Nigeria has introduced tax reforms that scrap three key taxes for small businesses but tripled the capital gains tax (CGT) rate for corporations, signalling a significant shift in the country’s fiscal policy.

Under the new tax laws signed by President Bola Tinubu last week, companies with annual turnovers of ₦100 million ($64,994) and below are now exempt from Companies Income Tax (CIT), Capital Gains Tax (CGT), and the newly introduced National Development Levy, according to PwC Nigeria’s analysis of the Nigerian Tax Reform Acts.

This move is aimed at reducing the tax burden on small businesses and encouraging formalisation within Nigeria’s economy. While small businesses benefit from tax exemptions, larger corporations are set to face higher costs on capital gains. The CGT has been raised from 10% to 30% for companies.

The exemption marks a notable expansion from the previous threshold, which applied to businesses earning ₦25 million ($16,248.5) and below. Companies also qualify as small if their total fixed assets do not exceed ₦250 million ($162,485.4) according to an analysis by PwC Nigeria.

“These reforms represent one of the most significant overhauls of Nigeria’s tax landscape in decades,” PwC said in its report titled “The Nigerian Tax Reform Acts: Top 20 Changes to Know and Top 6 Things to Do.” The report urges businesses to reassess their tax compliance strategies ahead of the implementation date of January 1, 2026.

