Week ended Friday, 27 June 2025.

The Nigerian Exchange closed the week ending June 27, 2025, with a compelling mix of growth and rotation, revealing where smart money is moving.

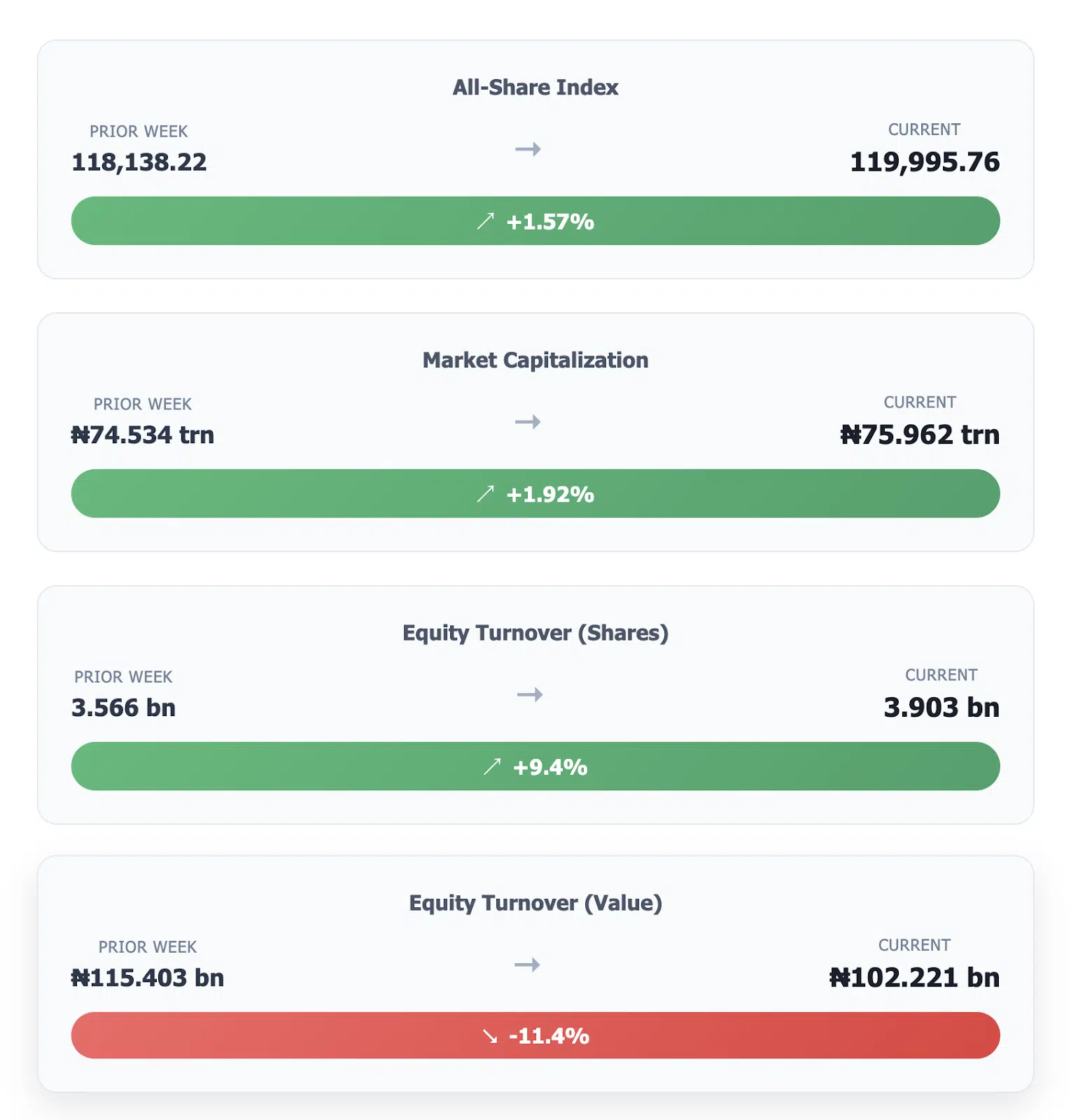

The headline All-Share Index climbed 1.57% to 119,995.76 points, while market capitalisation expanded by ₦1.428 trillion to reach ₦75.962 trillion. But here’s what the surface numbers don’t immediately tell you: this wasn’t just another week of broad-based gains.

Volume surged 9.4% to 3.903 billion shares traded, yet the total value dropped 11.4% to ₦102.221 billion. This apparent contradiction signals a fundamental shift in market dynamics: investors have rotated from high-priced blue chips into smaller, more speculative plays.

The math is clear: more shares changing hands at lower average prices means money flowed toward mid-cap and small-cap opportunities.

Market breadth painted an even more telling picture. With 78 stocks advancing versus only 27 declining, the positive momentum reached nearly three-quarters of actively traded securities.

The +51 spread between gainers and losers marked the most bullish breadth reading in six weeks, suggesting that institutional accumulation, rather than retail speculation, drove the week’s performance.

