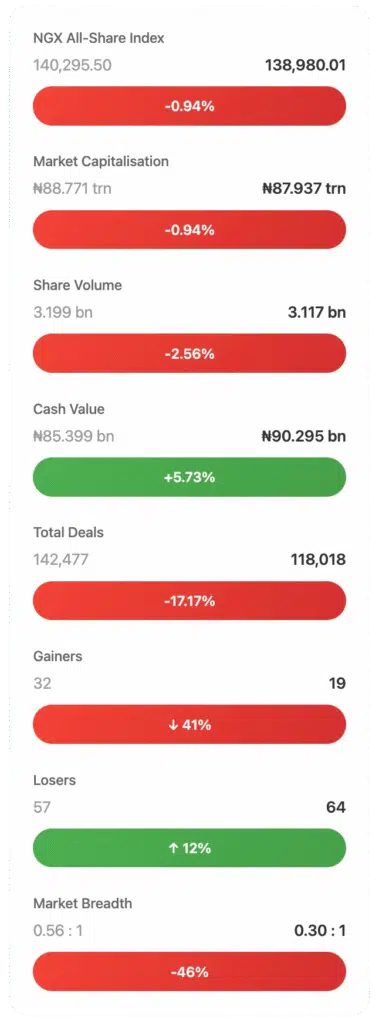

A four-session week (Friday was a public holiday) closed red at the headline level, but the tape wasn’t uniformly weak. The All-Share Index (ASI) slipped 0.94% to 138,980.01, while market cap settled at ₦87.937 trillion.

Turnover showed a classic “rotation” mix: fewer shares changed hands week-on-week, yet cash value rose—signalling preference for higher-priced tickets on certain days, even as breadth deteriorated overall.

What really caught our attention was Tuesday’s spike in value (₦39.87bn) without an equivalent surge in shares traded—textbook institutional prints—followed by a monster volume day on Thursday (1.82bn shares) that coincided with the only strongly positive breadth reading of the week. In short: big cheques early; broad participation late.

Under the hood, Financials dominated volume (81.55% of shares, a third of value), and three names—Sovereign Trust Insurance, Access, and Fidelity—soaked up 54% of all shares traded but only ~11% of value, a sign that the week’s “activity heat” skewed toward lower-priced counters even as blue-chip blocks printed elsewhere.

The index map showed widespread, if orderly, drift: Banking, Consumer Goods, and Industrial Goods all eased; Growth eked out a small gain; Commodity was flat-to-up by a whisker. That’s defensives taking a breather while pockets of spec still hunt.

You can read our stock market report series here.

Key Market Metrics Dashboard

Sources & notes: Weekly totals, breadth and ASI close from NGX weekly report; market cap shows the reported close (₦87.937tn); the “previous” cap is derived from the stated -0.94% WoW move. Volume/value/deals comparisons are directly from NGX.

Here’s what the numbers mean for investors

Breadth turned decisively negative—just 19 advancers versus 64 decliners—so the “average” stock fell even as money found selective paths, particularly on Tuesday’s high-value tape. When the value rises while the share count drops, it usually means larger denominations are being swapped—think block prints or higher-priced stalwarts, rather than a retail frenzy.

Then, on Thursday, the script flips: a surge in shares traded and a strong, positive breadth day (41 up vs. 14 down) suggest that dip-buyers stepped in broadly before the long weekend. Net-net: institutions set the tone early; breadth rescued late, but not enough to save the week.

Sector leadership was concentrated in activity rather than performance. Financials accounted for 81.55% of all shares (2.542 billion) and approximately a third of the value (₦30.357 billion)—a significant participation, albeit a modest cash share. Services and Consumer Goods were a distant second and third in volume, at ~3.7% and 3.4%, respectively.

Meanwhile, the sector indices bled in unison—Banking (-1.52%), Consumer (-1.18%), Industrial (-2.08%), Oil & Gas (-0.77%)—with NGX Growth the lonely green shoot (+0.15%) and NGX Commodity essentially flat (+0.04%). Translation: broad de-risking with just a sliver of risk appetite.

