Week Ending June 20, 2025

Let me tell you something we’ve learned after two decades of watching markets:

The Nigerian Stock Exchange doesn’t give you many gifts. But when it does, you better pay attention.

Here’s what actually happened last week: The All-Share Index jumped 2.35% in five days. Trading volume nearly doubled to 3.566 billion shares. Financial services stocks dominated with 60.73% of all trading. And if you owned companies like GTCO or Beta Glass, you made 18%+ returns just by holding quality stocks.

The best part? This wasn’t luck or market manipulation. This was real money moving with real conviction—₦115.4 billion worth of conviction.

Here’s why this matters for your portfolio: When you see volume patterns like this combined with sector rotation into defensives, you’re witnessing the early stages of a sustained move. The smart money isn’t gambling—it’s positioning for what comes next.

Every number, every sector shift, every trading pattern from this week tells a story about where Nigerian markets are headed.

Let us break down exactly what happened and how you can position yourself for what’s coming.

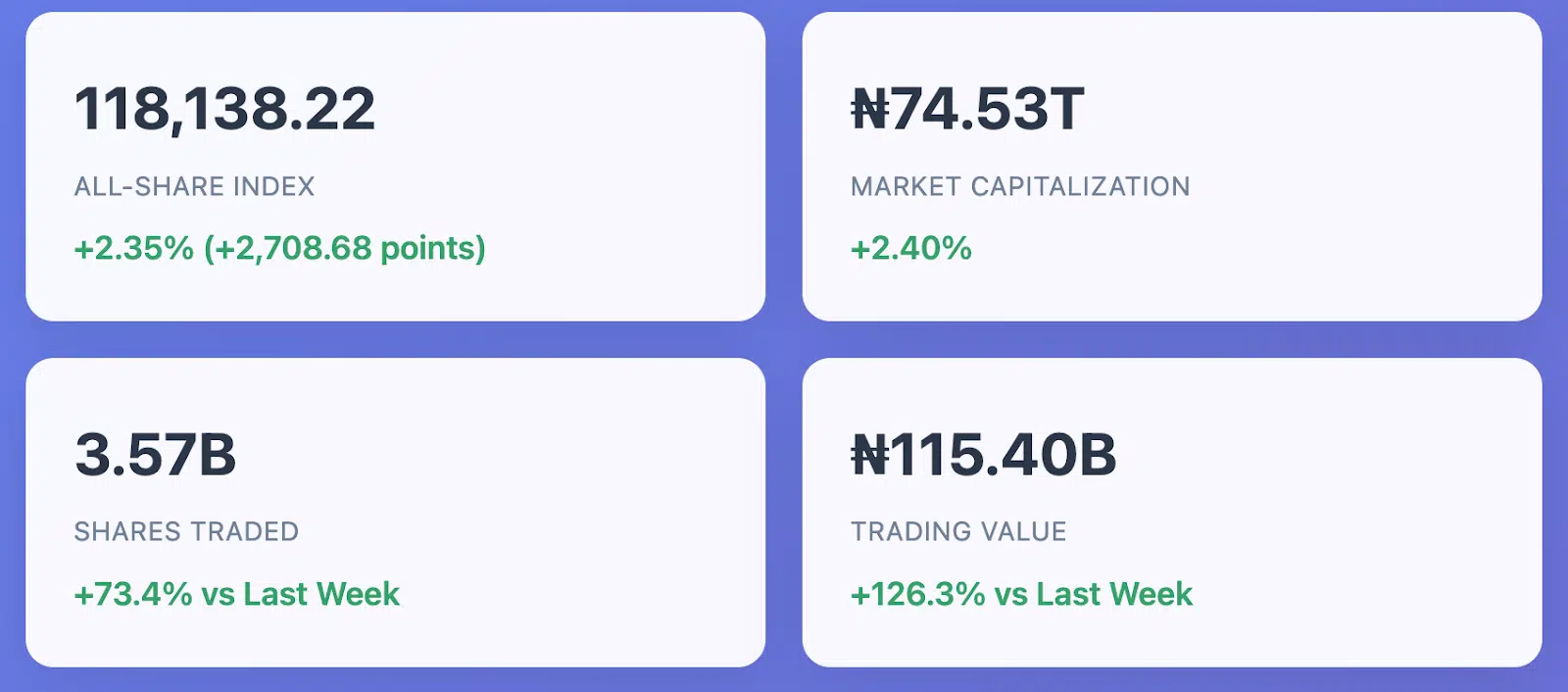

The Numbers That Actually Matter

Let us cut straight to what you care about:

