When Nigeria ratified the African Continental Free Trade Area (AfCFTA) in 2020, it was sold as a once-in-a-generation opportunity, a chance to plug Africa’s largest economy into a single market of 1.3 billion people and finally shift from oil dependency to production and trade.

The promise was clear: to open borders, boost intra-African trade, and position local businesses for continental growth. Five years later, the federal government has just completed its first implementation review, marking a quiet but significant milestone in its AfCFTA journey.

The report, published by the Federal Ministry of Industry, Trade and Investment with technical support from the UNDP, marks Nigeria’s assessment under the Phase I Protocols, the backbone of the AfCFTA, covering Trade in Goods, Trade in Services, and the Protocol on Rules and Procedures on the Settlement of Disputes. In essence, these protocols are the nuts and bolts that decide whether trade actually flows or stays trapped in policy documents.

While officials privy to the review stress that Nigeria has made progress in implementing the framework agreement, a closer look reveals a mixed picture of early wins, persistent gaps, and a policy environment still trying to find its rhythm.

Trade in Goods: Tariff issues and trade facilitation

The backbone of AfCFTA is tariff liberalisation, entailing the reduction of duties on 90% of goods traded among African countries.

Nigeria has submitted its tariff offer, committing to scrap duties on 90% of goods traded within the bloc. The submission, made through the ECOWAS common schedule, follows AfCFTA’s agreed rules that allow countries to gradually phase out tariffs on a small share of sensitive products over a period of up to ten years. While the government has not disclosed the exact number of tariff lines covered, the offer signals Nigeria’s move to align with the AfCFTA’s broader goal of boosting intra-African trade and reducing barriers across the continent.

The Manufacturers Association of Nigeria (MAN) notes that only around 10–15% of Nigeria’s exports go to African markets, still largely dominated by crude oil alongside smaller shares of manufactured goods and processed foods. Despite tariff commitments, non-tariff barriers, such as border delays and inconsistent product standards, continue to blunt the real gains of regional trade.

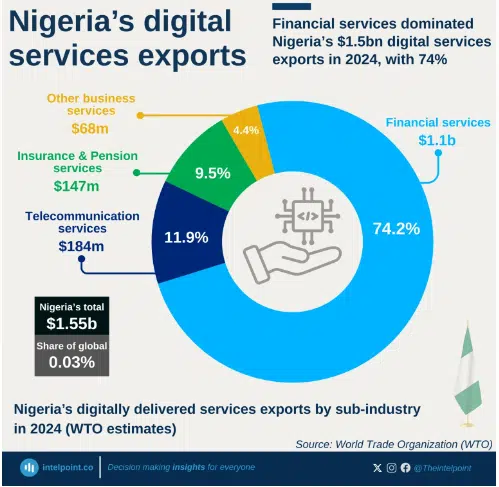

Source: Intelpoint

The Minister of Industry, Trade and Investment, Dr Jumoke Oduwole, speaking at the 31st Nigerian Economic Summit in Abuja, acknowledged this reality. “The question is not just about policy ambition, but about delivery,” she said.

“How do we translate trade policy into practice so that exporters can begin to feel the impact?” The ministry’s 2025 priorities, she noted, include investment mobilisation, export diversification, and trade policy reform, with AfCFTA at the centre. “We’ve taken practical steps. We submitted our schedule of tariffs, established a Central Coordination Committee for AfCFTA to get certainty in implementation,” she added.

While tariffs are being aligned on paper, trade facilitation remains one of the biggest barriers. Olusegun Awolowo, National Coordinator, Nigeria/AfCFTA Coordination Office, has stressed that aligning tariffs alone won’t deliver real gains. Nigeria must “streamline customs procedures and interconnected transport systems which are essential to ensuring the seamless movement of goods within and across her borders,” he said.

