Framing the new week & new month beginning Mon, 1 Sept 2025

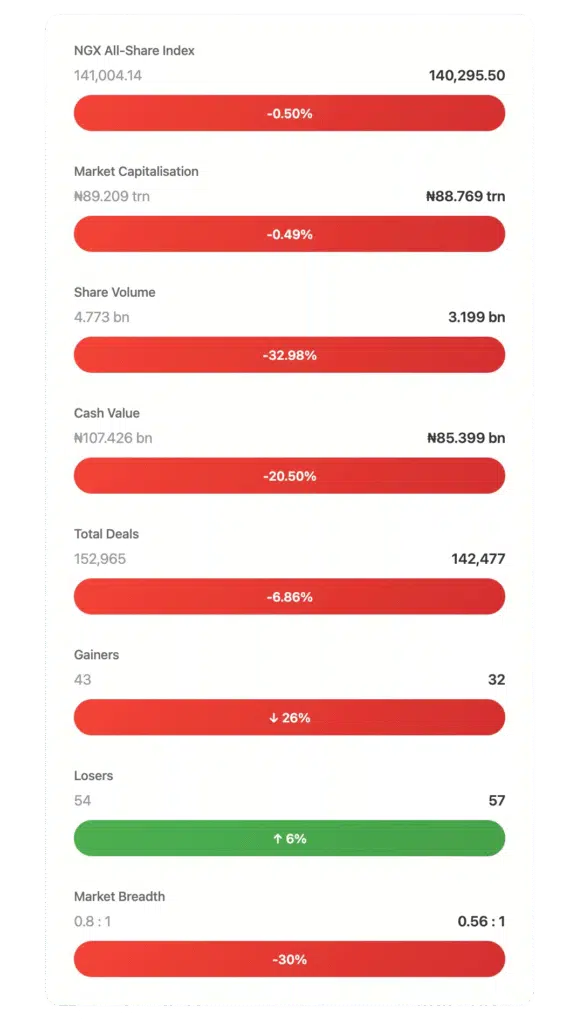

New month, fresh tape—but last week left a pretty straightforward set of footprints. Liquidity cooled, breadth narrowed, and leadership retreated to the safest corners of the board. Equity turnover fell to 3.199 billion shares (₦85.399 billion) in 142,477 deals, down from 4.773 billion (₦107.426 billion) in 152,965 deals the week before—roughly −33% by volume and −20.5% by value. That is not apathy; that’s selectivity.

Price action corroborates it. The NGX All-Share Index slipped 0.50% to close at 140,295.50, with market cap easing 0.49% to ₦88.769 trillion. Almost every index finished lower, except the NGX AFR Div Yield (+0.94%)—a neat tell that dividend-seekers quietly set the tone while momentum cooled. As a new month opens, that defensive hum matters.

Under the hood, Financials still did the heavy lifting—68.61% of equity volume and ~50% of traded value—but even there, the weekly banking index printed a −1.21% decline. Consumer Goods (-0.89%) and Insurance (-1.02%) backed away after big year-to-date runs, while Oil & Gas barely budged (−0.18%). Rotation didn’t disappear; it just got cautious.

Finally, the flow mix broadened. ETP deals ticked up even as units/value softened, and bond activity rose across units, value, and deals. When equities cool and bonds perk up heading into a new month, portfolio rebalancing—not panic—usually explains it.

Read our stock market analysis for August 2025 here

Key Market Metrics Dashboard

Market Analysis Narrative

Here’s what really caught our attention: conviction narrowed without vanishing. Total equity value declined by approximately ₦22 billion week-on-week, but the market still processed ₦85 billion across over 142,000 transactions. That’s real liquidity—just choosier.

The sector mix says the same thing. Financial Services pushed 2.195 billion shares (₦42.689 billion) across 66,808 deals, contributing 68.61% of all shares and ~50% of all cash; Consumer Goods followed (277.9 million shares; ₦9.91 billion), then Services (179.0 million; ₦1.31 billion). When one sector carries nearly 70% of the tape, leadership is intact—even if prices take a breather.

Breadth told the real story. Only 32 advancers vs 57 decliners, with 57 unchanged, is textbook narrow participation. The day-by-day internals sharpen that picture: Monday opened with healthy breadth (40 advancers vs 17 decliners), but the subsequent four sessions skewed negative, even as Thursday delivered the turnover peak (884.96 million shares; ₦28.25 billion).

