BUA Cement Plc, one of Nigeria’s biggest listed cement producers, recorded the highest profit growth among its peers for the second consecutive quarter in the three months ending September 2025, outperforming rivals Dangote Cement Plc and Lafarge Africa Plc.

A Finance in Africa analysis of the latest financial statements shows that BUA Cement’s after-tax profit surged by 640.8% year-on-year in Q3 — the biggest growth among the top three cement makers. Dangote Cement followed with 149.8%, while Lafarge Africa posted 144.1%.

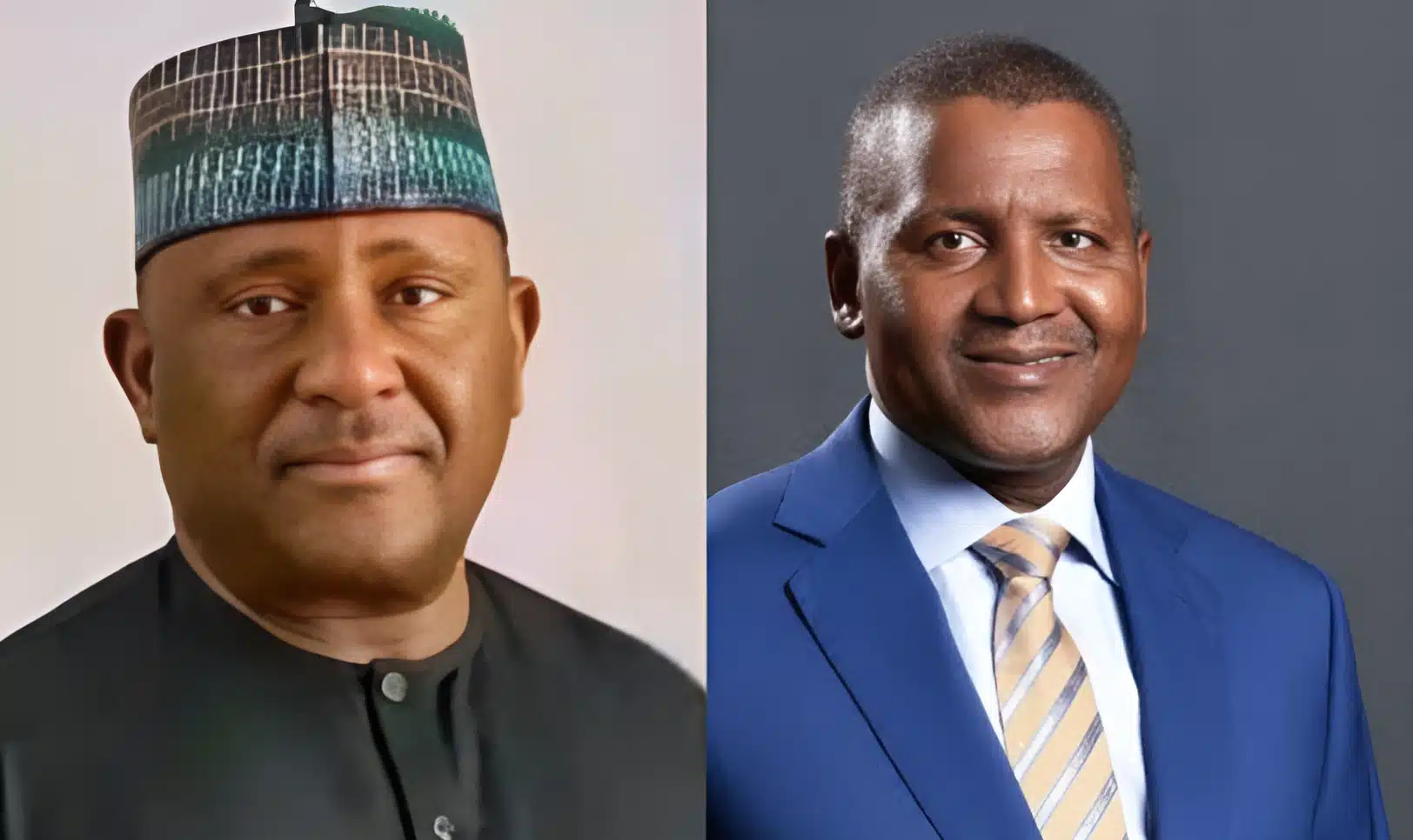

Despite the slower pace, Dangote Cement, Africa’s largest cement producer with a market capitalisation of ₦11.1 trillion ($7.81 billion) as of October 31, retained its dominance in absolute earnings, reporting a profit of ₦228.9 billion ($414.9 million).

