Fraud-related losses recorded by Kenyan lenders almost quadrupled in 12 months, fuelled by rising cyber threats amid rapid digital transformation across the sector.

Losses jumped by 264% to KSh 1.5 billion ($11.1 million) from KSh 412 million ($3.1 million) in 2023, weighing on banks’ profitability and constraining their ability to build capital buffers, according to the latest Financial Sector Stability Report by the Central Bank of Kenya (CBK).

CBK noted that reported fraud cases more than doubled to 353 from 153, with the value of attempted fraud rising from KSh 680.9 million ($5 million) to KSh 1.9 billion ($14 million).

“Cyber risks have increased due to the digitalisation of payments and transfer of money from person to person,” the report read.

“The cyber threats increased from 805 million in 2022/23 to 3.5 billion in 2023/24 signalling a significant increase in cyber security risk,” it added.

Threats to system misconfigurations saw the steepest rise over the two-year period, while web application attacks remained lowest.

Mobile fraud cases spike as costs surges 340%

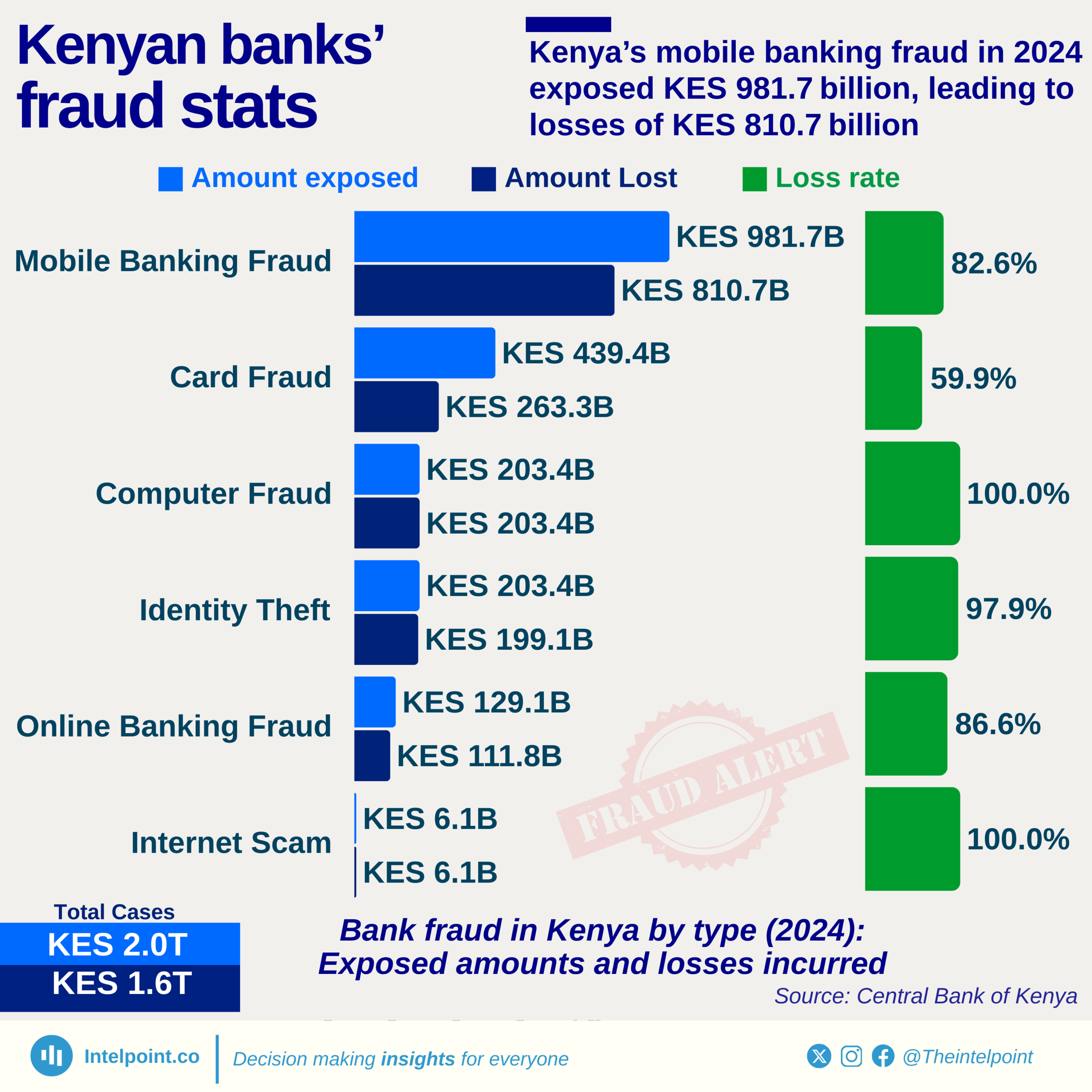

Further analysis of the report reveals that cybercriminals increasingly targeted customers through computers, mobile and online banking, payment cards, identity theft and internet scams.

Losses rose sharply across most channels, with mobile banking hit hardest. Costs soared 340% from KSh 183.4 million ($1.3 million) in 2023 to KSh 810.6 million ($6 million), driven by a significant increase in mobile fraud attacks from 78 to 146.

This left banks facing potential losses of up to KSh 981.7 million ($7.3 million), the highest amount recorded during the period.

Card fraud also surged, climbing from KSh 15.5 million ($114,965) to KSh 263.3 million ($1.9 million), even as the number of incidents edged up slightly from 21 to 24.

Computer-based fraud resulted in losses increasing to KSh 203.8 million ($1.5 million), up from KSh 74.8 million ($555,974) the previous year, while identity theft rose to KSh 199.1 million ($1.4 million) from KSh 32.6 million ($241,765).

Internet scams remained the least costly channel, though losses grew significantly from KSh 797,000 ($5,912) to KSh 6 million ($44,482). Online banking saw only a marginal rise in losses, from KSh 106.2 million ($788,503) to KSh 111.8 million ($829,079), even with reported cases jumping by 87.

Banks remain resilient

The CBK noted that despite the elevated operational risk associated with the spate of cybercrimes and the challenging macroeconomic environment, Kenya’s banking sector remained resilient in the 2024 fiscal year.

Core capital rose from KSh 893.63 billion ($6.6 billion) in December 2023 to KSh 989.2 billion ($7.3 billion), strengthening banks’ capacity to absorb market shocks. As a result, the sector’s capital adequacy ratio rose to 19.6%, comfortably above the 14.5% threshold.

Profit before tax also increased by 18.71% to KSh 260.3 billion ($1.9 million), from KSh. 219.3 billion ($1.6 million) a year earlier, supported by loan recoveries and tighter lending standards.

However, total net assets contracted by 1.6%, from KSh 7.7 trillion (57.1 billion) to KSh 7.6 trillion ($56.3 billion) as net loans and advances to customers fell 2.7%.

Last year, Kenya’s economy slowed to 4.7%, down from 5.6 in 2023, reflecting weakness across key sectors.

“Despite conducive weather conditions and supportive policies, the economy faced a high cost of production due to high energy prices, tight financial conditions, delays in government payments to suppliers and lack of ,fiscal support to the vulnerable groups, thus moderating overall growth in 2024,” the report said.

Economic pressures were compounded by a volatile exchange rate, which peaked at KSh 162.7/$1 in January, even as inflation remained within the CBK’s 2.5–7.5% target range throughout the year.

NB: The figures in local currency have been converted to their estimated US dollar equivalent using KSh 134.8/$1 — the average exchange rate in 2024.