In 2023, the Nigerian economy went under the knife as a new administration took over the reins of government.

President Tinubu during his inauguration announced the end to the costly fuel subsidy program and two weeks later, the Central Bank of Nigeria (CBN) moved to unify the multiple segments of the foreign exchange market thereby decoupling the Naira from the artificial peg and allowing market forces of demand and supply to determine the naira’s value.

These twin policies constituted the fulcrum of the administration’s plan to put the country on the path of market-driven growth.

While the business community anticipated these reforms, the pace of execution caught them unaware, and the impact was felt in their profitability and balance sheets.

The most impactful of the twin policies was the unification of the multiple segments of the FX market, which devalued the naira from N462/$ to close the year at N907/$. This resulted in FX losses of companies amounting to trillions of naira in 2023 and 2024.

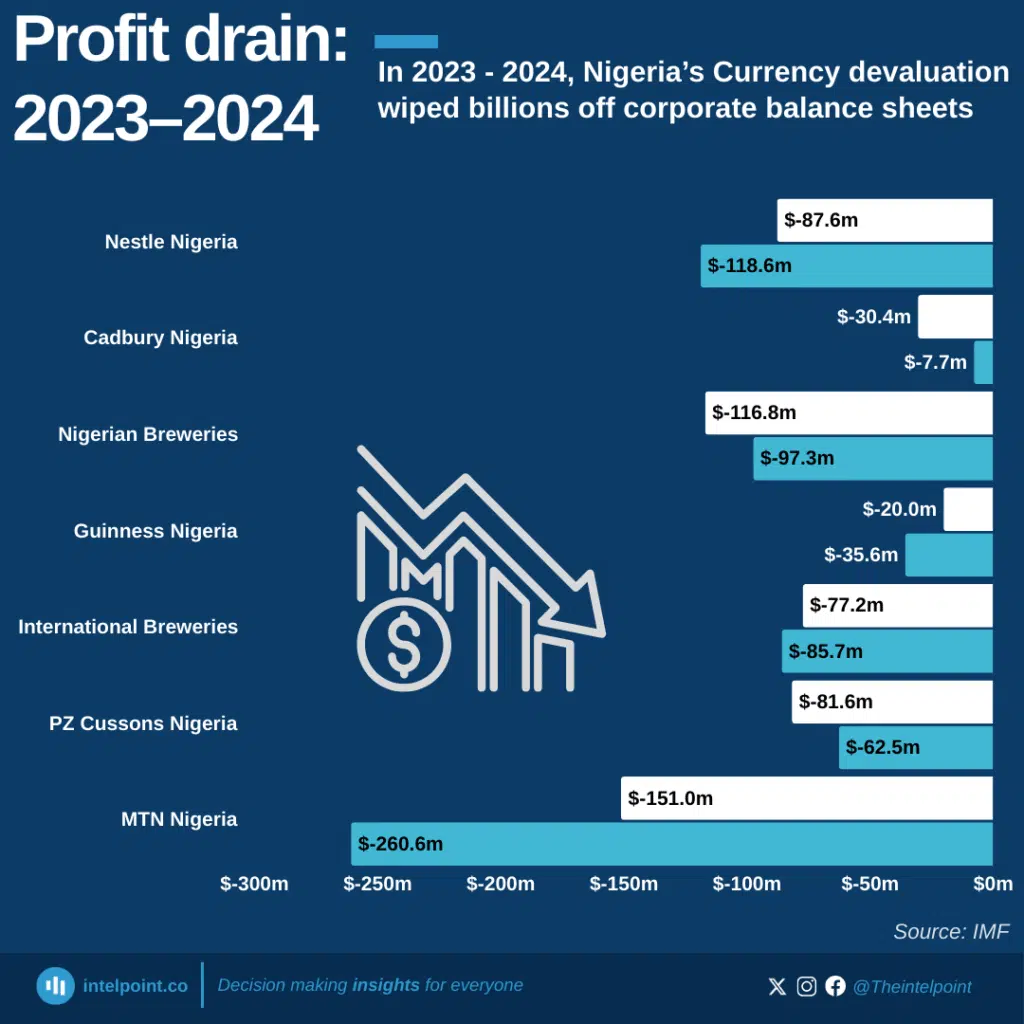

The consumer goods sector seemed to take the biggest hit from these reforms in 2023 and 2024, as many firms were exposed to FX-denominated obligations. Almost every company in this sector posted huge losses in 2023 and 2024, majorly exacerbated by foreign exchange losses.

