Nigeria’s windfall from exchange rate gains has plunged, marking a significant shift in the country’s fiscal dynamics. In the first half of 2025, revenue from exchange rate gain dropped by 73.2% compared to the same period last year, highlighting the impact of a more stable naira and fewer arbitrage opportunities.

Exchange rate gains—extra revenue earned when the naira weakens against the dollar—have boosted government earnings, particularly in foreign currency-generating sectors like oil and gas. But the naira has shed its volatility in 2025 as the currency has traded within the ₦1,500–₦1,600/$ range, making those gains evaporate.

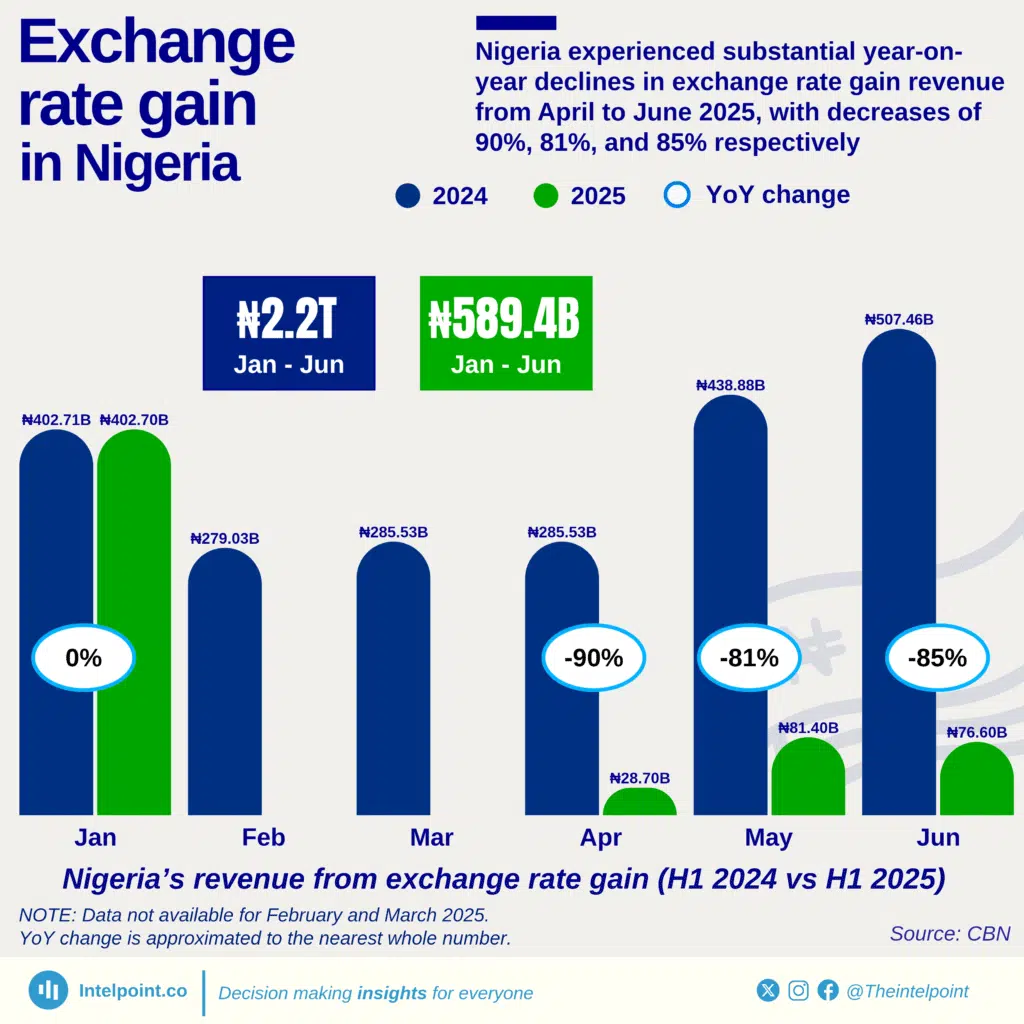

According to data from the Federation Account Allocation Committee (FAAC), the country earned ₦589.45 billion ($385.3 million) from exchange rate gains between January and June 2025, down from ₦2.199 trillion ($1.44 billion) during the same period in 2024.