High turnover on down-breadth days typically indicates distribution rather than accumulation.

Still, buyers didn’t hide. Three names—FCMB Group, Champion Breweries, and Access Holdings—soaked up 24.34% of weekly volume and 15.40% of value (778.60 million shares; ₦13.16 billion across 11,288 deals).

That’s where the market chose to be loud. Combine this with dividend resilience (AFR Div Yield +0.94%), and the pattern is clear: risk remained on a leash, not off the field.

Winners & Losers Analysis

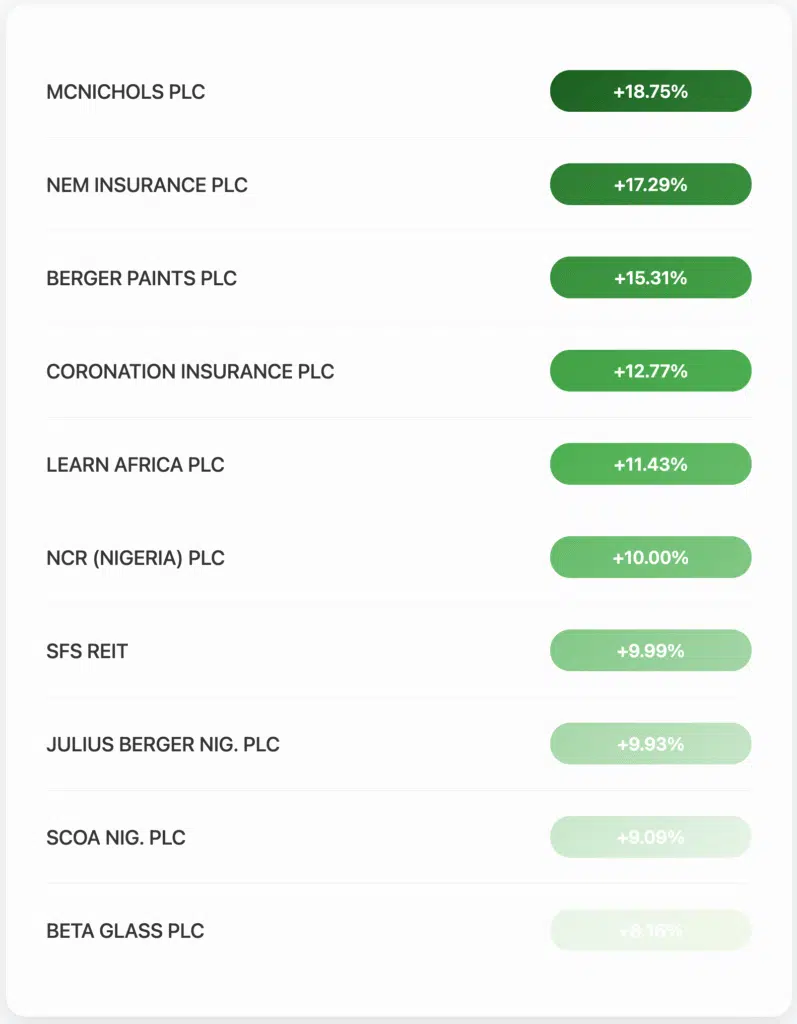

Top 10 Gainers (Week)

If you owned MCNICHOLS, you booked +18.75% in five sessions; NEM Insurance delivered +17.29%, and Julius Berger tacked on +9.93%—a spread that mixes small-cap momentum, financial defensives, industrials, and a property trust (SFS REIT).

That’s not one theme; it’s selective buyers picking pockets of strength.