Other key changes at a glance

Value Added Tax (VAT) retained at 7.5%, with global best practices

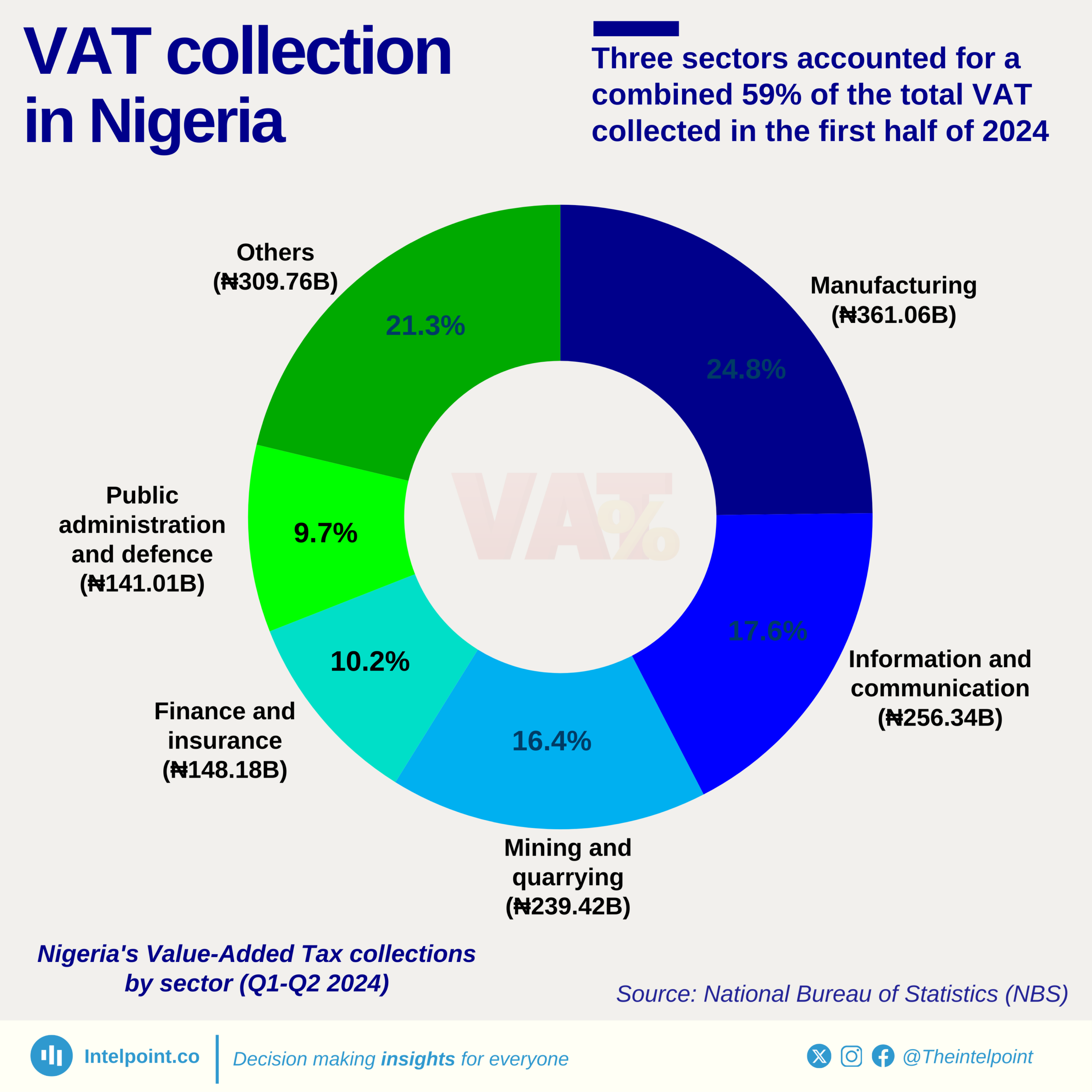

Nigeria retains its 7.5% VAT rate but adopts globally accepted VAT principles. Businesses can now claim input VAT on all purchases, including services and fixed assets, provided these are linked to VATable supplies.

Personal income tax relief

Individuals earning ₦800,000 ($519.9) or less per year are now exempt from Personal Income Tax (PIT). Higher-income earners will face progressive tax rates of up to 25%.

Additionally, tax exemption thresholds for compensation due to loss of employment or injury have been increased from ₦10 million ($6,499.4) to ₦50 million ($32,497.1)

New VAT sharing formula

The Acts reduce the Federal Government’s share of VAT from 15% to 10%, while increasing the allocations of states and Local Government Areas to 55% and 35%, respectively. The VAT revenue assigned to states and local governments is further allocated as follows: 50% divided equally, 20% based on population, and 30% based on place of consumption.

Under the current VAT revenue distribution structure, revenue is allocated to the states and local governments utilising equality – 50%, population size – 30%, and derivation-20%

Heavier penalties for tax defaulters

The reforms introduce significantly tougher penalties for tax defaults. Failure to file tax returns now attracts a fine of ₦100,000 ($65) in the first month and ₦50,000 ($32.4) for every subsequent month of default.

In addition, businesses risk a ₦5 million ($3,249.7) penalty for awarding contracts to individuals or companies not registered for tax. Other penalties include sanctions for refusing access to tax technology systems or attempting to improperly influence tax officials.

Public sentiment

Before the passage of the bills, a survey by SBM Intelligence across eight states — Abuja, Anambra, Bauchi, Cross River, Kano, Lagos, Oyo, and Rivers — revealed general support for the reforms, particularly the relief measures for small businesses.

But there were concerns about the plan to raise VAT from 7.5% to 15% by 2027, which many fear could fuel inflation.

“I believe the bills can stimulate the economy if properly implemented,” said Yakubu Samaila, a trader in Bauchi. “But raising VAT without fixing the economy will only worsen hardship for struggling Nigerians.”

But under the new tax bills, Nigeria retained VAT at 7.5%.

PwC’s recommendations for businesses

Given the changes introduced by the Acts, PwC companies and businesses need to proactively assess the corporate structure, operational, financial, and compliance implications arising from the tax laws.

“Organise sensitisation workshops for relevant board committees and executive management on the impact of the reforms on your business,” it said.

The tax advisory firm also added that companies should empower their staff by training and upskilling staff to ensure seamless adoption of new tax laws in specific roles and processes that are impacted.

Exchange rate used: $1 = ₦1,538.6 as of June 27, 2025