Your Money This Week:

- All-Share Index: 118,138.22 (+2.35%)

- Market Value: ₦74.534 trillion (+2.40%)

- Trading Activity: 3.566 billion shares worth ₦115.403 billion

What this means in real terms: If you had ₦100,000 spread across the market, you made ₦2,350 just by holding for five days.

Not bad for a week’s work, right?

But here’s what really caught our attention—the trading volume nearly doubled from last week’s 2.057 billion shares.

When volume surges like this, it’s not speculation. It’s conviction.

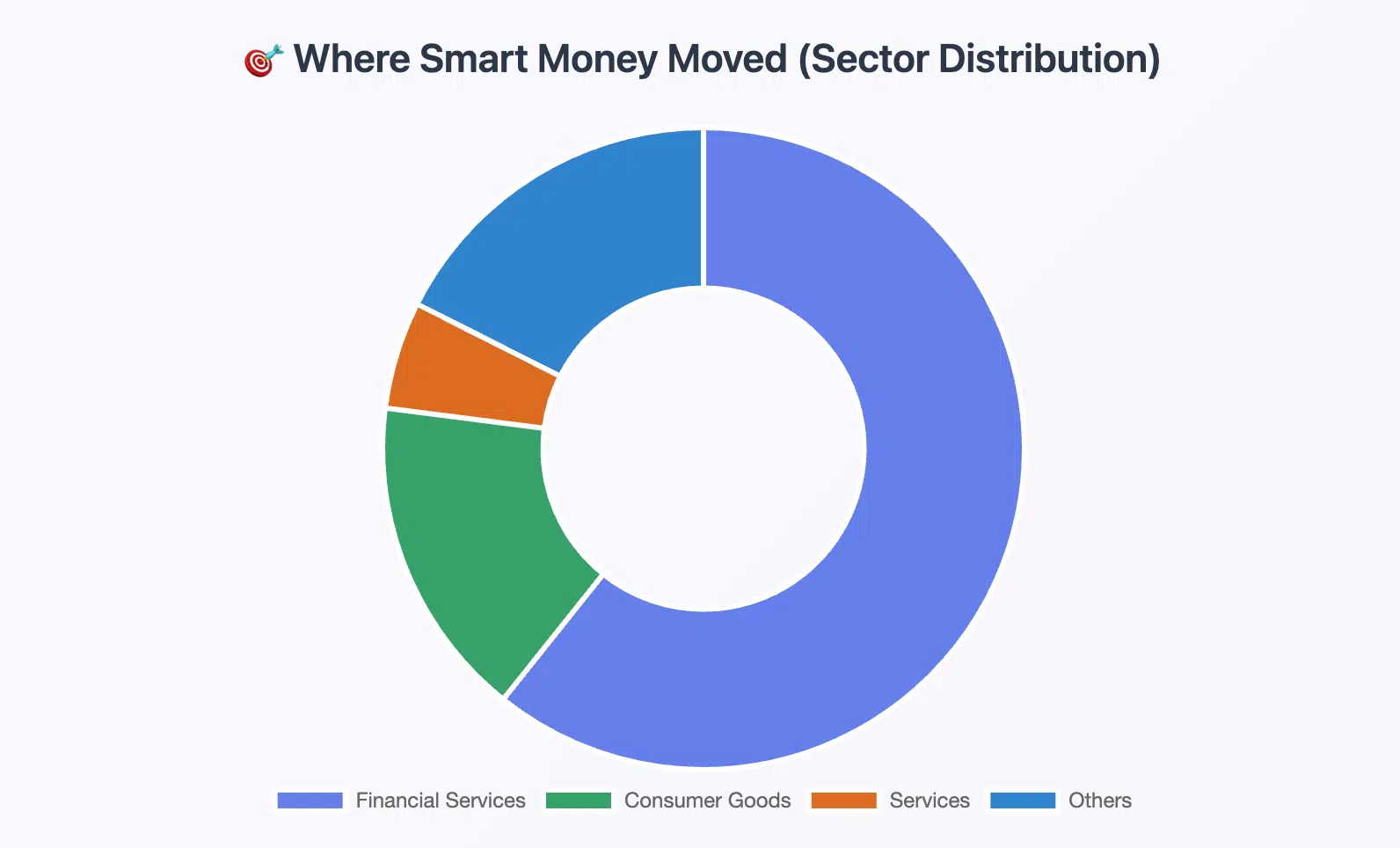

Where Smart Money Moved This Week

The Financial Services sector absolutely dominated the show:

Financial Services Performance:

- 60.73% of all trading volume

- ₦62.046 billion in total value

- 45,851 deals executed

Think about that for a second. Six out of every ten shares traded this week were financial stocks.

Why this matters to you: When uncertainty hits global markets, Nigerian investors consistently flock to banks and financial institutions. It’s like watching a master class in defensive investing play out in real time.

The Full Sector Breakdown:

- Financial Services: 2.166 billion shares (60.73%)

- Consumer Goods: 580.893 million shares (16.29%)

- Services: 193.300 million shares (5.42%)

