Last week, money flowed aggressively into the market, but it didn’t chase the usual blue-chip suspects. Instead, insurance names and growth plays stole the show while a few heavyweight indices cooled. That rotation, coupled with surging liquidity, sets the stage for an intriguing July run.

Here’s what happened between Monday, 30 June, and Friday, 4 July.

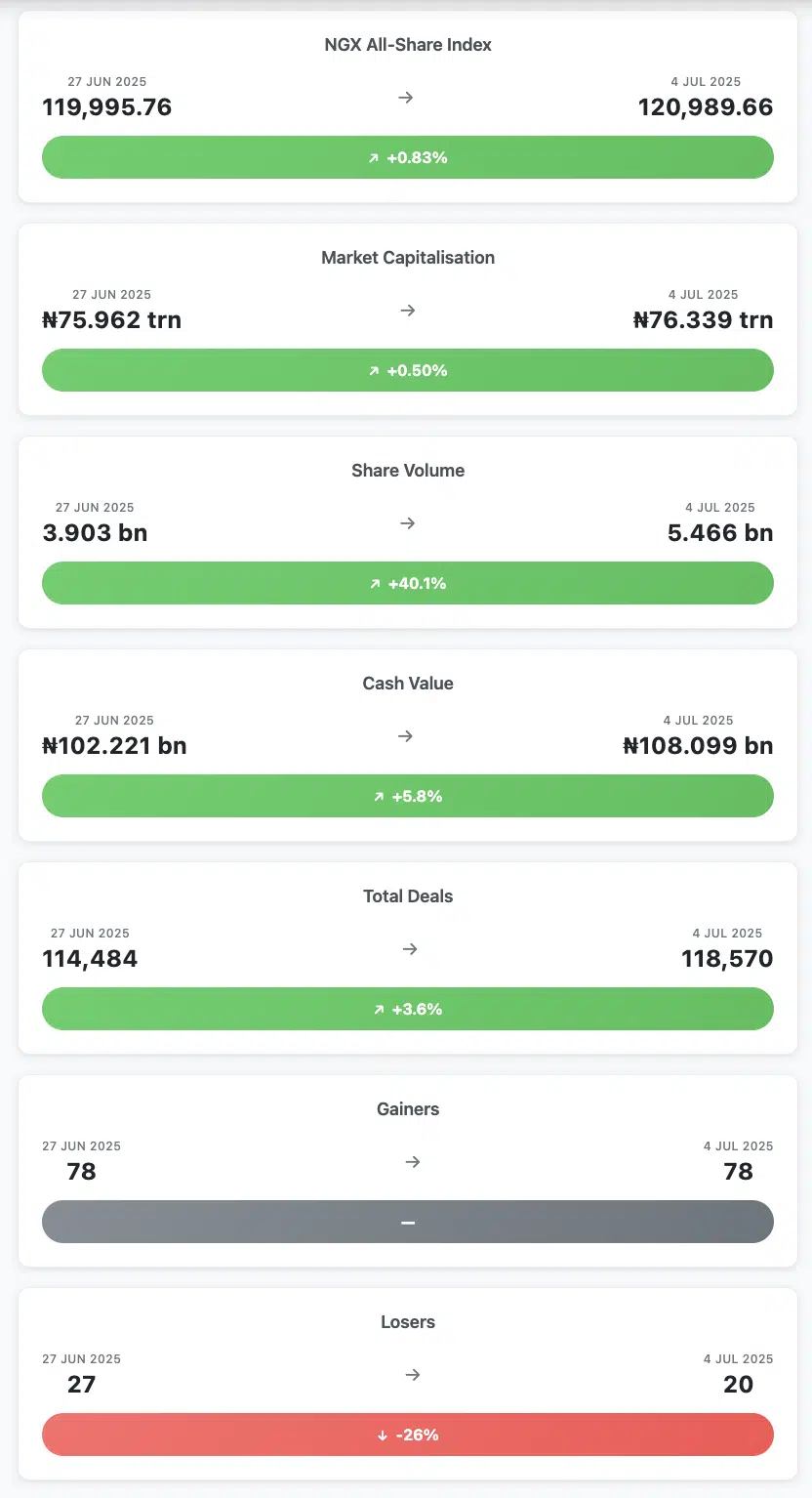

- The NGX All-Share Index (ASI) nudged 0.83 % higher to 120,989.66 points.

