Nigeria has recorded the second-largest decline in the number of dollar millionaires globally over the past decade, according to the latest Private Wealth Migration Report by Henley & Partners and New World Wealth.

The report shows that the number of High-Net-Worth Individuals (HNWIs) — those with over $1 million in liquid assets — in Nigeria dropped by 53% between 2014 and 2024, falling from 15,000 to 7,200. This marks a loss of 7,800 millionaires over the period, the second-largest drop among 59 countries analyzed.

Last year, Nigeria lost 1,000 millionaires, falling from 8,200 in 2023 to 7,200. The country now has 20 centi-millionaires (those worth over $100 million) and three billionaires. Nigeria also retained the unenviable title of experiencing Africa’s biggest millionaire exodus.

Currency woes, capital flight, and market underperformance blamed

Andrew Amoils, head of research at New World Wealth, attributed the drop to several factors, including naira depreciation, increased emigration of wealthy Nigerians to countries such as the United Arab Emirates (UAE), the United Kingdom (UK), and parts of Europe, and the underperformance of Nigeria’s local capital markets.

“The Nigerian stock market hasn’t developed in line with global peers like the Johannesburg Stock Exchange,” said Amoils.. “Security concerns have also driven out significant wealth.”

Since July 2023, the naira has lost more than 50% of its value following two major devaluations. Data from the Central Bank of Nigeria (CBN) shows the official exchange rate rose from ₦645.10/$ in 2023 to an average of ₦1,450/$ in 2024, with the naira trading between ₦1,500 and ₦1,600/$ as of mid-2025.

While the CBN’s recent push to unify exchange rates and improve forex liquidity has brought some relative stability, the long-term erosion of wealth has already taken a toll.

Despite strong recent performance by the Nigerian Exchange Limited (NGX) — ranking among Africa’s top-performing bourses in 2023 and early 2024 — structural issues around liquidity, depth, and investor confidence still lag behind more developed markets like South Africa and Egypt.

