Insurance is a financial backup plan. It helps protect you when unexpected things happen, like car accidents, fires, theft, or even death. When you purchase insurance, you receive a policy, which is essentially a legal agreement between you and the insurance company.

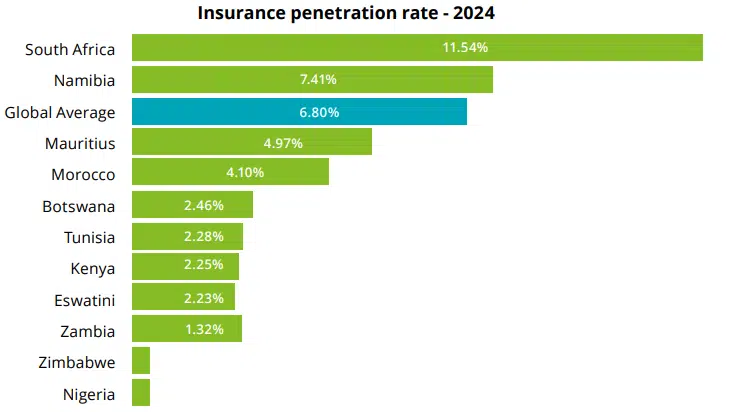

One way to measure a country’s reliance on insurance is by examining its insurance adoption rate, also known as insurance penetration. This means the ratio of total insurance premiums written in a country to its Gross Domestic Product (GDP), expressed as a percentage.

In developed countries such as France, the UK, and the US, insurance penetration typically ranges from 8% to 11%. This indicates that a significant portion of their economies is tied to insurance, reflecting strong participation from both individuals and businesses.

But in many African countries, it’s a far cry.

Key takeaways

- There’s an enormous gap between South Africa (11.54%) and the rest of the continent, with most countries having a penetration rate below 3%.

- North Africa exhibits moderate development (Morocco), while East Africa demonstrates growth momentum (Kenya, Tanzania). In contrast, West Africa remains largely untapped, despite its large population.

- The key market drivers for insurance economies are the adoption of mobile technology, enabling insurtech solutions, and financial inclusion initiatives.

These percentages indicate that relatively fewer African individuals and businesses are utilizing insurance services.

A high penetration rate typically indicates that a country has a mature and trusted insurance industry. A low rate, on the other hand, often signals a young or underdeveloped insurance market that hasn’t yet gained wide public trust or use.

Insurance adoption trend in African countries

One of the most recent data sources on insurance adoption and penetration in African countries is the Deloitte 2024/25 Africa Insurance Outlook.

The report revealed how individuals and organizations in various African regions are actively choosing to protect themselves or their assets from potential financial losses by paying premiums for coverage.

1. South Africa

Insurance Penetration Rate: 11.54%

South Africa dominates the African insurance landscape, boasting the highest penetration rate at 11.54%, which is significantly above the global average of 6.8%, according to the report.

We can say it’s chicken coming home to roost because the country’s mature insurance market is driven by:

- Strong presence of major insurers (Old Mutual, Sanlam, Discovery, Liberty, and MMH)

- Sophisticated product offerings, including life, health, and short-term insurance

- Well-established regulatory framework

- Advanced financial services infrastructure

The country demonstrates resilience despite facing economic challenges, including a high interest rate (7.25% repo rate), inflation of around 4.4%, and modest GDP growth of 0.6% in 2024.

Now, let’s look at the situation in Eastern Africa.

2. Kenya

Insurance Penetration Rate: 2.25%

According to the report, Kenya experienced a 4% growth in gross written premiums of insurance in 2022, reaching $2.5 billion.

It states that non-life insurance dominates the market with a 54% market share, while life insurance showed a moderate 4.5% increase.

Based on this performance, Kenya represents the most developed insurance market in East Africa, benefiting from the adoption of mobile technology, which enables insurtech innovations.

As of July 2025, Kenya has 31 active InsurTech companies, and they have collectively raised $51.7 million in funding to date.

3. Tanzania

Insurance Penetration Rate: 0.62% (improved from 0.58%)

The Tanzanian insurance sector, according to the recent report, experienced a 14% increase in gross written premiums to $450 million in 2022.