- Market capitalisation increased by ₦377 billion to close at ₦76.339 trillion.

- Turnover ballooned to 5.466 billion shares worth ₦108.099 billion—a hefty 40 % jump in share volume and a 5.8 % lift in cash value week-on-week.

- Breadth was the real headline: 78 gainers vs. 20 losers delivered a stout 3.9-to-1 advance/decline ratio, the widest positive spread in seven weeks.

Key market metrics dashboard

Market breadth: 3.9 advancers: 1 decliner

Market analysis narrative

Here’s what the numbers mean for investors. A 0.83 % rise in the headline index may look modest, but the underlying rotation is anything but. Insurance (+5.86 %) and Consumer Goods (+4.08 %) led the charge, while Industrial Goods (-2.11 %) and the Premium Index (-0.77 %) lagged. When defensive insurers outrun heavy industrials, it usually signals investors are repositioning for earnings resilience and dividend yield.

Liquidity tells the same story. Of the 5.466 billion shares exchanged, 50 % sat in Financial Services, but the Oil-&-Gas counters absorbed the most significant slice of cash—₦39.8 billion—despite contributing just 16 % of volume. That mismatch reveals conviction: big cheques chased energy plays even as crude-price headlines stayed muted.

Daily tape action confirmed the trend. Monday opened with a blockbuster ₂.03 billion-share session—the largest day since late April—fuelled by institutional blocks in Access Holdings and Royal Exchange. Mid-week momentum cooled, but Wednesday’s breadth (61 advancers vs 16 decliners) underlined persistent bid depth.

The week’s only real wobble came on Thursday when a 2.3 % slide in Dangote Cement dragged the Industrial Goods index into the red.

Why the sudden love for insurance and consumer names? Simple maths: the NGX Growth Index jumped 8.04 % as mid-caps regained favor after being overlooked through Q2.

Investors chased relative bargains ahead of the July earnings season, locking in exposure to companies whose input-cost pressures are finally easing courtesy of a stronger naira.

Yet caution lights are blinking. The ASI now sits barely 1 % shy of its 121k resistance shelf; meanwhile, the Banking index’s RSI is flirting with overbought territory after six straight green weeks. Translation: the upside is still in play, but expect tactical profit-taking, especially in the heavyweight banking cohort.

You can read our analysis of the last week of June 2025 here.