BUA Cement, owned by Africa’s sixth-richest man, Abdulsamad Rabiu, according to Forbes, ranked second with a profit of ₦108.9 billion ($71.6 million), while Lafarge Africa recorded ₦75.1 billion ($49.4 million).

Its sister company’s BUA Foods is the most valuable listed company in Nigeria with a market value of ₦12.5 trillion ($8.79 billion).

The latest results mark a continuation of the group’s momentum this year. In Q2, it overtook Dangote with profit growth of 512.7%, compared with 303% and 248% for Lafarge. In Q1, Lafarge led the pack with a 837.2% surge, while BUA and Dangote recorded 351.4% and 85.7%, respectively.

Cost control and FX gains drive BUA’s performance

BUA Cement’s third-quarter performance was underpinned by disciplined cost management and a swing to net foreign exchange gains. The company’s cost of sales fell by 8.78% year-on-year to ₦134.9 billion ($88.7 million), while finance costs declined 15.2% to ₦17.9 billion ($11.8 million).

Revenue rose 26.8% to ₦278.4 billion ($182.9 million), supported by higher sales volumes and pricing adjustments. In addition, the company recorded a ₦20.8 billion ($13.7 million) net foreign exchange gain, a turnaround from a ₦17.5 billion ($11.04 million) loss a year earlier.

Over the first nine months of this year, BUA Cement continued to outperform competitors, posting a 491.9% year-on-year profit increase. Dangote Cement and Lafarge Africa followed with 166.3% and 246%, respectively.

Analysts see strong momentum ahead

Analysts at Afrinvest West Africa Limited noted that BUA Cement remains on track to achieve its ₦1.2 billion ($843,881) full-year profit forecast for 2025.

“The performance over the nine months indicates a favorable operating environment and continued management effort to contain costs while deepening promotional and marketing activities,” the investment banking firm said in a note last week.

It highlighted BUA’s strong balance sheet, effective foreign exchange management, and rising cash position as key strengths. “The company’s equity capital efficiency of 58.1% and ongoing debt reduction efforts are impressive takeaways. Against this backdrop, we have adjusted BUA Cement’s target price upward to ₦147.7 per share ($0.10).”

BUA’s market strength

As of October 31, BUA Cement’s market capitalisation stood at ₦6.09 trillion ($4.28 billion), ranking it as the fifth-largest listed company on the Nigerian Exchange Limited.

The company’s quarterly results reaffirm its position as a key player in Nigeria’s cement industry and underscore its ability to deliver consistent growth despite macroeconomic headwinds.

Analysts expect that ongoing expansion projects and improved energy efficiency will further enhance profitability in the coming quarters.

Industry outlook remains positive

Nigeria’s cement industry continues to show resilience, driven by sustained demand estimated at around 30 million tonnes annually. The sector’s growth is supported by public infrastructure projects, real estate expansion, and urbanisation across Africa’s most populous nation.

Despite macroeconomic challenges such as high inflation, FX volatility, and high energy costs, the industry’s profitability has remained robust. Cement producers have also benefited from a gradual recovery in construction activity and price adjustments to offset higher input costs.

Dangote Cement, with plants across ten African countries, remains the continent’s largest producer, accounting for a significant share of Nigeria’s cement supply. However, BUA Cement’s recent performance highlights growing competition in the market as producers seek to expand market share and enhance operational efficiency.

Lafarge Africa has continued to record steady earnings growth, driven by higher domestic sales and sustained cost-optimisation efforts. In August, Holcim Group, the Swiss building materials giant, completed the sale of its 83% stake in Lafarge Africa to China’s Huaxin Cement Co. Limited in a $1 billion deal — one of the most significant foreign acquisitions in Nigeria’s industrial sector this year.

The transaction — which also includes plans for Huaxin to acquire the remaining Holcim shares by 2026 — positions the Chinese cement giant to challenge the dominance of Dangote and Rabiu in Africa’s largest cement market.

Note: Exchange rates are based on official averages: ₦1,422.2/$1 as of October 31, 2025; ₦1,521.5/$1 for Q3 2025; and ₦1,584.5/$1 for Q3 2024.