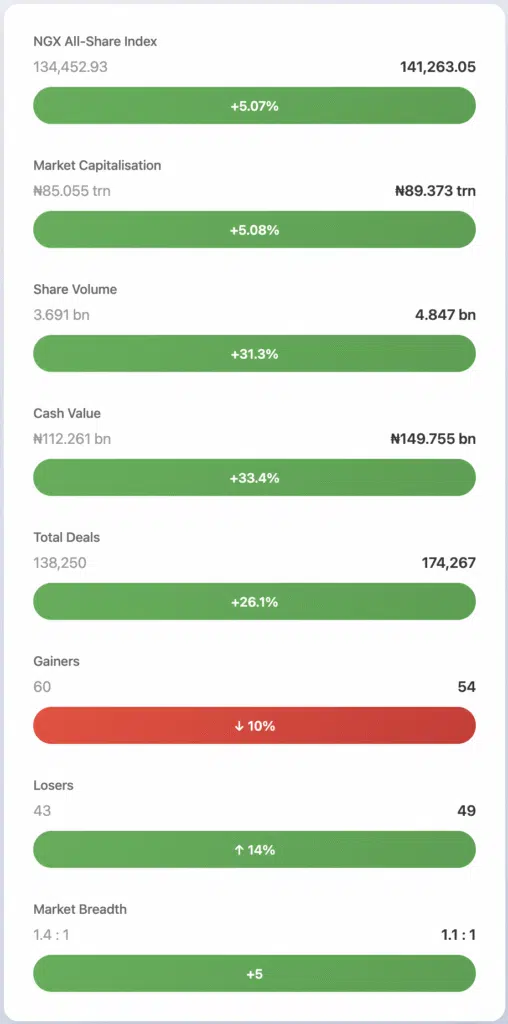

Last week felt less like a normal trading stretch and more like a sprint fueled by fresh capital. The NGX All-Share Index punched through the 140k ceiling, adding 5.07% to finish at 141,263.05 points, while market value swelled 5.08% to ₦89.373 trn.

But the real story was activity: investors exchanged 4.847 bn shares worth ₦149.76 bn in 174,267 deals, a 31% jump in volume and a 33% jump in value versus the previous week’s 3.691 bn shares and ₦112.26 bn. Money didn’t just come in—it came in fast.

Driving the charge was a broad risk-on rotation into industrials and growth names. Indices such as NGX Industrial Goods (+10.12%) and NGX Growth (+12.26%) led, while traditional defensives—Insurance (-1.22%) and Oil & Gas (-0.48%)—took a breather. With breadth still positive (54 gainers vs. 49 losers), bulls enter the new week with momentum firmly on their side.

Key Market Metrics Dashboard

Market breadth remains constructive, despite some profit-taking among previous winners.

Market Analysis Narrative (what the numbers mean)

Here’s what caught our attention:

- Liquidity surge with conviction. The 31% leap in volume came alongside a matching spike in value—no sign of “cheap-share churn.” Institutional money was active, especially in large-ticket industrial names.

- Sector rotation into builders and innovators. NGX Industrial Goods (+10.12%) and NGX Growth (+12.26%) outpaced the broad market, hinting at renewed cap-ex optimism amid stabilizing macro data. Conversely, insurance and oil and gas slipped, suggesting a temporary pause in defensive positioning.

- Financials still anchor turnover. Banks and other financials supplied 68.37% of weekly volume and 40.79% of value, reinforcing their status as the market’s liquidity conduit even as leadership broadens.

- Concentrated trade in three mid-tier names. FCMB Group, Fidelity Bank, and Universal Insurance together soaked up 25.69% of total shares traded—an unusually high slice that often precedes index-rebalancing rumors or earnings surprises.

- Momentum swings inside the week. Wednesday’s breadth flipped negative (32 decliners vs 39 advancers) before dip-buyers stormed The market closed on Friday with 34 advancers and 35 decliners. Expect volatility clusters to persist as traders digest earnings.

You can read our NGX analysis of the last week of July 2025 here.

Winners & Losers Analysis

Top 10 Gainers

Industrial goods, telecoms, and mid-tier banks dominate—evidence of broad risk appetite.

Top 10 Decliners

Declines cluster in small-cap financials and logistics—profit-taking rather than structural damage.