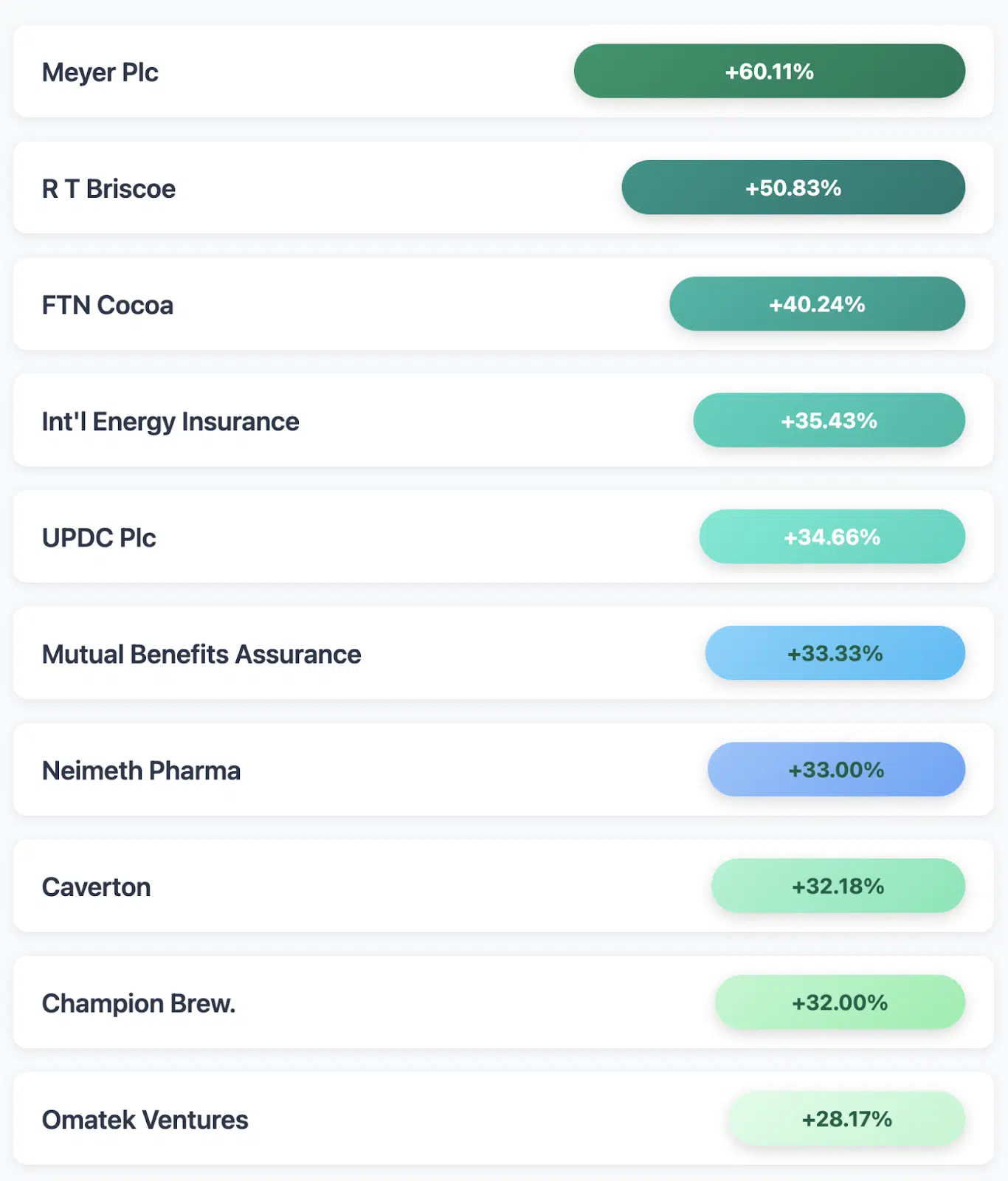

Winners & Losers analysis

Top 10 gainers

Narrative: Seven of the ten winners sit outside the NGX-30, confirming a decisive tilt toward mid-cap “catch-up” plays. Notice the sector cluster: paints (Meyer), insurance, real estate (UPDC), and consumer staples (Champion). That cross-sector breadth hints at a rising-tide sentiment rather than a single-theme frenzy.

