Nigeria, Africa’s most populous country, has yet to release its real Gross Domestic Product (GDP) data for the first quarter of 2025, a month after the scheduled publication, raising fresh concerns about data governance, institutional capacity, and investor confidence.

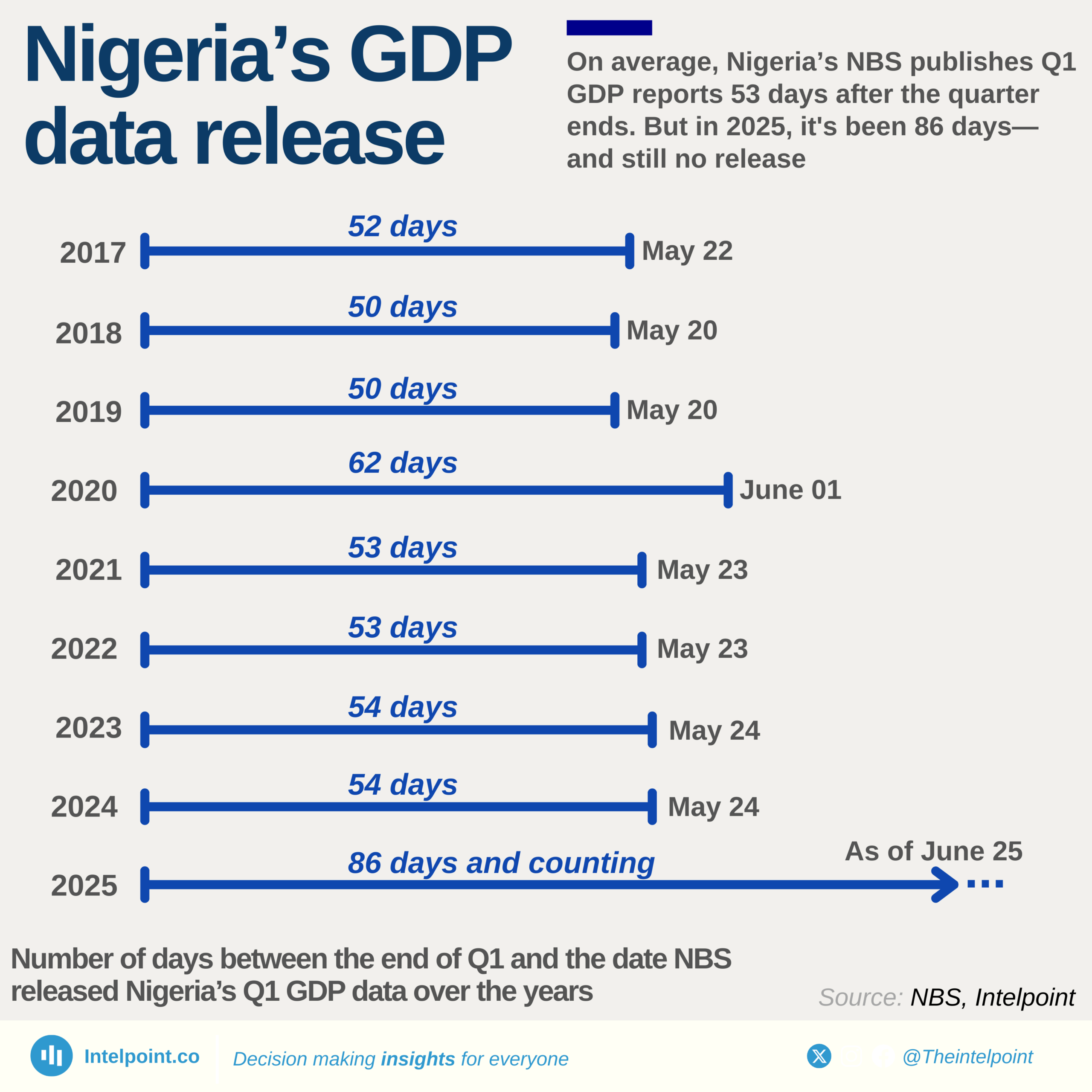

The GDP, which measures the value of goods and services produced within a country over a specific period, is a critical benchmark for assessing economic performance. In Nigeria, the National Bureau of Statistics (NBS) traditionally publishes GDP data quarterly, with Q1 figures typically released by the end of May. According to the agency’s official calendar, the Q1 2025 data was due on May 26.

However, by late June, the data remains unpublished—an unusual delay that analysts warn could undermine Nigeria’s reform momentum and deter Foreign Direct Investment (FDI) at a time when the country is seeking to boost credibility, attract foreign capital, stabilise its currency, and reduce inflation.