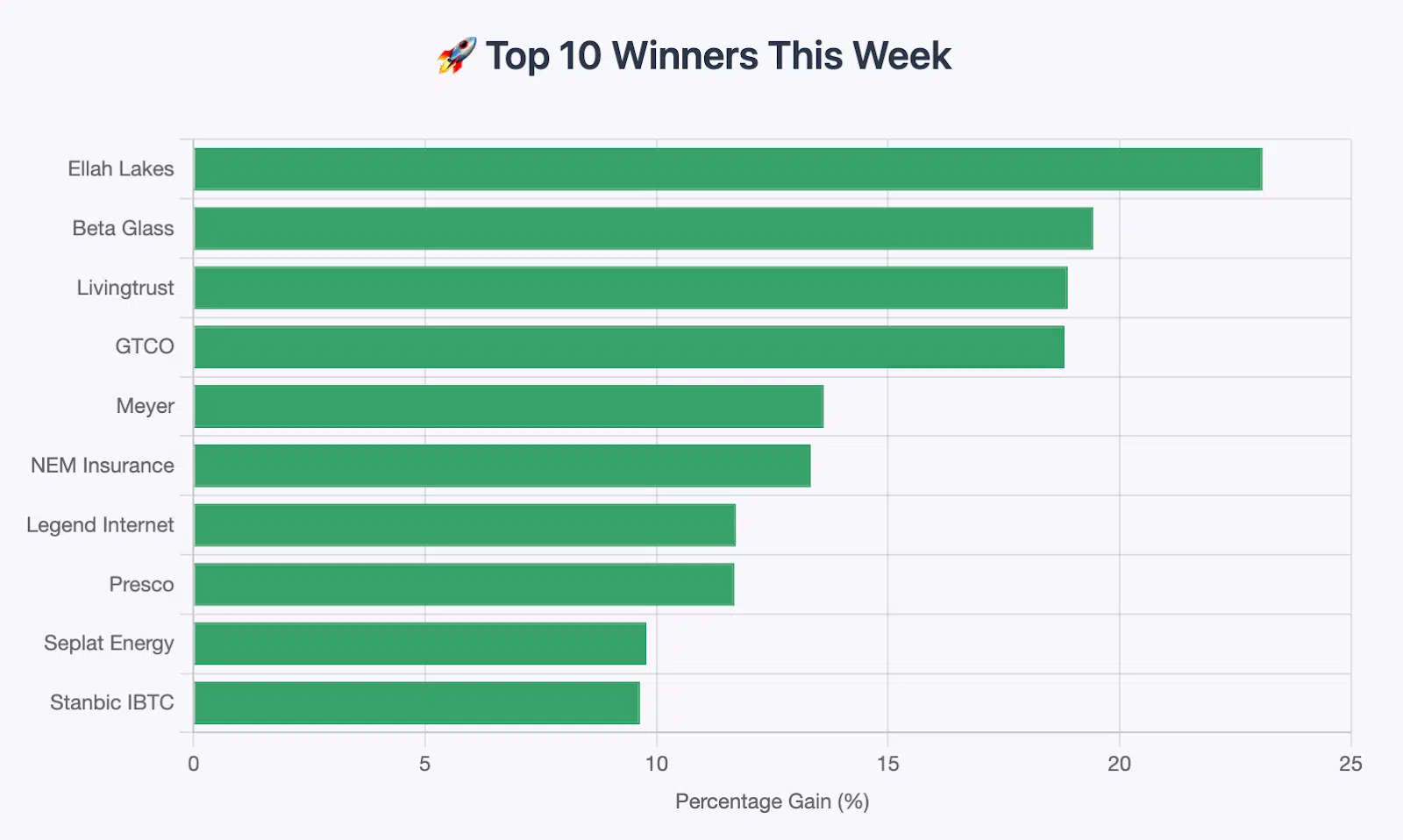

Last Week’s Biggest Winners

Here’s where things get interesting. The top performers weren’t just random stocks—they tell a story:

Top 10 Gainers:

| Company | Open Price | Close Price | Gain | % Change |

| Ellah Lakes | ₦4.33 | ₦5.33 | +₦1.00 | +23.09% |

| Beta Glass | ₦231.10 | ₦276.00 | +₦44.90 | +19.43% |

| Livingtrust Mortgage | ₦5.72 | ₦6.80 | +₦1.08 | +18.88% |

| GTCO | ₦71.50 | ₦84.95 | +₦13.45 | +18.81% |

| Meyer | ₦8.45 | ₦9.60 | +₦1.15 | +13.61% |

| NEM Insurance | ₦15.00 | ₦17.00 | +₦2.00 | +13.33% |

| Legend Internet | ₦7.09 | ₦7.92 | +₦0.83 | +11.71% |

| Presco | ₦985.00 | ₦1,100.00 | +₦115.00 | +11.68% |

| Seplat Energy | ₦4,964.40 | ₦5,450.00 | +₦485.60 | +9.78% |

| Stanbic IBTC | ₦79.35 | ₦87.00 | +₦7.65 | +9.64% |

The pattern is clear: Financial stocks dominate the winners list, but industrial and energy companies are also joining the party.

If you owned GTCO, you made almost 19% in five days. That’s the kind of return most people hope for in a year.

The Losers: Hidden Opportunities?

Every rally has its casualties. Here’s who got left behind:

Top Decliners:

| Company | Open Price | Close Price | Loss | % Change |

| N Nig. Flour Mills | ₦112.55 | ₦93.20 | -₦19.35 | -17.19% |

