Africa is home to one of the biggest movie industry in the world by volume of movies produced, its music Afrobeats stands head and shoulders with its global contemporaries, an innovative fashion industry blending traditional attires with modern designs, a motley of centuries-old stories and legends from hundreds of cultures, creative artistic representations that continue to inspire and a young vibrant population.

All these form a recipe for a delectable and thriving creative sector that should attract investors across the globe. Despite its promise, the sector, like others, has failed to blossom as many expected. Industry players have touted the lack of investment as the bane of the subpar performance of the industry in Africa’s economies.

Funding squeeze on screen streaming ventures

However, creative enterprises which have received significant funding in the past have failed to deliver returns to investors. The recent sad tale of the founder of IrokoTV, Jason Njoku, of how the company struggled to build a profitable streaming business in Nigeria mirrors the entire creative industry landscape on the continent.

Jason Njoku’s autopsy of the streaming business he built and the industry in Nigeria could be summarised thus “…we finally accepted there was no market for paid premium services and exited Nigeria… As I humbly survey the wreckage of the last 15 years of streaming in Nigeria and Africa, it’s clear our (then $2k GDP per capita) was too small to support even a $5/mo product…”

It is important to note that IrokoTv started in Nigeria- Africa’s biggest economy and home to the continent’s biggest entertainment industry with Nollywood competing with global players in terms of movie production volume. Irokotv raised up to $35 million and its founder stated they spent $100 million in trying to recreate a profitable African Netflix but weren’t successful.

It is not only investors in IrokoTv who discovered the difficulty in investing in creative enterprises in Africa; last year, movie producer Kunle Afolayan announced that Netflix is pulling back on investing in Nigeria’s original creative projects after coughing out around $23 million since 2016.

The firm later responded that it remained committed to funding projects that met its standards. However, not only is Netflix tacitly pulling back from the continent, but last year, Amazon Prime decided to cut down operations in Africa to focus more on Europe. This move signals a fading confidence among players in the movie streaming industry on the potential of the African markets.

Scale is still out of reach

UNESCO estimates that the creative sector in Africa contributes around $5 billion to the continent’s GDP and supports up to 5 million jobs. But that’s just a drop in the ocean compared to the size of the global creative industry, which stands at $2 trillion.