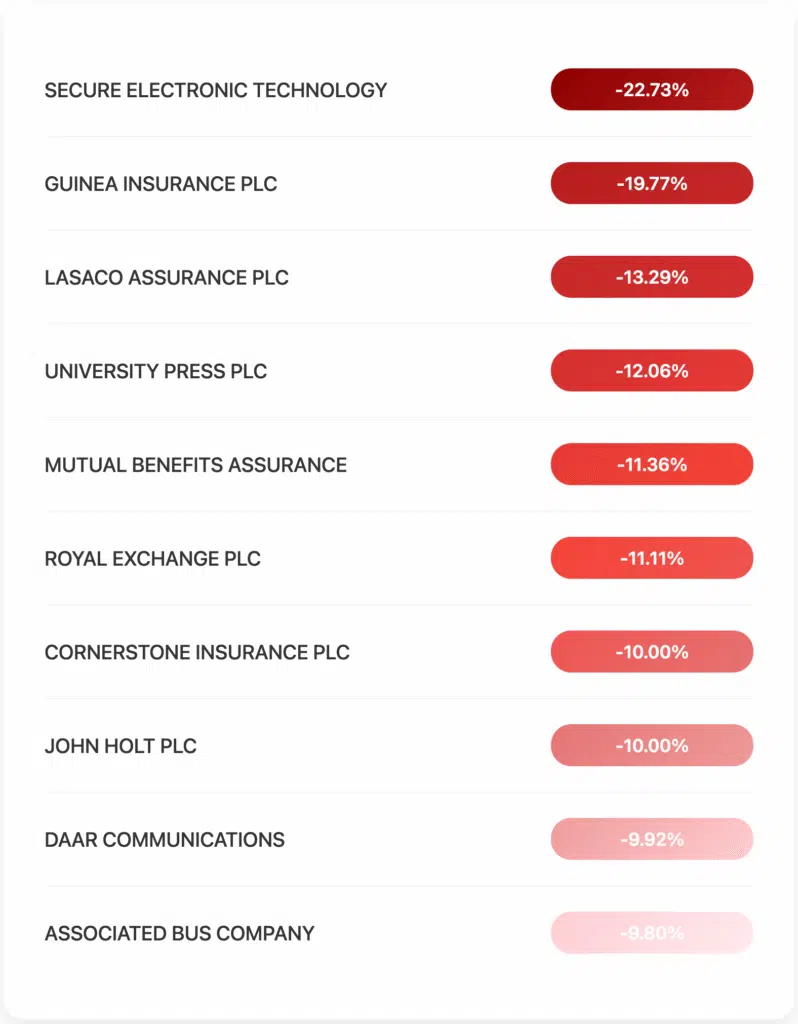

Top 10 Decliners (Week)

Notably, Insurance names sat at both extremes—NEM among top gainers, while Guinea, Lasaco, Mutual Benefits, Cornerstone fell double-digits—evidence of intra-sector dispersion and stock-specific selection.

University Press also adjusted for a ₦0.15 dividend during the week (ex-div 25 Aug), which partly explains the print.

Sector Performance Deep Dive

- By Volume (shares): Financial Services 2.195 bn (68.61%), Consumer Goods 277.88 m (8.69%), Services 178.99 m (5.59%); others ~17.1%.

- By Value (₦): Financial Services ₦42.689 bn (50.0%), Consumer Goods ₦9.910 bn (11.6%), Services ₦1.308 bn (~1.53%).

- Index Moves (WtD): AFR Div Yield +0.94% (only riser); Banking −1.21%; Insurance −1.02%; Consumer Goods −0.89%; Oil/Gas −0.18%; ASeM flat.

Takeaway: Smart money stayed anchored in Financials (flow), while price leadership rotated defensively toward dividend payers (print).

Volume & Value Analysis

- Top activity trio: FCMB, Champion Breweries, Access = 24.34% of weekly volume and 15.40% of value (778.60 m shares; ₦13.16 bn; 11,288 deals). That combination—two banks plus a brewer—captures both liquidity and consumer demand bets.

- Deal concentration: Financials executed 66,808 of 142,477 deals (~46.9%), underscoring institutional depth even in a softer week.

Daily Market Progression

| Date | Deals | Volume | Value (₦) | Adv | Dec | Unch |

| Mon 25-Aug | 33,305 | 591.22 m | 11.65 bn | 40 | 17 | 72 |

| Tue 26-Aug | 28,819 | 604.99 m | 12.89 bn | 27 | 34 | 67 |

| Wed 27-Aug | 28,651 | 682.85 m | 22.22 bn | 17 | 40 | 70 |

| Thu 28-Aug | 26,129 | 884.96 m | 28.25 bn | 19 | 39 | 71 |

| Fri 29-Aug | 25,573 | 435.13 m | 10.39 bn | 19 | 31 | 78 |

Momentum peaked on Thursday (value and volume highs) despite negative breadth—classic distribution tells into the month-end.