Companies and their losses in 2023 and 2024

Consumer Goods & Manufacturing

- Nestlé Nigeria Plc: Reported an after-tax loss of $87.6 million in 2023, primarily due to a $214.9 million FX loss. In 2024, Nestle Nig Plc woeful performances continued all thanks to a $183.6 million FX loss resulting in an after-tax loss of $118.6 million.

- Cadbury Nigeria Plc: Recorded a loss of $30.4 million, marking its first loss in six years. In 2024, the company recorded a loss of $7.68 million, influenced by an FX loss of $2.3 million.

- Nigerian Breweries Plc: Posted a net FX loss of $169 million, leading to an after-tax loss of $116.8 million in 2023. The next year, the net FX loss of Nigeria’s biggest brewer reached $104.8 million, leading to an after-tax loss of $97.3 million.

- Guinness Nigeria Plc: Incurred an after-tax loss of $20 million, influenced by FX losses totalling $54.1 million in 2023. In 2024, post-tax losses rose to $35.6 million,n mainly attributed to almost $60.5 million net foreign exchange losses of which $26.7 million in unrealised.

- International Breweries Plc: Reported a loss of $77.2 million, up from $46.81 million in 2022. In 2024, the losses increased to $85.7 million, mainly due to a net realised FX loss of $107.9 million.

- PZ Cussons Nigeria Plc: Faced an after-tax loss of $81.6 million, with FX losses amounting to $96 million. The following year, losses reached $62.5 million, attributed to FX losses of $101.6 million.

- Unilever Nigeria Plc: Despite an increase in after-tax profit to $9.41 million, the company recorded FX losses of $5 million.

Industrial

- Neimeth International Pharmaceuticals Plc: Posted an after-tax loss of $2.58 million in 2023, compared to a profit of $41,300 in the previous year.

- Morison Industries Plc: Reported a loss of $98,566 thousand in 2023, down from $232,000.

Telecommunications

- MTN Nigeria Communications Plc: Reported a loss after tax of $151 million, primarily due to FX losses of $816.3 million. In 2024, net losses climbed to $260.58 million.

- Airtel Africa Plc: Faced a pre-tax loss of $63 million for the fiscal year, compared to a profit of $1.03 billion the prior year, due to FX losses of $807 million.

Macroeconomic realities in 2023 and 2024

President Tinubu’s reforms in the energy and foreign exchange markets need no explanation, but their impact on individuals and businesses continues to generate talking points.

The impact on inflation was dire as Nigerians saw a steady increase in average prices of goods and services from January to December, closing the year at 28.92%. The following year, the inflation rate reached 34% – the highest in 28 years before easing in the later part of the year.

The depreciation of the Naira was the major contributor to the rise in prices of goods and services, especially imported products.

Elevated inflation levels squeezed the incomes of individuals and households, leading to a decline in purchasing power. The level of unsold goods became a worry for many firms across the country. According to the Manufacturers Association of Nigeria (MAN), the value of unsold goods in 2024 stood at $1.39 billion, marking an increase of 87% from 2023.

Beyond problems with inflation, weak customer demand and exchange rate, businesses were also bedevilled with a hawkish monetary policy from the Central Bank of Nigeria (CBN). In 2024, the new management of the apex bank hiked the interest rate by a combined 875 basis points from 18.75% to 27.25%. The apex bank’s Governor, Yemi Cardoso noted that the move was aimed at taming inflation and sucking excess cash in circulation.