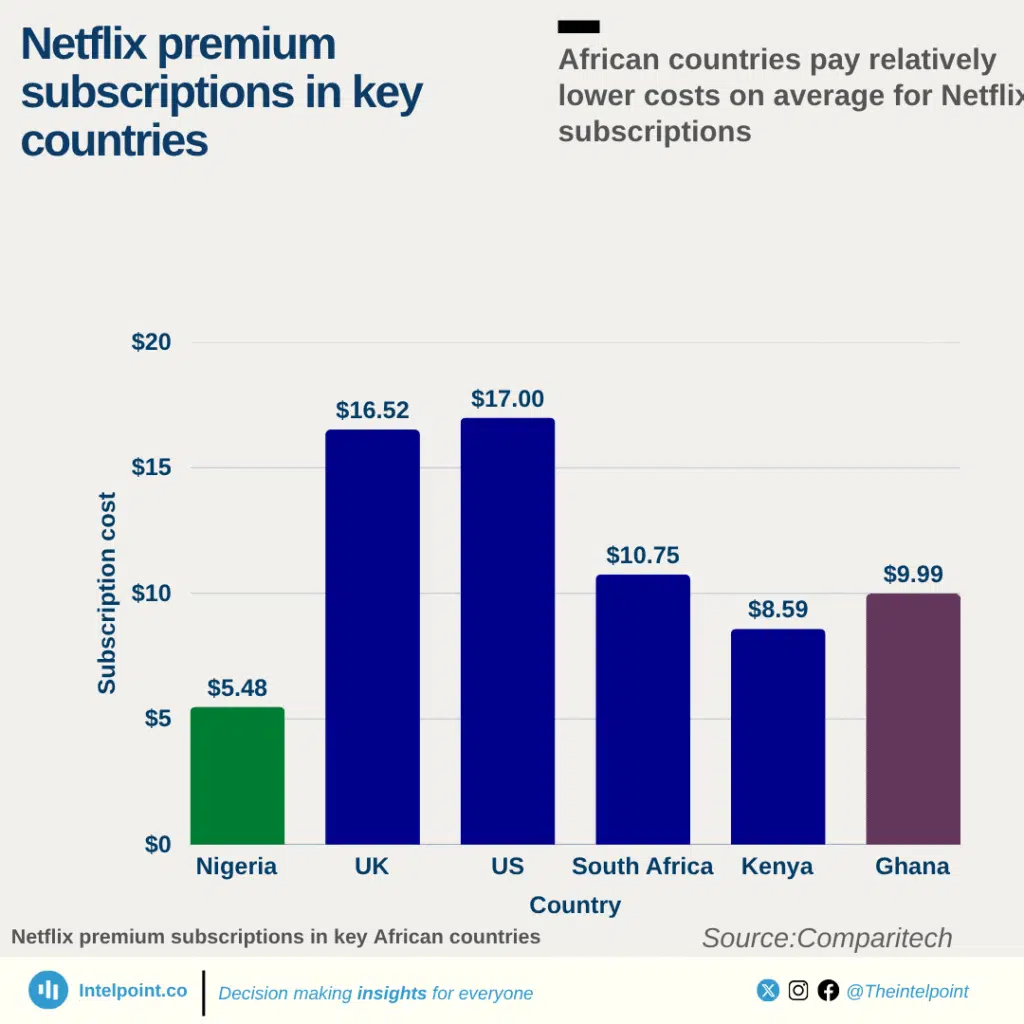

However, economics was as much a factor for Netflix in its funding pullback as to originality and standards. For example, Netflix subscribers in Nigeria will now pay $5.48 monthly for a new premium package while the standard plan will go for $4.1.

On the other hand, subscribers of similar plans in more advanced economies pay more than three times the amount that subscribers in Nigeria and other low and middle-income countries pay. In the U.K., for example, Netflix subscribers pay as much as £16.52 monthly for the premium package, while in the U.S, it stands at $17, with similar price ranges across Europe and North America.

In South Africa, Netflix charges $8.52 for a basic package, which is lower than Showmax and has put the homegrown platform as the market leader in the movie streaming industry of the Rainbow Nation. Across Africa, Kenyans pay $7.99 for a basic plan while Ghanians pay similar prices.

Beyond the disparity in prices, Netflix subscribers in Africa pale in comparison to Europe, North America and even Asia. Total subscribers to the service in Africa stand at under 2 million, with South Africa holding the lion’s share with almost 1.2 million, followed by Nigeria with around 170 thousand. However, the United States and Canada command around 80 million Netflix subscribers despite having a population figures around a quarter of Africa’s.

The lesson here is that building a profitable enterprise, especially in emerging economies like most countries in Africa, rests not in the quality of the product but in the capacity of the market to use the product. Across African countries, disparity exists in the market capacity to patronise creative products.

For example, Nigeria, with its over 200 million population, spent around $7.5 million at cinemas in 2024 while South Africa spent $29.9 million despite having under a third of Nigeria’s population. In Egypt, box office revenue in 2024 stood at $1.1 million while Kenya’s was $383 thousand.

To understand how nascent the African box office is, the French box office in 2024 generated $1.36 billion in revenue. However, Africa is grossly underserved in cinema infrastructure, with a ratio of 1 per 787,000 people compared to 1:50,000 in Europe.

Pay-TV fights for survival

Across Africa in the past two years, macroeconomic headwinds have negatively impacted the performance of Pay TV firms. For example, MultiChoice, the continent’s biggest Pay TV company, saw its subscriber base decline by 18% mainly due to customer attrition in Nigeria and other countries in Africa as inflation and economic woes bite.

Since 2022, exchange rate pressures coupled with supply chain disruption have exacerbated inflation levels in many African countries. The company has been forced to hike subscription fees in the past two years and faces increased opposition from consumer protection agencies across its markets.

For the year ending March 2024, MultiChoice Group saw its revenue from its Nigeria operations plunge by 30.7% from $493.5 million to $341.7 million in the previous year. The company in FY 2024 recorded a loss of $219.8 million, an increase from $155.3 million in the previous year. In that period, the company reported a 9% decline in subscribers, with the Rest of Africa led by Nigeria recording a 13% decline, while that of South Africa stood at 5%.

In its recently released results for FY 2025, revenues declined to $2.72 billion (ZAR 49.98 billion) from $2.89 billion (ZAR 54.99 billion). The decline in revenue was attributed to a 7% YoY churn in active subscribers,s mainly from Nigeria.

