Rebasing a country’s Gross Domestic Product (GDP) is a technically rigorous process used to revise the measurement of economic output. It involves updating the base year—the reference period for constant price calculations—to reflect shifts in economic structure, production patterns, and market dynamics.

In Nigeria’s latest rebasing exercise, the National Bureau of Statistics (NBS) has changed the base year from 2010 to 2019. Coming over a decade after the last update, this recalibration offers a more current, granular view of Nigeria’s economy and reveals a structural transformation that had long been masked by outdated data.

Why 2019?

The decision to adopt 2019 as the new base year was shaped by both methodological and economic factors. Notably, 2019 was a year of relative macroeconomic stability preceding the global COVID-19 shock. Using a pre-pandemic year avoids statistical distortions and provides a cleaner baseline for post-pandemic growth comparisons.

To carry out the rebasing, the NBS deployed a Supply and Use Table (SUT)—a statistical framework detailing the flow of goods and services across the economy. This version captured 46 industries and 217 product groups, offering more sectoral depth than previous efforts.

GDP was then recalculated using the three internationally recognised approaches—production, expenditure, and income—to ensure consistency and reliability.

Better data, better insights

Reliable data underpinned the entire exercise. For business activity, the apex statistical agency relied on the National Business Sample Census and the National Establishment Survey. Agriculture, still a major source of employment, was re-evaluated using the National Agricultural Sample Census and the National Agricultural Sample Survey—both conducted at scale for the first time since the last rebasing in 2014.

To capture the informal sector, data from the 2019 and 2023 Nigeria Living Standards Surveys were used, incorporating activities like petty trade, informal manufacturing, and home-based enterprises, particularly in rural areas.

“This rebasing gives us the most reliable estimate yet of the true size and structure of the economy,” said Adeyemi Adeniran, statistician-general of the federation, at the official release of the updated data last month.

Revealing a service-driven economy

The rebasing significantly changes Nigeria’s economic narrative. The economy is now shown to be far more diversified and service-oriented, with oil and gas playing a reduced role. In nominal terms, oil and gas contributed 5.85% to GDP in 2024, down from 8.60% under the previous series. Meanwhile, sectors like crop production (17.5%), trade (17.4%), and real estate (10.8%) now lead the pack.

Agriculture’s share has risen from 22.1% to 25.8%, aided by better enumeration of crop, livestock, and fishery production. Sub-sector revisions are particularly dramatic: forestry was revalued by 843%, and livestock by 458%.

However, the most significant shift occurred in services, now comprising 53.1% of GDP. Water transport grew by 1,367% after better data collection from agencies such as the Nigerian Ports Authority and Nigerian Maritime Administration and Safety Agency. Arts, entertainment, and recreation—buoyed by Nollywood and streaming services—grew over 300%. Administrative and support services surged 3,366%.

Real estate emerged as the third-largest sector, jumping from 6.24% to 10.8%, thanks to improved assessments of informal housing and land transactions.

The digital economy: Present but undefined

Although the NBS states that digital activities are now included, it remains unclear how these were measured or classified. No standalone digital economy sector was created. Its cross-sectoral nature—spanning telecoms, trade, finance, and services—makes it hard to isolate. Notably, telecoms declined from 8.25% to 6.78%, not due to a drop in activity, but because of upward revisions elsewhere.