| Sunu Assurances | ₦5.23 | ₦4.56 | -₦0.67 | -12.81% |

| Oando | ₦69.00 | ₦61.00 | -₦8.00 | -11.59% |

Contrarian thinking: Oando at ₦61.00 might be creating a value opportunity. Sometimes the market overreacts, and patient investors get rewarded.

How the Week Unfolded

Here’s how momentum built throughout the week:

| Day | Volume (Million) | Value (₦ Billion) | Winners | Losers |

| Monday | 721.8 | ₦22.01 | 21 | 43 |

| Tuesday | 787.3 | ₦25.67 | 29 | 35 |

| Wednesday | 640.1 | ₦26.01 | 38 | 32 |

| Thursday | 894.0 | ₦22.03 | 43 | 20 |

| Friday | 522.8 | ₦19.68 | 37 | 27 |

Thursday was the inflection point. That’s when 43 stocks advanced compared to just 20 declining—the strongest market breadth of the week.

Volume Leaders: Where the Action Really Happened

The three most actively traded stocks told us everything about investor psychology:

Top 3 by Volume:

- Zenith Bank

- Champion Breweries

- Access Holdings

Together, these three accounted for:

- 1.003 billion shares (28.14% of total volume)

- ₦26.076 billion in value

- 14,232 transactions

What this reveals: When volumes surge, smart money goes to quality. These aren’t speculative plays—they’re the foundation stocks that serious investors build portfolios around.