The winners and losers

This week’s biggest winners:

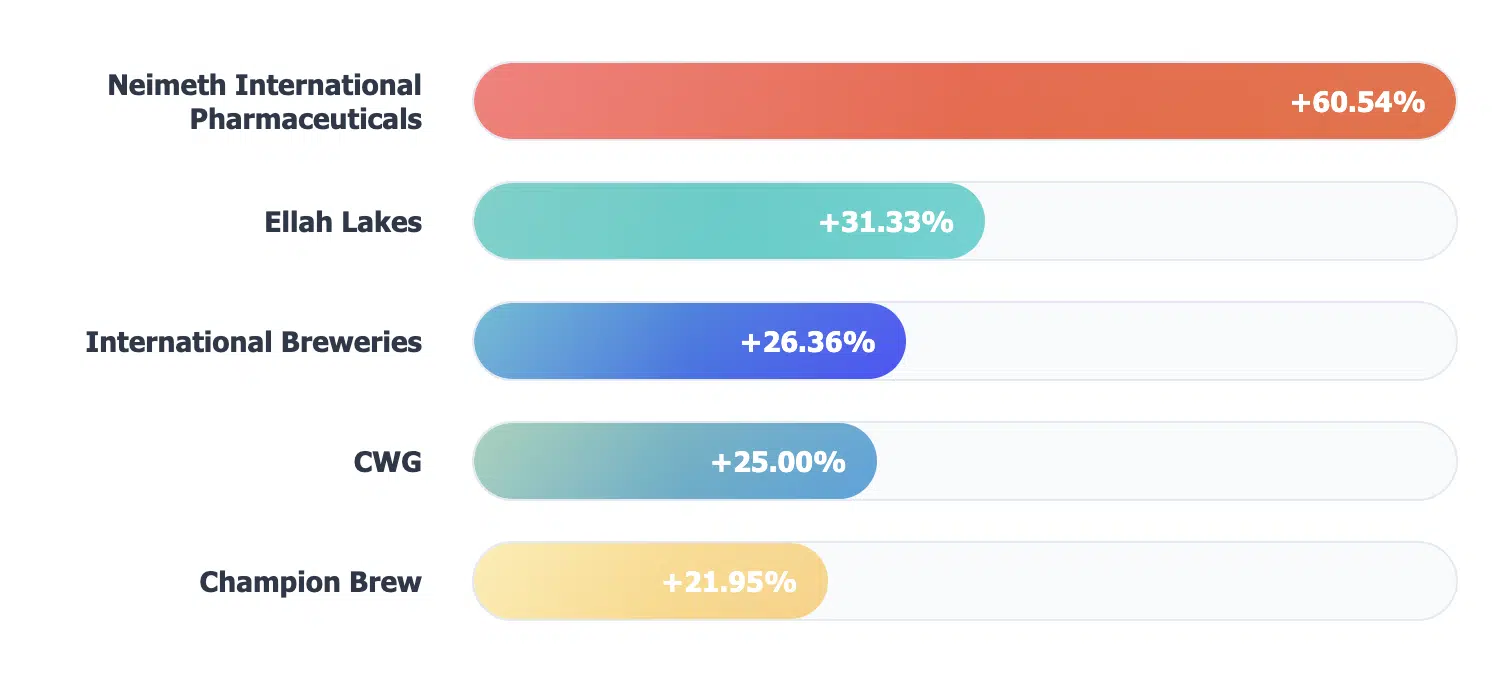

Notice the pattern? These aren’t your typical blue-chip companies.

The Losers:

The week’s biggest story unfolded among small- and mid-cap names that most institutional reports barely mention. Neimeth International Pharmaceuticals rocketed 60.54% higher after what appears to be supply shock news in the pharmaceutical sector.

When a stock doubles in a week on volume, it’s rarely random; someone knows something, and early positioning typically rewards patient investors.

Ellah Lakes (+31.33%) and International Breweries (+26.36%) joined the party, suggesting consumer-facing companies benefited from improving sentiment around domestic demand.

CWG (+25.00%) and Champion Brew (+21.95%) rounded out the top five, creating a diverse group of winners spanning pharmaceuticals, leisure, beverages, technology, and brewing.

This breadth across unrelated sectors indicates broad-based optimism rather than sector-specific momentum.

The losers’ list proved equally instructive. Multiverse Mining (-9.33%) and Associated Bus Company (-9.26%) led decliners, both small-cap names that likely suffered profit-taking after strong recent runs. More concerning was Oando’s -7.38% decline, given its size and importance to the Oil & Gas index.

BUA Foods’ -6.46% drop also stands out, as food producers typically benefit during periods of defensive positioning.

Oando’s decline stands out—when a major oil stock drops 7.4% while crude oil stays stable above $81, that’s usually profit-taking, not panic.