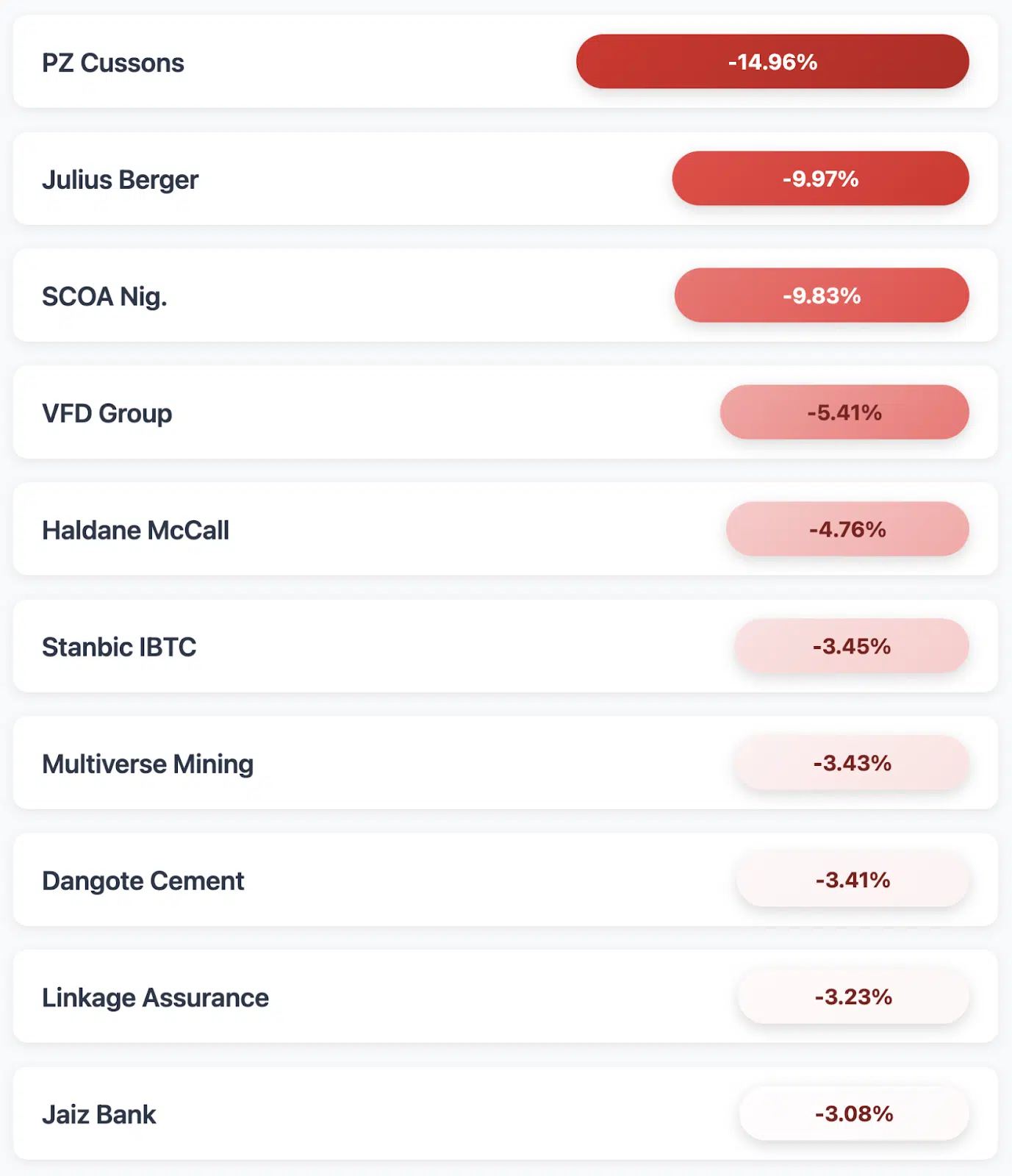

Top 10 decliners

Narrative: Profit-taking hit industrial heavyweights (Dangote Cement) and FMCG bellwether PZ Cussons, while construction major Julius Berger cooled after a stellar Q2 run-up. None of the decliners lost more than 15 %, suggesting orderly rotation rather than panic.

Sector performance deep dive

| Sector Index | W-o-W % | Comment |

| Insurance | +5.86 % | Cheapest P/B on the board; investors grabbing yield ahead of half-year dividends |

| Consumer Goods | +4.08 % | Lower input costs & resilient demand lifted staples |

| AFR Div Yield | +2.63 % | Rotation into high-payout names |

| MERI Growth | +2.02 % | Mid-cap revival in full swing |

| Industrial Goods | -2.11 % | Dangote drag outweighed gains elsewhere |

Volume dominance remained with Financial Services (50% of shares, 32% of cash), thanks to Zenith, Access, and GTCO flows. Yet Oil & Gas stole the naira spotlight, booking ₦39.8 billion in trades—37 % of weekly value—with just 16 % of volume. That cash-heavy skew suggests institutions topping up on energy counters at attractive multiples.