The concentration stat of the week: three tickers—STIP, ACCESS, FIDELITY—captured 54.05% of volume but only 10.87% of value. That mismatch screams “lower-priced liquidity magnets” rather than high-ticket leadership, and it helps explain why the ASI leaked even as the tape was busy.

Winners & Losers (Full Format)

Top 10 Gainers

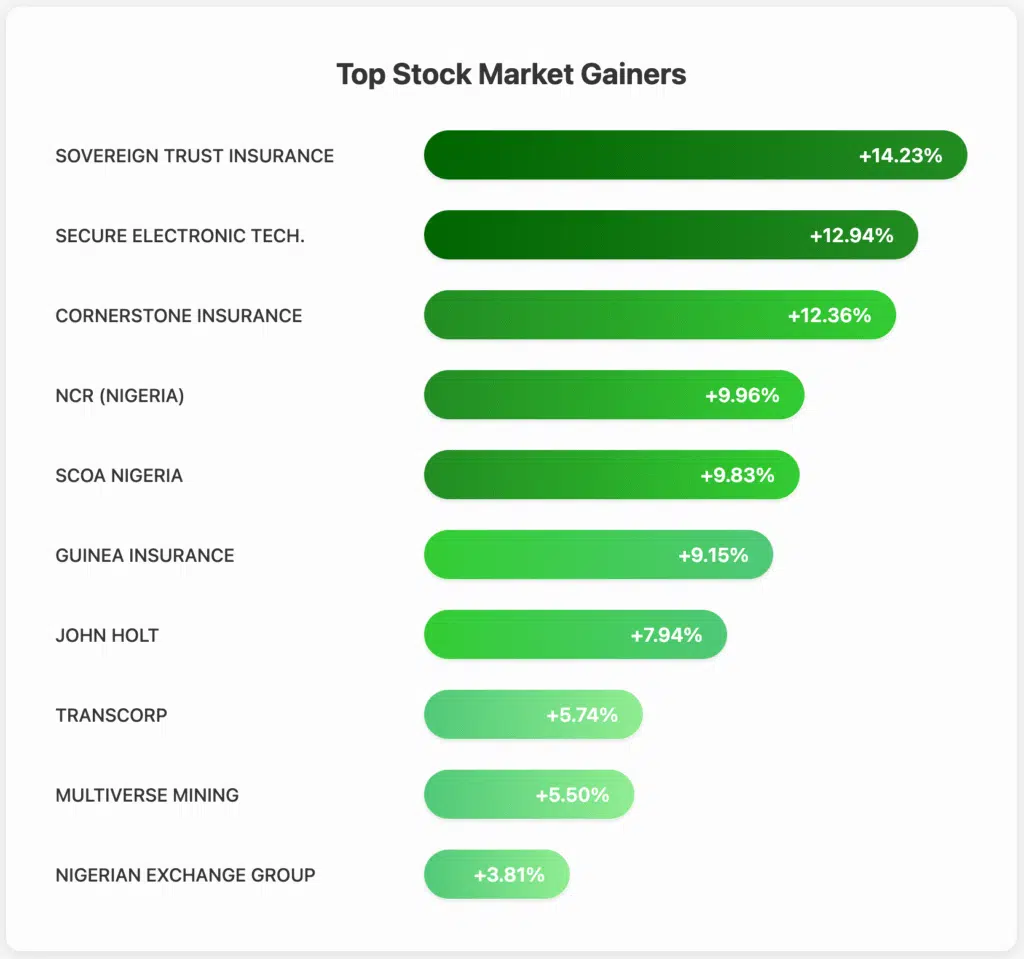

Pattern watch: Insurers pepper the winners list (STIP, Cornerstone, Guinea), alongside cyclicals (Transcorp, Multiverse) and a marquee services name (NGX Group). If you held Sovereign Trust Insurance, you booked a 14.23% return in four sessions; Transcorp holders saw a 5.74% return. Momentum was evident in lower-denomination financials, with selective participation from large caps.

Top 10 Decliners

Read-through: Declines clustered across staples (PZ), materials (Lafarge), consumer discretionary (Champion), and insurance (AIICO). That cross-sector synchrony is precisely what you see when macro risk dominates stock-specific stories.