Nominal growth, real constraints

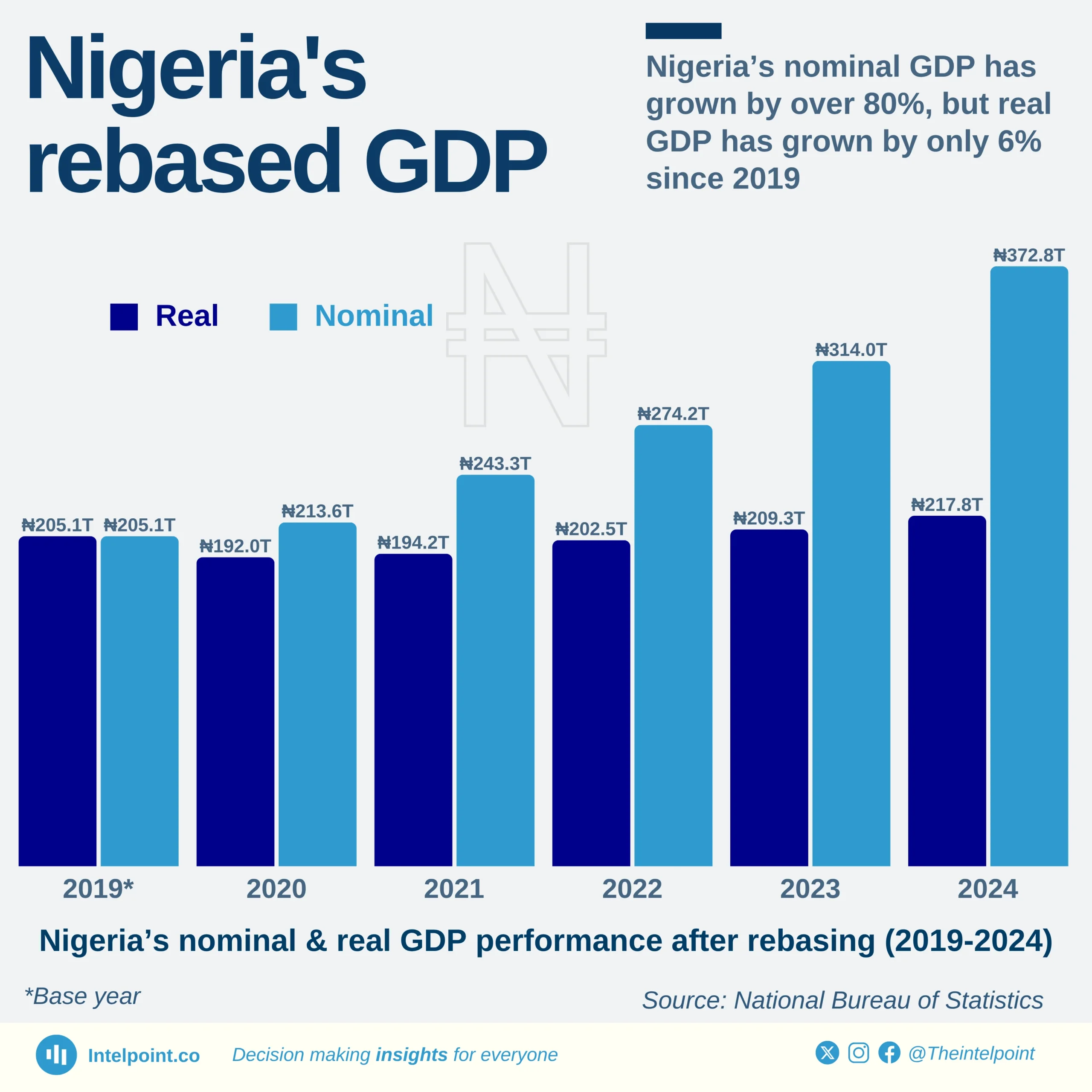

Using the official exchange rate of ₦307/$1 in 2019, Nigeria’s nominal GDP for that year is now ₦205.09 trillion ($668.1 billion), a 41.7% increase from earlier estimates. This upward revision continues through 2024, with GDP size revised upward by between 34.6% and 39%.

However, the naira’s depreciation means that in dollar terms, GDP has fallen—from $668 billion in 2019 to about $252 billion in 2024 (using the average exchange rate of ₦1,478.9/$1). So, while the economy appears bigger in naira terms, it has shrunk in dollar value, highlighting underlying fragility.

Debt metrics improve—but reality persists

One immediate benefit is a lower debt-to-GDP ratio, improving fiscal optics and potentially boosting investor confidence. But this statistical space doesn’t translate to real fiscal relief. Debt service continues to consume an outsized portion of revenue, and the government’s fiscal capacity remains constrained.

The rebased data also revise real GDP growth trends. The contraction in 2020 is now pegged at –6.96%, deeper than earlier estimates, due to more accurate data from sectors like hospitality and transport. Growth rebounded to 0.95% in 2021 and hit 4.32% in 2022, but has hovered around 3–4% since.

Industry’s shrinking role raises alarm

Industry’s contribution fell sharply—from 27.7% under the 2010 base year to 21.1% under the 2019 base. Oil refining’s nominal value collapsed from $456 million in 2019 to just $8.11 million in 2024. Livestock recorded negative real growth due to rural insecurity and value chain disruptions.

The informal economy’s share rose to 42.5%, underscoring how much of Nigeria’s economic activity remains unregulated, untaxed, and vulnerable.

Segun Ajayi-Kadir, director general of the Manufacturers Association of Nigeria, warned against reading too much into the nominal GDP boost. “The rebasing confirms that Nigeria’s economy may be statistically larger, but it is not more productive—and certainly not more industrialised,” he said.

He called for urgent reforms to boost manufacturing and productivity. “The rebased GDP should be seen as a wake-up call, not a cause for celebration.”

GDP projected to hit $450 billion

Following the recent rebasing, the Centre for the Promotion of Private Enterprise (CPPE) has projected that the economy could nearly double in size to an estimated $450 billion by the end of 2025—up from $252 billion in 2024—provided the country maintains macroeconomic stability and avoids major disruptions.

“As the Nigerian economy progressively recovers from the shocks of recent reforms, we estimate GDP could hit $450 billion by year-end,” said Muda Yusuf, founder and CEO of CPPE, in a statement on Sunday. “However, achieving this projection will require a stable macroeconomic environment and targeted support for underperforming sectors.”

A sectoral breakdown of the latest GDP data shows that 37 sectors recorded positive growth, while nine contracted and three remained in recession. The top-performing industries included metal ores (25%), financial services (15.3%), transportation (14.1%), and ICT (7.4%). In contrast, coal mining (-22.3%), livestock (-16.7%), and textiles (-1.63%) were among the worst performers.

Despite accounting for 96% of GDP, the non-oil sector remains significantly underrepresented in government revenue—a structural imbalance that experts say must be addressed to unlock Nigeria’s full economic potential.

“Special attention is needed for sectors in recession, those that contracted, and those experiencing slow growth,” Yusuf added. “Addressing structural bottlenecks, improving access to finance, tackling insecurity, and fostering innovation will be critical to driving inclusive recovery and sustainable growth.”