Half of Guaranty Trust Holding Company Plc’s (GTCO) African banking subsidiaries saw their profits decline in the first half of 2025, underscoring the widening impact of inflationary pressures and higher operating costs across key markets on the continent.

A Finance in Africa analysis of the group’s latest half-year financial statement shows that five out of the group’s ten African subsidiaries reported lower earnings compared to the same period in 2024—marking a reversal from last year when all subsidiaries posted profit growth. In 2023, only one subsidiary recorded a modest 7.39% decline.

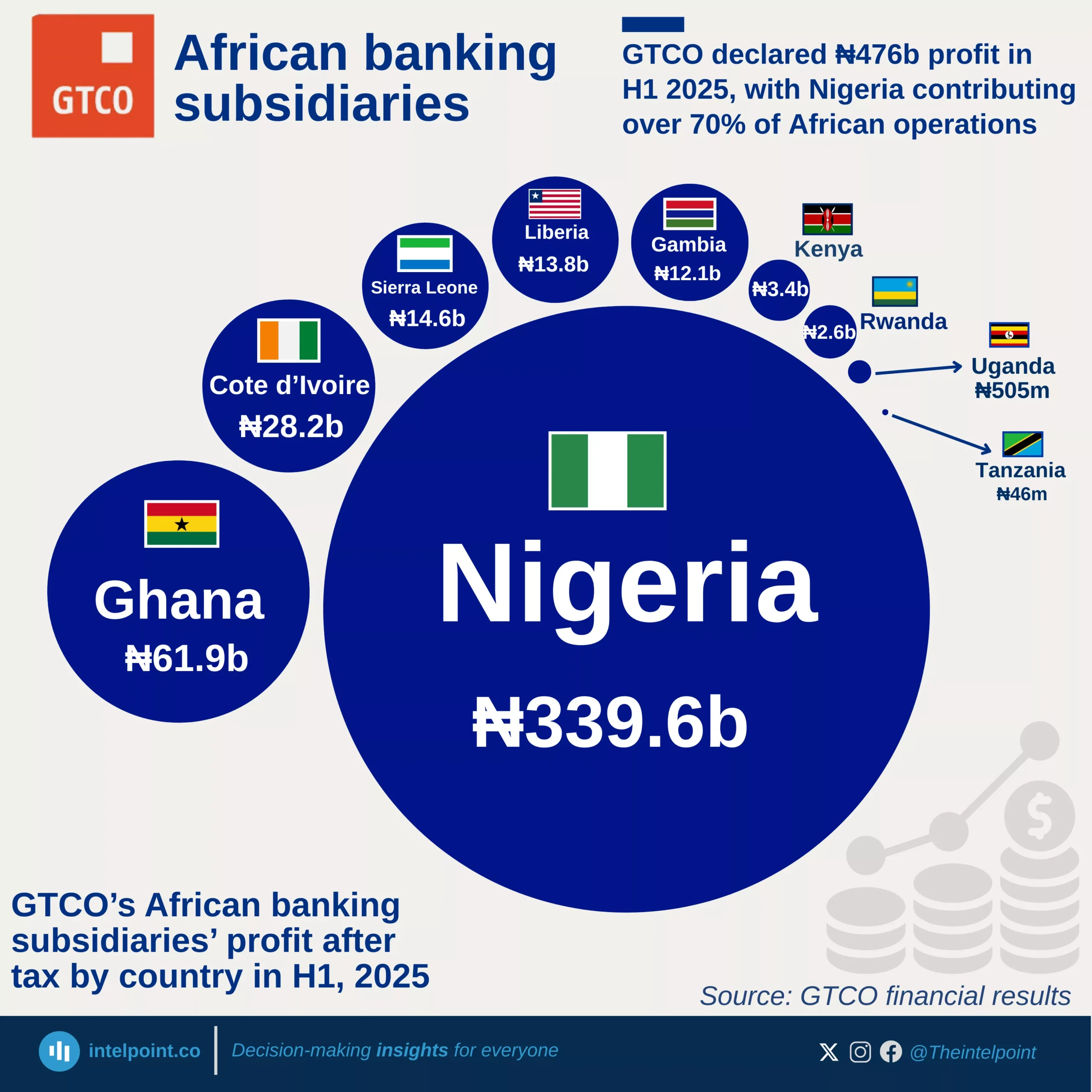

The 34-year-old Nigerian financial group reported that one West African and four East African subsidiaries — GTBank Nigeria, GTBank Tanzania, GTBank Kenya, GTBank Uganda, and GTBank Rwanda — saw their combined after-tax profit plunge by 56.5% to ₦346.2 billion ($223.1 million) from ₦798.1 billion ($531.0 million) in the same period of 2024.

By contrast, subsidiaries in Ghana, Sierra Leone, Liberia, Gambia, and Côte d’Ivoire collectively grew their earnings to ₦130.6 billion ($84.2 million) from ₦95.9 billion ($63.8 million). The group’s United Kingdom unit also saw a 10% year-on-year decline.

GTCO, which operates across 11 countries with over 350 branches, ranks third among Nigerian banks with the largest African footprint—behind United Bank for Africa (UBA) with 20 subsidiaries and Access Holdings with 15.

Inflation, reforms weigh on profits

The group attributed the decline in profitability to “increased operating costs in Nigeria, West and East African regions due to sustained inflationary pressures and the impact of reforms, which offset gains from the translation of subsidiary operating expenses to naira on the back of exchange rate stability.”