Where smart money went this week

Here’s what the big players were doing:

Financial Services Still Dominated:

- 2.030 billion shares (52% of all volume)

- ₦41.934 billion in value (41% of total)

- Just 3 banks handled 22% of ALL trading

But here’s the surprise I bet you missed:

The “Others” category moved over 1 billion shares.

These are mid-cap stocks most people ignore. When they get this much action, something’s brewing.

Two possibilities:

- Institutions are positioning ahead of earnings season

- These stocks are about to enter major indices

Either way, you should pay attention.

The index rotation story

Best Performing Indices:

- MERI Value: +6.32%

- Consumer Goods: +3.73%

- Insurance: +3.67%

- Banking: +2.59%

- All-Share: +1.57%

Worst Performer:

- Oil & Gas: -2.23%

When value indices outperform growth by 4x, institutional money is rotating. This usually signals either

- Growth stocks are too expensive

- Value stocks are finally getting noticed

- Both

Etfs & bonds snapshot

Exchange-traded fund activity surged dramatically, with 71,070 units trading worth ₦50.203 million – nearly 10 times the previous week’s ₦5.800 million. NEWGOLD dominated with ₦41.943 million in trades alone, representing 84% of the total ETF value.

This massive flow into gold-backed securities suggests that investors sought inflation hedges amid concerns about currency volatility.

The bond market exhibited similar yield-seeking behavior, with 143,857 units worth ₦134.173 million changing hands, compared to 106,836 units worth ₦104.905 million the previous week.

The 28% increase in bond trading value indicates an institutional appetite for fixed income, particularly given the new TSL SPV listing, which offers a 21% coupon. When bond volumes surge alongside equity activity, it typically signals a portfolio rebalancing rather than a flight-to-safety move.

Government bonds dominated the activity, with FGSUK2033S6 and FGS202760 accounting for the most significant trades. The preference for government paper over corporate bonds reflects ongoing concerns about credit quality.

However, the successful TSL SPV bond listing at 21% suggests that investors remain open to high-yield infrastructure debt with proper guarantees.

- ETFs: 71,070 units traded worth ₦50.20 m, nearly 10× last week’s cash. NEWGOLD swaps alone printed ₦41.9 m.

- Debt: 143,857 bond units crossed, value ₦134.17 m. New listings, such as TSL 2035S1 (21% coupon), gained traction, signaling an appetite for high-yield infrastructure paper.

Takeaway: spill‑over demand into yield assets remains selective—gold‑backed and guaranteed notes rule.

Corporate actions & listings brief

- Stanbic IBTC added 2.945 billion shares via a rights issue—float now 15.9 billion. Liquidity events like this often compress price in the short term; we watch for a re‑rating later.

- TSL SPV listed a ₦5 bn, 10‑year, 21 % guaranteed bond. Coupon implies blended cost ~T/Bills +900 bps—good real yield in a falling inflation arc.

What do these numbers tell you about next week?

Six Things to Watch:

- Value Rotation Continues: MERI Values +6.32%, suggesting this trend has legs. If growth stocks continue to disappoint, expect more rotation.

- Oil & Gas Bounce Potential. With crude stable above $81, the -2.23% sector decline might be a buying opportunity.

- Mid-Cap Momentum Over 1 billion shares in the “Others” category signal something’s brewing beyond the prominent names.

- Oil & Gas bounce? Crude prices stabilized above $81; watch to see if Oando recovers its lost ground.

- Banking profit‑taking—six straight green weeks; RSI hovering 70.

- Consumer Goods earnings window—Cadbury, Beta Glass numbers may confirm volume‑driven rally.

Several themes emerged from the week’s data that deserve continued monitoring. The rotation toward value stocks suggests institutional investors expect either slowing growth or better opportunities among undervalued names. This trend could accelerate if the upcoming earnings season reveals growth companies missing elevated expectations.

The weakness in the oil and gas sector, despite stable crude prices, warrants attention. If this represents profit-taking following a strong year-to-date performance, the sector could still offer opportunities. However, if fundamental issues emerge around production or refining margins, the weakness could spread to related industries.

The surge in small and mid-cap activity suggests these names may be entering a favorable period. When institutional volume concentrates in tier-one banks while retail investors chase smaller names, it often creates opportunities for patient investors willing to research beyond the obvious choices.

Bottom Line

This week’s data reveals a Nigerian stock market gaining sophistication and depth. The successful execution of significant corporate actions, healthy trading volumes across multiple sectors, and broad participation rates all suggest a maturing capital market that can handle substantial flows while maintaining orderly price discovery.

For investors, the key insight is recognizing where the smart money moved: into value stocks, defensive sectors, and yield-bearing assets. The shift from growth to value, the surge in gold ETF activity, and the strong demand for high-yield bonds all indicate that investors are seeking protection against uncertainty while remaining committed to equity exposure.

Volume rotated into mid‑caps while blue‑chip banks anchored sentiment. Breadth widened, indexes climbed, and value styles topped the chart. Only Oil & Gas lagged amid profit‑taking. Liquidity stays healthy, though naira volatility may still set the tone.