In a sweeping overhaul of Nigeria’s credit system, the Federal Government has announced that all citizens’ credit scores will soon be linked to their National Identification Numbers (NIN).

The move is part of a broader strategy to establish a unified, transparent credit infrastructure that captures every Nigerian’s borrowing behaviour across banks, fintechs, and microfinance institutions.

Speaking in Abuja on Tuesday, Uzoma Nwagba, Managing Director of the Nigerian Consumer Credit Corporation (CREDICORP), said the reform will link every citizen’s credit profile to their NIN, enabling full traceability of loan activities and introducing real consequences for defaulters.

“This is a fundamental shift in how credit works in Nigeria,” Nwagba said at the media briefing. “Whether you borrowed from a bank, a digital lender or a microfinance outfit, that data will now be traceable and carry real consequences,” he added.

CREDICORP’s vision is to consolidate loan data into a national credit bureau, backed by mandatory reporting from all financial institutions.

Under the new framework, defaulters may face restrictions when renewing official documents like passport or driver’s licences, and even in private transactions such as renting homes.

The pitch is twofold: improve credit access while enforcing financial accountability and reward responsible borrowing and rebuild lender confidence in a market burdened by high default risks.

Inside Nigeria’s credit gap

While addressing the press, Nwagba estimated the Country’s credit gap at $118.27 billion – a stark reflection of how far the country lags in financial inclusion .

That figure represents over 68% of Nigeria’s 2024 GDP and nearly 20 times the total value of commercial bank loans to individuals, which stood at $2.46 billion as of Q1 2025, according to the Central Bank’s data.

What’s worse is that most of this demand isn’t rejected for being uncreditworthy – it’s simply invisible. Nearly 80% of Nigerians still don’t have a bank account. If you’re not in the system, you can’t borrow. You can’t build credit. You can’t move forward.

A recent Renaissance Capital report adds a hard number to the consequences: Nigeria’s top banks missed out on $544 million in potential earnings in 2024 because they didn’t have the credit to meet the demand.

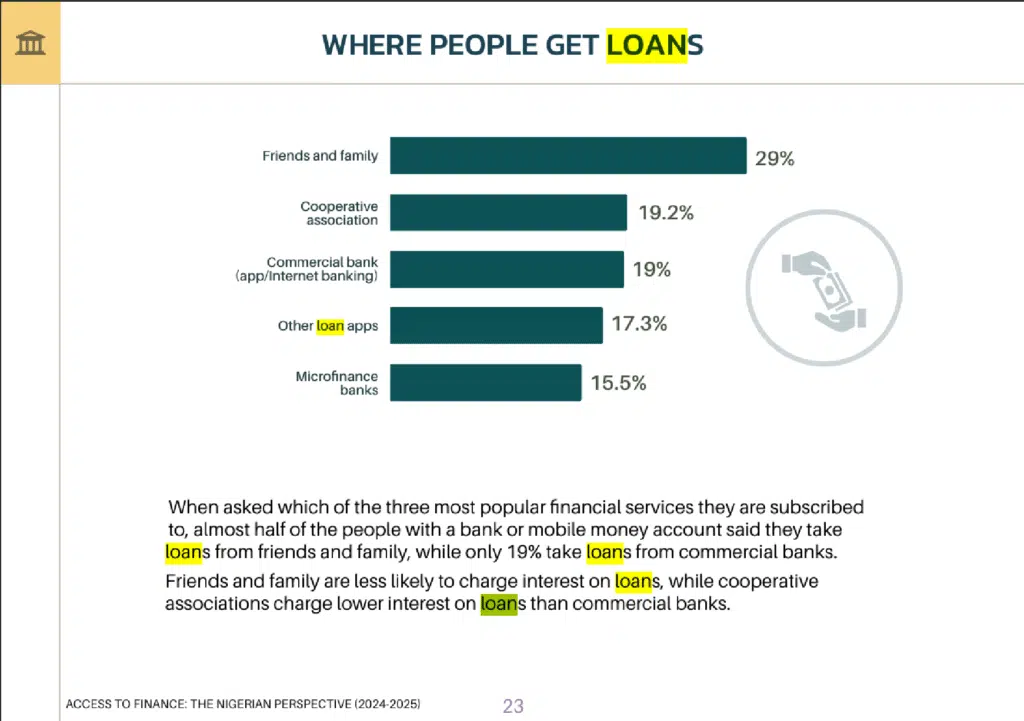

The linkage between access to finance and inclusive growth is well established. In countries like South Africa and Kenya, expanded credit access has spurred consumption, expanded SMEs, and strengthened supply chains. In Nigeria, by contrast, the absence of credit translates to stunted demand for local goods, limited job creation, and heightened informal borrowing at exploitative rates.

The real question is: how much GDP growth, industrial productivity, and household resilience does Nigeria lose each year due to this exclusion?

Without the tools to finance education, assets, or business growth, a large portion of the population is locked out of formal economic contribution.

The credit-NIN integration proposed by CREDICORP could be a game-changer – but only if it’s paired with aggressive financial onboarding, lender incentives, and real-time credit scoring tools that reduce risk and build trust.

Closing just 20% of the credit gap would unleash over $23.26 billion in new liquidity – enough to double the country’s consumer spending base and drive demand across critical industries.

This is a developing story

Exchange rate used: $1 = ₦1,547 ( as of June 19, 2025)