26.42 | $238m |

| 31 Mar 2025 – last 13F before the zero-stake filing | 8.6 m | $2.15 | $19m |

| 5 May 2025 – Schedule 13G/A shows 0 shares | — | JMIA traded $2.4-$3.0 that week | – |

Note: 1 ADR – 2 ordinary shares. You may see reference to 18 million ordinary shares later in this article.

Recall that Baillie Gifford bought the bulk of its position soon after Jumia’s April 2019 IPO, when the stock was in the mid-$20s.

It kept roughly the same share count through the 2020-21 meme-stock spike (when JMIA briefly topped $60), so there is no evidence in SEC filings that it sold materially into that rally.

The final block was dumped in April–early May 2025, around $2.5. Even allowing for a few unreported trims above $5 later in 2024, the firm would still have realised an 80 – 90% capital loss on most of the shares it originally bought.

Because 13F/13G forms show end-of-quarter snapshots, we cannot see every trade. But the near-flat share count for six years—and the fact that the last 8 m-plus ADRs were sold at a single-digit price—makes it almost certain that Baillie Gifford’s overall position ended deep in the red.

Jumia’s story so far

Latest numbers

| Metric | FY 2024 | Q1 2025 |

| Revenue | US$167.5 m ↓ 10 % YoY | US$36.3 m ↓ 26 % YoY |

| GMV | US$720.6 m ↓ 4 % YoY | US$161.7 m ↓ 11 % YoY |

| Operating loss | US$66.0 m (-10 % YoY) | US$18.7 m (from US$8.3 m LY) |

| Adjusted EBITDA loss | US$51.3 m (-12 % YoY) | US$15.7 m (from US$4.3 m LY) |

| Liquidity (cash + term deposits) | US$133.9 m | US$110.7 m |

- Land-grab years (2012-2016) – Launched in Lagos, raced into a dozen African markets, raised more than $600 m from Rocket Internet, MTN, AXA and others, and became the continent’s first tech “unicorn”.

- IPO & backlash (2019) – Floated on the NYSE, shares initially tripled but tumbled after Citron Research labelled the company a “fraud”, denting credibility and chilling fresh capital.

- Retrenchment & survival (2020-2024) – Quit weaker countries, sacked co-founders, cut head-count and marketing, shut food delivery in several markets; losses narrowed yet revenue shrank as the footprint shrivelled to nine core countries.

- Investor exit (2025) – Long-time anchor Baillie Gifford dumped its entire 18m (9m ADRs) -share stake, leaving Jumia leaner, short on deep-pocketed allies and still chasing a clear path to profitable growth.

Jumia has swung from hyper-growth to disciplined survivalist:

- Capital raised pre-IPO: ~US$600 m across six rounds (Millicom, Summit, MTN, AXA, Goldman Sachs, Orange, CDC and others).

- Markets served today: nine countries after pulling back from less profitable outposts.

- Strategic goal: reach breakeven by Q4 2026 and full-year profitability in 2027, per management guidance.

A slimmer Jumia still isn’t profitable

Jumia’s “survival-first” strategy has done exactly what it says on the label: cut fat fast. Head-count, fulfilment overheads, and marketing spend all fell double-digits in 2024, helping operating losses narrow 10 % year-on-year to $66 m and trimming cash burn to roughly $23 m a quarter.

By Q1 2025, the company was running even leaner, yet the burn crept back up as currency shocks inflated costs, pushing the operating loss to $18.7 m. Q4

The cost-cutting diet, however, has also starved the top line. Jumia’s full-year 2024 revenue slid 10 %, and Q1 2025 revenue tumbled 26 % as it exited South Africa and Tunisia and watched Egypt’s devaluation wipe out hard-won gains.

Management points to a 21% rise in orders for physical goods as proof that underlying demand is recovering, but those orders are coming from a smaller basket of markets and at lower average ticket sizes. Without a new growth engine, the company risks becoming a structurally smaller business that still bleeds cash.

Liquidity buys time—possibly two years at today’s pace with $111m on the balance sheet. What it does not buy is relevance in a continent now flooded with cross-border discounters such as Temu and Shein, or protection from another round of devaluations in Nigeria, Egypt and Kenya.

To convince investors that the current austerity is a bridge, not a cul-de-sac, Jumia must show that its leaner platform can scale: monetising JumiaPay beyond its marketplace, turning its logistics network into a third-party service, and proving that higher-frequency verticals (food, quick commerce) can be profitable after last year’s layoffs.

The survivalist era has stopped the bleeding, but Jumia needs fresh muscle—new revenue streams and stronger unit economics—before the cash runs dry.