The weak demand from customers coupled with the exchange rate crisis, hike in cost of borrowing and cost of borrowing put a strain on business operations across the country.

Many businesses were forced to scale down operations, while others completely shut down. For multinational companies that could not withstand the pressures of the economy, it was time to exit. During this period, the country witnessed one of the largest exoduses of companies in a long time.

The Manufacturers Association put the total number of companies that shut down in 2023 at over 700 across the nation.

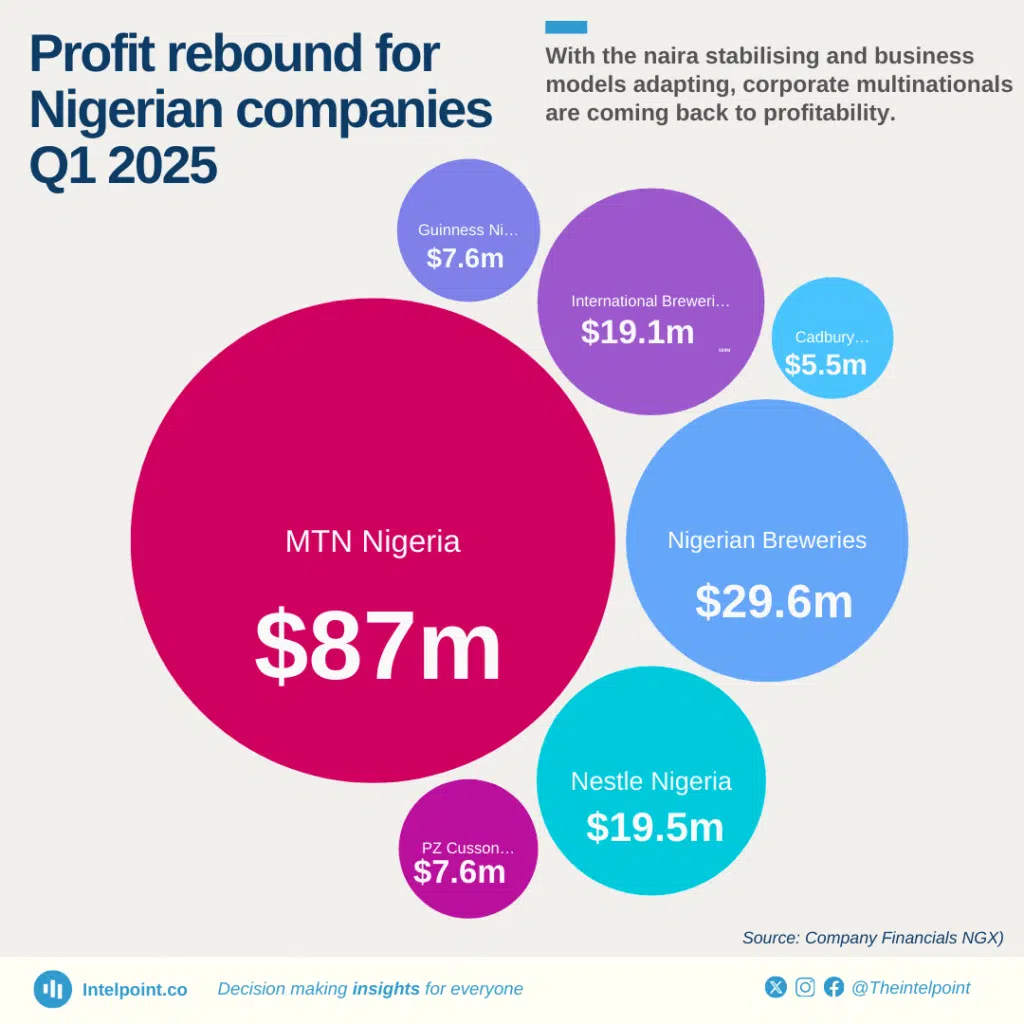

Companies are turning the corner in 2025

In the first quarter of 2025 so far, we have noticed a couple of businesses on the loss trajectory turning the corner by returning to profitability, while others are reducing losses despite inflation still elevated and pressures on the FX unabated.