It noted that rising deposits and total assets also drove a marked increase in regulatory costs. “The 42.5% growth in interest expense was driven by volume expansion and an increase in the Cost of Funds (CoF) from 1.54% in H1 2024 to 2.17% in H1 this year. Strong revenue growth put CoF at 30.1%,” the company said in its first half investor relations report.

Further analysis revealed that total operating expenses for the countries that experienced profit declines rose by 30% to ₦188.9 billion ($121.7 million), while loan impairment charges climbed 21% to ₦53.0 billion ($34.2 million).

Analysts at Coronation Research, the research arm of Coronation Group, said the increase in operating expenses reflects higher personnel costs, regulatory levies, and general inflationary pressures, all of which drove the cost-to-income ratio up to 28.3% from 16.1% a year earlier.

“Looking ahead, we expect operating expenses to rise by about 18–20% year-on-year in full-year 2025, reflecting persistent inflationary pressures and higher regulatory levies, while loan loss provisioning could edge up in line with the uptick in the Non-Performing Loans ratio,” Coronation Research said.

“Consequently, net profit growth will likely remain constrained, with full-year 2025 earnings projected to settle broadly around ₦818.4 billion–₦904.5 billion ($527.4 million–$582.8 million).”

Regional pressures across Africa

GTCO’s headwinds reflect wider macroeconomic pressures across Africa, where persistent inflation, rising interest rates, and currency volatility have squeezed bank margins and weakened consumer spending.

In Kenya, inflation averaged 3.6% in the first half of 2025, driven by elevated food and energy costs. The Central Bank of Kenya (CBK) cut its benchmark lending rate for the eighth consecutive time in October, trimming it by 25 basis points to 9.25%, despite mounting inflationary pressures.

This marks the lowest level since June 2023, when the rate was last increased to the same point. The CBK said the decision was aimed at “supporting credit expansion and sustaining growth momentum while maintaining price stability.”

In Tanzania, inflation remained moderate at 3.21%, but rising import costs and currency weakness lifted operating expenses. According to the Tanzania Investment and Consultant Group, the Tanzanian shilling depreciated 9.6% year-on-year against the US dollar to TZS 2,569.5 in June 2025, from TZS 2,345.4 a year earlier — reflecting persistent import demand, foreign exchange shortages, and a stronger dollar.

The weaker currency has increased costs for financial institutions reliant on imported technology and systems.

Uganda and Rwanda also contended with price pressures. Uganda’s inflation averaged 3.65%, while Rwanda recorded an average of 6.17%, mainly due to higher food and housing costs.

In Nigeria, GTCO’s largest market, inflation stayed above 20%, easing from 33% last year but still elevated due to currency reforms, petrol subsidy removal, and volatile energy prices.

Collectively, these inflationary dynamics have raised the cost of doing business, dampened loan appetite, and heightened default risks across GTCO’s regional network — resulting in slower credit growth and higher impairment charges.

Earnings decline amid stronger revenue growth

GTCO reported a 50% drop in group after-tax profit to ₦449.01 billion ($289.3 million) in H1 2025, from ₦905.57 billion ($602.5 million) a year earlier. It was the group’s first earnings decline since the first half of 2022.

The sharp fall was primarily driven by an 83.5% plunge in non-core income to ₦108.8 billion ($70.1 million), which offset gains from higher interest income.

Despite the weaker performance, GTCO’s fundamentals remain strong, with total assets and deposits expanding in most markets. The group’s pre-tax profit of ₦600.9 billion ($387.2 million) showed that West Africa (excluding Nigeria) contributed 30.7%, while East Africa accounted for 1.58%.

From local bank to global brand

Originally founded as Guaranty Trust Bank in 1991 with ₦20 million ($2 million) in capital from 42 investors, GTCO restructured into a holding company in April 2021. It was listed on the Nigerian Exchange Limited in 1996, with its share price rising 294.2% over the past decade.

Its regional expansion began in 2001 with Gambia and Sierra Leone, followed by Ghana (2004), the UK (2006), Liberia (2007), Côte d’Ivoire (2012), and East Africa — Kenya, Uganda, and Rwanda (2013) — before Tanzania joined in 2018.

Of the group’s ₦600.9 billion ($387.2 million) pre-tax profit, the West African region (excluding Nigeria) contributed 30.7%, while East Africa accounted for 1.58%.

London listing and market milestone

GTCO’s first-half results came two months after its landmark listing on the London Stock Exchange on July 9, 2025—the first ever by a Nigerian financial institution. The listing, a key step in its global expansion strategy, pushed its market capitalisation above ₦3 trillion, making it the first Nigerian bank to reach that milestone.

As of October 10, 2025, GTCO’s market capitalisation stood at ₦3.46 trillion ($2.37 billion). The company’s share price, which began the year at ₦57.00 ($0.039), has gained 66.7%, ranking it 74th on the Nigerian Exchange in terms of year-to-date performance.

“Guaranty Trust Holding is the 16th most traded stock on the Nigerian Stock Exchange over the past three months (July 11–October 10, 2025),” the African Exchange, a real-time trading platform, said in its market summary.

Outlook

While GTCO remains one of Africa’s most profitable banking groups, rising inflation, regulatory pressures, and high operational costs across its key markets threaten near-term earnings. However, analysts believe its diversified regional presence and strong capital base provide a buffer against volatility.

Note: All figures were converted at the official average exchange rate of ₦1,551.9/$1 for H1 2025, ₦1,503/$1 for H1 2024, and ₦1,455.4/$1 as of October 10, 2025.