“These delays are going to affect the credibility of a country that wants to attract foreign investments,” said Joachim MacEbong, a Lagos-based governance analyst. “You can’t talk about investment if you don’t have regular and reliable statistics.”

While monthly inflation data continues to be released on schedule, GDP—arguably the most comprehensive measure of economic health—has been stalled. MacEbong added that the longer the silence, the more doubts arise about the capacity of the NBS.

The last GDP report, covering Q4 and full-year 2024, was published on time in February. It showed GDP growth reaching a three-year high of 3.84% in Q4 and 3.4% for the full year.

Peers report GDP numbers, Nigeria goes silent

Across Africa, national statistics agencies have already published Q1 data. Morocco posted 4.2% year-on-year growth on April 16, followed by Rwanda’s 7.8% on June 20. Ghana and South Africa reported Q1 growth of 5.3% and 0.1% respectively, in early June.

Among these countries, Rwanda and South Africa experienced quarter-on-quarter declines, while others saw improvements. Larger economies—including the U.S, China, and members of the European Union—released their Q1 data between late April and mid-May.

Rebasing cited as cause, but questions remain

Though no official explanation has been issued publicly, a senior NBS official who requested anonymity told Finance in Africa that the delay is linked to a long-planned GDP rebasing exercise.

“GDP is a very important macroeconomic variable that should not be done in a hurry. We want to ensure that things are put in their proper perspective before it is released,” the official said, adding that the release is imminent.

In January, the NBS announced that it was preparing to rebase GDP and inflation data, shifting the base year from 2014 to 2019. This change aims to better reflect Nigeria’s evolving economy by capturing high-growth sectors like ICT, e-commerce, tourism, and the blue economy. While rebased inflation figures have continued to appear, GDP has not followed suit.

“We know that in Q4 there was an improvement in growth, but it’s important to know on time whether that trend continued,” said Adeola Adenikinju, president of the Nigerian Economic Society (NES). “Analysts want to see what is happening at the sector level so they can advise accordingly.”

Investor risks and data reliability

The delay could further dampen investor interest. Nigeria recorded a 42% drop in FDI in 2024 to $1.08 billion from $1.87 billion the previous year, according to the United Nations Conference on Trade and Development.

With peers like Ghana and South Africa offering more timely and transparent economic data, Nigeria risks falling behind in the race to attract capital.

“Timely data is critical for everybody—policymakers, investors, and citizens,” said Muda Yusuf, CEO of the Centre for the Promotion of Private Enterprise. “It helps evaluate how policies are performing and whether expectations are being met.”

Q1 growth expected to improve

Despite the delay, indicators suggest the economy may have expanded in Q1. The Composite Purchasing Managers’ Index (PMI) from Stanbic IBTC showed sustained private-sector activity across agriculture, manufacturing, services, construction, and retail.

The PMI remained above the 50-point threshold from January to March, signalling likely growth.

“Private sector activity in Q1 was stronger compared to the previous quarter,” said Muyiwa Oni, head of equity research (West Africa) at Stanbic IBTC. “This aligns with expectations of around 3.9% year-on-year non-oil GDP growth.”

A recent report by Proshare also projects a Q1 GDP uptick, citing stable foreign exchange rates, lower petrol prices, stronger demand, and a rebased Consumer Price Index that has moderated price levels.

The International Monetary Fund and World Bank remain optimistic that Nigeria’s ongoing reforms—including fuel subsidy removal, FX realignment, and bank recapitalisation—will spur stronger growth through the rest of 2025.

Other key data also delayed

GDP isn’t the only critical data point delayed. Labour and capital importation reports have also lagged.

The latest unemployment figures, for Q2 2024, were released back in November 2024, with the jobless rate falling to 4.3% from 5.3% in the previous quarter. Before the 2023 rebasing of labour data, the NBS had delayed employment statistics for two years, reporting a 33.3% unemployment rate for Q4 2020 in March 2021.

Similarly, the most recent capital importation data, covering Q3 2024, was only released in December. It showed a 51.9% quarter-on-quarter rise to $1.25 billion. As of late June, no dates have been set for updated labour or investment data.

The NBS’s current leadership is heavily criticised for the lack of credibility of its data, according to Abimbola Adewale, a Lagos-based analyst.

“The key issues I have observed are around changes in the methodology of key economic indices, including inflation and unemployment, which are not reflecting true realities,” he said.

Way forward

With Q2 nearly over, analysts are urging the NBS to expedite the release of Q1 GDP and reaffirm its commitment to transparency and calendar discipline. For a country pursuing ambitious reforms and foreign capital, credibility in economic data is not optional—it’s essential.

“The NBS has yet to explain the delay or provide any guidance,” said Adenikinju of NES. “It’s important that they communicate clearly and restore trust in Nigeria’s statistical system.”