Corporate Actions & Market Events

- Price Adjustment: University Press (ex-div ₦0.15) on Mon, 25 Aug; ex-div price ₦6.15.

- Listings (Funds):

- NIDF—additional 270,382 scrip units listed (total now 1,056,014,529).

- Coronation Infrastructure Fund (CNIF)—87.9 million units of Series 1 listed (₦100/unit; 10-year closed-end fund).

- NIDF—additional 270,382 scrip units listed (total now 1,056,014,529).

- Rights Trading: Industrial & Medical Gases Nigeria Plc—199,797,458 rights at ₦32.00, 2-for-5, trading opened Fri, 22 Aug; closes 02 Oct 2025—symbol RR2025IMG.

- FGN Bonds (Supplementary Listing): 19.30% FGN APR 2029 (+4.705 m units → 940.34 m total); 19.89% FGN MAY 2033 (+295.99 m units → 2.513 bn total).

- ETPs: 202,506 units (₦23.784 m) in 390 deals vs last week’s 396,920 units (₦39.032 m) in 365 deals. Most active by deals/units included LOTUSHAL15, STANBICETF30, VSPBONDETF; NEWGOLD printed modest volume but meaningful value.

- Bonds (secondary): 80,523 units (₦74.045 m) in 32 deals vs 58,537 (₦58.768 m) in 26 deals.

What this means for your investment strategy

Conservative investors

Last week’s AFR Div Yield outperformance (+0.94%) against broad weakness argues for a dividend-quality tilt. Consider maintaining core exposure in liquid Financials (the sector carried ~50% of weekly cash) while pacing entries—bank index printed −1.21% WtD. Use breadth as your risk gauge; when advancers persist below decliners, let the tape come to you.

Growth-oriented investors

The Access/FCMB flows (plus Champion Breweries) indicate that liquidity and consumer spending are the week’s actionable duos. Track whether Thursday’s high-turnover downtick resolves higher this week; if value and volume expand on up-days, momentum can re-ignite quickly into early September.

Beta Glass (+8.16%) and Julius Berger (+9.93%) show there’s still a selective bid for industrial cash-generators even in a down week.

Value hunters

The losers’ column is a ready-made watchlist. Insurance saw dispersion: NEM rallied by +17.29%, even as Guinea, Lasaco, Mutual Benefits, and Cornerstone fell by 10–20%. That divergence is where mispricings often hide—but demand a catalyst and confirm with breadth before stepping in.

University Press screened weaker, but note its ₦0.15 dividend adjustment on Monday—strip that out to avoid false signals. This is not investment advice; please do your due diligence.

Forward-Looking Analysis (Week of 1 Sept 2025)

- ASI level to watch: Can the index reclaim 141,000 (last week’s prior close 141,004.14) and hold? That’s your simplest read on whether distribution has run its course.

- Breadth/momentum: Monitor advancers vs decliners daily; last week, only Monday printed positive breadth. A sustained shift to positive breadth, combined with rising value, would flag accumulation.

- Sector tells:

- Dividends: If AFR Div Yield stays bid, defensive posture persists.

- Banks: A turn up from −1.21% WtD could quickly restore market-wide risk appetite.

- Consumer Goods & Insurance: Both eased WtD but remain strong YtD; watch for buy-the-dip footprints (value rising on up-days).

- Dividends: If AFR Div Yield stays bid, defensive posture persists.

- Flows beyond equities: Bond units/value rose (units +37.6%, value +26.0% vs prior week), while ETP deals increased despite lighter units/value. If that persists, expect measured, not manic, equity risk-taking.

Appendix: Sector & Product Tape (selected stats)

- Financials: 2.195 bn shrs; ₦42.689 bn; 66,808 deals.

- Consumer Goods: 277.881 m; ₦9.910 bn; 15,518 deals.

- Services: 178.992 m; ₦1.308 bn; 7,580 deals.

- ETPs (by deals/volume): LOTUSHAL15, STANBICETF30, VSPBONDETF led activity.

- Bonds (most notable listings): 19.30% FGN APR 2029 & 19.89% FGN MAY 2033 supplementary units.

Please note that this analysis reflects market observations and institutional patterns, rather than personalized investment advice. Always conduct your due diligence and consider your risk tolerance before making investment decisions.