This collapse reflects the government’s shift toward market-reflective exchange rates and the closing of arbitrage gaps that once inflated naira revenues. The transition aligns the budget benchmark more closely with actual market rates, eliminating the surplus typically recorded during sharp currency depreciation.

“In H1 2024, we had severe FX volatility. The naira depreciated quickly, so exchange gains were large,” said Adewale Abimbola, a Lagos-based economist. “But 2025 has seen more FX stability, which is a positive development.”

His remarks suggest that Nigeria may be entering a more predictable and investor-friendly FX regime, where reliance on exchange rate gains to prop up financial performance declines, and broader macroeconomic fundamentals take centre stage.

Arbitrage gains vanish as budget and market rates align

A key factor behind the collapse is the alignment of the official budget benchmark with actual market exchange rates. While FAAC distributions are recorded monthly, they reflect revenue earned in the previous month. For instance, ₦402.71 billion ($263.2 million) in exchange rate revenue shared in January this year corresponds to income earned in December 2024, before the new ₦1,500/$ benchmark likely took full effect.

By February and March 2025—corresponding to earnings from January and February—there was no record of any exchange rate revenue. This coincided with the Central Bank of Nigeria’s (CBN) reported official exchange rates, which averaged ₦1,475 in January and ₦1,500 in February, almost identical to the 2025 budget assumption. With no significant gap between the budget rate and market rate, there was little room to generate arbitrage revenue.

This is a stark contrast to the situation in early 2024, when the budget benchmark was set at ₦800 per dollar, while the actual exchange rate hovered around ₦1,455 per dollar. That difference allowed the government to convert dollar inflows at higher market rates but book them against a much lower budget benchmark, effectively producing large naira surpluses.

In 2024, exchange rate gains accounted for 30.7% of total FAAC allocations in H1 of the year. That figure has now dropped to just 6.06% in 2025.

In nominal terms, June 2024 saw ₦507.46 billion ($331.7 million) shared from exchange rate revenue, nearly half of that month’s ₦1.143 trillion ($747.1 million) total FAAC distribution. One year later, in June 2025, exchange rate revenue stood at just ₦76.61 billion ($50.1 million), less than 5% of the ₦1.659 trillion ($1.08 billion) shared.

This shift occurred despite an overall increase in FAAC distributions. Total revenue shared in the first half amounted to ₦9.723 trillion ($6.36 billion), up 35.6% from ₦7.171 trillion ($4.69 billion) in the same period last year.

However, most of the increase came from non-exchange-related revenue sources, indicating that the government is moving toward a more stable, market-reflective fiscal framework.

Federal government retains biggest share of a shrinking pool

Of the ₦589.45 billion shared in exchange rate gains in H1 2025, the Federal Government took ₦280.93 billion ($183.6 million), while state and local governments received ₦140.26 billion and ₦113.14 billion, respectively. Oil-producing states received ₦64.52 billion under the 13% derivation formula.

While the revenue structure remained similar, absolute values declined sharply. The Federal Government’s share fell 68.4% from H1 2024, while states and LGAs saw similar declines.

The distribution pattern shows Nigeria’s centralised fiscal system, where the Federal Government remains relatively insulated from revenue shocks, while subnational governments bear the brunt of fiscal contractions.

Naira forecasts: Stability or slippage ahead?

Analysts are divided on the outlook for the naira. Augusto & Co. projects a cautiously optimistic end-of-year rate of ₦1,600/$, citing remittances, attractive yields, and a dovish stance by the US Fed. However, it also warns of continued FX inflow constraints and speculative activity.

VerivAfrica is more bearish, forecasting the naira could average between ₦1,930 and ₦2,000/$ due to weak export performance and declining investor appetite.

So far in 2025, the naira has remained within the ₦1,500–₦1,600/$ range, due in large part to the CBN’s aggressive market intervention. According to CSL Research, the apex bank injected over $4.1 billion into the FX market in H1, compared to $1.3 billion in the same period last year.

Afrinvest and CSL forecast the naira will hold within the ₦1,500–₦1,600 band through year-end, though they caution that sustaining stability without a rise in external inflows—such as oil revenues or foreign portfolio investment—will be challenging.

As Nigeria pivots to a more transparent and market-aligned exchange regime, the days of windfall FX revenues may be over. But for policymakers, the trade-off may be worth it: a stronger foundation for long-term fiscal and economic stability.

The figures were originally reported in naira, and have been converted using $1 = ₦1,529.9 as of July 16, 2025.