However, efforts are underway to address this. In 2024, the Nigeria Customs Service began rolling out its Unified Customs Management System (UCMS), known as B’Odogwu, to automate cargo clearance and reduce delays. The agency says it plans to digitize most ports and border stations by 2025, a move projected to sharply cut waiting times and ease regional trade bottlenecks.

Still, for many small exporters, AfCFTA’s promise still feels out of reach. A 2020 Brookings/NACCIMA survey found that only 25% of Nigerian MSMEs were even aware of the agreement, and few are formally registered, making it difficult to meet certification and rules-of-origin requirements. Despite tariff offers, non-tariff and institutional hurdles continue to hold smaller firms back from the regional market.

Trade in Services: The winning frontier

While goods dominate headlines, services could be Nigeria’s biggest AfCFTA win. Following the 2024 GDP rebasing, the country’s service sector contributes about 53-57% to the economy, driven by ICT, finance, logistics, and creative industries.

Nigeria has submitted draft service offers under AfCFTA in its five priority sectors (business services, communication, financial, transport and tourism), which are under stakeholder validation by the Nigerian Office for Trade Negotiations (NOTN).

Yet, despite the progress, regulatory barriers remain a serious constraint. Licensing requirements in professional services are still cumbersome, and cross-border payment systems need clearer rules and smoother implementation to unlock the promise of trade in services.

Insights provided for TechPoint by Dr Jumoke Oduwole capture this: “Africa remains a marginal player on the global stage. The continent accounts for less than 1% of the otal digitally delivered services trade, valued at approximately $4.6 trillion in 2024. Nigerian and African technology innovators often struggle to export their services and expand their operations to other African countries due to complicated regulatory rules and procedures.”

Notwithstanding, some bright spots are emerging. Fintechs like Flutterwave and Paystack now hold licenses in multiple African countries, demonstrating how digital finance can lead the way in implementing the AfCFTA.

According to recent estimates from Intelpoint, the data and research arm of Businessfront Limited, Nigeria’s digital and online service exports reached roughly $1.5 billion in 2024, largely driven by financial services, therefore suggesting strong but uneven progress beyond goods.

Find more insights at Intelpoint.

As Vice President Kashim Shettima pointed out during the AfCFTA Digital Trade Workshop and Global Market in February 2025, Nigeria’s progress in digital commerce, services, and innovation has positioned the country as the continent’s digital trade hub.

“Our innovations in mobile payments have transformed cross-border payments, financial inclusion, and digital transactions across the continent,” he stated, affirming that the country’s real dividends from AfCFTA won’t necessarily come from moving goods but through trade in digital services, finance, innovation, and skills.

Yet, that potential still hinges on regulatory harmonisation. The Nigeria Data Protection Commission (NDPC) has signed cooperation pacts with a few African counterparts, but gaps in cross-border data rules continue to slow fintech expansion. On the ground, logistics firms like Westrend Logistics say fragmented road transit guarantees and border delays keep driving up the cost of moving goods across ECOWAS borders.

Dispute Settlement: The Weakest Link

Perhaps the most underdeveloped aspect of Nigeria’s AfCFTA readiness is dispute resolution. Phase I of the agreement includes a Dispute Settlement Protocol (Rules and Procedures on the Settlement of Disputes), loosely modelled on the WTO’s system, allowing member states to contest unfair trade practices before the AfCFTA’s Dispute Settlement Body. But the mechanism remains largely untested and slow to take shape.

Nigeria still lacks a domestic mechanism for handling AfCFTA-related disputes. The Ministry of Justice has not established a specialised tribunal or legal desk to manage trade cases under the pact. Some progress is emerging, however: in 2024, ECOWAS organised a series of capacity-building workshops in Abuja for judges and legal officers, aimed at strengthening regional understanding of AfCFTA dispute rules and cross-border trade enforcement.

At the workshop, Mr Kolawole Sofola, ECOWAS Director of Trade, stressed that the ECOWAS Court had a critical role to play in upholding legal frameworks that underpin regional integration and trade liberalisation.