Non-life insurance dominates the market with an 83.2% market share, while the life insurance sector experienced a remarkable 33.9% growth.

Factors like new distribution channels, including bancassurance and mobile money integration, facilitate premium payments.

Micro-insurance companies, such as BIMA, are serving low-income customers in Tanzania, leveraging mobile technology to offer affordable health, life, and personal accident insurance. BIMA, which also operates in Ghana and Kenya, covers over 30 million customers.

4. Ethiopia

Insurance Penetration Rate: 0.3%

Ethiopia remains highly underpenetrated, despite being Africa’s second-most populous country, due to its limited financial infrastructure and low income levels.

Although Ethiopia’s economy is expected to grow by 8.9% in the upcoming fiscal year, a slight increase from this year’s estimated 8.4%.

Regulatory restrictions on foreign participation also contribute to the low adoption rate.

5. Ghana

Specific penetration rates are not disclosed in the report under study.

However, the Insurance adoption rate in Ghana is very low, hovering around 1% of the Gross Domestic Product (GDP), according to a 2021 report by KPMG.

This low penetration rate, excluding health insurance and pensions, indicates significant potential for growth in the Ghanaian insurance market.

It’s an irony, considering the active implementation of IFRS 17, with support from the National Insurance Commission.

6. Nigeria

The rate of insurance penetration in Nigeria has been regarded as one of the lowest in Africa, with a 0.3% penetration rate.

According to the Augusto and Co., 2022 insurance industry report, the industry’s Gross Premium Income (GPI) stands at ₦520.1 trillion.

It’s an irony because, in the first nine months of 2024, Finance and Insurance led the GDP growth with a 30.3% increase, followed by Water Supply & Waste Management at 8.3%, and Mining and Quarrying with a 5.7% growth.

While there’s persistent pressure on the currency to depreciate, the large population provides a significant potential market. According to Worldometer, Nigeria’s population is currently 237.5 million.

According to the 2021 Access to Financial Services in Nigeria Survey report by EFInA, only about 2 million Nigerians have any form of insurance coverage. In the report’s comparison of Nigeria with five other African countries, it found that Nigeria has the highest proportion of uninsured adults.

Nigerian businesses fare no better in the insurance rankings. Of the 388 businesses sampled by Interpoint Africa in January 2024, a substantial 96.4% had no insurance coverage.

According to the report, the most common reason businesses lacked any form of insurance was that the business owners were unsure of where to begin. However, the more compelling reason was that insurance products were too expensive.

7. Namibia

Insurance Penetration Rate: 7.41%

According to the report, Namibia has the second-highest penetration rate in Africa, benefiting from proximity to the South African market and similar regulatory standards.

According to FT Partners fintech industry research published Q4 last year, “Outside of South Africa, insurance penetration rates are low in Africa due to lack of awareness, cost, minimal product innovation, regulatory obstacles, and unsteady incomes.

“Insurtech innovation plays a large factor in growing the continent’s insurance market by providing more affordable products that cater to currently untapped demographics.”

What this means for African insurance companies

Africa’s insurance market remains significantly behind the global average in terms of coverage. Still, the good news is that things are improving.

Factors such as a growing population, improved technology, and updated government policies are creating genuine growth opportunities.

To truly succeed, insurance companies in Africa will need to:

- Create new kinds of products that fit people’s needs

- Use mobile phones and apps to reach more customers

- Work closely with regulators who support financial inclusion.

Over the next 3 to 5 years, we can expect steady progress in countries such as South Africa and Kenya, where the market is already more developed.

At the same time, countries like Nigeria and Ethiopia, where relatively few people currently have insurance, could experience significant growth as their economies strengthen and more people gain access to mobile technology.

Final thoughts

For many insurance companies in Africa, digitisation shouldn’t be considered a silver bullet.

Insurance companies still need to understand the unique needs and challenges of the markets they serve.

In many places, people don’t fully trust insurance, don’t really understand how it works, or lack the digital skills to use online platforms. So while using technology is important, a successful strategy will combine digital tools with face-to-face interactions to build trust and help customers better understand what they’re buying.