Sector Performance Deep Dive

| Sector (by volume) | Shares Traded | % of Total | Narrative |

| Financial Services | 3.314 bn | 68.37% | Banks remain a liquidity hub, positioning ahead of H2 results. |

| Consumer Goods | 326.46 m | 6.73% | Demand is tied to the stability of soft-commodity prices. |

| Services | 279.74 m | 5.77% | Telco-driven flows (MTN’s 20% rally). |

| Others | 926 m | 19.13% | Broad catch-up buying in industrials and growth plays. |

Index Movers: NGX Growth (+12.26%) and Industrial Goods (+10.12%) stole the spotlight, while Insurance and Oil & Gas lagged.

Volume & Value Hot-Spots

- *Top-3 tickers—FCMB, Fidelity, Universal Insurance—absorbed 1.245 bn shares (25.7% of volume) on just ₦15.83 bn consideration.

Read-through: sizeable block trades hint at institutional accumulation or index inclusion bets. - Deals density was highest on Monday & Thursday (37.6k and 37.4k respectively), even though Thursday posted the week’s widest negative breadth (55 decliners)—classic sign of rotational churn, not capitulation.

Daily Market Progression

| Date | Deals | Volume (m) | Value (₦ bn) | Adv | Dec | Unch |

| 28 Jul | 37,626 | 795.6 | 23.23 | 46 | 25 | 56 |

| 29 Jul | 28,358 | 940.8 | 30.63 | 51 | 25 | 52 |

| 30 Jul | 36,424 | 922.0 | 35.40 | 39 | 32 | 56 |

| 31 Jul | 37,371 | 1,109.4 | 33.65 | 29 | 55 | 43 |

| 1 Aug | 34,488 | 1,079.2 | 26.85 | 34 | 35 | 58 |

Thursday’s reversal flushed out weak hands; Friday’s stabilisation suggests dip-buyers remain vigilant.

Corporate Actions & Market Events

- Seplat Energy listed 11.5 m additional shares under its employee share-based plan—the float is now 599.9 m units.

- MRS Oil Nigeria completed its voluntary delisting on July 28, 2025, following an earlier suspension.

ETPs & Bonds: ETF turnover tripled to 442,918 units worth ₦25.22 m, while bond trading exploded to 1.36 m units valued at ₦1.118 bn (vs. 33k units prior)—a sign that the search for yield is broadening.

What This Means for Your Investment Strategy

Conservative investors

Stick with Tier-1 banks and telcos that continue to command a strong liquidity position. Dividend visibility, combined with solid capital buffers, keeps GTCO, Zenith, MTN Nigeria, and Access at the core of a low-beta Nigerian portfolio.

Growth-oriented investors

The 10%–12% bursts in Industrial Goods and Growth indices are early innings, not late cycle. Cement, infrastructure, and building-materials companies (e.g., Lafarge Africa) offer operating-leverage upside as government capital expenditure resumes. Pair with fintech lenders like FCMB, where volume speaks louder than rumours.

Value hunters

Oil & Gas shed 0.48% despite stable crude. Look for oversold majors (e.g., NGX Group, down 12%) now trading near book; but only add after confirming volume turns positive. Insurers, such as Cornerstone, which is currently down approximately 16%, may re-rate once the Q2 numbers clarify their solvency ratios.

This commentary is for information only and not investment advice. Do your own due diligence before acting.

Forward-Looking Analysis

| Watch-List | Key Levels / Catalysts |

| All-Share Index | Immediate support 138,000 pts (gap fill); upside target 145,000 pts if breadth widens. |

| Industrial Goods Index | Needs follow-through above 5,100 pts to confirm breakout. |

| Liquidity Pulse | Sustain ≥₦25 bn average daily value to keep rally intact. |

| Catalysts | Q2 earnings season (banks & builders), MPC rate guidance, global crude volatility, Seplat float increase effects. |

Momentum check: If daily advances outnumber declines 3 of the first four sessions, expect another leg higher; if Oil & Gas rebounds alongside banks, the index could test 10-year highs before month-end.

Please note that this analysis reflects market observations and institutional patterns, rather than personalized investment advice. Always conduct your due diligence and consider your risk tolerance before making investment decisions.