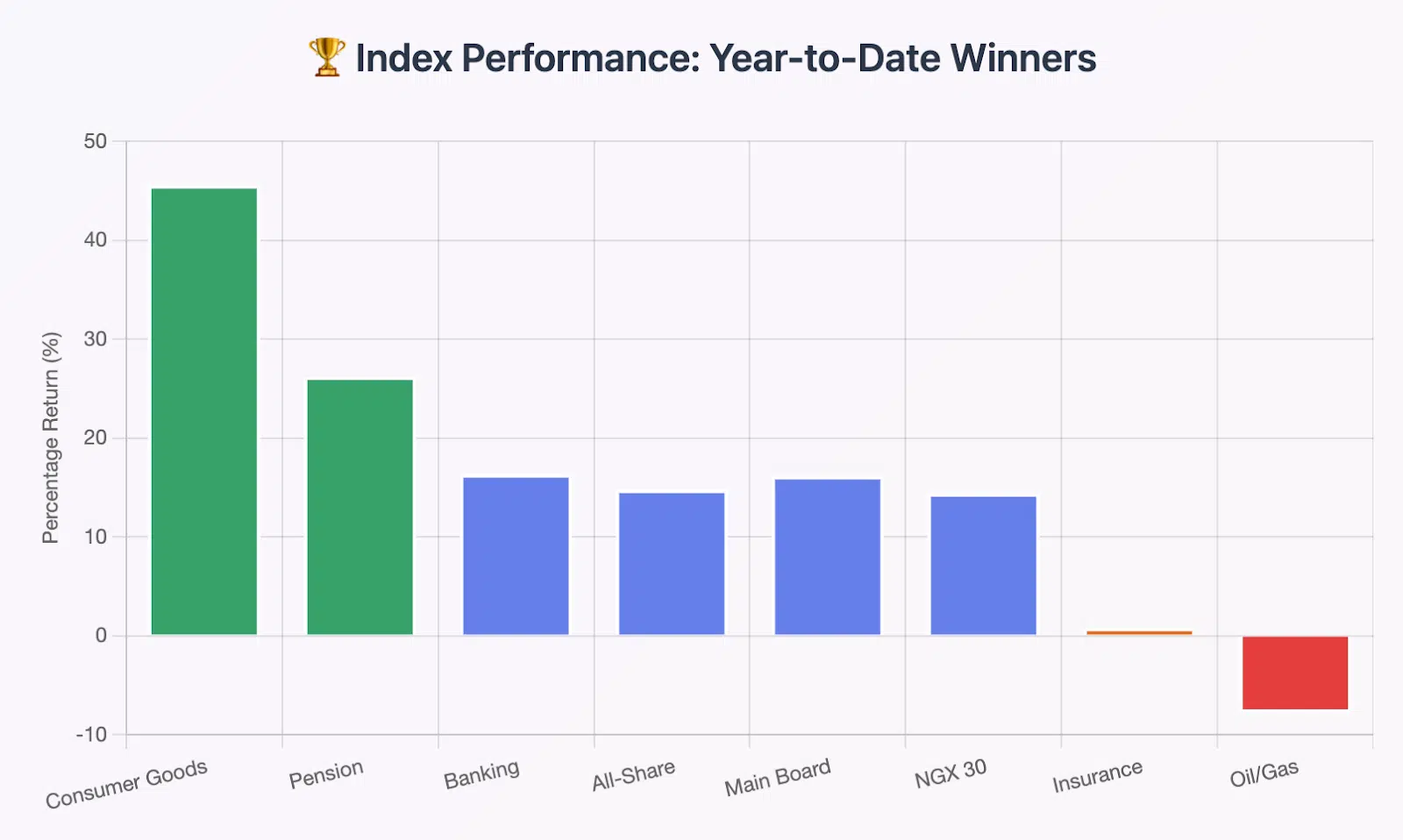

Sector Performance 📊

Index Performance (Week-on-Week):

- NGX All-Share Index: +2.35%

- NGX Banking Index: +3.58%

- NGX Oil/Gas Index: +5.27% Best performer

- NGX Pension Index: +4.21%

- NGX Premium Index: +3.24%

- NGX Consumer Goods: +2.16%

- NGX Insurance Index: +2.37%

The surprise winner? Oil & Gas with a 5.27% gain, largely driven by Seplat Energy’s strong performance.