Africa’s wealth outflows intensify

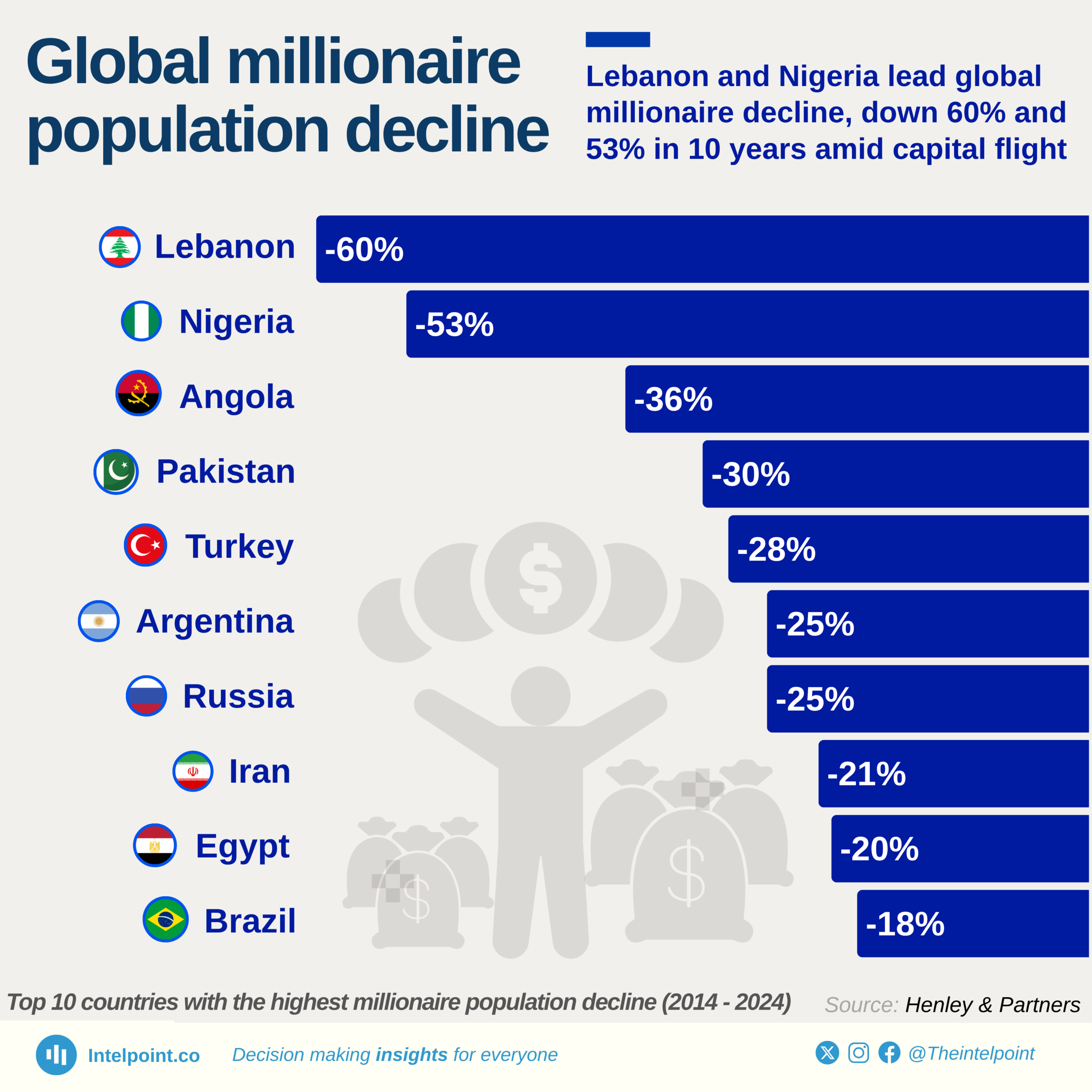

Globally, Lebanon recorded the highest millionaire loss over the last decade (60%), followed by Nigeria (53%), Angola (36%), Pakistan (30%), Türkiye (28%), and Argentina (25%). Others in the top 10 include Russia (25%), Iran (21%), Egypt (20%), and Brazil (18%).

Henley & Partners forecasts Nigeria will lose another 200 millionaires in 2025, reducing its HNWI population to 7,000. This would be the second-highest projected decline in Africa, behind South Africa, which is expected to lose 250 millionaires.

While South Africa and Egypt recorded 12% and 20% drops respectively, smaller African countries are bucking the trend. Seychelles, Morocco, and Mauritius — projected to reach 50, 100, and 100 millionaires respectively — recorded strong millionaire growth of 35%, 36%, and 63%.

These countries are benefiting from political stability, investor-friendly environments, and growing reputations as offshore and lifestyle wealth destinations. Angola and Egypt are expected to see fewer millionaire exits in 2025, at 50 and 100, respectively.

Europe also sees wealth drain

Globally, 142,000 millionaires are expected to migrate in 2025, up from 134,000 in 2024. The UK is set to experience the world’s largest net outflow of HNWIs — 16,500 — driven largely by new tax rules. A key migration destination for many Nigerians, the country’s millionaire population has declined by 9% over the past decade.

“Since the 2016 Brexit vote, the UK has shifted from being a net importer to a net exporter of wealth,” the wealth report noted.

Tax reforms enacted by the previous Conservative government — including sharp increases in capital gains and inheritance taxes, and the removal of non-domicile benefits — took effect in April 2025 and have triggered a rush to exit.

Trevor Williams, chair of FXGuard and former chief economist at Lloyds Bank Commercial Banking, said the UK’s millionaires drop makes it the only country in the world’s top 10 wealth markets (W10) to post a decline. By contrast, the US saw a 78% increase in millionaires during the same period — the fastest growth in the W10.

France, Spain, and Germany are also set to lose 800, 500, and 400 millionaires, respectively, in 2025, while Ireland, Norway, and Sweden are experiencing rising outflows as affluent individuals seek more tax-efficient and investor-friendly destinations.

UAE, Monaco, and Malta leading inflows

The UAE continues to dominate as the top global destination for migrating millionaires, with an estimated net inflow of 9,800 HNWIs in 2025. Golden visa schemes, zero income taxes, and an upscale lifestyle are also attracting wealth to Monaco, Malta, Portugal, Italy, Greece, and Switzerland.

Emerging hubs include Dubai, Florida, Milan, St. Julian’s, Lisbon, the Athenian Riviera, and Swiss financial enclaves like Zug and Lugano.

Saudi Arabia is the biggest climber in the Middle East, projected to welcome a net inflow of 2,400 millionaires, driven by economic reforms and a surge of returning nationals and foreign investors to cities like Riyadh and Jeddah.

In the Americas, Costa Rica, Panama, the Cayman Islands, and Bermuda are poised to attract record numbers of wealthy migrants. In Africa, Morocco, Mauritius, and the Seychelles are listed among the top inbound destinations for millionaires in 2025.

Montenegro tops global wealth growth

Montenegro recorded the fastest millionaire growth rate globally over the past decade, with a 124% increase, thanks to its now-discontinued citizenship-by-investment program (2019–2022), low taxes, Adriatic coastline, and EU membership prospects.

Malta follows with 87% growth, although recent European Court of Justice rulings against its naturalization-by-investment process may slow further gains. Latvia, with 70% growth between 2014 and 2024, is also expected to attract 100 more millionaires this year.

“If you look at the fastest-growing wealth markets, most are either attractive destinations for migrating millionaires — like the UAE, Montenegro, Malta, and the U.S. — or emerging tech and innovation hubs like China, India, and Taiwan,” said Amoils of New Wealth.

“This underscores how critical millionaire migration is to long-term wealth creation and economic power,” he added.