Volume & Value Analysis

Most-traded equities by volume

- Royal Exchange Plc

- Access Holdings Plc

- Japaul Gold & Ventures Plc

Together, they moved 1.688 billion shares (31% of market volume), but only 11.9% of the cash value—classic low-price, high-liquidity plays where speculative capital flits in and out. By contrast, Seplat, MTNN, and Dangote Cement dominated value despite far lower share counts, confirming a two-tier market: penny-stock churn alongside blue-chip accumulation.

Daily market progression

| Day | Deals | Volume (m) | Value (₦ bn) | Adv | Dec |

| Mon 30 Jun | 25,173 | 2,031.9 | 44.34 | 32 | 31 |

| Tue 1 Jul | 21,546 | 527.1 | 11.28 | 48 | 23 |

| Wed 2 Jul | 21,964 | 1,049.4 | 12.17 | 61 | 16 |

| Thu 3 Jul | 24,207 | 933.4 | 29.31 | 55 | 15 |

| Fri 4 Jul | 25,680 | 923.9 | 11.00 | 39 | 27 |

Inflection Point: Wednesday’s 61/16 breadth marked peak momentum; Thursday’s cash surge signaled large-lot rebalancing into Oil & Gas majors.

Corporate actions & market events

| Event | Detail |

| Dividend Adjustments | MCNichols, Sterling HoldCo, BUA Cement, and Livingtrust went ex-dividend, trimming reference prices by ₦0.04–₦2.05. |

| Delisting | Notore Chemical Industries Plc’s entire share capital was delisted on 4 July following shareholder approval. |

| ETPs | 218,675 units worth ₦18.79 m traded (vs 71,070 units last week). NEWGOLD accounted for ₦5.92 m; STANBICETF30 printed ₦5.61 m. |

| Bonds | 165,333 units crossed for ₦170.37 m. FG-linked issues (FGSUK2025S2) dominated activity with ₦70.35 m turnover. |

What does this mean for your portfolio this week?

Last week’s 40% volume surge combined with 3.9-to-1 positive breadth isn’t just noise—it’s the market telling you precisely where smart money is positioning for the next phase. Here’s how you should think about your holdings:

According to Oge Ndukwe ( CoachOge), CEO at Globfolio,

“The market is clearly on a solid uptrend, led by the consumer goods index. This is not surprising, as the same sector suffered a massive sell-off following rising foreign exchange losses. As rates moderate, these companies are emerging from a low base, which is why their various stocks have experienced a significant rally.

We may see profit-taking this week, but my analysis of sub-sectors suggests that banking, insurance, and oil and gas are likely to continue adding strength over the next six months.

Even as we look forward to Q2 results, companies that deliver earnings surprises will attract more interest.“

If You’re Conservative

The Insurance sector’s 5.86% weekly gain wasn’t accidental. When defensive sectors outperform while breadth stays this strong, you’re watching institutions rotate into dividend sustainability ahead of half-year payouts.

Your Action Plan:

- Lock in insurance exposure: Companies like AIICO and NEM Insurance are trading at the cheapest price-to-book ratios on the board. If you owned Mutual Benefits Assurance this week, you made 33.33% in five days—that’s the kind of return that builds real wealth over time.

- Bank profit-taking time: After six straight green weeks, tier-one banks like Stanbic IBTC (down 3.45% this week) are showing signs of strain. Trail your stop-losses but keep core positions in GTCO and Zenith Bank for dividend capture.

- Consumer staples on sale: PZ Cussons dropped 14.96% to ₦32.40—potentially creating a value entry point in a company that benefits from naira strength and lower input costs.