“The success of the Trade Agreement will require the ability to resolve trade disputes fairly and efficiently. The strength of our legal systems, including the capacity of the Community Court, will determine the success of deepening intra-regional and Continental Trade,” Mr Sofola stated.

Regarding all aspects of the Phase I Protocols, business groups are sounding alarms over weak protections. NECA (Nigeria Employers’ Consultative Association) has warned that without mechanisms to counter unfair trade, such as dumping or subsidies, Nigeria could suffer under AfCFTA.

The association has called for the enforcement of existing trade remedies tools and stronger domestic legal safeguards. Other African countries have taken tangible steps, with Kenya Trade Remedies Agency (KETRA) and South Africa’s International Trade Administration Commission (ITAC) already in place.

Sectors reaping benefits

So far, AfCFTA’s benefits appear uneven across sectors. In agriculture, Nigeria remains largely protectionist. The country still shields staples like rice, sugar, and poultry behind high tariffs and import controls, citing food security. Yet it spends over $10 billion a year importing food and earns less than $400 million from agro-exports, according to the Ministry of Agriculture. This stance has slowed integration with African agro-value chains.

Manufacturing and construction materials are among Nigeria’s rising success stories under AfCFTA. Cement giant Dangote Cement now has operations in 10 African countries and a capacity of about 52 million tonnes per annum. In 2023, its pan-African volumes outside Nigeria rose from 7.4 Mt to 8.5 Mt in the first nine months, boosted by expanded plant operations in Ghana, Senegal and other markets.

The tech and logistics sectors are gaining visible traction. Lagos-based Kobo360 has expanded into East Africa, and MAX Mobility is following suit: after its $31 million Series B in 2021, MAX rolled out operations in Ghana and Egypt—and has received investment aimed at scaling into East Africa, with Rwanda among its target markets.

Textiles and light manufacturing remain Nigeria’s weak link under AfCFTA. The Nigerian Textile Manufacturers Association (NTMA) warns that local mills are losing ground to a flood of cheap imports, mostly from Asia and rerouted through African ports.

The country now spends about ₦1.3 trillion annually on textile imports, while NBS data show shipments have more than doubled since 2020. Without tariff enforcement and targeted incentives, Nigeria risks hollowing out what was once one of West Africa’s largest employers.

Nigeria’s transition journey into institutional readiness

Nigeria’s AfCFTA framework is improving but still fragmented. The National Action Committee (NAC-AfCFTA), chaired by the Trade Ministry, coordinates across customs, finance, and foreign affairs, with a new Central Coordination Committee launched in 2025 to tighten links. Still, there are factors of thin funding and overlapping mandates, which slow implementation.

In Nigeria’s 2025 budget, the transport sector includes ₦1 billion for AfCFTA-implementation efforts, one of the few explicitly labelled allocations.

Meanwhile, private sector engagement remains low. A Centre for International Private Enterprise (CIPE) survey of 1,800 Nigerian MSMEs across five states found that 67% were unaware of the AfCFTA agreement, with only 25% of firms saying they knew about the trade agreement.

“This lack of knowledge is particularly acute among smaller businesses and can represent an enormous obstacle to the successful uptake of AfCFTA,” according to CIPE.

As the African Union pushes toward full operationalisation of AfCFTA’s digital trade protocol in 2025, Nigeria’s performance, because of its status as Africa’s largest economy and most populous market, will shape the credibility of the continental trade project.

As it stands, the next 12 months are critical. With the first review complete, Nigeria must translate commitments into commerce, which would entail digitising customs, strengthening legal infrastructure, and empowering SMEs to trade regionally.

Dr Oduwole summarised Nigeria’s challenge bluntly at the Summit: “Talk is cheap. The real test is whether we can align private sector dynamism with public reform and ensure that trade truly becomes the lever for jobs, industrialisation, and shared prosperity.”

If this happens, Nigeria would be at the centre of delivering on the promise of the AfCFTA in achieving not just freer trade, but a more connected, competitive, and self-reliant African economy.