Who is investing in Africa’s creative ventures?

Unlike the fintech space in Africa, where VCs dominate the funding of startups, the entertainment sector is different. Here we see institutional investors, NGOs and multilateral development organisations funding these enterprises. This is because growth and profitability in the entertainment space are different from the fintech space, which can easily explode in a short time.

However, between 2012 and 2022, private capital inflow into the creative industry in Africa’s creative industry reached $346 million across 58 investments, according to data from the Africa Private Equity and Venture Capital Association (AVCA). The research further noted that 67% of these investments stem from venture capital, while 33% originated from private equity.

In the past few years, multilateral development institutions and Non-Governmental Organisations 9NGOs) have signalled a strong commitment to Africa’s creative industry. In 2024, Afrexim Bank committed $2 billion to its Creative Africa Nexus (CANEX) from $ 1 billion in the next three years.

Also, HEVA Fund of the United Nations and Next Narrative Africa in September last year announced a $40 million fund for African filmmakers, which will be allocated to equity and grants. The International Finance Corporation (IFC) also has its eyes on the creative sector and has partnered with SONY to invest in the sector.

Last year, the Mastercard Foundation committed $2 million to partner with Kenya firm Wowzi and Egypt-based Masrai Digital Payment (MDP) to support digital creators in Africa.

But it is not only multilateral organisations and NGOs that are pushing funds into the creative sector; governments across Africa are not contributing their bits. In Nigeria, the federal government, through the African Development Bank (AfDB), is investing $614 million in the creative sector under a program called Investment in Digital and Creative Enterprises (IDICE).

For traditional banks in Africa, the creative sector is relatively new and decentralised, making it difficult for these institutions to assess potential returns on investment. Although Nigeria’s Access Bank has a creative sector loan, the rigorous process of accessing loans from traditional banks has discouraged many creatives.

Music keeps the money moving

While confidence in Africa’s movie sector is waning, music is booming and has seen significant investment in the last few years. The continent’s music streaming industry is the fastest growing in the world, expanding by 25% in 2023, and African music artists received $59 million from Spotify in 2024 much with Nigerian and South African artists receiving a preponderance of the payment.

However, the figure was paltry compared to the global payment for royalties in 2024 from the Swedish music streaming app, which totalled $10 billion. The figure from Africa is unsurprising as the music streaming in the continent represents only 2% of the global music streaming industry.

African artists like Rema, Burna Boy, Tyla, Tems, etc have gained international recognition and headlined international music concerts, which have served as a confidence booster for investors. Last year, Universal Music Group (UMG) acquired a majority stake in Nigerian-based Mavin Records for an undisclosed fee.

Other growing segments of the creative industry

Aside from film and music, the creative sector in Africa is also seeing an uptick in gaming and fashion. These are propelled by Africa’s relatively young population and its tech-savvy nature. According to PwC in her media outlook for 2024 to 2028, the video games and esports industry is expected to grow by a CAGR of 6.8% during the period.

In a report by KPMG, revenues from the gaming industry in Africa reached $1 billion in 2024, with five major countries of Nigeria, South Africa, Egypt, Tunisia and Algeria accounting for over $200 million in revenues. Mobile games are the most prominent video games which infuse social interaction into the game component and allow users to create a community within the platform.

Already, there are an estimated 186 million active digital gamers in the Sub-Saharan Africa (SSA) region, and the figure is projected to rise to 217 million in the next two years. Currently, around 66 active studios across 23 countries in Africa are developing games that feature local African stories and lifestyle.

Firms like Maliyo Studios in Nigeria, which partnered with Disney to launch a game based on the Disney animated series, Iwaju. The pattern is becoming prominent in Africa, where game developers build games from movie titles and attach franchises to them because there is an already established audience around the movie and vice versa.

A young population, rapidly improving access to internet-enabled smartphones, are responsible for the growth in Africa’s gaming industry, which has drawn investors like Disney, Electronic Arts, Riot Games, etc. Last year, Sony began deploying resources from her $10 million investment fund meant to support Africa’s gaming sector in South Africa’s games publisher Carry1st, whose product became one of the most downloaded games in the United States.

However, the challenges in the gaming industry are not different from others being experienced in the broader creative sector- poor internet connectivity, low in-game purchases, limited access to locally developed games and so on.