Year-to-date context:

- All-Share Index: +14.78%

- Consumer Goods: +45.59%

- Banking Index: +16.34%

Corporate Actions: What’s Moving Behind the Scenes

This Week’s Key Developments:

1. Chams Holding Rights Issue

- 2.348 billion new shares offered at ₦1.70 each

- Ratio: 1 new share for every 2 held

- Qualification date: June 16, 2025

2. Sterling Financial Expansion

- 6.66 billion additional shares listed

- Total shares: Now 52.1 billion (up from 45.5 billion)

3. Thomas Wyatt Nigeria

- Trading suspension lifted after filing required accounts

- Back to active trading Wednesday, June 18

4. New Futures Contracts

- NGX30Z5 and NGXPENSIONZ5 futures launched

- Expiration: December 19, 2025

ETFs and Bonds

Exchange Traded Products:

- 31,960 units traded worth ₦5.8 million

- Top performer: STANBICETF30 with 7,830 units

Bond Market Activity:

- 106,836 units traded worth ₦104.9 million

- Strong appetite for government securities

- Preference for longer-duration bonds

What This Means for Your Investment Portfolio

Let us share insights from someone who’s been watching these markets closely.

Oge Ndukwe (CoachOge), CEO at Globfolio, puts it perfectly:

“Fundamentally sound stocks benefiting from current macro events remain a top pick for us, especially the non-banking stocks less prone to regulatory risk.

You saw what happened in the market this week following the CBN circular; it is a clear reminder that a diversified portfolio across different sectors is key.

The market would have been affected if banks had not released a statement confirming their positions and explaining how they plan to write off the forbearance loans.

This week, I plan to double down on oil and gas amidst the Middle East crisis, watching selected strong companies like Seplat for a clear buy signal.

Here’s what this means for you:

If You’re Conservative:

- Focus on quality banks: GTCO, Zenith Bank, Access Holdings

- Consider consumer staples: Companies that benefit from domestic demand

- Watch dividend plays: Airtel Africa paid ₦61.75 dividend this week

If You’re Growth-Oriented:

- Energy sector opportunity: Seplat Energy up 9.78% signals sector recovery

- Industrial plays: Beta Glass (+19.43%) shows manufacturing strength

- Financial services momentum: Mortgage banks leading gains

If You’re Value Hunting:

- Oando at ₦61.00: Potential oil sector value play

- VFD Group: Fintech exposure at attractive levels

- Selected insurance stocks: Trading below historical averages

Note, this is not investment advice; please do your due diligence.

Your Action Plan for This Week

What to Watch:

Momentum Indicators:

- Can banking stocks break above key resistance levels?

- Will oil & gas continue its 5.27% weekly rally?

- Consumer goods sustainability after 45.59% YTD gains

Key Levels:

- All-Share Index: Support at 115,000, resistance at 120,000

- Banking Index: Watch for break above 1,300

- Volume confirmation: Need sustained high trading activity

Potential Catalysts:

- Corporate earnings season approaching

- Interest rate policy decisions

- Global oil price movements

The Bottom Line

This week proved something fundamental about the Nigerian market:

Quality always finds a way to rise.

The stocks that led gains weren’t penny stocks or speculative plays. They were established companies with real businesses, strong balance sheets, and clear competitive advantages.

Your takeaway: Build your portfolio around companies that:

- Have consistent trading volumes

- Show earnings growth

- Operate in defensive sectors

- Pay regular dividends

The math is simple: A 2.35% weekly gain with doubled trading volumes isn’t luck—it’s the market rewarding patience and quality focus.

Whether you’re just starting your investment journey or you’ve been at this for years, this week reminded us why staying invested in fundamentally sound companies often beats trying to time the market.

Remember: Every great portfolio was built one quality stock at a time, through weeks like this one.