Sector Performance Deep-Dive

- Activity: Financial Services printed 2.542bn shares (81.55% of volume) for ₦30.357bn (33.62% of value). Services did 114.61 million shares (~3.68% volume) for ₦0.816 billion (~0.9% value). Consumer Goods traded 105.45 million shares (~3.38% volume) for ₦5.492 billion (~6.1% value). That mix = heavy flow in cheaper financial names; higher Naira tickets concentrated in fewer consumer counters.

- Indices (WoW): Banking -1.52%, Consumer Goods -1.18%, Industrial Goods -2.08%, Oil & Gas -0.77%, Growth +0.15%, Commodity +0.04%. Broadly defensive posture with a narrow growth bid.

Volume & Value Analysis

- Total market: 3.117bn shares, ₦90.295bn, 118,018 deals. Prior week: 3.199bn shares, ₦85.399bn, 142,477 deals → fewer shares (-2.56%), more cash (+5.73%), fewer prints (-17.17%). Interpretation: big tickets concentrated in fewer hands; retail-style churning tapered.

- Concentration: STIP + ACCESS + FIDELITY = 54.05% of volume but only 10.87% of value → low-price liquidity drivers.

Daily Progression (Mon–Thu)

| Date | Deals | Volume (m) | Value (₦ bn) | Adv | Dec | Unch |

| 01-Sep | 33,843 | 407.96 | 14.77 | 15 | 33 | 78 |

| 02-Sep | 31,400 | 407.57 | 39.87 | 11 | 49 | 65 |

| 03-Sep | 28,177 | 482.75 | 19.67 | 15 | 44 | 67 |

| 04-Sep | 24,598 | 1,818.99 | 15.98 | 41 | 14 | 71 |

Corporate Actions & Market Events

- Ex-Div: Red Star Express Plc marked ex-dividend on 03/09/2025 (₦0.35), price adjusted from ₦12.00 to ₦11.65.

- Regulatory: NGX suspended trading in three issuers (Regency Alliance Insurance, International Energy Insurance, and Universal Insurance) on Monday, 1 September 2025, due to default filings. The suspension on Universal Insurance was lifted on Wednesday, 3 September 2025, after the required submissions were made.

ETFs & Bonds

- ETPs: 129,163 units traded (₦11.282m, 239 deals) vs 202,506 units (₦23.784m, 390 deals) last week → lighter risk appetite in listed funds.

- Bonds: 17,617 units, ₦18.000m, 12 deals (down from 80,523 units, ₦74.045m, 25 deals previously), consistent with a brief equity-first tilt despite headline index softness.

What this means for your strategy (this week)

Conservative:

- Keep core exposure but tilt to liquidity and defensives while breadth is negative. Consider large, dividend-reliable names within sectors that fell modestly (e.g., Consumer Goods -1.18%, Oil & Gas -0.77%) and let prices come to you. Tighten risk on highly extended industrials (Industrial Goods -2.08%).

Growth-oriented:

- Momentum scan: Insurers led the winners board (STIP +14.23%, Cornerstone +12.36%, Guinea +9.15%). Use strength-on-pullback logic rather than chasing green candles—Thursday’s broad rally shows buyers are there, but the weekly trend is still down.

Value hunters:

- Contrarian watchlist: Lafarge (-13.08%), PZ (-13.28%), Champion (-13.29%) and University Press (-9.75%) flagged double-digit weekly drawdowns. Pair any bottom-fishing with sector context (Consumer -1.18%, Industrial -2.08%) and look for stabilizing breadth days like Thursday before adding.

This is not investment advice; please do your due diligence.

Forward Look (week of 8 Sept 2025)

- Levels: Watch for an early attempt to reclaim ~140,295 (last week’s open) and to hold 138,980 (weekly close). A sustained push back above Tuesday’s value tone would confirm institutional appetite.

- Participation: Monitor whether Financials continue to shoulder over 80% of the share volume (healthy liquidity) or if leadership broadens (indicating healthier risk-on).

- Tape tells: Another high-value/low-volume day implies block prints are back; another high-volume/positive-breadth day (like Thu) would hint that last week’s selling was more rotation than risk-off.

- Corporate/Regulatory: Monitor any further suspension/filing updates, as well as ex-div adjustments—micro-catalysts that can impact short-term flows in specific names.