Risk Management: With the All-Share Index just 1% below 121,500 resistance, don’t chase momentum. Scale into positions over 2-3 weeks.

If You’re Growth-Oriented

The NGX Growth Index jumped 8.04% this week while the Premium Index managed only -0.77%. That’s not rotation—that’s a fundamental shift in where growth lives.

Your Opportunities:

- Mid-cap momentum: Meyer Plc’s 60.11% explosion from ₦9.15 to ₦14.65 signals serious money chasing overlooked industrial plays. RT Briscoe (+50.83%) and FTN Cocoa (+40.24%) joined the party—this breadth across unrelated sectors means something bigger is brewing.

- Energy revival: Caverton’s 32.18% gain hints at Oil & Gas recovery beyond the majors. With ₦39.8 billion flowing into energy counters (37% of weekly value), institutional conviction is building.

- Insurance breakthrough: International Energy Insurance (+35.43%) proves that specialized players can deliver explosive returns when sector sentiment shifts.

Your Risk: These moves are sharp and fast. Use position sizing—don’t bet more than 3-5% of your portfolio on any single mid-cap momentum play.

If You’re Value Hunting

Sometimes, the market overreacts, and patient investors get rewarded. This week, you have several opportunities:

Your Shopping List:

- Dangote Cement at ₦425: Down 3.41% from ₦440, this industrial heavyweight is trading at a mid-season discount. When construction demand picks up, you’ll be positioned.

- Julius Berger at ₦112: The 9.97% drop to ₦112 from ₦124.40 looks like profit-taking after a stellar Q2 run. Infrastructure spending isn’t going anywhere.

- VFD Group at ₦14.00: Down 5.41%, this fintech-exposed play offers leverage to digital payment growth at attractive multiples.

The Contrarian Play: PZ Cussons at ₦32.40 represents a 15% discount from its weekly open. Consumer staples companies with intense naira exposure could be surprised when input cost pressures finally ease.

Sector Allocation Strategy

Based on last week’s flow patterns, here’s how to position your portfolio:

Overweight (35-40%):

- Insurance: 5.86% sector performance with dividend catalysts ahead

- Consumer Goods: 4.08% gain signals resilient domestic demand

- Selected Mid-Caps: Growth index momentum has a runway

Neutral Weight (25-30%):

- Banking: Maintain core positions but expect profit-taking

- Oil & Gas: Cash flow preference, but watch for technical breaks

Underweight (15-20%):

- Industrial Goods: Temporary weakness but value emerging

Your Week Ahead Action Plan

Immediate Moves:

- Scale into insurance names on any Monday morning weakness

- Trail stops on banking positions that have run 20%+ year-to-date

- Build watchlists of mid-cap winners for pullback entries

Key Levels to Monitor:

- All-Share Index resistance at 121,500: A break above opens the 124,000 target

- Daily volume above ₦25 billion: Confirms institutional conviction continues

- Breadth holding above 50 advancers: Maintains bullish momentum

The Bottom Line for Your Money

Last week proved something fundamental: when volume surges 40% while breadth stays this positive, you’re not seeing speculation—you’re watching institutional repositioning for the next earnings cycle.

The math is simple: Meyer Plc delivered 60% returns in five days by focusing on operational excellence. Mutual Benefits Assurance gained 33% by trading at discount valuations. These aren’t lottery tickets—they’re quality businesses finally getting recognized.

Your competitive advantage: While others chase headlines, you can position in the sectors and stocks where institutional money is flowing. The companies that led last week’s gains weren’t random—they were undervalued plays with improving fundamentals.

Whether you’re building wealth for retirement or trading for growth, last week reminded us why staying close to where the smart money moves often beats trying to predict where markets are headed.

Please note that this analysis is based solely on market data and does not constitute personalized investment advice. Always conduct thorough research and consider your risk tolerance before making any investment decisions.