- MTN Nigeria– in Q1, 2025, the company reversed its losses of 2024 by posting a profit after tax of $87 million as foreign exchange losses declined to $3.5 million in the quarter under review.

- Nestle Nigeria Plc– this company bounced back from losses, posting a post-tax profit of $19.5 million in the first three months of the 2025 financial year. It also cut FX losses to $106,000 from $146.5 million in the same period of last year.

- Cadbury Nigeria Plc– the chocolate maker saw its pretax profit soar to $5.5 million in Q1, 2025, from a loss of $7.9 million in the same period of last year.

- Guinness Nigeria Plc– this company has reported back-to-back profits in Q2 and Q3 of its 2025 financial year. In Q2, the company’s PAT reached $7.6 million, while that of Q3 2025 stood at $4.5 million. This represents a massive improvement from the losses recorded in the same period of last year.

- Nigerian Breweries Plc – the company recovered from the losses of the previous quarters to record an after-tax profit of $29.6 million on the back of a significant reduction in foreign exchange losses and an increase in revenue.

- International Breweries Plc – like its counterpart in the brewery industry, IB Plc, cut FX losses to post a net profit of $19.1 million in the first three months of the year.

- PZ Cussons Nig Plc– in its unaudited financial statement for the quarter ending 28th, February, PZ Nigeria recorded a net profit of $7.2 million from a loss of $61.6 million in the same period of last year.

- Dangote Sugar Plc – this company cut its losses in the first quarter of 2025 to $14.4 billion from $44.2 million in the same period of last year, signalling a recovery.

These are just a few companies showing positive signs of recovery from the economic malaise of the past two years.

However, it remains to be seen if the recovery is permanent, as the symptoms of the economic diseases still hover over their operating environment.

Commenting on the sustainability of the return to profitability, the Director-General of the Centre of the Promotion of Private Enterprise (CPPE) Dr. Muda Yusuf, in Nigeria explained that the foreign exchange shocks seen in 2023 and 2024 have largely calmed in 2025 just as companies have realigned their strategy to fit the prevailing market conditions.

In his words, “The massive forex shock experienced in 2024 has largely dissipated. This was the major game changer. Over the last year, we have witnessed substantial moderation in exchange rate volatility. The currency depreciation has considerably reduced. The impact on these companies was profound because of their huge forex exposure.”

“Secondly, many companies have reviewed their business models to ensure resilience. The strategic responses of corporations to the shocks of the economic reforms have also contributed to the recovery.”

Stock market investors are confident of sustainability

The return to profitability by these loss-making companies has not gone unnoticed by investors in the Nigerian bourse.

For example, the consumer goods index, which was battered by the severe macroeconomic conditions, has seen its share index rise by 23.4% in 2024 so far. It is interesting to note that much of the increase in the index started around April, when the first quarter results were being released.

Companies with standout performances from the index are PZ Cussons Nigeria, whose share price has gained 52% so far this year. The company’s share price currently stands at N29, a quantum leap from N15 in the same period of last year.

PZ Cussons Nig is not the only company seeing increasing trading activity on its stock, MTN Nigeria’s share price has added N80 to its opening year price to reach N280 per share. MTN Nigeria Plc has been able to turn around its slump in share price between 2023 and 2024 to reach a nearly two-year high.

Nigerian Breweries Plc’s share price has increased by N22 since the beginning of the year, from N32 to N54 per share.

The new management of Guinness Nig Plc has seen share price rise to a one year high of N84 from around N49 as of May, 2024.

1Note: Companies’ profit or losses have been converted using the applicable exchange rates as of the year-end or quarter-end, as appropriate.